Do you want to Retire Early in India? A detailed guide with Excel calculator

Today you will read one of the fascinating stories of one of our readers (Naren from SavingHabit.com) who has shared his personal journey on early retirement and also gave a step by step path on how to change your mindset about it. This is a long article, but quite deep on the topic of early retirement. I suggest you read till end.. Over to Naren

–

A few weeks back, I had shared my comments on early retirement on the “Myth of Early Retirement” article and Manish asked me to to elaborate on my comment and also do a guest post on this topic.

In this post I will go in detail on how to plan for early retirement and also share my personal early retirement journey.

Disclaimer : This article is purely the author’s personal opinion. The author is not a certified financial planner. Seek the help of a certified financial planner for your individual situation.

When mid-level IT employees in their 40s are being forced into early retirement anyway through layoffs, it has become a necessity for our generation to pro-actively plan for an early retirement. As early as 2011, JagoInvestor reader Ujjwal working in IT predicted this exact scenario and recommended planning for early financial freedom.

How I discovered Early Retirement?

- I graduated in computer science straight into a recession caused by the double whammy of the dot-com bust and the 9/11 attacks. My father had recently retired from his public sector job and I did not have any job offer on hand as campus hiring dried up completely. It felt like I was being tossed around by economic forces beyond my control.

- When I finally entered the workforce at a Big Company, I was soon frustrated by the usual job stress and job insecurity.

- I decided to end this “working for money” problem once and for all by joining an early-stage internet startup. Joining a startup was also my dream since college and I had plans to start my own later. The idea was when the startup will sell for millions, I would strike it rich and never have to work again. Well… 6 years later when the startup was sold, my services were no longer needed. I was out of a job without striking it rich 🙂

- Around this time, I discovered the early retirement community online that talked about focusing on the one thing I could control : my savings rate. All along I had focused on things outside my control and failed to solve the “working for money” problem. Out of all the options available to salaried employees to achieve early financial independence, early retirement offers the highest chance of success because its success or failure is under your control: how much you save each month.

WHAT IS EARLY RETIREMENT?

Most of the Early Retirement literature online is from the U.S which is understandable because they have a longer history of regulated stock markets & mutual funds compared to India.

In this article I’ll do my best to translate Early Retirement for Indian conditions as we have our cultural differences when it comes to money like parents paying for child’s college expenses, joint families where children take care of parents in their old age etc and recent cultural changes mirroring the U.S like home loan EMI, SIP, credit card spending, low savings rate etc

Let me first start with what most people think when they hear the term “Early Retirement”:

- It is a stage by Age 40 when you are able to meet all your expenses through passive income from investments like Real Estate (rental income), Mutual Funds, Stocks (dividends) etc.

- So you don’t have to work anymore to meet your expenses.

- You can easily live on only investment returns post-inflation so your corpus will last forever beating inflation…theoretically.

While this is the “popular dream”, in reality Early Retirement simply means achieving financial independence early in life so you can focus on achieving your important goals in life. This is popularly abbreviated online as FIRE : financial independence/retiring early.

You can be employed at this stage, but in alignment with your life goals for example:

- To do something you love

- To spend more time with loved ones

- To earn money with less stress & more work-life balance

- To lead a healthy & active lifestyle

It is possible to retire early by age 40 but only if you aggressively save at least 50% of your income starting early in your earning life instead of doing a small monthly SIP with the goal of retiring in old age at 65.

Save 50% of my income??!! I can barely meet my expenses each month

Relax! You are already saving more than you realize. You already contribute 12% of your basic income mandatorily to your EPF and get another 12% employer match. That is a 24% savings rate on your basic income. So calm down and I’ll discuss some strategies for increasing your savings rate later in this article.

There is a reason behind the 50% savings rate

This is the simple idea behind Early Retirement before inflation & investment returns enter the picture. 50% savings rate may not be possible immediately for people whose income is low or expenses are high but early retirement is not possible unless you increase your savings rate to at least 50%

Here are some inspiring real-life people saving close to 50% :

– 1 income, EMI, 1 kid, private sector, Bengaluru. Income: 81K, Savings:43K

– Unmarried, private sector, Mumbai. Income: 65K. Savings: 30K

– 1 income, Government job, no kids, Rajasthan. Income: 70K, Savings: 42K

– Both working, 1 kid, private sector, Mumbai. Income: 1.05L, Savings: 45K

Here is the link to the “Family Finances” section from ET Wealth magazine. Make sure to look for households who fit your profile and are saving at least 50%. Ask yourself : If people similar to me can save so much, why shouldn’t I save more than my current rate?

Let’s step back here for a minute

When you truly want something you will come up with solutions rather than excuses and you’ll get inspired instead of finding faults. Imagine in your mind’s eye for a moment all the positive reasons why you want to retire early like Family-time, Freedom, Health, Low-Stress, Travel, Security etc.

Now get yourself into an optimistic “can-do” frame of mind before reading further.

