Detailed Guide to Pradhan Mantri Awas Yojana (PMAY) scheme

Have you dreamed of your own house? Are you planning to buy your first house?

But, buying own house is not possible without taking loans and paying heavy EMI’s. However, now it is quite possible for new home buyers with subsidized loan given under “Pradhan Mantri Awas Yojana” which is an initiative by government under “Affordable Housing for all by 2022” in the country. It is also referred as credit linked subsidy.

With this scheme you can buy a new home/flat, construct a house or you can enhance your home by adding room, toilet or kitchen. Till date 15 Lakhs house has been constructed and 75 Lakhs loans has been sectioned under this scheme. The overall structure of the scheme is not easy to understand. So, let’s understand all the elements in simple points.

1. Who can opt for PMAY?

- A First time home buyer, who does not have any home on his name or in name of any family member.

- He or his family should not have availed any central assistance under any housing scheme of government.

- An individual who has a pucca house and wants to enhance it by adding toilet, room or kitchen etc.

Family includes Self, Spouse and Children. But, if daughter/son is earning adults(irrespective of marital status), than he/she will be treated as a separate entity. So, this means even if parents and earning children are staying in a house owned by parents, they can individually opt for PMAY provided he/she doesn’t have nay house own name.

2. What will be the eligibility and subsidy?

Government has categorized different groups taking their annual earning in to consideration, which will be helpful in evaluating eligibility and amount of subsidy. Following table shows different groups and other criteria.

[su_table responsive=”yes” alternate=”no”]

| Groups | Annual Income | Maximum loan amount for subsidy | Interest rate for subsidy | Maximum Subsidy Amount | Allowed Area |

| Economically Weaker Section (EWS) | Upto Rs. 3 Lakhs | Upto Rs. 6 Lakhs | 6.50% | Rs. 2.60 Lakhs | 30 sq. mt. (322.917 sq. ft.) |

| Low Income Group (LIG) | Rs. 3-6 Lakhs | Upto Rs. 6 Lakhs | 6.50% | Rs. 2.60 Lakhs | 60 sq. mt. (645.834 sq. ft.) |

| Middle Income Group-1 (MIG 1) | Rs. 6-12 Lakhs | Upto Rs. 9 Lakhs | 4% | Rs. 2.35 Lakhs | 160 sq. mt. (1722 sq. ft.) |

| Middle Income Group-2 (MIG 2) | Rs. 12-18 Lakhs | Upto Rs. 12 Lakhs | 3% | Rs. 2.30 Lakhs | 200 sq. mt. (2152.78 sq. ft.) |

[/su_table]

*1 sq mt = 10.7639 sq ft

*Maximum term allowed for subsidy is 20 years for all the 4 groups. That means subsidy will be calculated for the term of loan or 20 years whichever is less.

*Interest portion of EMI at subsidized rate will be discounted at 9% to get the net present value of subsidy.

Let’s understand the above table through case studies-

1. If your annual earning is Rs. 3,00,000 and you have taken home loan of Rs. 10 Lakhs for 15 years at 8.50% interest p.a. So, what will be the subsidy amount?

As your earning is Rs. 3 Lakhs, you fall in EWS group. So, You will get 6.5% of interest subsidy on Rs. 6 Lakhs of loan for term of 15 years provided the house area is not exceeding limit of carpet area of 30 sq. mt. The amount of subsidy will be Rs. 2.09 Lakhs (Back calculation – considering EMI at 6.5% on loan amount of Rs. 6 Lakhs for 15 years and interest portion out of it discounted at 9% to get NPV).

2. If your annual earning is Rs.8,00,000 and you have taken home loan of Rs. 20 Lakhs for 25 years at 8.50% interest p.a. So, what will be the subsidy amount?

As your earning is Rs. 8 Lakhs, you fall in EWS group. So, You will get 4% of interest subsidy on Rs.9 Lakhs of loan for term of 20 years and not 25 years (as maximum term is 20 years) provided the house area is not exceeding limit of carpet area of 160 sq. mt. The amount of subsidy will be Rs. 2.35 Lakhs (Back calculation – considering EMI at 4% on loan amount of Rs. 9 Lakhs for 20 years and interest portion out of it discounted at 9% to get NPV).

You can refer the video given below to understand PMAY –

3. Will subsidy be given for existing home loan?

The subsidy under this scheme can be availed on existing home loans sanctioned on or after 17/06/2015 for EWC section and LIG section. And for MIG 1 & MIG 2 subsidy can be availed if loan is section on or after 01/01/2017.

So, if you have an on going home loan which you received in 2017. In that case also you can apply under PMAY to avail subsidy. And the amount of subsidy will be calculated as per your current income earning section i.e. if now you are earning 10 Lakhs then you will fall under MIG 1 and original term of loan will be taken in to consideration.

