Is Stock Market Crash on the way ? [ 4 charts ]

Did you invest in ELSS recently for tax saving? If you have done that with the intention of getting quick great returns in 3 yrs and then liquidate the funds, you might not like this article. Indian stock markets are seeing some serious sell-offs in the last 1-2 months and there are some reasons for it. In this article we will look at some indicators which can help you take further decisions.

Why Nifty Started Falling from levels of 6300?

You should ask why shouldn’t it fall? Everyone has bad memories about markets and 6300 in nifty is a level from where we saw one of the biggest crashes in 2008. A lot of investors had a really bad experience at that point, as they were stuck at that point and could not sell-off in 2008. They kept their stocks with them in the hope to sell it off next time when the market reach the same levels. This is what exactly happened when markets reached the levels of 6300 recently, everyone said .. “BOSS. I am now getting out of markets as I have reached my previous levels, No matter what happens next, I am just out !”, which is very natural and well-known phenomena is markets.

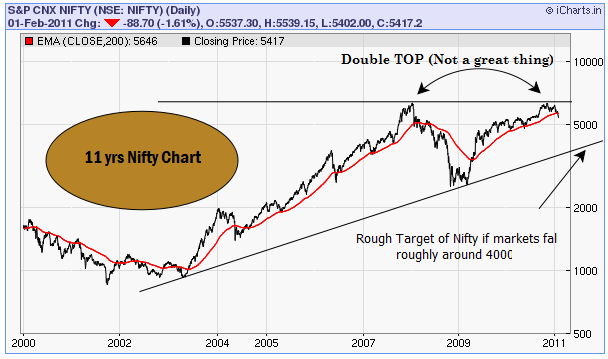

When the majority of people do this, there is serious sell-off suddenly. In technical terms, this phenomenon is called Resistance and we can see a probable double TOP at the level of 6300, not a very great thing for people looking to BUY :). I say probable double top because it will only be confirmed after markets break the target of 5350 at nifty (got this tip from Nooresh Merani). It would be a bad situation to watch ours for. Look at the last 11 yrs chart of Nifty below.

3 major indicators indicating the fall in Indian Markets

There are some serious events which are worth looking at. Let’s look at them

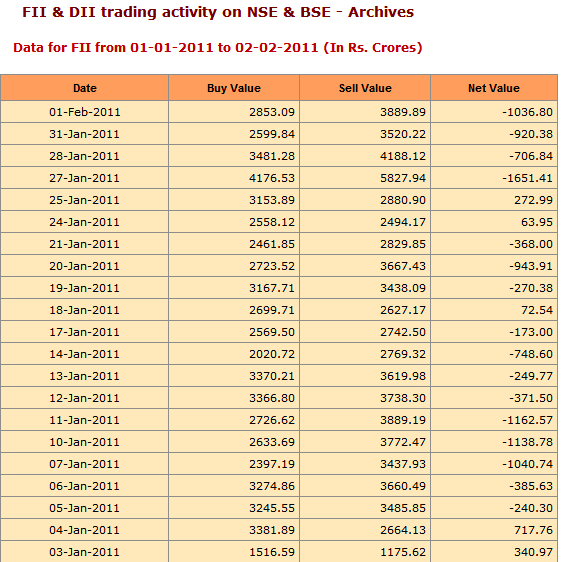

1. FII’s are selling

The biggest reason for the current market fall is due to FII (foreign institutional investors) selling off. Suddenly American and European markets are looking better than Indian or Asian Indices. Note that US markets are rising from last some months and Europe has outperformed Indian markets by 20%+ in Jan alone. FII’s have sold a lot of in the last 1 month, below is the data are taken from the NSE website.

However, not everyone agrees to this argument. “FII’s have invested around 50,000 crores in Indian markets from the point when Nifty was around 5,400 last time, which was around Aug 2010, However FII’s have sold taken out just 15% of what they invested, and right now we are at the same levels , so still lot of FII’s money is lying around.

So, the biggest reason for the fall is the fear of rising inflation and interest rates and the way it will affect our markets and economy in coming days”- says Deepak Shenoy of Capitalmind.in .