(Source)

Early Retirement is an improved version of Conventional Retirement

Around 100 years back even conventional retirement at age 65 was not possible for everyone. What was once a fantasy is a reality now. Now everyone believes it is perfectly normal to retire at age 65.

Similarly, for the first time in history, due to innovations like regulated stock markets, mutual funds & SIP, even the salaried middle-class can now retire early which was previously possible only for high-earning executives or businessmen. So if you try and understand Early Retirement you too can take advantage of it and enjoy a better quality of life.

Be ready to take some tough decisions on what is important to YOU in life rather than just going with the flow of what everybody else is doing with their life.

Can I just retire early and never have to work ever?

The typical dream of Early Retirement is to “sit and eat” from the retirement corpus without having to work for money from age 40 to age 90 which is a long span of 50 years which no one can predict.

It is a difficult feat to pull off as Life has a habit of springing surprises especially when you have kids and elderly parents. But it is possible if key variables outside your control like the stock market returns work in your favor and there are real-life success stories like Mr.MoneyMustache.

Two big problems with this “I never want to work again” Early Retirement thinking:

- UNCERTAINTY:

- If a family member has a major health expense not covered by health insurance, how will you meet that expense if you are not earning any additional income?

- If you cannot find a tenant for your rental income house for more than a year, how will you meet household expenses if you are not earning any additional income?

- If the stock market crashes by 15% and goes into a 5-year recession, will you have the stomach to withdraw money for monthly expenses from an already depleted corpus?

- What if all of the above happen simultaneously in your life like the expression “When it rains, it pours” ?

- STRESS: you’ll replace the stress of a job with the stress of obsessing over running out of money every single day of your early retirement.

My Alternative Early Retirement Plan for Indian conditions

- By Age 40: Finish saving up for retirement by saving at least 50% of your income in retirement SIP.

- After Age 40: Stop your retirement SIP & switch to work that you truly enjoy in order to cover monthly expenses.

- From Age 40: Let compounding double your retirement corpus every 6 years until age 65!

The idea is to permanently secure your comfortable lifestyle by age 40 so you can follow your dreams without fear. Even in the worst case scenario you’ll always be guaranteed to enjoy the comfortable lifestyle of your 30s.

The benefits of this alternative approach

FREEDOM: Free by Age 40 to do work you truly enjoy

While saving up for retirement your monthly budget at 50% savings rate will look like this:

By age 40 once you finish saving up for retirement, you don’t need the retirement SIP anymore and your budget will look like this

After age 40, you can work for a 50% lesser salary at jobs that are more fulfilling and less stressful but fully pays for your monthly expenses including support for kids & elderly parents:

Most people who want to retire early simply are tired of the job stress and deep down are not averse to working if there is work-life balance and they are working on something they truly enjoy.

SECURITY: Your retirement fund is actually a 25-year emergency fund!

If you ever lose your job before age 65 like the TCS/Cognizant/Infosys mid-level managers in the headlines : you can use a small portion of your retirement fund to fund monthly expenses for even 3-4 years while you re-skill and find another job after which you can replenish the amount you took out during the jobless period.

Instead of trying to live off the retirement fund for life from age 40, you strategically use the retirement fund to build a safety net for uncertain times and take calculated risks like starting a business or a new career.

LESS STRESS: Not having to worry about money running out

It is an open secret that even the pioneers of early retirement that I hero-worship like MMM & ERE bring in active income in their “early retirement” from working on their passions like building houses by hand or working as a quant trader/researcher leaving their retirement corpus to compound meaning they are not solely living off of their early retirement corpus themselves.

So if the early retirement gurus are bringing in active income why shouldn’t you factor in the active income from your dream-job in your early retirement plans? Why assume that working on something you enjoy won’t cover monthly expenses even after working at it for 3-4 years?

You’ll be sitting on a 25-year emergency fund in the form of your early retirement corpus for God’s sake! If you are still unsure, you can start working on your dream-job as a side-project while you are still working at your day-job to give yourself enough runway and confidence that it will make money by the time you quit your day-job.

PRACTICE: Great Training for “full retirement”

Scaling down your work by 50% by age 40 is a great way to get a preview of what “full retirement” will look like at age 65. You will get a lot of wake-up calls mostly around the state of your health, investment returns , wasteful expenses and whether you really have any true passions in life or were you just lying to yourself about “dreams & passions” to mentally escape from job stress 😉 So while planning for Early Retirement also work on your passion on the side to prepare yourself for the post-40 life.

4 STRATEGIES TO INCREASE YOUR SAVINGS RATE

Strategy #1 – Lower your expenses: This is the only thing under your control so tackle this first. Analyze your lifestyle using apps like Spendee to cut down wasteful spending without being “penny wise and pound foolish”.

For example: In our house we use the internet for entertainment so no T.V or cable expenses, we mainly eat home-cooked food so our eating-out expenses are low, we do yoga at home so no gym fees, we own high-quality phones & laptops that are expensive but we maintain them carefully for years so they work out cheaper in the long run.

It took us almost 3 years to systematically reduce our spending without feeling deprived. In your household, what are the top 3 categories where you could get the same value but for way less money?

