Impact on Direct Tax Code on various products

Direct Tax Code is the new proposed bill for changing the tax rules in India. If it comes into effect from April 1, 2011, it will change the whole taxation system and will change the way our taxes are calculated from years . The new tax code will have impact on Insurance Policies, Home Loans, PPF, Ulip, Mutual Funds, Shares and Taxation slab. A common man has to understand whats there in future for him so that he can plan accordingly. However the Direct Code tax is still in draft and might come into effect, but there is no guarantee. Experts feel that it can not come in its original form. Lets see what are the impacts on different investment products if DTC comes into effect .

Effect on Endowment/Moneyback insurance policies

As per Direct tax code, any amount you receive at maturity from an insurance policy (including bonus) will be taxed. However this rule will not apply for policies where;

- In any given year , premium paid in a year is less than 5% of Sum Assured , and

- The policy runs till maturity.

So if you have anyEndowment Policy or Moneyback Policy and in any year if you paid or will pay more than 5% of Sum assured as premium or make your policy as paid up in between, all the money you receive in the end will be taxed at the time of maturity. For policies where premium paying term is lesser than the total tenure, still all these rules will apply. For example , if you have a policy where sum assured is Rs 5,00,00; then there can be two cases where you will be taxed at the end.

- First : If you pay more than 25,000 as premiums .

- Second : Even if you pass this 5% rule , but you do not run your policy till maturity.

Effect on ULIP’s

The same rule applies to ULIP also. The first point is exiting before 10 yrs will badly hurt you from cost point, as all the Ulip’s are heavily front loaded and exiting before 10 yrs means the total cost is (commissions) turns out to be too much for you. Only if your total premium per year is less than 5% of the Sum assured, you can save yourself from getting taxed. But most of the Ulip plans in the country will not meet that criteria as majority of the policyholder’s pay much more than 5% of sum assured as premiums. A big number of policies have sum assured as 5 times of the premium, as it’s the minimum requirement of a Ulip policy . Read about recent war between SEBI and IRDA over ULIP control

Effect on PPF

For PPF account any amount you have accumulated till 31 Mar 2011, will be tax free in any year of withdrawal. However any new contribution made after 31 mar 2011 will be taxed in any year when its withdrawn . All these rules will apply to existing as well as new accounts. One important point you should consider here is that PPF will still remain one of the best debt product, because this “tax on maturity” rule will be applicable on all the products, so from that point , PPF will still have one of the best returns in debt segment. This whole rule applies to your EPF as well . (Tip : Read Why you should open a PPF account even if you dont need it right now)

Strategies

- Deposit more this year (2010-2011, so that amount becomes tax-free at the end .

- Invest in your child who is below 3 yrs, so that you get benefit of tax on amount contributed for next 15 yrs, and after 15 yrs , when your child is age 18 , he/she will get that amount and it will be considered as his/her income , but at that time the tax outgo will be lesser as they will not have any other source of income , so the tax outgo will be less . This will not be a significant, but still 😉 (Read Clubbing Rules of Income tax)

- Dont withdraw big partial chunks in between. Better withdraw smaller amounts so that in any particular year your taxable incomes remains low

Effect on Home Loans

Self occupied house

The tax benefits on self occupied home loans will be withdrawn once DTC comes into effect . At present Rs 1 lac is exempted for principle repayment and Rs 1.5 lacs for the interest repayment. After DTC comes, you will have not get tax benefits (Report on Returns from Real Estate in India)

House given on Rent

1.5 lacs interest deduction will be applicable for the home loans where the house is the second one and is given on rent. You might want to reconsider taking home loans if tax break was one of the major deciding factor .

In true sense tax break on home loans should always be secondary factor while deciding the purchase of house, because if you look back in your home loan documents, it’s clearly written that tax benefits are always as per the applicable rules of the year. So dont feel cheated and yell on govt for this.

Effect on Mutual Funds & Stocks

DTC does not differentiate between short-term and long-term capital gains, which means that any withdrawal after 31st Mar 2011 will be taxed in the year of withdrawal. Currently any profit earned after 1 yrs of investment is tax-free in Equity mutual funds and Stocks , this will not remain so . So if you have any Equity mutual funds or stocks with you, better sell them just before 31st Mar 2011 , so that current tax rules apply to that part of your investments .

