What is mean by Instant Gratification? And how does it affects your Financial Life?

Do you understand the meaning of Instant gratification and its affect on your financial life ? We will learn that today. How did we become a generation that “wants things now!” no matter what?

Think about this – both, our parents generation and ours, save , invest and spend. What then, is the difference between them and us? It’s mainly that they used to first earn money, save & invest that money and then spend it on things they needed.

They got ‘delayed gratification’; this quality of waiting before they are able to buy. However, we have reversed the equation. We first buy, and then pay for it later; without having a clue if we will be able to earn that money in the future or not!

And that’s is where the problem lies — Once we buy something, the deal is done! Then we have to live with it because we can’t change our minds about it later.

We love ‘the thing!’ & We need ‘the thing!’ . Our life is not complete / not possible without ‘the thing!’ . ‘The thing!’ can be a home (debate on buying ve renting), a car, some household item, the latest gadget or 3 pairs of jeans from the big Sale!

I’m not talking about the planned and carefully thought out spending we do in life, rather I’m referring to the spending which ‘just happens’, the spending that does not add much value to our lives. Even if it adds any value, it’s mostly short-lived and makes us feel happy for just a while.

This ultimately, weakens our financial life, since we do not concentrate on our major and important financial goals, chasing the smaller and futile wants in life. A lot of this phenomena is result of the impulse called “Instant gratification!” which is what, we will look at in this article.

It’s important to realize, that the more we give in to Instant Gratification, the more we sink into the dal-dal of debt & misery. Sooner or later we’re in upto our neck and it gets too late to fix things. The biggest example of this was the recent sub-prime crisis in the US. “BUY NOW! Pay later” was the attitude!

Let me tell you a short story to give you an idea of what I am talking about.

Two small children Anita and Ramesh, lived in a small village with their parents. Their father gave Rs 5 to each of them to eat a watermelon. Both of them visited a farm and asked the farm owner for a large watermelon.

“A big one will cost Rs 20 and a small one would cost Rs 5”, said the farm owner pointing to the watermelons in the field. With the irresistible urge of having the sweet and juicy fruit, Ramesh bought the smaller watermelon and started eating it. Anita however, wanted the big watermelon.

“OK, I too will buy a smaller watermelon”, she told the owner. “But can you please leave my watermelon in the field itself, I will be back in a month and take it at that time!” The little girl knew that her patience would be rewarded. By waiting one month, she could have a big, ripe watermelon for the price of a little green one. She got the bigger fruit, because she controlled her “Instant gratification” and waited patiently!

What is Instant Gratification ?

Instant Gratification is the habit, of always wanting to enjoy now, and not having the patience to wait for future benefits (an experiment). Anything which gives us temporary happiness or excitement, but is not actually a good thing for your life, can be put in this category.

For example…

- When you sleep till late in morning and do not take pain of getting up and exercising.

- You eat those unlimited sweets in your office cafeteria.

- When you eat that burger with EXTRA cheese !

These were some examples to just give you an idea about what Instant Gratification is, – mainly concentrating on the immediate result and not thinking about its outcome in future or how it will affect us later in life.

If you can control yourself and concentrate on “delayed gratification” , your life can change! like anything , But we just are not bothered about it and do not have motivation. Do you know why this is? Let me be straight & blunt! The challenge is that most of us do not have to face life or death situations, or seek food and shelter and defend our territory everyday anymore ! (like these people)

The result, is that we can’t see the impact of our spending in the future. Think about a poor person who struggles daily for food. If he has to spend Rs 100 on something, how will he think? If you offer him a burger, he will instead ask for the same amount in cash, because he knows that the money will help him get food for next 3 days.

He’s not focused on taste in this case.

We however, are privileged, blessed even. If something bad happens once in a while, our next meal or next place to sleep isn’t in danger. Hence some of us have just lost that attitude of looking at things without instant gratification . If you have seen bad times in your life financially, you will know, what I am talking about.