Strategy #2 – Increase your income: If you’ve cut all wasteful expenses and are still not saving enough then your only option is to increase your income. Your early retirement goal gives you the clarity and urgency to do what is necessary to get that promotion or better-paying job. It will not happen overnight but you can work towards it purposefully now that you have a time-bound reason.

Strategy #3 – Get out of Debt: If you’ve made the mistake of buying a house on exorbitant EMI at an early age, you need to first crush your EMI or education loan before attempting early retirement. You need to simultaneously lower expenses and increase income. Read : Is home loan EMI jeopardising your other financial goals? Here’s what to do

Strategy #4 – Work as a team with your spouse: By age 30 you are probably married and both of you are earning. Get your spouse on board and work together as a team. If all you want is a couple of years freedom to try your hand at a new career or business, try a mini-retirement instead.

If you are debt-free and your spouse’s income can take care of expenses, you can quit your job with the safety net of your spouse’s income. If you succeed in your venture and are able to cover expenses then your spouse too can quit their job to follow their dreams. This way both of you can make money doing what you like. Even if you fail in your venture, you can re-join the workforce & try again later.

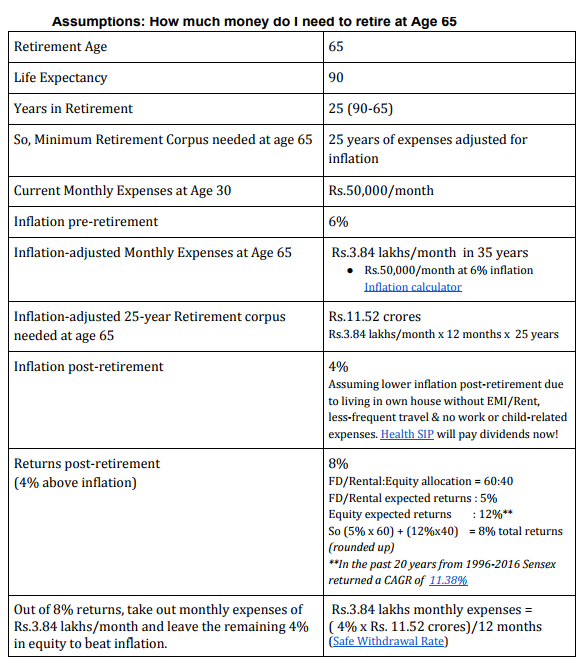

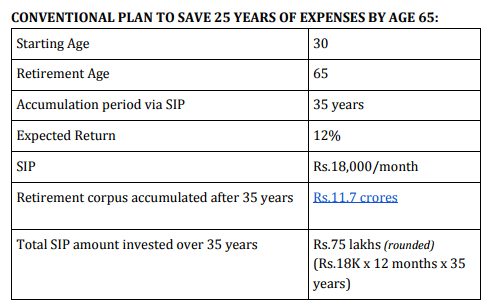

Wow! An investment of Rs.75 lakhs in SIP over 35 years has given a retirement corpus of Rs.11.7 crores

But look closer and you’ll notice that this is a bad bargain for the number of years this person has to save. Why should you take 35 years to accumulate 75 lakhs?

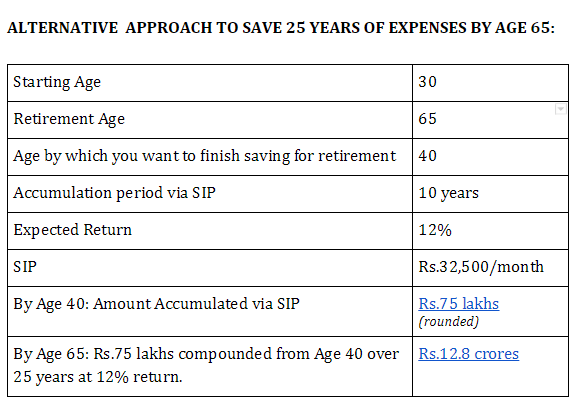

Let’s see what happens if you try and accumulate the same Rs.75 lakhs within 10 years and then stop your SIPs but let the Rs.75 lakhs compound untouched for another 25 years.

WHAAAAT???!!! How did you end up with Rs.12.8 crores at age 65 even though you stopped SIPs at age 40!!!

THE SECRET : Compounding really works its magic on large numbers

SIP does not do the compounding by itself…only when you finish saving up a large corpus does meaningful and substantial compounding gets started. That is why you should accumulate your retirement corpus as early as possible for compounding to start doing its job.

See here, here and here for others who’ve illustrated how saving up early then stopping and letting the money compound untouched grows the money like crazy meeting or even exceeding your goals as compared to doing a small monthly SIP for decades.

