Till what age should you take your Life Cover ?

From some last some days I am getting queries that some Life Insurance Policies are not giving cover for more than 65 yrs of age or for Tenure of more than 25 or 30 yrs and why they dont want to take those policies because they want a cover till 70 or 80 yrs of age . So People are confused on which one to take. They generally want a cover which covers them till 70-80 yrs of age or sometimes whole life . Let us talk about till what age should you target your Life cover generally .

Why do we buy Life Cover ?

Now lets talk Logic and think logically , no expertise required here . What is Life Insurance and How much Life cover do you need ? Life cover is to cover the risk of early Death of bread winner and for hedging the risk of loss of income due to the sudden unexpected death of the main earning member . So ideally Life Insurance cover should only be there till the retirement of the earning member , because anyways after that he/she wont be earning , so no one will financially dependent on that person . You only think , If you are 70 yrs old , do you need Insurance cover ? Who is dependent on you by that age , generally ? How many of you are dependent on someone who is in that age ? Are you ?

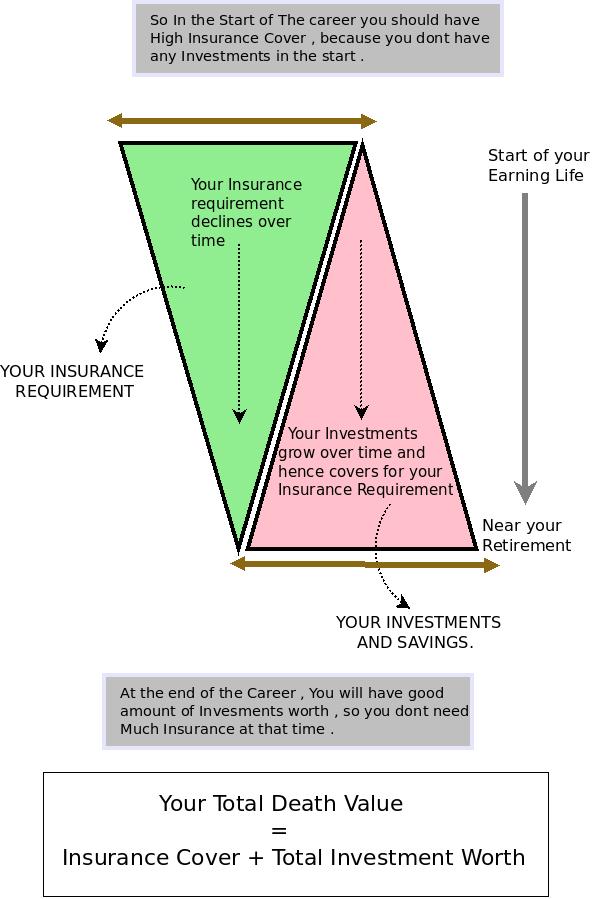

Hence if a person age is 30 and he is planning to get retired at age of 58 . He requires a policy which covers him till age 58 , not more .. See the Diagram Below …

[ad#big-banner]

So what do we learn ?

Life Insurance is in other terms a replacement of your potential Future earnings. Hence, Insurance amount which your dependents gets should be a substitute of all the amount the bread winner is going to earn in his life time and provide for needs of his Family. Therefore when you are near the retirement and if you die, your potential future income which you were going to bring in the family will be less and hence your Insurance cover at that time should be less . We today have Level Term Insurance where we have the same level of Insurance at that time , which is ok . Note that we also have decreasing life insurance cover and Increasing Life Insurance cover also . So lets see the main points we learnt here

- We need High Insurance cover at the start of the Career when have no Investments . Look at iTerm Term Insurance from Aegon Religare and Some Tips while taking Term Insurance

- We need to be covered till the time we want retirement .

- The day we earn enough money which our dependents need even if you die , you can get rid of your Insurance and then you don’t need Insurance .

- So there is no point in having Insurance after your Retirement , unless your intention is to get a big sum of money at the end even if it does not matter much .

- This is the main reason why Insurance companies also give Cover till age 65 because that’s the time most of the people on earth get retired anyways .

- Whole Life p0licies does not make any sense apart from the fact that they provide pension which is very low. See review of Jeevan Tarang Policy from LIC to understand more on this .

- You should have sound Investment Planning so that when you reach your retirement you have grown your Huge Corpus .