4. How to enroll to avail benefits under this scheme ?

You can enroll for this scheme online or offline. In offline mode you need to visit the bank from where you want to apply loan or where your home loan is existing, get the form of PMAY and fill & submit the same.

For the online mode you need to follow following steps –

Step 1#: Go to the website of PMAY. Below given page will appear –

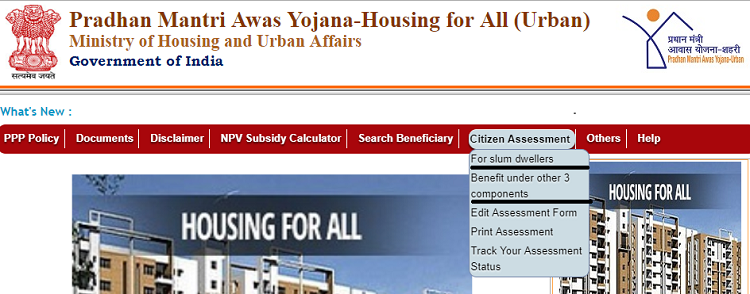

Step 2#: Click the citizen assessment drop-down and select the benefits under three components as shown below.

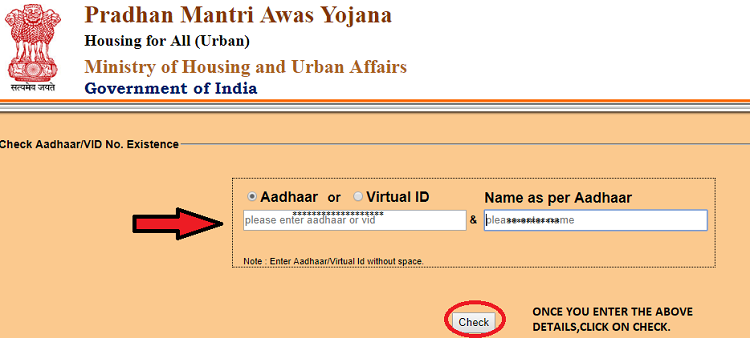

Step 3#: Once you click the benefit under other 3 components, the below window appears. Now enter your Aadhaar details and or virtual ID and click on check.

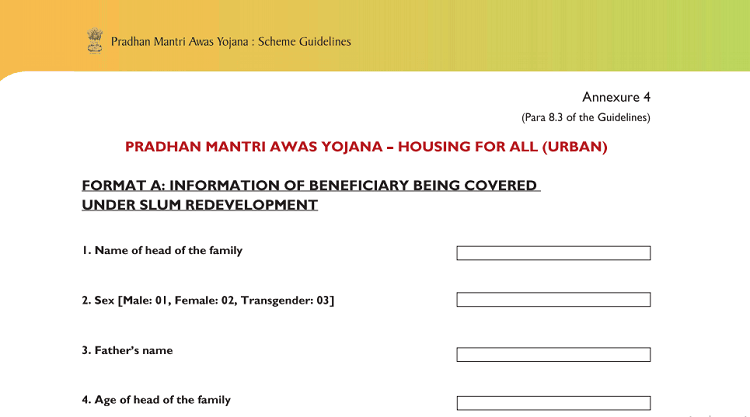

Step 4#: Once you check your Aadhaar card existence, the below page will appear. Fill the form with required details. To give you a glimpse, screenshot is attached.

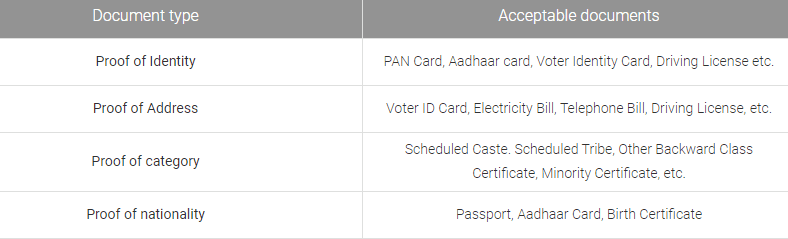

Step 5# Attach required documents

Once your application is submitted, after due examination if you are a eligible beneficiary under PMAY, you will be added to the list of beneficiary. You can find it on the website of PMAY in beneficiary tab. If your name comes in beneficiary list then you need to inform about the same to the bank from where you have granted loan.

5. How will I receive the interest subsidy benefit under PMAY Scheme?

The Bank (where you have applied for a loan under this scheme) will claim subsidy benefit for eligible borrowers from National Housing Bank (NHB). The NHB will conduct due diligence to exclude claims where the customer has submitted multiple requests. Then all the eligible borrowers will receive the subsidy amount to the Bank.