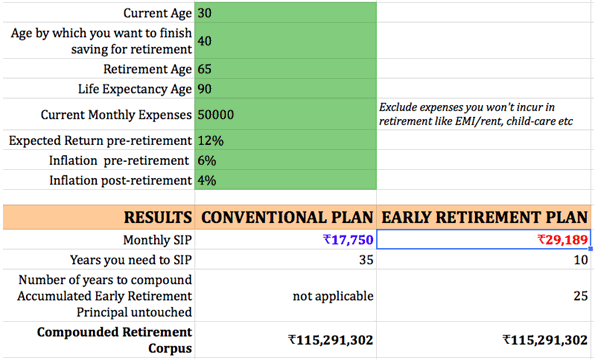

ILLUSTRATION OF THE TWO APPROACHES VIA EXCEL CALCULATON

Download Early Retirement Calculator

MATHEMATICAL PROOF

THE RULE OF 72 a.k.a What they did not teach you in school

Question 1: How long will it take for Rs.75 lakhs to double @ 12% annual return?

You don’t need a calculator to answer this. Use The Rule of 72.

This handy thumb-rule derived from the compound interest formula says that to find the number of years required to double your money at a given return %, you just divide 72 by the return %

So 72/12 = 6 years.

Answer: Rs.75 lakhs @ 12% annual return will double in 6 years

Question 2: How many times will Rs.75 lakhs double @12% annual return over 25 years?

Answer: 25/6 = 4 times

Rs. 75 lakhs @ 12% return will double 4 times over 25 years

Question 3: What’ll be the final value of Rs.75 lakhs after doubling 4 times at the end of 25 years?

Answer:

Doubles first after 6 years : Rs.75 lakhs x 2 = Rs.1.50 crores

Doubles again after 12 years : Rs.1.50 crores x 2 = Rs.3 crores

Doubles again after 18 years : Rs.3 crores x 2 = Rs.6 crores

Doubles again after 24 years : Rs.6 crores x 2 = Rs.12 crores

Total doubling : 4 times

Final corpus : Rs.12 crores

- Now refer back to the alternative accumulation plan’s final retirement corpus of Rs.12.8 crores to verify that the Rule of 72 produces a result remarkably accurate to the result from a lumpsum investment Calculator.

- Also verify using CAGR calculator that the initial lumpsum invested and future compounded corpus works out to a 12% annual return.

A word of caution on debt: Compounding works against you when you have outstanding debt. For example: Say you have a 36% annual interest Credit Card and an outstanding balance of Rs.1 lakh on it. If you don’t pay back the debt for 2 years then the credit card balance will double to Rs.2 lakhs.

How? Rule of 72: 72/36 =2. So your debt will double in 2 years!

(Source)

FAQ 1: If I’m saving first for my retirement what about saving for my child’s college expenses?

Use the same Early Saving strategy to save for child’s college expenses:

At the time of the child’s birth itself, invest the prevailing cost of college into mutual funds and let it compound for 18 years to beat education inflation. For example: 4-year engineering course at IIT currently costs Rs.8 lakhs. Say your kid was just born this year. If education inflation is 12% y-o-y the same course will cost Rs.60 lakhs in 18 years. To beat this education inflation: Invest prevailing cost of Rs.8 lakhs in mutual funds at the time of the child’s birth itself and let it compound over 18 years to Rs.60 lakhs @ 12% annual return by the time your child is ready to enter college. Your child can take out an education loan for any shortfall over and above your savings.

If you don’t have Rs.8 lakhs to invest in mutual funds at the time of your child’s birth:

- Finish saving for your retirement first by age 40 so you don’t have to worry about losing your job or sacrificing your dreams.

- Then start SIP for your kid’s future expenses like higher education or wedding

- To bridge any shortfall between your SIP savings & the education or wedding expenses, your child can take out an education loan or scholarship for college and a personal loan for their own wedding.

- Since you’ll be earning while your child is in college, you can help out with whatever college expenses you can afford. Your child may also earn income through internships or side-projects while still in college.

Take care of your own retirement first before you save for your child because the child has other viable options like education loans, scholarships, low-cost weddings etc. No bank will give you any “retirement loan” if you’ve not saved enough for your retirement!!!

Plus you can be a role-model to your child by balancing your dreams & your reasonable duty towards your child. You will be giving them the inheritance of them not having to worry about your retirement also when they make their own retirement plans

Like how the air hostess tells us in the safety precautions before every flight…..

I highly recommend that you read Manish’s article on how not to stress too much about the inflation in higher education expenses.

FAQ 2 : What about buying our own house?

I recommend from personal experience: Don’t buy a house on EMI at a young age in your 20s or 30s when you don’t know where you’ll settle down permanently. We move to other cities and even countries for work these days and there is no knowing ahead of time where you will settle down in old age.

Instead save SIP in mutual funds towards buying a house until you have 100% clarity closer to retirement in your 50s or 60s and then build or buy a brand new house or flat fully in cash without EMI. The SIP returns should be able to match the real estate inflation. Until your retirement it is cheaper to rent in India at 4% rental yield even at 10% annual rent increase instead of paying EMI at 10-12% and also property tax, water tax, maintenance, repairs, association dues etc. only to end up with an “old flat” after 25 years!

A couple we know are doing exactly this: after traveling all over India for work & renting throughout they are now building a house in their hometown for retirement in their mid-fifties. Subramoney also recommends the same approach: See point #9 of his article.