- Insurance at the end is the hedge against your risk of loosing the earning Potential , its just not a tool to make money on your death .

- Use Insurance as Protection not for Saving , Dont just invest for Tax saving !!

Final Take Away

You have to Notice some imporant point here , Dont take the above diagram by heart and assume that your Insurance cover goes down every year , It can happen that because of other commitments you might have to increase your cover . The main takeaway from this article is that at the end of your career (your retirement life) you should have enough investments and money so that you dont need Life Insurance. Also there can be exception cases where this logic does not apply , we are talking a general case here and not a specific one 🙂 .

[ad#text-banner]

December 11, 2009

December 11, 2009

Manish,

I am working in a psu and my present salary is Rs 26000/- (in hand). I have just completed 25 years. I am unmarried. I have took a LIC Term Plan of 50Lakhs for 35 years.

1) Whether my present cover which i have took is adequate/more than needed?

2) Keeping my career plans in mind, i have planned to buy Rs 50L term insurance more when i get my desired job which ay happen in period of 5 years. Whether this plan is right or should i go for incresed cover right now?

Thanks.

1. For now .. it looks fine to me based on your info

2. You can increase the cover later, but as of now your cover is around 10 times your yearly salary . I would recommend you using our life insurance calculator : http://jagoinvestor.dev.diginnovators.site/calculators/html/Insurance-Calculator.html

I do agree with the viewpoint, i.e. you don’t need cover beyond 60. But the Level Term Plans are needed to account for the inflation, hence keeping the insurance benefit at the same level is needed since inflation is already reducing the real value of your death benefit every year.

Abhinav

thanks for your views .

Manish

My father is 54 and mother is 50. I Want to take a term insurance of 5 lakhs. Please suggest which one to opt for?

Vivek

Who is financially dependent on them ? Just 5 lacs ?

Manish

It was indeed a pleasure to go through your blog which I happened to stumble upon just by chance. I have always wondereed why such blogs don’t get the publicity they deserve. I for one am surely going to spread the good word. Thanks a lot for enlightening me. Bye the way I have a doubt. Can the private insurers be trusted at all. You seem to be recommending Aegon Religare for term insurance. I have read good reviews of it thorugh the Hindu Business Line too. But coming from a small town, we have been brainwashed to believe that only LIC or SBI will stand the test of time.And insurance is indeed a matter of trust.Don’t you agree?

sudhakaran

Thanks 🙂 . Regarding Insurance , Its not a matter of trust atall . Its a matter of Facts and figures only . companies are here for making profits and not charity . If your claim is incorrect . No company on earth will give you money , LIC or Aegon . doesnt matter . We have made SBI and LIC as gods , because we never had a choice .

There are some reasons why policies get rejected , one of the biggest is the wrong or missing information in the forms because everyone is in hurry to fill it and just do signatures at the end , agents are not bothered about what you fill in , he is interested more in getting it done fast . so most of the times some of the other information is incorrect or missed , and after many years , the claim is rejected when companies finds it and then customers blame it on companies .

The process is very strict and follow rules , if you are correct from all angles , no one can deny the claims . So dont worry much . for a better setup , split your insurance in two companies .

Manish

Dear Manish,

After I spent quality time on your blogs I am writing this.

Believe me there are 2 areas on which I have never thought seriously

1- Term Insurance

2- PPF

I am glad people like you are there to teach us.

Ok coming to my query which requires your opinion :

I am a 26 year Guy (married recently),

Monthly take home around 53K

My wife earns 42K

We have combined Home Loan of 35 Lacs (thats the only liability I can say on both of us at present)

Now question is about my view point on my future financial planning and your advice:

1 Recurring Dep 10000

2 LIC 3440

3 Gold 5000

4 Home Loan 15000

5 MF 5000 *

6 Stock 3000 *

7 PPF 5500 *

8 Term Insurance 750 *

Total 48000 (approx)

( The items marked * are yet to be applied which I am planning to start in 2 months time )

Though You can suggest on my complete portfolio , I am willing to ask you on * marked mostly.

5. To achieve a Good financial gain in 15-20 years Time

——————————————————–

I have planned to invest in equity diversified funds (the good rated ones ofcourse with past record)

5000 PM using SIP for 15-20 years.

6. To achieve intermediate gains

——————————

A- grade share investment with horizon of 1-5 years.