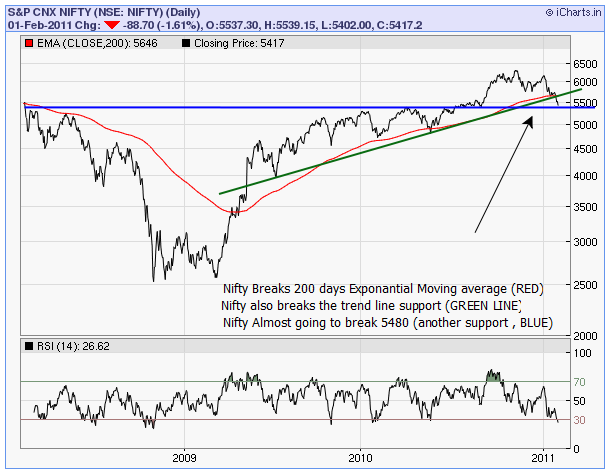

2. Markets broke its 200 day EMA + important Support points

This is not a small thing to ignore, breaking of 200 EMA is a significant event, and it has happened only twice in last 2 yrs, but it bounced back from that point, However, this time it has broken it again and got below it and not bouncing back. Incase it does not bounce back above it, It’s not a comfortable situation. So if you know GOD personally, please pray.

Look at the 3 yrs chart below which shows the 200 EMA breaking and other trend line breaking. Learn more about Support and Resistance and other important things related to stock markets here, here and here

Should retail Investor Buy right now for the long-term?

I had a talk with Nooresh Merani, a technical analyst at Analyse India, and he feels that the main panic button is still not triggered.

As per him – “The major point comes at 5350 on Nifty which is very crucial, we can not say we are entering a Bear market unless market crashes below the levels of 5350. If that is broken, then there can be further weakness in Indian markets and sell off, However if markets bounce back from these levels of 5350-5400 and go up further, it would be safe to buy only if markets move above 5700 levels , unless then better to be high on cash and not take any action. If markets can move above 5700 again , it would be a great idea to deploy cash and see levels of 6800-6900 on Nifty” – Nooresh Merani (blog) .

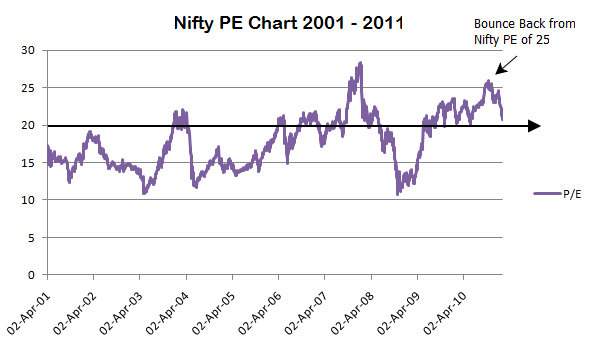

3. Nifty PE touched 25 and now moving down

Please read this post on Nifty PE incase you have no idea what is it. Nifty PE has been a good indicator till now to show the over-bought and over-sold regions and we can expect it to be a good indicator. In the last 10 yrs, It was the second time when Nifty PE went beyond 25, Only in 2007-2008 it was around 27-28 and even body knows what happened after that. Even now Nifty PE touched 25 and now it’s moving towards 20, I would not be very bullish for long-term in this kind of scenario. But there are cases where it has bounced back from 20 again to move higher, so keep it as a possibility. See the chart below which shows you the Nifty PE movement in the last 10 yrs.

Conclusion

Technical analysis is an art of reading charts and there are some serious concerns seen in the chart, however, it’s not at all recommended to take the words on rock and believe it blindly. This article and the information here are to facilitate your decision-making process. By no means, this article suggests you sell off anything.

If you are a long-term investor with monthly SIP’s running in Mutual funds, you should better concentrate on what you are good at in life and keep your SIP’s running. Only traders or short-term investors trying to catch the market movements should take decisions based on the information provided. Also if you are going to invest in markets or mutual funds for 1-3 yrs and are a first-time investor, you should understand that there is a possibility that you do not get much out of markets in returns.

Comments please. Give your comments on the charts above and what do you think should be the next move? Let’s not predict, but prepare ourselves for whatever happens next.

Note : Nifty was at 5526 at the time of publishing this article .

February 3, 2011

February 3, 2011

Hi Manish,

I don’t find at which date you wrote these articles. It is bit difficult to correlate the words “now” “today” “this year” etc.,

Say you wrote this article on xxx month, yyyy year. But I am reading this article on aaa month, bbbb year. As a reader I obvious would like to know when this article was written to know the meaning of “now” “today” “this month” “this year”.