Recommended reading: Why large investment in property at young age could be risky

FAQ 3: But we want to do extended travel frequently. That’s why we want to retire early and stop working!

Think win-win: Once you achieve financial independence you can quit your job and travel for say a year. After a year of travel, you can recharge both yourself and your bank accounts by returning to the job market for a couple of years to work on something you enjoy (maybe something related to travel!). Then travel again. Repeat the process until your 60s by which time hopefully you would have traveled everywhere you wanted to and your compounded retirement fund will be waiting for you!

My Personal Journey so far

- Age 36. Married. No kids yet.

- We’ve saved up 30% of our retirement target so far

- By age 45, we’ll finish saving up 100% of our retirement target & then let it compound untouched over the next 20 years

- Own a flat bought with savings & no EMI in a city where we don’t live 🙂 Although it gives us a modest rent that we SIP, I consider it a poor decision as we could have reached financial independence already by renting instead of owning.

- 3 years in Big Co IT dept : paid off student loan & credit card debt so savings rate was low : around 25%. Debt-Free so I work at Internet Startup for 6 years : Saved little over 40% of my salary!

- 3 years back, wife and I took a calculated risk to start own business when we had a savings runway of 6-7 years. 3 years later business income now covers monthly expenses and savings rate is climbing slowly towards 50%

- Once we reach our retirement target by age 45, I may take up a job at a non-profit working for a better India at a much lower salary but only if it fully covers our already low expenses.

- We exercise 30 mins to 1 hour daily towards our Health SIP & maintain a healthy diet. We plan to be be fit and healthy in our 60s when no health insurance will cover us.

- We’ll save what we can for our future child using the Rule of 72 since the child has age on their side for compounding to work until age 18. But we’ll definitely teach the child to be financially independent in their 30s itself and follow their dreams without needing money from us 🙂

This is our story in brief. We took calculated risks and re-invented ourselves with the safety net of savings that would have lasted for only 6-7 years. Imagine how you too can work on your dreams stress-free with the safety net of savings that’ll last for 25 years.

We are a regular couple with middle-class values. If we can do it so can you. Good luck!

Special Thanks: My wife & I are forever grateful to Mr.MoneyMustache for demonstrating that you can simply save your salary to freedom 25 years ahead of schedule!

I want to end with a well-written poem about “A Man with Savings” that makes the point much better than I ever could with all the math & personal stories.

Please share your thoughts about early retirement under comments section. I would be happy to read them and also discuss more on this topic.

July 31, 2017

July 31, 2017

agree with your concept

Thanks Deepak Gawariya

Hello,

What asset class have you considered while assuming 12% annualized returns?

Thanks.

Its assuming Equity asset class!

Very nice article naren and explained in details and simple language.

While i was reading it looks to me somebody is narrating my 17 years of life.. I actually did the same .. for first 17 years work in biggest IT company .. travelled a lot overseas .. created a pool of money for my retirement and kids education and once i realize that it is sufficient i plunged into starting a company with couple of my friends and enjoying my time thoroughly from last 2 years.

Couple of missed i realize i am still not able to do.

1) not focussed much on my health till now

2) As move into starting a new company work pressure is not reduced but satisfaction is.

Saurabh

Thanks for sharing your story saurabh!

It is inspiring to read about real-life people like you who have been on the path ahead of us and all we need to do now is follow the path.

The concepts I wrote in the article were based on other real-life people I’ve met & read about who inspired me with their early retirement.

btw… If you are not finding time to focus on your health , consider outsourcing it to a personal trainer or dietician. That way it happens on auto-pilot. Focusing on health will also help you better deal with stress at work,

I recommend reading Manish’s “Health SIP” article:

http://jagoinvestor.dev.diginnovators.site/2012/03/health-sip.html

Thanks naren..this is what i did exactly two months back…hired a personal trainer and ehen he comes and knock at 6 in morning i have to go to gym :):)

Simple logic i apply in my life..wherver i cannot create self motivation bring external force to do that..

Cheers

Saurabh

Thats the way to take actions in life. “Being committed” is an over rated thing !

Simply fantastic!

Thanks for your comment Pallavi

Great article by author !!!

I had already made this plan for my early retirement, but was not sure if it will work out as I calculated.

But after reading this article, I am confident that author & other people like me can achieve their retirement corpus, as per the calculations mentioned above.

I would like to appreciate the good work by jagoinvestor team to educate young investors.

Keep it up

Excellent article. Eye opener and well composed. This is bit hatke approach, so it is obvious that people feel it hard to digest. I’ve been following the approach of saving more than 50% of income for more than 10 years without compromising my lifestyle, so this is very much possible.

Thanks for sharing your real-life savings rate Jayaprakash!

I hope after reading your comment people realise that saving a lot does not mean you have to compromise your lifestyle.

Early retirees are “frugal” and not “miserly”. Frugal means getting “more value for less money”.

In fact, by being frugal you end up making healthier & more efficient choices that result in more wealth without extra hours at work or chasing risky investments.

