Is it really worth saving small amounts like Rs 2,000 per month?

A lot of young investors are often confused if it’s really worth saving small chunks of money in the start of their careers?

A lot of investors don’t save enough at the start of their career and wonder if they should start saving only in the future when they are able to save a “respectable” amount like Rs 10,000 or Rs 50,000 a month?

Today I want to let you know why small savings matters!

The #1 benefit of small savings

Does it really matter in long run if you save Rs 2,000 per month for a few years? Even if you do it for 3 yrs, you will just have Rs 60,000-70,000 with you. It’s not a big amount of money.

A lot of people might be able to put a big lump sum in one go to compensate for the pain of taking the effort of saving a small sum of money each month. On top of it, if you ignore saving a small sum of money for a few years, your final wealth will not be drastically different had you saved small amounts.

What you just read above is what a lot of investors think about small saving. It’s a classic mathematical way of looking at it.

However I often tell people that it’s not about the amount, but about the HABIT OF SAVING MONEY.

Cultivate the Habit of Saving

When you start your investments and start investing per month, the bigger benefit is that you are forcing yourself to take out a chunk of your monthly income and invest it somewhere.

You are actually developing the HABIT of saving on a regular basis, which is not an easy thing to achieve.

Today, a lot of investors are earning good amount of money and they also have a decent surplus, but what is missing is the habit of saving. They have never done it before in life for many years, and now when suddenly they are having surplus which potentially can be invested, they are finding it tough to do that, because they are not able to control themselves with the distraction this world offers them.

Imagine two kids, one of them always saves 5% of his pocket money and spends the rest. Another one spends all his pocket money. This continues for 15 yrs of their life. You can imagine what will be the psychology of both the kids and how it will impact their future.

The same is true for investors after they start their career and earning life.

Small savings compounds and boost your wealth in the future

Small savings might not look big enough at the start, but over the period of time, they compound well and adds to your wealth creation, sometimes big and sometimes small.

So let’s imagine that your future saving scenario looks like this

[su_table responsive=”yes”]

| Year | The amount you will save per month |

| First 10 yrs | Rs 2,000 for 3 yrs, then Rs 3,000 for 3 yrs, then Rs 5,000 for 4 yrs |

| Next 25 yrs | Rs 20,000 per month (increasing with 8% per year) |

[/su_table]

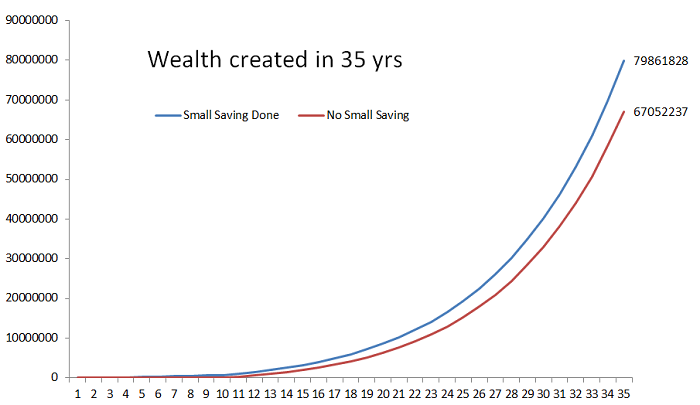

Given the scenario above, imagine two cases

- Case 1: You invest in first 10 yrs – Small savings done

- Case 2: You DONT invest for first 10 yrs – No small savings done

If you add up all the money which you invested from your pocket in CASE 1 and Case 2, you will find out that the difference is just 2.4%. Yes, incase 1, you will invest 1.77 cr and incase 2, it will be 1.73 cr. Hardly any difference you will say

But when you find out the difference in the wealth created at the end in both cases, it will be a gap of 16%. In the case of Case 1 you will make 7.98 cr, whereas in case 2, you will have 16% less wealth. That’s a decent amount of money.

Below you will see the wealth difference in both the cases.

The above example tells us that if someone is not saving small chunks of money just because they feel it will not be worth it, it’s not the right way of looking at it, because in the long term it will surely help in boosting the wealth one will create.

Small savings also help you in dealing with emergencies

Another benefit of saving small amounts at the start and not waiting for the “right” time is that one will at least start having some amount for emergencies. In our example above, if one invests even small amounts for the first 10 yrs of life, they will have a sizeable amount of Rs 7.2 lacs at least.

This is not a small amount. It can help the investor in dealing with any kind of emergencies. One can even avoid taking loans for things like buying a car, vacation or home appliances.

If nothing happens, it will give a nice feeling to the investor and boost his confidence that it is possible for him to create wealth. Remember to create 1 crore, you need to create the first 10 lacs and to do that you need first 1 lac.

You have to start somewhere.

Don’t delay your investments, else it will cost you later

The more you delay investing, the more you will have to invest in the future to cover up the short fall. Here is a small example I want to share with you

If you invest Rs 10,000 per month for the next 30 yrs (assuming a 12% return and 7% increase in SIP per year), you will be able to create 5.36 crore in 30 yrs.

Do you what happens if you delay by just 5 yrs? In that case, you will create only Rs 2.78 crore. Yes, Only 2.78 crore against 5.36 cr.

And now if you want to reach the same corpus of 5.36 cr, you will have to start with the SIP of Rs 19,300

Cost of Delay Calculator

Below is a simple cost of delay calculator where you can try out different scenarios for yourself and see what will be the impact of delaying the investments.

[WP-Coder id=”20″]

Start Small – It helps you in building the habit of saving

To conclude I would say, starting small has its own benefit. It will develop your habit of savings. If you can’t save Rs 2,000 at the salary of Rs 30,000, it will be equally tough to save Rs. 20,000 at the salary of 1,00,000.

“Investing” is more about your own behavior & not external factors.

Do let us know what you feel about this article? Do you know someone who has been delaying their investments (are you one of them?)

March 3, 2020

March 3, 2020

Hello Manish, this is truly a very useful information particularly for the new generation that lives pay check to pay check.

Thanks Sreeraj !

Your post is really awesome, I will try to implement on my client and myself.

Hey Bidur

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Vandana

One more Fantastic Message for investors! Just a small suggestion, It would be great, if there is an option in these articles to forward these messages to other people through email from this window itself to other people, that would help us spread across your messages whom it is needed./recommended. Thanks for the Message, I always lookforward for your messages!

Hello Mr. Shravan,

Thank you for your suggestion. We will try to implement your suggestion.

Thank You

Anuradha

Manish, I am a financial planner myself. I must say you are doing an amazing job, I’ve learnt a lot from reading the articles, have implemented a lot of ideas for my clients and for my own personal financial investments.

Hello Rohan,

Thank you for your appreciation

Manish

Saving is very important for everyone. You are suggesting some good tips. It’s wonderful.