Applying for home loan? Here are 4 highly critical checklist you should follow

Are you going to apply for a home loan in the near future? If Yes, then this article is written exactly for you, because I am going to share with you a checklist which you should follow to make sure that your loan application process is smooth and also to increase the chances of your loan application getting approved.

We all take various kind of loans these days, be it home loan, car loan, personal loans or even credit cards. I will show you some very important checklists which if you follow; you will save yourself from various issues faced by other loan seekers.

Note that while this article is primarily written with a home loan in mind, but the checklists discussed will also apply for any kind of loan.

Checklist #1 – Check your CIBIL report/Score in advance

Don’t underestimate the role of credit reports/score in loan approval process these days. The first thing the lender looks at is your credit score/report when you apply for any kind of loan (even credit card).

The moment you enquire for a loan with a lender, they check your report from CIBIL or any other credit bureau like Equifax or Experian and based on the remarks on your report and your score, they either reject your loan application or forward your case for further checks.

There are many real-life cases, where a person applied for a loan and found out that it got rejected because of this credit report is messed up. It might be due to a credit card settlement he did a few years back or because he was not able to make timely payments on his past loans.

Imagine a person who has already paid the booking amount for a car or a house and then he is stuck because he/she can’t get the loan approved. That’s not a situation; you would like to get into!

CIBIL score of 750+ is a good score

How much CIBIL score can be considered good enough to get any kind of loan? Well, there is no guarantee that you will get a loan just because your credit report is high, but as per CIBIL, out of every 100 people who got a loan approved, 79 people had a score of more than 750.

This means that if your score if more than 750 out of 900, there is a good chance that your loan will be approved, provided there are no bad remarks on your report and other things like income proofs are in place.

Apply for your CIBIL report in advance

So when should you apply for a CIBIL report?

I think it should do it much before you apply for a loan. I suggest at least 6 months in advance because if there is some issue in the report, you get enough time to rectify that mistake.

There are many cases, where a person applied for a home loan after paying the down payment money, and their home loan is not approved because of CIBIL related issues. Now they are stuck as they are not getting back their down payment money back and their application is also not getting approved.

They run around to fix their issues or try to improve their CIBIL score, but now it’s very late because it takes many months to follow up with CIBIL or Banks involved. Last-minute fixes do not work, that’s the reason this check needs to be done well in advance.