Saving a lot is a matter of cutting out the wasteful expenses in our daily life while retaining the fun aspects. It is simply a resource allocation problem based on your top priorities.

When you set a target of 50% savings, you’ll find creative ways to cut expenses or bring in more income. Setting a measurable target for oneself increases the likelihood of achieving the goal.

This is gem of an article. Concepts and ideas of early retirement put so nicely. Kudos to JI team.

I really liked author idea of taking up low stressful job after 40 just to meet the expenses without disturbing the investment base.

Customization for Indian context made this article very appealing to read.

Couple of pointers. The way CTCs are set up in private sector, even if the employer matches 12% basic making it 24% basic, this 24% basic income saving would be fraction of the total salary. This fact should not create a false hope for many that they are saving atleast 24% salary.

Saving 50% of sal is wonderful but practicing it for a decade or more till the age of 40 won’t be easy. It takes hell lot of discipline. I won’t bother much about returns but focus on developing the habit of saving diligently. If not equity SIP, one can even look at liquid tax saving investments such as PPF, NPS, etc..

I would be reading this article many times for long time.

agree with u

Thanks for appreciating the concept Krish!

Answers to a couple of valid pointers you raised:

reg: difficulty of saving 50% for 10 years.

Saving 50% of salary for 10 years might look difficult but it is not a whole lot different than paying 50% of salary towards home loan EMI for 10 or more years. My point being: people already have the discipline to pay EMI month-after-month but with a 50% savings rate they would be paying themselves instead of the bank.

reg: PF contribution being on basic income and not CTC

Even people who are only meeting monthly expenses right now should feel hopeful that they are socking away money in their EPF and that my 50% savings rate recommendation is over and above this EPF savings. My point being: they are not starting from zero! 🙂

The goal is to calculate our true monthly savings rate and take corrective action if it is too low for early retirement.

For example: as the below article suggests if HR structures the basic income to be 50% of CTC, the total employer+employee PF contribution of 24% on basic income would translate into a 12% savings rate on CTC which takes you one step closer to the ideal 50% savings rate. As you work towards increasing your salary and reducing your expenses you will reach the remaining 38% savings rate sooner or later.

https://inc42.com/resources/salary-structure/

A simpler way to save is to use your expenses :

If your monthly expenses are “X”,

then your monthly savings should at least be “X”

When you save based on expenses you’ll have a much clearer idea of your retirement needs than when you use income.

Add up all the money you are saving in EPF, PPF, SIP, NPS etc when you total up savings of “X”

The total return % will be a function of the different return % from each of the savings instruments.

Excellent article !!!!

Initially I was a little confused upon the approach but then seemed to be convinced.

It does not matter much if the resultant is 12% or 11% or 15% as it is beyond our control

but the basics are right and logic is sound.

Save now and enjoy later is good concept. What if some unexpected happens? Can we enjoy after that and during 40s, will we have the same energy levels as in 30s inspite of having Health SIP? It is all about what is your priority, but do save some % atleast and need not be high figures like (40%-50%) as mentioned in the article.

Not everything and every experience in this world can be matched with finance. So, better to stitch both saving and enjoyment together instead of weighing one over the other.

There is some issue with excel. The post retirement inflation has no impact on the retirement corpus. Please check.

Nitin

The post-retirement inflation number is not used as an input for any other formula because the excel stops at calculating the corpus needed at retirement and not beyond it.

Please ignore the post-retirement inflation number for now. Updating it does not do anything for now.

Sorry if it looks misleading.

Nice Article—Very inspiring…….Very good links…..Thanks a lot for sharing your real life story…..

Thanks for your comment RAJIV

Thanks Rajiv. Good luck with your early retirement journey!

Nice article, really helpful.

Thanks a million to the authors.

Thanks Animesh! Best wishes for your early retirement!

Nice article. But it reflects as if for all your problems there is only one solutions – MUTUAL FUNDS (that too equity)

But in all calculations it is straight forward assumed that the return from equity will always be @12% rate (of course its average rate over a period of time). But this may or may not be the case always with everyone.

Many my friends and relatives have assets like FARM and PLOTS or GOLD. If I go with this article, it indirectly suggest that they should immediately liquidate those assets and invest that amount in equity/mutual fund and let the compounding do its work. If they do so, all of them might attend this ‘early retirement target’ today itself.

But what if this 12% return assumption dint work out..?

Its a huge risk.

These calculations remind me of the LIC agents who used to sell their policies few years back showing such x% of assumed returns. .

P.S – Thanks for all the reference links in the article and I am not pessimist and do believe in mutual funds in fact I have got the returns even more than 12% so far. But 25-30 yrs of time and entire income of your life …..

True such returns might be difficult to happen in future buy it should therotecially be better than other assets. Also sip and lumps under data over 20 plus years shows 20 + percent returns. Reliance growth fund etc

@praful

Naren, the author here.

You raise good points. My answers below.