Effect on Kisan Vikas Patra(KVP)/NSC/Tax Saving FD

All of these will loose the tax benefits

Effect on Income Tax Slab

The following tax slab will be applicable

| Income Level | Tax |

| Upto 1.6 Lacs | NIL |

| 1.6 – 10 Lacs | 10% |

| 10 – 25 Lacs | 20% |

| 25+ Lacs | 30.00% |

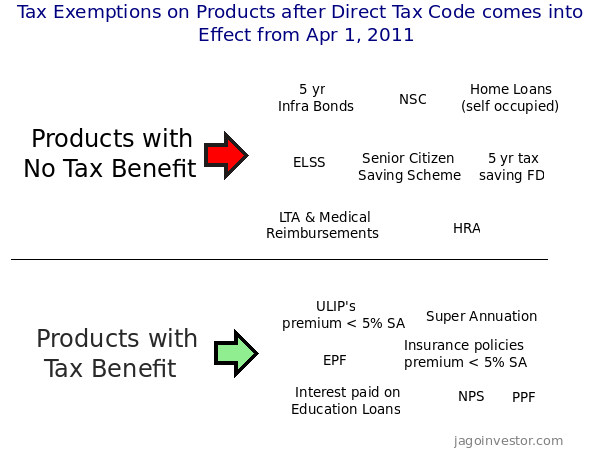

Effect on 80C

Sec 80C will be replaced by Sec 66 and limit will be raised from 1.2 Lac (20k for Infa bonds) to 3 lacs . Have a look at following classification of profucts from taxation point .

What do you feel about Direct Tax code ? Are you Happy about it ? Do you think it would be easy for Govt to bring Direct tax code without much fuss ? Share your thoughts

May 9, 2010

May 9, 2010

Hello, For a ULIP plan of LIC started in 2010, I am paying annual premium Rs 50,000. Term is 35 years. Sum assured is Rs 5 lacs Life cover and Rs 5 lacs accident cover.

Under the new DTC :

a) Will the premiums paid in subsequent years be Tax exempt?

b) Will proceeds on maturity be tax free?

Thanks for your advise.

Kamal

a) NO , it will be not .. because your premiums are more than 5% of SA

b) Might not be … this is unclear at the moment

Manish

i want to take 10 lakh LIC Money back policy.

the premium is 64 K so can i claim taxbenefit on entire 64K after Direct tax code.

Girish

You will get tax benefit only if your premium is below 5% of total SA . Which is not their in your case !

Manish

I have 2 queries:

1. In the post you mentioned – ‘So if you have any Equity mutual funds or stocks with you, better sell them just before 31st Mar 2011 ‘.

Do you mean we should not invest in MFs such as HDFC Top 200 etc?

2. My spouse is house-wife. If she happens to gain profit by selling shares (not intra-day), I understand she will need to pay capital gain tax. So how will she pay that tax. I am employed and my employer computes and deducts tax and at the end I file Form 16. Not sure how my wife will pay, does the Online trading firm directly deducts this profit tax? How will my wife come to know how much profit she made in the year and what is that she need to pay?

What is the exact process?

Sunil

1. I said that because of DTC , as there will be tax on long term gains after DTC comes , so you can sell the share or MF just before Apr 1 , 2011 and book the profits (if after 1 yr) and reinvest .

2 She will have to pay the tax and file the return her self . She will have to pay tax at the rate of 15% on all the profits she makes in a year . Also she will have to keep track of the profits she is makes, its her responsibility .

Manish

Thanks a lot Manish!

My questions may have sounded foolish but thanks for spending time and clarifying it patiently.

Regards

Sunil

The questions you asked were not foolish , they were genuine and very common .

Keep it up

Manish

Hi Manish,

As per dicussion paper of DTC (new): “Investments made, before the date of commencement of the DTC, in instruments which enjoy EEE method of taxation under the current law, would continue to be eligible for EEE method of tax treatment for the full duration of the financial instrument.”

Does that mean that if I start a SIP in ELSS scheme this year for 10 years then I will continue to get EEE benefit when I sell these units?

Ninad

Will have to look at this , will post a article on this soon

Manish

Manish ,

Me glance through with article pertiment to EEE in today’s economics times but didnt understand …could you pls educate the same .

I didnt get your said “You are also inclined more than required on Debt side as well ” kindly precise ….

And yeah you truly advised about Life insurance …that’s prime reason I have planned for ULIP which will deliver benifit such as insurance + investment +tax as it’s equity linked ….would you advise me to opt this or shall I consider any good goverment approved LIC scheme which will fetch steady return .

This is with addition to above mentioned .

Can you pls advise any best term plan which could cover me and my partents ….confirm EMI cost too if psbl .

Thanks Take care !

Rakesh

You can go for any Term plan , the yearly cost would be very less

Manish

If I start a SIP in ELSS scheme this year for 10 years then I will continue to get EEE benefit when I sell these units?