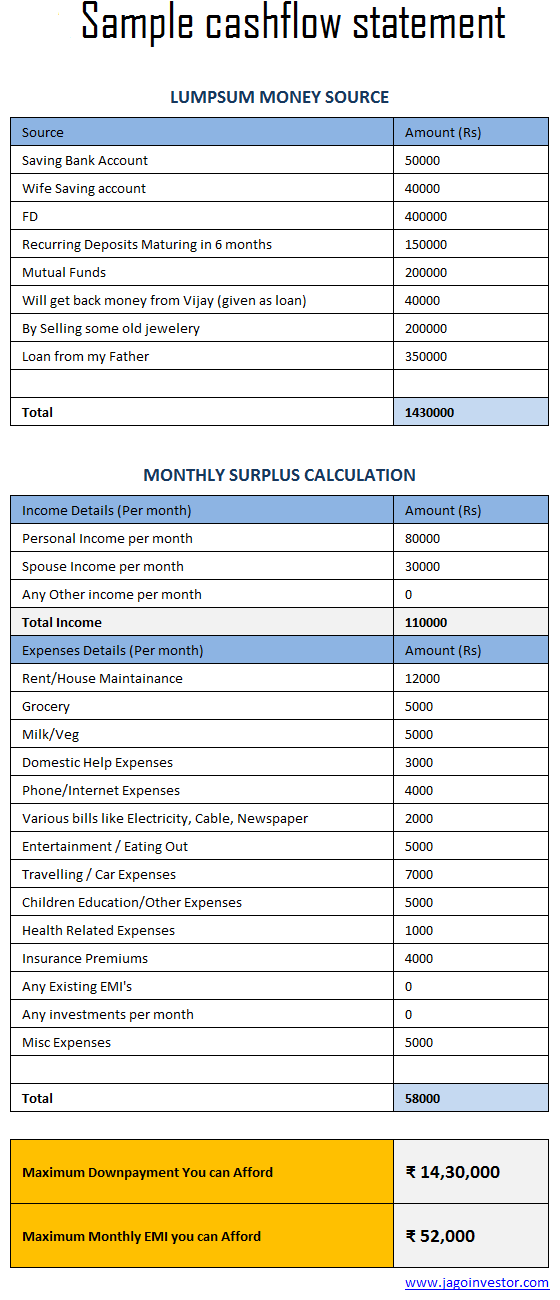

Checklist #2 – Make a simple Cash flow statement

If you are applying for a big loan like a home loan or a car loan, then it’s very important to understand where you stand financially. You should have a very clear idea about the maximum down payment you will be able to make (and you should also try for that) and what is the realistic EMI you can pay each month.

As our wealth is scattered across various financial products like saving bank account, fixed deposits, mutual funds etc, it’s important to note it down in an excel sheet to get better clarity.

You should also list down the income and expenses details so that you can get an idea about how much you save each month. Your surplus each month is a very important criterion used in calculating your loan eligibility by the lender.

Below is a sample working of cash flow in an excel sheet, which gives the good enough indication of the down payment amount and the potential EMI a person can afford.

Download this Excel Sheet and Calculate your numbers

It should not happen that you applied for a loan much beyond your capacity and then at the last minute, you are wondering where you will arrange for extra money. It can be a very frustrating situation, where you are stuck in a deal and you are not able to figure out how to arrange for the money.

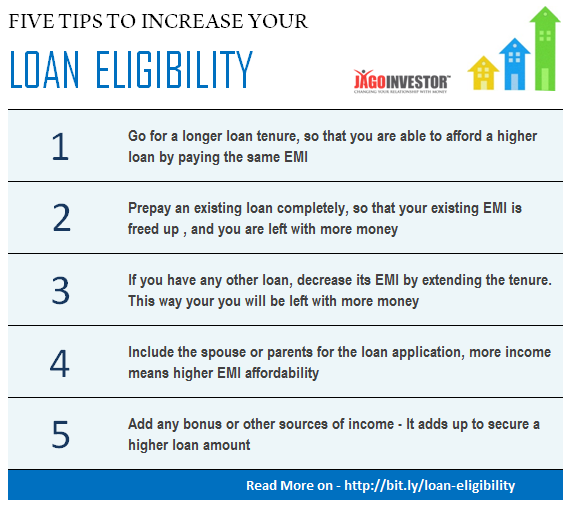

Checklist #3 – Increase your home loan eligibility

When most of the buy a house, they wonder how big a house they will be able to afford? Just because they have a high salary, they think that they will get a big loan, which most of the time is true, if you don’t have any existing loans.

But then a lot of people have several small loans running like a personal loan or a bike loan or any other consumer loans, and these small loans come in the way of your loan eligibility because they show up in your “pending loans” or “Existing EMI” list.

So one the actions you should take is to close off any small loans you have because they will increase your “surplus” as the EMI will get stopped, and also you will have one less commitment to take care of and lender likes that.

Below are some handy tips if you want to increase your home loan eligibility.

Let’s see an Example

Suppose, your per month income is Rs 1 lacs and you have a bike loan (or personal loan) currently running with Rs 8,000 EMI per month with 10 more installments to go. Now with this profile you are eligible for Rs 43 lacs of home loan.

How can you increase your home loan eligibility in this case? You can prepay your entire bike loan as it’s a small loan if you look at the outstanding amount; you can dig into your other savings and pay it off. This will surely reduce your savings a bit, but increase your loan eligibility by another 8-9 lacs because now you have another Rs 8,000 surplus each month.

See the home loan calculator snapshot below which shows you this.

Even your CIBIL report will also show that you have successfully completed and paid off a loan provided you do this a few months in advance before you apply for a home loan.

Close you credit card outstanding also

You should also consider to pay off your entire credit card outstanding bills. May people keep rolling their credit card debt by paying the minimum dues, but that’s not a good thing if you want to get some loan in coming future.