1. I’m not suggesting even indirectly that people who have non-equity assets should convert it into equity nor is my intention to hype up mutual funds. We ourselves have a flat which we only plan to sell so that we may buy another place of residence where we will settle in old age

Remember that we are only talking about “accumulating” inflation-beating assets for old age at 65. If your friends’ & relatives’ real estate assets are meant for old age at 65, there is no point in converting them to equity now at age 40.

Real estate requires a large upfront investment which is only possible via EMI debt for salaried professionals with no family money. But Equity is easier to accumulate steadily over time by paying an SIP amount monthly without incurring debt. So for someone with no assets of their own yet and who wants to retire early, equity is easier to buy & flexible to sell.

2. re: 12% assumed return

Agree that returns are hard to predict. That’s why I created the Excel calculator which you can download from the article, put your own expected return % and calculate the SIP required to retire early based on your situation and risk-reward expectations.

More than the return % the focus should be on beating inflation. The main idea behind the article is to accumulate the money needed to secure your current lifestyle and freeze it in any inflation-beating asset..not limited to equity. That way when you are ready to take out your retirement money from the freezer in old age at 65, it will be inflation-adjusted.

As long as you beat inflation, it does not matter if equity gives lower than 12% return.

What matters is the “buying power of money” in your kitty to meet your needs and not the “number of crores” in your kitty.

I based my illustrative 12% return on the 20-year Sensex returns between 1996-2016.

http://www.bseindia.com/indices/IndexArchiveData.aspx

Important to realize that 12% is not the year-over-year return. You have to do a CAGR to smooth out the up-and-down market returns. So if you can invest and wait for 25 years the ups-and-downs won’t affect you as you are only interested in the smoothed-out CAGR return.

3. re: having your entire income in equity

Agree. It is risky to have all your money in equity close to retirement.

Personal finance hygiene dictates that you rebalance your portfolio annually with the help of a financial advisor based on your goals and timelines. The rebalancing will move your equity profits into safer assets like real-estate, PPF, fixed-income instruments etc closer to retirement. That’s how you accumulate non-equity assets needed for your post-retirement needs. It is a holistic financial planning process based on your needs rather than ad-hoc investments in assets that produce the “maximum return”. Rebalancing your portfolio is a more detailed topic. A brief introduction is available here: http://www.livemint.com/Money/tPdeSfiI8kpG0OPnQGKc4N/Oneminute-guide-to-understanding-portfolio-rebalancing.html

“Personal finance hygiene dictates that you rebalance your portfolio annually ”

This is really important point which I think you completely missed in your article. Hope to read something in detail on this on Jagoinvestor.

Thank you for pointwise reply Naren.

I have still not plunged in MF or equity. Plan to finish my home loan in 2 years time (I have had faced job loss twice, it becomes difficult with outgoing emi) and then think about it.

Amazing work. It was a pleasure to read the article. Very practical and simple to understand. Keep up the good work.

Thank you Vishal for reading. Glad it was of help!

As usual very helpful article!!But I have a question, what kind of monthly investment we should opt for retirement. I mean if you can share tour take on options( SIP, PPF, retirement plans etc) available for investment for this specific goal of early retirement, that would be really helpful.

Thanks sonal.

I’m not a financial planner so I it won’t be right for me to recommend specific financial instruments.

The high-level concept is to accumulate the money needed to secure your current lifestyle and freeze it in any inflation-beating asset..not limited to equity. That way when you are ready to take out your retirement money from the freezer in old age at 65, it will be inflation-adjusted.

Now that you understand the high-level concept, you need to seek the help of a financial advisor for your specific goals and timelines.

Really an eye opener for ever one who wants financial freedom at early age ..kudos to Jago investor team..which is regularly inspiring us to save & invest samrtly..

Thanks Sachin for your appreciation. Good luck for achieving early financial freedom!

Nice article. Very useful.

There is one point

“From Age 40: Let compounding double your retirement corpus every 6 years until age 65!”

Here I am not sure about how to double retirement corpus every 6 years ? At the age 40 your risk taking capacity is less and it might be difficult to manage 12% compund returns. Can you please elaborate on this point.

The corpus should be big enough to start compunding faster automatically by 40 . the risk already is taken in early iyears nvestor now just needs to a stay put in the equity assets through ups and down.

@yogesh

I based my illustrative 12% return on the 20-year Sensex returns between 1996-2016.

http://www.bseindia.com/indices/IndexArchiveData.aspx

Important to realize that 12% is not the year-over-year return. So your portfolio is not guaranteed to double exactly every 6 years because no one can predict market returns.

You have to do a CAGR to smooth out the up-and-down market returns. So if you can invest and wait for 25 years the ups-and-downs won’t affect you as you are only interested in the smoothed-out CAGR return at the end of 25 years.

I would advise that you seek expert advice on your portfolio if you are worried about risk. The advisor will educate you about portfolio rebalancing as a tool to manage risk. Here’s a brief intro:

http://www.livemint.com/Money/ziMlyjxgi17YUorjUHHNvN/Know-when-to-review-and-rebalance-your-portfolio.html

An excellent and thought provoking article. However one thing I find over optimistic is the return % . In the current scenario with sluggish economy, falling interest rates, achieving 12% return consistently over period of 10-15 years sounds unrealistic. Calculating returns is never a straight line as there will be ups and downs. But the gist of article is well understood.