Dipak

No , you will get EEE only for the units which you get before DTC comes . Note that after DTC comes , there will be nothing called ELSS as per current information

Manish

Hello Manish,

I have read your article on the DTC code and found this information as wrong. “House given on Rent

1.5 lacs interest deduction will be applicable for the home loans where the house is the second one and is given on rent. You might want to reconsider taking home loans if tax break was one of the major deciding factor

”

Under the current IT laws There is no Limit for taking deduction on the Interest paid for the loan we took for second house, that is if you pay 4 lakh as a interest in a financial year, you can claim 4 lakh as a deduction. the only criteria is that you need to pay the tax on Rent received by deducting all the charges (property taxes/maintenance charge) e.t.c

Rahul

Yup , i get it , Will make that change 🙂

Manish

Hello Manish,

Would appreciate your assistance over my below inverstement planning as am very new in this financial jungle .

First -From next nonth onwards I have planned to invest per month 13k in Mutual fund via SIP which comprise 3 open ended euity diversified fund and 2 ELSS to save tax under 80 C.Here , I am having long term investment horizon say 20 yrs .

Second -30 k annual premium towards Max new york life’s Magic builder to get life cover ,save tax and and build corpus ultimattely

My past investment includes only one LIC of 11 k of premium .

My current age is 26 .Objective of investment to build good corpus over long period of time .

After going through all above debate its really difficult for me to chosse right path specially Mutual fund which will be leveid for tax on this capital gain after this DTC code into effect .

Your suggestion will be indeed great help for me .

Rakesh

You are young , Your view on mutual funds look good , however your approach towards Life insurance does not look best . You are also inclined more than required on Debt side as well .

Take a term plan , start sip in Index and Equity funds , Have your company EPF . thats all .

Manish

Any ideas on DTC impact on Long Term Capital Gains from House Property. Whether section 54 etc would be retained ? (To change your house etc )

Regards

Rahul

You mean , can you use the long term capital gains to buy another property without paying taxes on profit ? I think it would be there , but still no idea on that

Manish

If Manish was the advisor of FM, what changes he would suggest before DTC came into effect? 🙂

Pavan

Depends on each person , can be generic 🙂

Manish

Dear Manish Chauhan

If today i invest in ULIP before DTC is implemented, then will i get tax benefit on maturity under Section 10 10 (D) (if premium is more then 5% then SA)?

DTC will be implemented on ULIP investments after 1-4-2011? Or it will be implemented on old policies also?

I have been informed by ULIP company that DTC will be applied only to those who invest after 1-4-2011 and they can assure me this by writing on stamp paper.

Ketan

Which ULIP says that ? as per my knowledge it will be applicable to all the ULIP’s , new as well as Existing : http://www.taxguru.in/income-tax/direct-tax-code-may-bring-ulip-life-insurance-plan-under-tax-net.html

Manish

Dear Manish,

1)How Do you Think Mutual Fund is anyways better than any Endowment Plan (premium less than 5% SA) after DTC?

2)Why are you still suggesting people for Mutual Funds and NPS?

3) What is this NPS and How is this better than EPF or PPF?

Regards

Pankaj

Pankaj

Because the obsolute return out of equity will always be higher than debt over long term

For other doubts see more articles from archives .

Manish

just came across this blog, very interesting discussion.

the worst thing about DTC is even principal is taxed on PPF withdrawals & i think its unfair and unethical.

avs

welcome , looking for more discussion in future

Manish

This tax code is a big joke for salaried upper middle class. All the investment instruments are being made taxable. How are people suppose to save for their retirement. India is trying to copy western countries to simplify the tax code, but with half baked provisions. In western countries citizens get first class infrastructure on paying taxes. What will a citizen receive here, let me guess – highly corrupted government setup and a below par continuously degrading infrastructure.

Manoj

From that angle , yes there is not much we get from paying tax .

Also the code is being rewritten again now , so i am sure the changes will not come in its original form.

Manish

Even though the code is being re-written, the basic theme will not change: EET. That means, we will not tax you until you accumulate wealth for us (Govt.), then, when you withdraw, we will tax you taking away your (or Govt.’s) accumulated wealth – which you (investor) invested for us (Govt.) sensibly.

Increase in tax slabs is applicable until we are getting salaries. Later, during retirement, we will not be able to get all our money if we want at one go – it will be taxed, whether low or high tax slabs.

The old days of saving in Gold and then dumping money in your backyard are going to return soon!

One doubt should be clear to all of us (Janta), since EET will be good for any Govt., this will not be opposed – if not next year (2011), it will be implemented anyway eventually with benefit to all… All the parties will know that more money is coming in via EET!