6 Examples of How Instant Gratification affects our Financial Life

Many a time, what we do in our financial life makes our future, dismal and weak, and we have no idea about it. We aren’t even aware!

#1 Not surrendering Endowment/ULIPs

This one is my favorite. “What should I do with my Policy? Should I Surrender it or make it Paid up?” is one of the top most queries I come across. It feels bad, accepting and acknowledging that you’ve made a mistake, and it hurts psychologically when you lose by not continuing the policy. But what is the effect, long-term?

You still continue paying huge premiums and it earns you very, very little.

So you don’t take any decision on your junk policies, ergo you do not have to face a tough situation! It’s Instant gratification in a way! But for your own good though, you should take action and take that loss now because right now it’s a whole lot smaller than if you stick with the policy and try to quit later!

#2 Keep losing Shares and selling your winners

Have you ever bought a share which gave you instant profits? What was your reaction? Most of the people want to sell it off and take that profit right now, otherwise the profits can vanish! But what happens in most of the cases?

The same stock or portfolio gives huge returns in future if it was left untouched and that feeling of instant happiness is so powerful sometimes that so many can’t control it. It also happens, if one does not have proper understanding of how equity works.

Many people who understand also fall for instant gratification though!

In the same way, you might be holding some stocks which is not performing well, but instead of getting rid of it and investing in better stocks, we keep on holding on to the loser in the hope that some day it will go up! (Read 5 mistakes I did in my first stock investment).

It’s another case of instant gratification as you seek temporary comfort. You don’t taking the tough decision of selling the loser, because the moment you sell it, it gives you a feeling of loss, but if you just keep it as it is, it’s a case of “I still have some hope !” Don’t do it!

3# Getting into wrong products for Tax saving

When we talk to lot of our paid clients on why they bought the Endowment/Moneyback policies or even ULIPs, the only reason turns out to be “Tax Saving”. Millions of people, get into the wrong products which they don’t need, & don’t understand, has no power to meet their financial goals in future, just to save tax!

I some times feel how much tax saving one does! If one invests with a premium of Rs 50,000 in a ULIP for instance, and if that person is in the 30% tax bracket, he will save 15,000 in tax. But if that was a ULIP with 50% premium allocation charges (as so often happens), 25,000 is lost the moment you sign the documents!

So you save 15k and lose 25k as charges! And yet,these are the same people who say “20k for a financial planner—too costly!” 🙂

#4 Not Paying a Financial Planner or a counselor

Now you know what stops you from paying for advice? Do you immediately get any instant results from advice which you can see? Does your portfolio return suddenly become higher than earlier? Do you immediately see the results which you wanted in your financial life ? No !

And that’s the reason most of the people are not excited about it . But now you would realize that, if years before you had paid some adviser and taken right advice, you could have saved a lot by not getting into wrong products , you might have got better results or same results with lesser risk than what you have got at without right advice!

The benefits of financial planning are always “delayed” as the planning will show the results years later.

We get a lot of inquiries for our paid services from readers who want more personalized service and paid guidance from us. We talk to them and they are very excited when they hear how their financial lives will get transformed working with us, however when we talk about the fee part, some of them just don’t come back!

Price is not a barrier for them as they are well earning, but the problem lies somewhere else which even they are not aware of, and that’s Instant gratification!. They can’t see the immediate results from it and hence they choose to live with their messed up financial lives instead of getting out of it.

I am sure they will lose 10 times more than what they tried to save in fees by not have proper advice over the next couple of years. What do you think ?

#5 Shopping for things you don’t need

How many times, have you bought things which you don’t need? But you still buy it, because it feels good! For example, you might buy another jazzy mobile phone even though your current phone is working well. You buy a nice new shirt – It was on display, which can be your 24th shirt but you actually don’t need it.

Women know very well what I am talking about here and if you are married, even you know what I am saying 🙂

Most of the instant gratification happens at “Sale”. Resist Sales. Sales tend to our minds into buying more than we need. We start justifying to ourselves, that we really do. If the “Sale” decides what you need in your life, then there is a problem!