Equities should be able to have 12 % returns for some time till our economies develop very well. Debt alone will never help . Balanced funds Ightfield help here calculations seem realistic

@MandarK

Naren, the author here.

Agree that returns are hard to predict. That’s why I created the Excel calculator which you can download from the article, put your own expected return % and calculate the SIP required to retire early based on your situation and risk-reward expectations.

More than the return % the focus should be on beating inflation. The main idea behind the article is to accumulate the money needed to secure your current lifestyle and freeze it in any inflation-beating asset..not limited to equity. That way when you are ready to take out your retirement money from the freezer in old age at 65, it will be inflation-adjusted.

As long as you beat inflation, it does not matter if equity gives lower than 12% return. What matters is the “buying power of money” in your kitty to meet your needs and not the “number of crores” in your kitty.

I based my illustrative 12% return on the 20-year Sensex returns between 1996-2016.

http://www.bseindia.com/indices/IndexArchiveData.aspx

Important to realize that 12% is not the year-over-year return. You have to do a CAGR to smooth out the up-and-down market returns. So if you can invest and wait for 25 years the ups-and-downs won’t affect you as you are only interested in the smoothed-out CAGR return.

Somebody once said that the best tool for writing fiction is excel. Want to retire at 40? Sure! Let us pull out an excel and plugin the numbers. What? You cannot afford to retire? No Problem! Just change the assumptions! Viola you can retire now and never have to work again!!!

If only life unfolded like the fiction we wrote using excel. Its time to get a dose of reality. The only financial plan that makes sense for everybody is this: earn as much as you can, save as much as you can, invest wisely and hope that lightning never strikes. And when things go wrong (it will), be geateful for whatever can be salvaged.

Well Said Raja “The only financial plan that makes sense for everybody is this: earn as much as you can, save as much as you can, invest wisely and hope that lightning never strikes”.

@raja

Naren, the author here.

A core premise of the article is that you don’t stop working even after you reach early retirement.

When you say earn “as much you can” , save “as much as you can”… the phrase “as much as you can” is not quantified and implies no upper limit when you can say “yes! I’ve achieved my target”. Early Retirees also want to “live as much as you can” while they still have their youth 🙂

The flip side of earning “as much as you can” is that you may have less time left to spend with family or on your health or your spiritual well-being. The article is about how to achieve work-life balance from a position of strength in the form of a large retirement corpus early in life.

While I agree that the Excel is not a crystal ball into the future, it is to be treated as a questionnaire on your current expense and saving situation and the output is to be treated as a bare minimum needed for one to retire early. Excel is simply a tool for us to set clear life goals, get started on an actionable path and course-correct along the way by tracking our progress.

You are welcome to share with us any alternatives to Excel that have helped you track your goal progress more accurately.

If you are ever planning to retire early, the math looks like this.

Monthly expenses is 50,000 per month

Desired monthly expenses is 50,000 * 2 = 1 lac (if money is no object….)

Desired annual expenses = 12 lacs

Assets needed = 12 / 0.01 = 12 crores

Why such a large amount? A family member can become bedridden. Inflation can shoot through the roof. A flood can destroy your house. A critical illness costs more than what your insurance company is willing to pay. Interest rates can go down to 1% or 2% per Annum. But you can rest assured that you have so much cash that you can handle it all.

Is this realistic? Remember that we live in a country with very few social safety nets. If you are poor and broke, misery is guaranteed. Which is why early retirement is not all that it is made out to be. The best plan is to earn as much as you can: look at your peers. Save as much as you can: Do NOT look at your peers. Invest in an index fund. Find a way to succeed at work. Find a way to beat the stress. And then as you age, things begin to fall in place.

Hi Naren and Manish,

Very Interesting Article, so to conclude to have early retirement one should save 50 k per month for 10 years and ensure to have returns on investments every year 12% irrespective of age ?

Can we start at the age of and plan to retire at 50 ? will this have any pro’s and cons, ( this is for those already in nearby 40’s )

Please suggest.

Thanks,

Shravan

@shravan

Naren, the author here.

Yes, you can target to retire by age 50 even if your current age is close to 40 or just past 40.

You can download the Excel calculator from the article to plug in your current age, current expenses and other details to get the SIP amount you need to invest each month.

The disadvantage of attempting early retirement close to your 40s is that the SIP amount needed per month will be large as you are trying to compress the timeline and your corpus has less time to compound before you reach age 65. It all depends on your income, expense and saving situation.

The main advantage of trying to retire by age 50 is that you’ll be done saving for retirement 15 years ahead of schedule 🙂 The second advantage is that near your 40s you might be in a senior role at work and so your income also would be higher allowing you to afford the large monthly SIP.

In my opinion, the advantages are more than the disadvantage. So don’t stress too much and give it a shot.