If you are looking for a home loan, then go to this home loan eligibility calculator, enter your details and our trusted partner will help you in securing the best home loan. You also transfer your home loan by applying here

Also, decide if you want to apply for a joint home loan

One way of increasing your home loan eligibility is to add your spouse or any other earning member from your family as a co-borrower of the property. This is one factor you should consider if the spouse is already an earning member. Even if it’s not a significant amount, still mentioning that they bring in some small income helps your loan application, as it adds to the “stability” factor.

Checklist #4 – Arrange all documents required for a home loan

Some background preparations on the documentation front can help you save last-minute hassles and running around. I have often seen many people running around, for ITR proofs and other documents because they didn’t plan well in advance. Below are various documents that might be required for your home loan documentation purpose.

It’s a good idea to prepare a file and arrange all these documents well in advance. These documents are keeping in mind a salaried resident Indian.

KYC related Documents

- 2-3 Passport Size photos of applicant and co-applicant

- Identity proof like PAN or Voter ID card, Passport, Aadhar card

- Address proof like Electricity bill, Telephone bill, Employer Certificate, Aadhaar Card

Income & Employment-Related Documents

- Past 3 months salary slips

- 3 yrs ITR (Income tax Returns)

- Latest 6 months bank statement attested by the bank in original

- Latest Form 16 for 2/3 yrs

- Proofs of all savings like FD’s, mutual funds, gold etc (for a down payment)

- All ongoing loan account statement for past 6-12 months

- Relieving/Experience letter of the previous company if current employment is less than 2 yrs old

Property Related Documents

- Original copy for Sale Deed or Agreement to Sale

- 7/12 extract

- Commencement Certificate

- NA certificate

- Search and Title Report

- Building Completion Certificate (if available)

- Latest Tax receipts

- Development Agreement

Below is a video from IREF, where a guy (seems to be from a bank) is explaining the home loan process and overall documentation requirement. It’s a 7-8 min video in Hindi, kindly view the full video to understand why some document is needed.

Extra documents for self-employed and business professionals

In case you are not a salaried person, then some documents will be different in that case, which is as follows

- 3 yrs ITR, along with profit and loss statements certified by a CA

- Your bank account statement for last 1 yr

- Shop Act License

- Partnership deed or Company related documents

- Brief write-up about your business and the nature of work/revenue

This common floor article mentions even detailed list of documents

Some Important points to remember before applying for a home loan

- In case you are planning to quit your job or planning to change the job, it’s better to first apply for a home loan and then quit/change, otherwise, it will get very tough to get a home loan later.

- If you are sure of getting an increment very soon or your pay rise is on the cards, then wait a bit and apply for the home loan later as it will increase your home loan eligibility

I hope this article gives a clear direction and action checklist to someone who is looking forward to a home loan or any other loan. Please share any other critical checklist which I have missed out. Also, I request other members to share their experience when they applied for a home loan.

June 1, 2016

June 1, 2016

Hi Manish,

Really great article, I just came across this online portal http://www.loankuber.com they have this interest rate calculator given on their website.

Are such rate calculators accurate?

Also is it safe to provide my credentials to such a website?

Hi,

Here is company called Good money, they are providing a platform for both investors and borrow where you can register as one of those and apply loans with a simple verification process and then they link you to the investor or borrower who match your requirement and helps to process a smooth transaction.

Thanks for sharing that !

Hi Manish,

I needed some clarity on home loan, i live in my own house ground + 1st floor , house is in my mother’s name, i am planning to construct another floor 2nd floor , my mother is a retd govt employee she wont get a loan, i wanted to know what are the documents i need to take for the loan for construction? iam a salaried employee.

Thanks & Regards,

Jayatheertha N

Hi jayatheertha

The basic point is the land has to be on the name of the person who is taking the loan.

Hi Manish,

In that case will i not be able to get a loan?

Thanks & Regards,

Jayatheertha N

You can get the loan only if ur grandmother who is the owner of property comes as co-applicant in the loan.. Banks wont finance unless the owner of the property comes as applicant or co-applicant in the loan.

Hi Manish,

Informative article as usual. Thank you

I have a doubt, about the chances of getting home loan sanctioned when some one has neither taken any loan nor has a credit card. What would be their CIBIL rating?