6# Spending due to Peer Pressure

Suppose there was no one in this world except you and your family, would your life still be same ? I am sure not! People around us affect our mind and make us feel that we are lagging behind. If they buy House or car , we start feeling the need for it. Peer pressure is one of the top reasons why people spend a lot of money.

You are persuaded to join or pay for an activity that your friends are participating in. Whether you are interested or not, you go with the flow because they tell you to. There are occasions where you have to join them and you should!

But not always, and not in everything.

Develop a “Need Mentality” to save your self from Instant Gratification

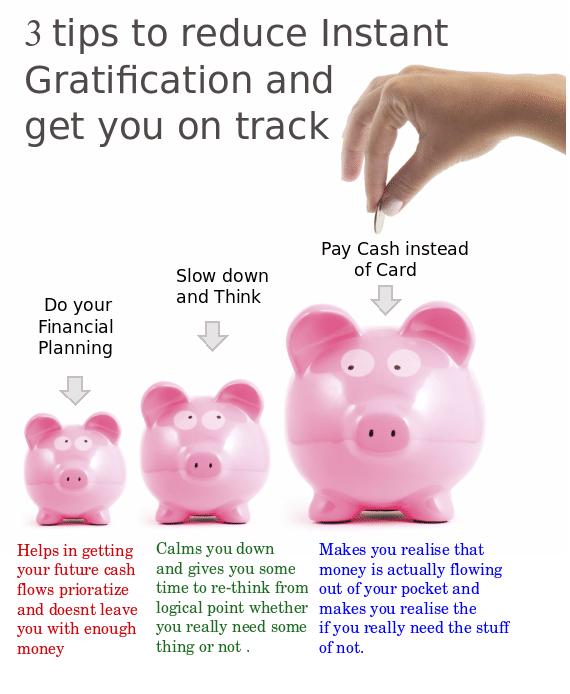

Here are 3 solutions which can help you reduce or avoid instant gratification in your financial life.

Do your Financial Planning :

You should do your financial planning and have a full plan on how you will invest your money for your future financial goals. Once your Insurance, child related goals and retirement are planned, you will have to commit the investment for these goals which are more important in life than other things which come along the way .

You will be more responsible and think twice before you spend on other unimportant things.

Slow down :

Don’t be impulsive, whenever you have to spend your money on anything, call some family member and tell them 4-5 reasons why it’s a good investment and is worth buying for, tell them enough reasons why it makes sense to buy it. If you are able to pass this process, then you can buy it else, reconsider.

What happens when you do this, is that you slow down and take a logical approach in deciding if you really want to want something. Let me give you a personal example. I recently did this for myself, when I wanted to buy a high-end Nokia phone.

I started counted the reasons why I should buy it and how it will add value to my life, I was very convinced that it’s an important and a valid expense for me.

Try to pay cash for your purchases :

When we don’t feel bad about paying, we tend to buy unimportant things and credit card is the main culprit here. You buy and you swipe your card, you don’t see the cash going out, so at the end you just make a single payment. It don’t hurt much.

Try paying with cash, and when every time you see those cash notes go out, you become more concerned and more logical in thinking about your expenses.

Other area’s in Life which where Instant Gratification affects us

Some other areas in life which we mess up are Education , Marriage and Career .

Education:

If you have seen “3 idiots” and “Tare Zameen Par”, you will understand better what I want to say here. Lot of people do not carefully plan their education. There are many people who have pursued something which looked easier to complete or seems to be paying well without understanding, if it aligns with their liking or not and thereafter suffer all life.

Marriage :

Marriage is another thing where people mess-up due to instant gratification. There are many couples, who are not happy after few years of marriage, because the whole situation didn’t turn out the way they imagined.

A lot of times people judge their partners within hours or few days of meeting them, where they like them a lot because they are handsome of beautiful , have lot of wealth, things which impress them at first. I am in no way saying that only love marriages are successful because they are NOT !

It’s the same case some times with love marriages too . The only point I am making is that even in marriages , their is this thing called Instant gratification which creates issues for many people.