Once the Bank receives the interest subsidy, it will be credited upfront to the loan account. Therefore it is called credit linked subsidy. For example, If the you avails a loan for Rs. 8 lakh and the subsidy received is Rs. 2, 20,000. The subsidy amount (Rs. 2, 20,000) would be reduced upfront from the loan amount (i.e., the loan would reduce to Rs. 5, 80,000) and then you would pay EMIs on the reduced amount of Rs. 5, 80,000.

And also in case your EMI is on going and you are eligible for subsidy. Then you may be offered by your bank for using subsidy as credit so your EMI will be reduced or for reducing the term of loan. I would suggest to go with reducing term of loan.

FAQ OF PMAY SCHEME:

Is woman co-ownership is mandatory for availing subsidy?

Yes, for EWS and LIG class of subsidy woman co-ownership is mandatory whether it be the case of new house or addition of kitchen/toilets etc. And for MIG 1 & MIG 2 it is not compulsory to have a woman co-owner to the house property.

Can I do renovation/up-gradation in an existing house with the help of this scheme?

Yes, you can if you fall under MIG 1 or MIG 2 section. You can not avail subsidy for renovation if you fall under EWS or LIG.

Is it mandatory to fetch Adhaar card details for all the members of the beneficiary family?

Yes, for processing the subsidy under PMAY for MIG 1 and MIG 2, it is mandatory to furnish the Aadhaar card details of all the family members.

I hope this article has helped you in understanding that how one can avail benefits under PMAY Scheme. Please feel free to ask your doubts or queries the in comment section.

July 26, 2019

July 26, 2019

Sir I have availed home loan from Allahabad Bank in 2019 me and my widow pensioner mother are co applicant in housing loan and property is registered with my mother and my wife.There is no pucca house in the name of any family member.Bank denied to initiate my loan under pmay subsidy due to mother is included in loan and property.Am I eligible for pmay subsidy or not kindly guide me.

I think the banks do not approve the subsidy if parents are included as owners in property.

Hello, I received 1.49 lakh subside from Pradhan Mantri Awas Yojan for a home loan.but my friends were received subsides 2.35 lakh. We all together were purchased an apartment and applied the same home loan amount and same bank and also we all have equal gross salary.why have received 1.49 lakh instead of 2.35. Please reply.

Have you calculated that for your case, it will be 2.35 lacs? Did you have the tenure also same?

Me and my mother purchased a house. We two are co applicant in home loan. We don’t own any house.

My wife and father don’t own any house.

Is my loan eligible for this scheme?

Hello Mr. Nawal,

Yes, you can get the benefit of this scheme. Kindly contact your bank and ask them the procedure and documents required for getting this benefit.

Thank You

Anuradha

My take home salary after all deductions is 17 lacs but the gross salary offered by employer is 22 lac then which is to be considered for checking my eligibility?

Gross will be considered .. I think money is also going for EPF / NPS also !

Hi ,

Income will be considered including the Taxes or after the Tax deduction ?

Suppose I have CTC as 19 LPA but after tax deduction it is coming as 17 so will I be eligible for the scheme or not ?

Hi Mohd Shadab

Thanks for your comment.

Income will be considered as overall annual earnings and not after deductions or exemptions.

Vandana

Hi,

If my earning is 13L and loan amount is 10L.

will I get full subsidy that is 2.30L or it will be calculated based on loan amount and duration.

Hi Shailesh

As your earning is 13L you fall in MIG-2 group so you can get subsidy of Rs. 2.30 Lac irrespective of loan amount or duration of loan.

Thanks

Vandana

If my earning is 10 lakh and I have taken home loan of 9 lakh will I get full subsidy? That means 2.35 lakh or its 4% of 9 Lakh?

Hi Shailesh

The government has defined the maximum subsidy that one income group can have via PMAY. So Rs. 2.35 lakh is a max subsidy which you can get if your loan amount is exceeding or equals to Rs. 9,00,000. It means that your loan will get reduced by 2.35lakh.

Vandana

Can you please elaborate that if I have a plot on my name combined with two brothers…on this plot not any pukka house is there…so may I elligible for pmay subsidy

Hi Hemant,

If you are a joint owner of any property then it will be considered as your property only in that case you won’t be able to get subsidy.

Thanks

Vandana

I took a housing loan from SBI last June and applied for PMAY under MIG 1 with SBI while applying for the loan; however, have not received any update so far. OC has not been received for the project as it is 400+ apartment project but I moved in last year as tower 1-2 were ready for possession.

Could this be a reason for the delay in getting the subsidy? How can I track the status of my request?

Hi Gurpreet,

See there are a lot of claims pending for PMAY subsidy, so that can also be a reason for delay.