I have one suggestion or rather request… 🙂

Could you please add date to the posts when you are writing it.

Thanks,

Deena

See the URL of the article, you can see month and year !

Oops!! I didn’t notice that..but still I feel readers prefer to see the date of the post at the top of the post I guess 🙂

I agree, a date right next to the name helps!

Thanks for great article

we are are again there 🙂

not able to get latest PE data

Stocks PE ?

Hey! I just wanted to ask if you ever have any issues with hackers? My last blog (wordpress) was hacked and I ended up losing many months of hard work due to no backup. Do you have any solutions to protect against hackers?

Seo

What exactly happened in case of your blog ?

u analysed the market very well…… nw we see wat s going on…. please see t current market situation & publish it ….

Ajay

Thanks ..

Manish

Manish,

Markets have definitely moved downwards since the time you wrote about an impending crash possibility.

What are your thoughts from here on? Do you think it looks like we might face a crash similar to 2008 levels? The macro-economic news don’t seem encouraging at all, let alone our own issues with inflation and high interest rates.

Thanks,

Ram.

Ram

I will not be able to comment on macro front , From technicals point of view , Nifty is in indecisive mode for so many months and roaming in a tight range, once its goes beyond 6200 or 5000 , there will be more force coming in that same direction .

Manish

Manish,

Thanks for the quick response.

Any views on the downside and where we might head to if the downtrend continues?

Thanks,

Ram.

Ram

No views on how much it can go down

Manish

Dear Manish,

I guess I was a stupid to invest in Sept 2010 in one go Rs.50000/- now I am at a loss of 6,000/- but I am long term investor, I mean more than 4-5 years…. What should be my next move…. I am Confused….

Harpreet

Even in Sept 2010 , the Nifty PE was as high as 22-23 . So definately it was not the best time to invest . However as you have invested now and as you say you are long term investor , it might be ok to wait for 5-6 yrs to see decent returns . However it depends where have you invested . If its mutual funds ,then its fine , but if its stock , u have evaluate its potential in coming times .

Manish

[…] NIFTY PE is still ~20 (market is not that cheap as you think) Here is a very informative article from one of my favorite blogger in financial planning space – Manish Chauhan (this guy is an ITG and works in Yahoo! B'lore) Is Stock Market Crash on the way ? [ 3 major reasons] […]

Hi Manish,

Can u please tell me how can we calcualte the MRP of a stock? Is there any formula for the same. Please help.

Kavita

MRP of stock is a concept from a company called Moneyworks4me , its not a general concept . They methodology would not be an easy one ! , go to their website .

manish

@moneysights @Jagoinvestor: thanks for response.

Let me give u background of my 1 lac investment.

I am having 3 SIPs in different Mutual funds and a no of stocks across different sectors (in large cap only)…..I am an average-market-techincals-understanding investor…I received unanticiptated 1 lac amount from some source and need this money after 1 year period; so looking for short term investment for this amount….the reason I say MF skeptical is w.r.t. 1 yr term, I see equity oriented MF are very risky considering all market issues (fluctuation, FII, etc) currently going on and debt oriented MF generally gives < than even FD interest(currently for 1 yr it is 7.5-8%) in 1 yr period…so I analyzed my portfolio and found I have very less investment in banking sector(considering even investment thru MF indirectly)…and infy is one which I always wished to have on my portfolio…

please let me know now your views with this background.

@Ankur,

we are perplexed that you think you are comfortable buying infy or stocks directly but feel MFs would be volatile, etc. What makes you think that infy will not fall & MFs would fall!

—

moneysights.com

@moneysights: I was almost sure that you might be amazed. As I mentioned I am Ok with taking risk on this 1 lac investment. And an average-understanding investor like me get influenced by difference between resistance price and current market price of particular stock. For e.g. in case of SBI, it shot to 3489 in month of Nov 2010 and as on Feb 8 2011, it was around 2600. And based on my little technical knowledge, I thought 2500 is support price of SBI and the trend looks upward, so thought of buying it…i would appreciate if enlighten me with what I thought incorrect…

@Ankur,

Well, we really don’t evaluate stocks based on technicals at moneysights.com. So, would be unable to comment. But, our concern wasn’t about you buying SBI or INFY. It was about what makes you think MFs would continue to be volatile. Besides, putting 1 lakh in 2 stocks might just concentrate your portfolio holdings too much. One needs to be diversified across sectors & stocks. We aren’t aware how many other stocks you have, but if you have none & plan to buy 1 lakh worth of these 2 stocks, it may just be risky. Not that we are saying SBI would go down. But if anyone in the markets knew what would happen tomorrow, investing in stocks would have been much simpler than it is today.