7. To have assured good lump sum income which can even utilsed for child study or future need

———————————————————————–

PPF of 70000 per annum

8. Without wasting any more money on any insurance/ULIP/LIC I want a better coverage ( I dont need return only INSURANCE)

—————————————————————–

I have assumed I would take ICICI Pru term insurance ( for 25 year coverage , 50 lacs insurance , the premium is around 8000)

Though Religare looks tempting but we are yet to know about the CLAIM process (and for a 50 lac claim -if i die 🙁 – i dont think

2-3000 makes big deal in a year.

Please write your comments on my PLANS.

Thanks in Advance Manish & All.

Nayak

You should first take a term insurance and cover yourself and start goal based investing , you can use Goal calculator i have made just 5 min back 🙂 http://jagoinvestor.dev.diginnovators.site/calculators/html/Goal-Planner.html

Also make sure your total current EMI’s do not cross 40% of take home . Financial Planning a much detailed topic and requires much more analysis and information . I would say you should read more and plan things yourself . Jagoinvestor is mainly for education purpose and I am sure you can learn more from it and think about this analysis yourself . You are not dependent on anyone .

Regarding Financial Planning its not some minutes work and requires much detailed planning and requires effort . you need to hire a financial planner for that

Manish

Thanks Manish… I have checked it.

However kindly comment on my decision on PPF & Term Insurance , is it good to take term insurance with spouse or for single. ?

Manish,

Why should we split the insurance between 2 companies? I don’t get the logic behind it. Please help

Repeating the comment in right section,

Manish,

Why should we split the insurance between 2 companies? I don’t get the logic behind it. Please help

http://jagoinvestor.dev.diginnovators.site/2008/11/we-will-today-discuss-some-of-best.html

Manish,

Taking the same insurance amount for my wife as well? I mean if I have insurance cover of around 1.5 cr, I should consider same for her as well? I was thinking more like taking care of any one BIG liability (like home loan) to be the base for her insurance amount cover. Please make me understand.

Harpreet

Not same amount !! .. I am saying think in the same way like you are calculating for yourself . The point here is how much financial impact will happen when other person dies . So if you are gone , how much insurance amount is required by her ? She will have to pay

– Home loan

– She would be earning herself so monthly expenses are taken care of.

– Anything else she needs to take care .

Same thing when she is gone , how much insurance amount would you require which can meet her share of financial contribution .

Think is “How much financial impact a person will have if other person is gone” way !!

manish

Thanks Manish. I got your point.

Yes I have calculated using the links provided only. So we can go for any low premium pay insurance companies? I mean we dont have to research on claim rejection part for any such companies, isnt it? A quick question, what criteria should be taken to buy insurance for my wife in case she is earning equally as I am and considering that we do not plan to have kids for another 3-4 yrs? I know I am taking away your sleep now but bear with me 🙂

Harpreet

There are cases where As per IRDA report claim rejection rate of private insurers have been bad compared to LIC , but as per Top PF guys i know like PV subramanyam , they advocate choosing the cheapest one and make sure you are always right in data .

For your wife , there is no distinction in procedure or strategy , insurnace is never gender specific . think the same way like yours .

Manish

Thanks Manish. What are you doing at this time man? 🙂 Well, I did thought of taking hypothetical amounts like Home loan + Children education + planning + annual expenses. The amount comes out to be ridiculously high (around 1.5 cr). I dont believe its THAT HIGH but still I dont want to make myself under or over insure, so keep re-calculating occasionally. I hope its ok to be a bit over insured? Also, any idea which company we can opt for buying insurance? I mean how to evalute before choosing one?

Harpreet

I dont think its too high .. Your dependents would need it considering you are not there . Did you calculate your insurance amount using : http://jagoinvestor.dev.diginnovators.site/2008/09/how-to-calculate-insurance-requirement.html and http://jagoinvestor.dev.diginnovators.site/2009/11/how-much-insurance-cover-is-enough.html ?

You should choose any two lowest cost insurance premium companies , make sure you dont leave any room for claim rejection by submiting all the information correct and filling the form correctly , Aegon Religare(60%) + SBI/HDF/ICICI (with riders) (40%) would work out good .