Thanks

In that case there wont be any credit score! or it would be -1

Hi Manish, I appreciate your blog on Home Loan. I would like to add here that the EMI(Equated Monthly Installment) which determines your repaying capacity and hence Loan eligibility is arrived at by adding the regular sources of income. Bonus is not some thing paid on a regular basis. Therefore, it is erroneous to say that adding bonus to your income will increase loan eligibility.

Thanks for sharing that sanjeev

hi Manish,

I am Anand, My Father has a building and he got approval to construct the house.

For loan can i be a co applicant and reap the benefits of tax saving ?

Thanks

Anand

Only if the land is also on your name!

thanks Manish for this.

dear manish,

i need clarification about two things:

1. whether 30 years tenure is bad in the sense , you are paying more interest

2. if you repay in lumpsum, interest will decrease

YEs, both statement are correct !

Hi Manish,

Sorry for dversion from the discussion but I hope you would reply to my query!

My elder brother got blessed with a newborn boy. He wants to invest to the secure future of the child. This is clear to him that a secured way of investment he wants to do for the child. So if he desires to have a good amount after 15 years, should he invest in FDs or PPFs.

I read somewhere that there is TDS on FD’s interest if the interest is exceeding 10k per year, it is also clear he can avoid this by making FDs in different banks.

But the real doubt is choosing PPF path or Fixed Deposit. Is there other secured way of investment which we can give a thought to?

Should he divide the money to invest in both. And is there any scheme or method through which a certain amount of money can be got for the child’s extracurricular activities during school education?

A child’s future can be ensured if a parent get income throughout the growing period of a child. Thus the first need will be to have sufficient insurance for the same. There are many insurance linked saving plans, through which a parent can invest in a child’s name. An insurance in parent’s name will be logical and optimal.

Once the above basic need is taken care, a parent needs to ensure a growth corpus, which ensures a choice of options to the child as he/she grows up. An important consideration for this is the time available. If it is long term, PPF is good. If the tenure ie between 10-15 years, one can safely invest in equity linked mutual funds to get decent returns. If the tenure is less than 5 years, debt funds/FD’s can help. They provide security of the corpus and reasonable interest.

As regards tax, banks are required to deduct TDS if the interest is >10000 for a person per year.(All deposits put together). Banks donot deduct TDS on interest given on saving bank balance. If savings bank interest is more than 10,000, one needs to pay tax on the differential as per his/her slab, if he reaches taxable limit. Splitting deposits in different branches of same bank or different bank won’t absolve him of tax. IT department has a software, where they can track the interest income of a person based on a PAN. Hence trying to avoid tax by splitting is not useful.

As regards split between FD and PPF, FD interest is taxable but corpus can be withdrawn whenever required subject to conditions. Unlike FD, PPF corpus is locked in for the first 6 years and then one can withdraw following certain rules.

If he is clear about the “secured” assets, then PPF would be a good choice.

Even debt mutual funds would be a good option given the secured nature !

Dear Manish,

I tried to get the details from Paisabazr site which you had mentioned in the link. Which clearly stated they do not have any details for the loan which I am looking for. It seem somewhere it is only meant to collect the data about the customer looking for the loan. I am really unhappy with the act.

Hi Nikhil

The way it works is that you enter all your details and their backend filters all data and finds out the banks which can provide the loan for that profile. Looks like for your profile (I mean the data you entered) there is no bank match, Or no bank provides loan for that profile. Its not just to collect the data, but to algorthimically find out the match , unfortunately in your case, there was no match .

Manish

Dear Manish,

Thanks for your prompt reply, I regret to inform that the details filled were right. With the same details all the banks are ready to give desired loan. Having said that the same banks were mentioned in the check list. As I needed a single comparison , details were shared. If you want to double check I can share the details with you and you will also get an assured calculation.

An excellent article, straight to the point. Thanks Manish !

Thanks for your comment vishesh

Mr. Manish, any idea when the people started writing articles on personal finance. How it came to your mind to educate the people

I loved Educating people , hence started writing !

As soon as you close any loan or EMI make sure to get the NOC from the bank.

Banks demand these documents as well, as a proof of loan closure.

Yes, thanks for sharing that !