—

moneysights.com

@moneysights, thanks for your response.

Investing in direct stocks vs Mutual Funds is about currently in highly volatile market, I tend to gain more control over my portfolio at much granular level. In MF case, I don’t have any control what do they with my money.

Although MF brings many benefits most important highly skilled manager managing investments etc; but I don’t know during high volatile market I become very possessive about my investments toward MF.

Ankur

I think its a personal preference and the way you share your relationship with your investments . I can see you would be better investing directly in stocks , rather than mutual funds , there are not rules in personal finance that mutual funds are always better than direct stocks .

Manish

Ankur

Good that you mentioned this point , SBI looks very very strong buy at the levels of 2500 . You can see that level is a strong support point as it has been a previous long term resistance point and have been broken last year .

This current down move looks like a fibbonacchi retracement of 50% . Should be a very good point to bet some big money with Stop loss of 5%-10% loss for an upside potential of 50-100% .

I would say go BUY .

Manish

HI Manish,

Considering the situation now in stock market, how do u think shud I invest? I have to invest 1 lac rupees. I was thinking of 50:50 investment in SBI and Infosys shares. What is your opinion on this? Investing in Mutual Fund looks skpetical today.

Ankur

I cant give your suggestions ,but I would personally wait for a better time to invest . Its not the best time .

Manish

@Ankur,

Any specific reason that you say “Mutual Fund” looks skeptical today?? There is never a bad time to start SIP if one has a long-term investment horizon. Least that Mutual Fund investment would do is offer you good diversification across good stocks with decent return possibilities.

Also, if you choose to invest in stocks why invest such large amounts at 1 go & that too in only 2 stocks??? One should always invests in smaller amounts & diversify across different sectors & stocks. Smaller ofcourse is a subjective number. So, unless your monthly investment amount is in couple of lakhs, you should not consider investing 1 lakh at one go.

In these circumstances of falling markets, no one would recommend you specific stocks w/o understanding your risk profile. Its better you make informed decisions on your own or choose to invest in Mutual Funds thru SIP or if you are in a rush, invest the 1 lakh over 2-3 months in good diverified Mutual Funds.

—

moneysights.com

Hi Manish,

I think the suffix to the title should be “- short term traders”.

For long term investors prospects are always good.

Look at other factors as well. I am sure FM will provide in upcoming budget some sops to increase the growth rate keeping in mind increasing fiscal deficit. FM will push LIC to support the market which has been done in the past. Money invested by people in tax saving avenues. This needs to be deployed in debt and equity instruments. How long can MF,Insurance companies will sit on cash?

Regards

Atul

Atul

I accept its for short term traders only, its mentioned in the article

That was a good insight… but i think it is a little early to call it a double top… anyways I am planning to re-enter the market and am looking forward to a big drop… plan to get in systematically over a period of 1 year to average out… liked your columns.

Siva

If you are expecting a big drop , why are you entering ?

Hi Manish,

This is my first post here.. and is about my favourite topic…

It was a clear double top…. But most of the market correction is now over… I expect this carnage to end near to 5200 levels..the max downside we can see in market is 5100 levels..unless we are rocked by a political turmoil.. One can enter fundamentally sound scrips at current levels for ST, MT & LT..

As Buffet says be greedy when others are fearful and be fearful when others are greedy… It is time to get really greedy… 🙂

Anand

looking at the yesterday’s turnaround between the day , seems like you were right about 5200 point 🙂

Manish

Dear Manish,

Your article was very educative. But as you said it was more for the traders than long term investors like me. So I am continuing with all my SIPS and may even go in for couple of more SIPS in coming days.

However, I have a nagging fear. I feel that India story is going horribly wrong, not because of inflation, but because of corruptions and scams and Government’s inability to do anything about it. Of course we may continue to grow , but not at the pace we thought earlier. So I feel that even if you are a long terms investor, you should expect only modest returns.

What is your opinion Manish?