Manish

I kind of agree with Mark here. I am 25 and currently does not hold any liability. In my case it makes sense to go for increasing term insurance plan, isnt it? I mean as a bachelor, I do not have much liability and does not have a big monthly expenses, so doing a calculation on my final insurance amount (keeping my current scenario in mind) will not hold much water as things will change in some time. What do you suggest here? Does it make sense to take hypothetical amount in mind (like what could be my home loan amount etc) at this time to arrive at a particular insurance amount. Any advice

Harpreet

Yes , you can think of some approx figure and calculate insurance requirement .. Even if you have high error in assuming things , yet the insurance premium (term) wont differ that much , Just assume that how much home loan would you have .. somewhere near 50 lacs ?

Even if there is a difference of 10 lacs on anyside .. there wont be difference of couple of thousands in premium which is ok i guess .. no ?

Going for increasing or decreasing term cover is a personal choice and depends on what you want .. its never fixed 🙂

Manish

Manish,

Interesting article. By the way I feel that rather than decreasing term cover there could be a merit in increasing term over 25 – 30 years that one may take insurance cover for. For example a young engineer in the working career of say 2-3 years may take a cover for say 20 lacs, so that (i) the premium is affordable and (ii) the amount fits in well into his scheme of things keeping in mind his present salary and the life style. Going forward he may start earning significantly higher salary and enjoying better life style, also he may have higher obligations (like home loan, enlarged family etc), and more years down he may have children having requirement for costly higher education.

Opportunities for increasing the term insurance covers become very costly options, and may even become unavailable because of health issues.

I think term policies with automatic increasing covers are a better option in such circumstances.

Mark

What you say makes sense , but there can be some cases it can happen that a person liability is very high in early life , imagine a guy who has a sister to be married and some home plans , now this guy cant afford to take less insurance in start .

So at the end it all depends on individual cases .

Manish

hi Manish,

just read this one, and believe me most of my clients whom i advise buying term cover for 15-20 yrs (person of 30 yrs age) always come back asking premium for 30-40 yrs as they are more worried for post retirement cover and its hard to make them underatan that the normal working life of a person of 30yrs age is till 45 0r 50 (looking at current work & life style scenario its difficult to work beyond) and this is your time to accumlate wealth and that becomes your INSURANCE over a peroid of time as ultimately insurance means security which may be in the form of assets like Fds, cash, gold, property, shares etc and does not mean buying POLICIES only but the problem lies in the very basic fact of awareness and Stereotype thinking about investments and its really hard to convince people about the true meaning of financial management as most of them are having a herd mentality and cannot think beyond boundaries…

in India an average person spends his income or savings maily on two things first is on MARRIAGE (to show off) and the second is MEDICAL expenses.

Rishabh

very well said . What we have to do with these people is ask them about how will these policies be helpful to them . Let them explain . I know most of them hate to even answer it , but we can then answer on their behalf .

Regarding Marriages , what you say is very true and you have said this at very right time , because my next article (Monday) is on same topic. I will talk on how should we think about marriages in india . regarding Health cost . Yes , most of the people incur big cost their because they never take care of their health properly all life. What everyone fails to understand is that exercising , having a good eating habits etc , in reality these the god given health insurance techniques .

Btw , what are your views on Private Vs public (LIC) term cover . thats another big problem we financial trainers have to face while convincing people .

Manish

Bravo Manish….

You just posted a right article at right time….Now the idea of insuring myself is crystal clear.

I have gone through the AR Iterm plan and i think its best suited for my present requirement.

Just hope that AR’s customer care support improves soon.

Manish i am looking forward to get some guidance on Health Insurance….Today i have gone through the IciciLombard’s ‘Family Floater Health Insurance Plan’…..It seems a good plan to me…Do you have heard of any other good plans…Looking forward a article or a simple reply…

Currently i am 27,going to get married within one year.

Ravi

Just make sure that the health insurance company has an in House TPA . generally companies have a different company as TPA which sometimes make claim process cumbersome .. so i would say look for a company with in house PTA , i guess Bajaj and ICICI have inhouse .. find out .. and read more .. i am as clueless as you are 🙂

so dont believe please .. just get the idea 🙂

Manish

TPA means a Third party administrator, implying un biased decision, implying a arbitrator between the insurer and insured. If the arbitrator or mediator is also a insurer would his opinion not be biased towards the insurance company. Why have a TPA at all, if it is inhouse; it can be called CPD – Claims processing department. The third party element is missing in the ‘in house ‘ model.

ok i messed up the terms .. but inhouse TPA i meant a internal department which takes care of claim settlement . But the assumption is that they are not biased which is not possible . So I take my words back .