You can visit the bank and ask, what is the reason. whether you have granted the subsidy but the bank has not credited the amount against your loan.

Vandana

Is it possible to apply for PMAY scheme first?, If application get processed then go for the home loan ?

Hi Avijit Paul

Thanks for your comment.

No, Loan sanctioned is pre condition. Because subsidy is against the interest which bank will charge so to credit the subsidy amount there has to be a home loan account in your name.

Vandana

Hi

How many years this plan will last ?

Hi Naga. K

Thanks for your comment.

This Scheme is in effect up to 31st march 2022.

Vandana

For all kind of income group or only for ews and lig it is upto 2022 bcoz I checked on website it is for 2021 for mig 1 and mig2

Can you please elaborate further on what constitutes Annual Income especially for salaried people.

Is it the CTC they are offered?.

Is HRA and other allowances to be included in this definition of Annual Income?

or is it the taxable income for the year as per FORM16?

Hi sanjay

Thanks for your comment.

It is the annual earning that you get in your hands. For a salaried person it will include, Basic + DA + HRA received + all other allowances or perquisites paid for.

Vandana

Does Interest from FD & LIC pension amount will be considered as income of a person under PMAY MIG-1 for the construction of ist floor of the existing house.

Hi C. Vikraman

Yes all the income whatever source it might be, will be considered as total income for all groups. And the other thing I would like to say that adding a new floor to existing house will not be considered for PMAY subsidy. It is available just for additions like kitchen or bathroom and not whole new house upon an existing.

Vandana

Request a clarification.

If i had a house, sold it off in the past, will i be eligible for this scheme as a first time purchaser.

regards

Hi Srinivas

Thanks for your comment.

If you or any one in your family do not posses any house on their name at present then you will be eligible for PMAY subsidy.

Vandana

But as per the article if loan is taken after 2015/17, even existing borrowers are eligible.

Technically govt is promoting to have one home for everyone and when someone sold out first property and buy new one even in that case, person will be a single property holder.

Confusion is that whether such cases will be considered as a first home buyer or not (at a time single property holder because first property is sold out).

Hi Sudhank,

What you are saying, makes sense technically. It means that a person can claim for subsidy but giving it to that person or not is up to the government. So they will try to give the benefit of this subsidy to a more needy person rather than a person who can buy a house without any kind of subsidy help.

Vandana

Sir, We availed Housing Loan from Punjab national bank in February 2018. We applied for CLSS Component under PMAY scheme. Till today this scheme amount is not credited. Please help us.

Hi M.SOMASEKHARA RAO

For this you have to contact your bank and check if you are eligible for the subsidy or not. It might also be the case that you got the subsidy but bank skipped it so only bank can help you in this.

Thank you.

Vandana

Allowed Area means in independent houses site area or constructed area?

Hi kmreddy

Carpet area means, the area inside the walls of a stand alone house.

Thank you,

Vandana

Hi, If both husband and wife are earning and together if their earnings cross the 18L (10L each), but do not have a house in either one’s names, can only one of them be an applicant to the scheme or does it have to be both of them applying together for one loan (which would make them ineligible)?

Hi Paddy

Thanks for your comment.

The total family income is considered for eligibility and not just husbands or wife. So, in that case as husband and wife both are earning more than 18 Lac they are not eligible for PMAY irrespective of the fact that they do not own any house.

Vandana

How to track this application?

I had applied offline through SBI almost a year ago. Still it’s not credited, bank says “even those who have applied in 2017 has not received this amount and there is no way to track it”

Those who have take loan from private banks got credited in 3-4 months.

Hi Rohit

I don’t know what to say on this but one thing is that private banks processing is faster than public banks. It might be because of number of applicant.

Thank you

Vandana

Is there any age criteria for people who avail loans ?

Hi Natrajan

Thanks for your comment. There is no such criteria defined in the rules but yes as they have defined everything on the basis of earnings so every person who is earning except a minor (below 18) is eligible to avail loan. However, a minor can be a co-owner to the property.

Vandana

Hi,

Can you please let us know what is considered as your annual income. Is it based on your current month salary or it is based on the annual return form 16 of previous year.

I am currently working in a company where my annual income is less than 1200000 rupees.

I have done agreement with builder on 25th July. Will I be eligible to claim the subsidy ?

From 1st August onwards my CTC will be revised to 19 lakh rupees. Will the clss benefit will be considered in the income at the time of loan sanction ? Or disbursement ?

Any help is appreciated . Thanks

Hi Asif

Annual income will be considered as per the previous year. So, you will be eligible for this scheme.

Vandana

Thanks for your clear message/

Thanks for your comment C. Vikraman .. Please keep sharing your views like this..

Vandana