Milind

Milind

Yes .. Continue your SIP’s . Regarding India story , do you think corruption etc is more now compared to past ? I dont think so … so i beleive it will still go the same way as it was going 🙂

Manish

“Also if you are going to invest in markets or mutual funds for 1-3 yrs and are a first time investor , you should understand that there is a possibility that you do not get much out of markets in returns .”

Why do you say that we will not get much in returns that too in 3 yrs?

Pavan

THere is a possibility , some one who invested in ELSS in start of 2008 has completed 3 yrs today , his returns are -5% or -10% after 3 yrs ,we are at the same point right now where we were in 2008 , it can be repeated PROBABLY !

Manish

Manish

Imagine if someone had invested in SIP instead of lump-some in same time period.

For example a monthly SIP in HDFC Top 200 in 3 years time would have fetched a whopping 25.98 annualized returns (data taken from HDFC mutual fund website).

The Sensex on the other hand had moved from 17700 to 18200 level in same period a mere 3% absolute increase.

The reasons for this extraordinary difference in lump-some investment and SIP is due to the immense volatility and the crash of market where Sensex tested 8000 levels.

Ajay

Thats a nice point .. Yes SIP is for these periods only when markets are very volatile or you cant judge the market movements 🙂

Japanese Funds have been selling EMs since Jan. Also US investors have redeemed EM funds. Although only about 2 billion has moved out of Indian Market, due to poor market depth, we are seeing sharp falls. I think this will continue till March. Getting P/E to 11 may be difficult as there are no other big panic like in 2008. Only ray of hope for lower PE is Egypt virus spreading to whole of middle east and finally to Pakistan. But I will rebalance around End March.

HI Manish,

I have been going through your blogs for quite sometime and I can say Hats Off to you for doing such a wonderfull thing for people like me who are new to financial world and learning basics.

I Recently invested 30k in both Fidelity Tax Advantage Fund and HDFC Tax Saver fund. So was it right time to for these ELSS ?

Also , I need help on when can we exactly time the buying of a fund in market.

I wanted to do SIP but am not sure if i can invest the amount regularly.

Sachin

As nifty PE are high at the moment , I dont think it was the best time to invest in equity that too with lock in of 3 yrs , dont panic ,you can leave your investments for long term .. you should get better returns in long term .

As you are planning to SIP , dont try to time the market in that case .. there is no easy way or I would saty there is no way

manish

So according to you should i go for SIP from now or not.

I am 24 years old and i can wait for long term . So I can take risk ?

If so , can you please suggest me some good funds with diversified portfolio. I am also planning for PPF with minimum of 500rs per month.

Sachin

As you are a begineer , dont rush at the moment .. invest your money in balanced funds through SIP route . for now choose HDFC prudence and do an SIP for few months .. get to know what all it takes to do good investing ,. learn .. there is no rush ,..

Its far important to avoid wrong decisions than to take right one’s .

manish

Hi Manish,

I think 15-16 PE is a thing of past now. Now it is a lot more mature market. Or am I becoming too optimistic about the future earnings?

I am a NIFTY Bees Investor. Is it a good thing to invest in passive ETF? I think FII like large-cap companies so buying NIFTY Bees would help in short term. Your comments?

Sachin: Recently stock market has shed almost 10% so it is necessary to know when you invested. If you have invested when sensex was/is 18K then it is a good thing. Be confident that sensex falling to 17K is unlikely and sensex falling to 16K is almost impossible.

sanjay

Nifty PE going to 15-16 is not of past .. you can see it happeneing many times in last 10 years and recently before 1-2 yrs back nifty was at 15 only . and we are at 20 right now , so its very much possible , what reasons do you have to say that its tough ?

Manish

Sanjay ,

I have invested in ELSS just on friday when sensex was at it low in recent times. I hope that I have made the right timing. As i read in some article that february of many years in the past has yielded good returns. Is it the case ?

Manish,

One query regarding long term capital gain tax on balanced funds.

HDFC Prudence is 70% Equity and 30% Debt and where as HDFC Balanced is 60% Equity and 40% Debt. This mean long term capital gain tax on Prudence is 0% where is on Balanced Fund it is either 10 % or 20% with indexation as it has less than 65% equity component.

Am I right ??????

Pl offer ur comments

Amit

Yes , you are correct

ok . Thanks Manish .

I wil keep following your blog.

Sure 🙂

Manish ,

One more clarification needed. I dont know if this is the right place to ask any doubts as the thread is about Stock Market going on.

Anyways,

I was just going through some articles and found that FD interest rates are raised.