Thanks for the views 🙂

Manish

Life Insurance cover is required until you have enough assets to see your family thru most of their goals, just in case you pass. The day u have enough, you dont need life insurance.

Correct ..

tell me one thing

normally insurance covers are such that after a specified period the whole amt is paid back to the insured.

but I heard that there is another type of insurance which functions just like car insurance. in case u claim it u’ll get it, else it gets lapsed. the premium in this case is very low

is it safe to go for these types of insurances

Karan

What you never heard of is called “Term Insurance” and thats the best thing a person can buy for his/her insurance needs . Learn more about it on my blog .

Manish

Manish,

Excellent article.. Very Valid argument… I also feel the same way. For ex if I have insurance of 50 lakhs, the moment I have investment worth 50 lakhs I dont need the term insurance (Please note Iam not talking about Health insurance which we need to take as long as possible).

Term insurance is a backup in case of an eventuality.. My financial Planner once told me that over insuring oneself is as bad as under insuring. ..

Lot of people get emotional and make financial decisions. For example lets take a person X. Assume that he is married with no kids yet. His wife is also earning (albeit 50% of his salary). His Insurance amount should be only to take care of monthly expenses in case of his absence. In this case if the expense is 30 K per month..his family should have enough money to meet that expense. If he gets kids later than he can take another term insurance (maybe at a higher premium)

If you over insure yourself , you are losing a chance to invest that money and leave the same for your Heirs.Also what is the probablity that Mr.X’s wife will not get remarried (Iam totally in favour of widow remarriage) ?

Sorry for the long post..I get frustrated when people say that they need insurance money when they die at 95 yrs.

you have a good financial planner , dont leave him 🙂

Your views are correct ..

Manish

wellsaid! KEEP THE GOOD WORK GOING.

all best wishes to manish as well.

thanks for this service.

Thanks srinivasu

Good article Manish.

But the saddest part is many people are looking at life insurance as an easy instrument to invest for tax exemption under 80C. I have a friend who is single, has no dependants or liabilities, but has 2 policies which she has taken just for tax exemption . She doesn’t want to explore/listen to other options saying that she doesn’t understand them.I dont know when these people realise their mistakes.

Swathi

can you drag her here at Jagoinvestor and have her read some Insurance articles like “Dont save just for tax saving” . Will that work ?

Manish

Manish,

I always had this in my mind and here it comes from you… nice post..

I was planning for a term insurance with decreasing cover just because of the reason mentioned by you here… that our insurance will be balanced by the investments which will grow over the years.

Are you trying to mean that we should go a term insurance with decreasing cover ? which one is better, increasing or decreasing ?

Thanks,

Shantharam

Shantaram

So the decreasing cover can be taken only if you can decide on strong Investment planning . I would suggest its better to go for Term Cover only .

Manish

There is a way out to handle the max term of 30 yrs provided by Insurance Companies.

A person aged 30 can go for a term insurance for 10yrs with the apt cover. Once he/she reaches the age 35, there will be more clarity on the liabilities he would be having. For eg. kids, home loan etc.

At 35 to 40 , one can then go for a max term which would then cover him till age of 65 – 70.

I have done the same.

Any thoughts.

Alok

We generally have a rough idea about our responsibilities before they come , like if you are 25 yrs old , you already know you are going to be married and will have 2 kids etc and then you have a rough idea of everything , So i feel the better thing would be to plan in advance and go for the full term Cover , If one feels that the cover can be reduced or increased later , one should do so .

Manish

The gist of the content makes lot of sense. Most of us don’t seem to really understand the intrinsic need for insurance till a certain age. Nice points manish, I still suggest people to plan their insurances till the max available age with long terms in mind by buying them in a timely manner. This way even after retiring, there will be financial freedom for the family members. Going for heath insurance is also a good option at later ages by decreasing insurance liabilities.

.-= Mohan´s last blog ..Review : Eagleton Golf Village =-.

Thanks Mohan