Manish,

Great read in much simplified form and was able to understood most of it.

It is sad to know that if the tax brackets are widening; on the other hand Government would embark upon the long term gains of individuals which will offset the benefits that people may get under DTC. If I were to interpret, this is simplification of the process; which doesn’t necessarily promise any concrete betterments for the tax payer, my personal opinion.

The code is being rewritten now , Lets see how it goes now

Manish

If everything becomes taxable whats free now? Of course bill has not come in to effect yet but it has faint chances of being implemented in its current form.

SS

We are gettign huge cuts in tax slab , that will hopefully makeover the loss :p

manish

Hi Manish,

This was just proposal. No one from finance ministry has confirmed yet officially that this is going to be implemented as it is. Also this wasthrown open to public so that they can register their responses to the code. Infact there are unconfirmed news that this code will be re-written again. Anyways with current proposal for sure housing sectore and MF companies are already lobbying hard for apposition of this code.

Hi Manish,

Wasn’t there a point dealing with long term capital loss ? Can we get benefit from it … as in equity we may face loss in a period of time .

Thanks and Regards

Tirthankar

although this question is not related to this topic. I would like to ask you to review new Smart Loans offered by HSBC and also any such such products from its competitors.

Hi Manish,

Here’s my take: in it’s current form, it appears that the entire amount accumulated on maturity will be clubbed with the income for that year and taxed. EET only means, as someone pointed out, a transfer of enormous liability. If the new DTC code comes with the same outlined provisions as per draft code on long term wealth creation, never mind the expanded tax slabs and inflation effects, the net amount in the hands of investors will not be much to cheer about.

All this would mean is reduced consumption at every level. Any smart investor would automatically reduce consumption (sorry Sony, I LOVE your LED TV, but I don’t have the money), knowing the big train wreck called Tax would take away a substantial chunk, to make up for the shortfall. Given that the Indian economy is driven primarily by domestic consumption, this could have a devastating effect on business and consequently, the stock markets.

Regards,

Manu

Manu

Thanks for putting your views . Looks like they are rewriting the tax code now . Lets see how it frames up .

Manish

Hi Manish,

A very informative article.

But just a doubt, is there any benefit for a salaried person other than increased tax slabs and simplicity in taxation (which is again not a monitory benefit)?

Whereas it seems to be putting on more burden on common man’s money.

Can you please throw a light on this aspect?

Also, would you recommend someone to delay his mojor investments for another one year (e.g. for retirment etc.) if he is just prepared to put a big chunk for that?

Prasad

your tax exemption limit also increases from 1 to 3 lacs . I would say one can wait for 1 yr to get more clarity on this .

Manish

We need a mechanism better than DTC…. I can agree to more tax.. if I get

1. It should spread to more population…. In the sense…. One should not be able to take money and not show that… (The money that comes to everyone should be identifiable)… Itz like restricting cash transactions…. but we need a better way

2. I should get facilities for the tax I pay.. I need better roads.. better living conditions, better health care, better education system…. better control agencies….. (eg.. who cares and fines a Car manufactures/ Bans a model.. when all his cars are burning on road)…..

3. I need mechanism to put a cut on bribe…. (Sadly it starts from us it self)

4. Govt employees should not harass public/ they should try to help people rather than making their life harder…. after all they should treat and respect the fact that because we are paying tax, they are getting salary

5. I need better attention given to agriculture sector

6. I need a leader who can lead us/powerful leader who can implement it!!!!

Not sure if it will happen in very short term . but overlong term things should change . Amen

Manish

manish

a very thought provoking article indeed. this shall help us plan our future finances in advance. but as everybody is speculating the dtc shall not become applicable in the form it was presented initially. some experts even think that the DTC may not be effective at all.

but assuming that the DTC is effective and the effect over the mutual funds is similar to what u have said, then, do u still hold that mutual funds will be the best investment tools (as u conceptulise now), b’coz

1. the tax exemption on ELSS will go off and

2. the profit on the MF at redemption even if more than 1 year old will also be taxed (any way what shall be the rate of income tax over such profits; any special rate or shall it be just added to the total income).

in this case the profit of mutual funds , post inflation and post tax will be quite less.

the DTC plans to tax every profit that the indian citizen makes. in case of the PPF like instruments it just postpones the income tax (EET method of taxing). or taxes the profit at maturity. it shall be vehemently rejected by the opposition i suppose and we will see some roll backs and such things. no body can project what shall be the final picture. we can just cross our fingers and wait for the final verdict

dr kishan

Dr kishan

Yea , I also think the code can not come in its real proposed form . lets see how it moves ahead

Manish