So i decided to go for it as inflation is also high.

Now , i was in confusion like which bank to go for.

And , i noticed one important thing.

Say I invest in Axis Bank 20k which gives 7% returns if FD is done for 6months and maturity amount will be Rs21400. And if i again reinvest 21400 in 6 months FD again , then I would be having Rs22898 which is equivalent of 14.49% return in year

Now If i would have invested same 20k in same Axis Bank for a period of one year instead of 6 months i would get 8.75% interest which is equialent to Rs.21750.

So Clearly we can see that if I do invest in time horizon of 6 months each i would be getting better returns.

Is my Analysis Correct ??

@Sachin

If u invest 20k for 6 months in FD for 7% returns, it will be 20,700 only. u wil get 21400 only after one year. note tat banks will quote interest rates per annum.

Regards

Jagadees

Hi Manish,

How do you calculate E in PE? by taking earnings over last 4 quarters or last 1 quarter or something else?

You should not have stale data to begin with. You have to consider that point also — especially when world is speedily recovering from a slump. (Note that real estate prices in India has reached pre-crisis levels. US bases financial institutions are reporting increasing profits quarter over quarter.)

Sanjay

The PE values was taken from nsewebsite . I have no idea how they calculate it

Manish

@Jagoinvestor,

PE for NIFTY or any other indice is calculated by first calculating PE for all individual companies which constitute the index & then taking the average i.e. add PEs of all constituent companies & then divide by number of constituents (50 for NIFTY).

Many people do think that instead of taking flat average NIFTY should take weighted average based on the weights of the individual constituents, but stock exchganges don’t calculated PE that way.

—

moneysights.com

Thanks for the info . I think its not a great way of finding the NIfty , it should be based on weaightage average or any other way , it can be market capitalization or whatever ..

Manish

Agreed. When we started calculating PE of indices, even we assumed weighted average method. But we were taken by surprise after finding the values didn’t match with NSE’s values. Still don’t know why NSE/BSE does that way….but then when exchanges declare their is PEs that way, you can’t have an option.

On the market cap bit, there will be no difference if you take individual PE or market-cap divided by net profit. In fact, we calculated individual constituents’ PE by market-cap divided by net PAT and then like NSE, we are forced to take flat average.

—

moneysights.com

ok , in that case it would be a good exercise where you see how NIFTY PE moved when it was calculated taking into consideration weighted average . Are there some kind of low and high ranges forming which can be considered as an indicators for overbiought and over sold like we have right now . example 11-12 is lower and 25-26 is on higher side ..

My gut feeling is that the current way should be giving the better indications ..

Manish

will definitely check that….and share when we are able to do it. i do remember that the values by weighted average were much much larger than the PE calculated by current method followed by stock exchanges.

ohhh is it ! . then it might be NSE trick to show that indian markets PE is low and hence make it look “attractive valuation” than what it is in reality 🙂 . Thats great info ..

It would be good to plot Flat PE vs weightage PE so see some trends and how markets moved in co-relation with both kind of PE . should be a mini-project in itself !

We doubt NSE would do it to show NIFTY as attractive. Maybe every stock exchange would be doing it that way, otherwise Global Fund Managers would have raised this point.

One thing which may justify the present method to “some extent” would be that SEs maybe viewing indices as akin to a stocks for promoting index investing. Most fund managers when referring NIFTY’s PE almost fall short of referring NIFTY as a stock – when saying NIFTY earnings growth, NIFTY’s book value, etc, etc. Hence the flat average method. Though, we are not sure if this justification is valid. Its purely our interpretation.

—

moneysights.com

Hi Sanjay,

The E in PE is calculated for last 12 months i.e. last 4 quarters.

—

moneysights.com

Thanks for the info.

Btw, I am saddened by the fact that your research shows weighted PE throws a very bigger number than flat PE. It means the prices are not cheap right now and wont be even if nifty falls to 5300 or so.

I would like to second Manish : It would be great if you can share the the graph plotted with weighted PE. It would be a real eye-opener.

@Sanjay,

i can understand your disappointment to know this 🙂 But don’t loose hope. What @Jagoinvestor has shared in this article is purely for technical analysis & is meant for people who have inclination/interest to base their investing decisions on technical.

If you are a long term investor, you should look at evaluating fundamentally good scrips. In fact, as per moneysights.com analysis, as of today there are approximately 100+ stocks from across the market that are trading below PE of 16 & PB of less than 3.5 & are also are fundamentally strong.

Note: If one is evaluating based on fundamentals, then it makes sense to look at stocks’ EV/EBITDA then PE. One of the fundamental drawbacks of PE is it hides the capital structure of the company (read face value of the stock & at times effect of stock split/bonus in the past). It is unfair to compare 2 stocks on PE when their face values aren’t same. EV/EBITDA has no element of face value & hence you may be better off looking at that picture.

Hope this is helpful

—

moneysights.com

Sanjay & moneysights

Yes .. I agree with moneysights .. One more point I want to add is that NIFTY or SENSEX is not the 100% representation of overall markets .. these indices are just representing few stocks from the ocean of stocks , while its true that the indice is a indicative of over all market , but still there are hundreds of stocks which are fundamentally great .

Its like when there is riot’s , many innocent people are also killed , Its very much like that .., dont “tag’ those innocent stocks as “bad” which still have potential , see them in absolute identity , you will find gold and silver even in this muddy situation 🙂 .. oops .. is it me talking like this ;0

manish

@Jagoinvestor,

We couldn’t agree with you more….in markets, there are always opportunities to be “discovered”, its only that whether one has the intention & patience to discover them.

We can quote Hero Honda (not an unknown name by an means) as an example – from the period February 2008 till date, Hero Honda has managed to appreciate by 111% compared to markets which are still in negative by absolute index value point. In fact, from Feb 2008 to 2009, when markets had given -50%, Hero Honda had actually appreciated by 24%. Yes, its true. We are sure there may be many mid-cap or unknown companies which probably must have given positive if not Hero Honda kind of returns.

—

moenysights.com

There is one more reason for market to fall. The ‘death cross’ which is seen today on chart (the 50 day EMA crossing below the 200 day EMA on a price chart) signalling further fall.

Pravin

Ahh ,, what is that 🙂 .. I heard it or first time , Has history been very cruel when this happened earliar ?

The ‘death cross’ is a widely-watched warning sign that the stock market could be heading for a sharp fall. When the 50 DMA moves downwards through a flat-to-downward sloping 200 DMA, the death cross is formed. This pattern is now formed in S&P CNX Nifty Chart.

For more info on Death cross please visit (http://www.investinganswers.com/education/principles-technical-analysis-death-cross-golden-cross-1402)

and (http://investmentsfordummieslikeme.blogspot.com/2011/02/12-sensex-stocks-displaying-death-cross.html)

Hi Manish,

I was reading Outlook money today and some of the portals now have the ability to trade in overseas markets.

As we are aware that overseas markets may give a better return than Indian counter parts, would it be better for an investor to venture there?

May be in some post you might want to elaborate on this?

Rajat

Rajat

May be you are looking at the recent better performance of overseas market . Do you mean to invest in those with very long term like 10 yrs ? I am not excited with that

Manish

Manish, in my opinion, Technical Analysis is quite tempting but often doesn’t hold much value for anyone probably except day-traders.

We must not forget that S&P P/E ratio kept rising from around 8 in 1982 to 44 in 2000. It was the period of mad growth, something similar to what India is expected to observe. It didn’t make sense, but it happened. 50+ P/E ratios are not new to China.

Also, technical analysis can not appreciate the foreign and economic stimuli. Accept it or not, our price levels are dictated by what is happening in US and Europe. The bullish optimism simply follows the ‘hot dollars’. Emerging markets are just beta multipliers, with a positive drift in the long run. If Europe tanks tomorrow, for no internal reason, we might go back to 3000; if all goes well, 7000 is not far away.

Just keep SIPping.

Smart Singh

I am actually a believer in Technical analysis , so i am little excited with it . However I take your point and agree that TA is not the end or its not the sole decider of something and we have to also confirm things from other angles .

Btw , I do not agree with you that technical analysis is of no use to anyone except day traders , Even for people who are long term traders like 3-6 months or even investors for medium term ,. Technical analysis can give a good idea on right points to buy and sell ..

There might be clash in beliefs here .. nothing wrong ! 🙂

Manish

Hi Manish,

Superb information, putting all reasons of fall of market in one article. I forwarded the link to all my friends. Why can’t you write about basics of Technical Analysis? Because persons who are new to these technical words find it to difficult to understnad and judge.

There are many posts on technical analysis on blog . search for them . it gives a good startt