Career :

Career is directly linked to Education, so if you mess up your education, you’ll certainly botch your career. But even after people do their education correctly, many mess up while choosing their jobs.

When I completed post graduation, many of my friends went for companies while showed the highest CTC, were the best known companies in IT, but they are shedding tears of blood now as they can’t see any growth for themselves after a point or it’s not something they really wanted to do in their jobs.

However some people who controlled their emotions and planned to choose their companies considering the work they will do there are very happy and excelling now. So don’t just see what makes you happy right now, see what will make you happy all life.

Conclusion

The whole point here, is that we don’t think much about long-term aspects of our spending and hence make bad investments and mess up our financial lives. Instead, we should use Instant gratification in our favor. One way we can do it is start SIP’s for your Financial goals now, and take action. Get a financial Planner and pay him to give you best advice and transform your financial life.

As 2010 is about to end now, dont let this year go waste as you learned a lot of stuff this year . Start your new year with some commitments and resolutions for 2011 which you will honor and not just write down !.

Share your comments if you’re a victim of “Instant gratification” at any point in your life? Also share how we can use this Instant gratification in our favor ?

At the end wishing you all Happy New Year .

December 30, 2010

December 30, 2010

Sir, very good article. Very motivate. Government should appoint you as a official financial planner and guide the poor people. in their financial planning. Because your services are only for paid members.

Thanks for your comment sivaprasad

Hi Manish,

Amazing article as usual. I have a question slightly linked with this topic

Currently, I am only able to save small fraction of my salary (5-10%) and feeling bad for it. I am indulged in larger than required home on rent (on peer pressure) and higher living expenses. However, 50% of the expense is going in EMI (Fixed, zero % interest for next 23 months) payment for a residential land property, which I think, may get a handsome return after couple of years. I could have payed from my saving for this property, but I didn’t wanted to part with a chunk of money. I have contingency money and sufficiently covered by insurance. I am sole bread winner for my family. My wife can work, however, she is taking care of small child now.

Do you think it is dangerous to live with that small saving each month? What you have done if you are in my position

Regards,

KP

KP

Good to get a comment from you . I can see you are concerned for your financial life and want to work on it . I want to know where is your “cushion” . I mean we all think about good things , best situations, comfortable situations ? But what about the bad one’s , what if they really happen ?

What will you do if real estate prices crash and does not recover for few years , I know I know it wont happen , but do you really think that it can never happen because you are holding some real estate . You said that your wife can work, but the question is after 3-5 yrs when a situation comes when she has to work, will she be really “employable” ? I am assuming that she is from IT background .

Saving 5% is dangerous , I cant ask your to stop the EMI’s .. but incase when you get some big money, start prepaying it .. Start practicing the “best practices” in your financial life . you said your living expenses are higher, I know they are higher, but cant you sit one day and really fine detail them and see how your 40% of INCOME which goes into EXPENSES can become 35% ? .. It can happen .. I am sure .. you just need to be more committment and hungry to do it .

I want to do a small exercise with your financial data and send you a 3 page report . Please fill up this form http://jagoinvestor.dev.diginnovators.site/schedule-appointment

This is actually for those who are interested in our paid services , but dont worry .. even if you dont want to go for it , just fill it , I want to take up the part which has your basic financial data . I will send you a report . This report will give some insight on your financial life.

Manish

Wonderful Article… Great Thoughts… Really helpful to too many!!!

Thank you so much…

Binson Mathew

Binson

Great to hear that 🙂 . Keep reading 🙂

Manish

One thing where in i cannot (STILL CANNOT) overcome this instant gratification is buying BOOKS… and i don’t want to overcome that because those will enrich your mind in one way or the other.

Wat you say sir?

Sunil

Instant gratification is bad only if it does not provide value in long term , in your case books give you emmence satisfaction and builds a knowledge base . Keep doing it

Manish

I am new to your posts Manish but this one just showed me what i used to be till now.

I am sure i will be changing my perception and will enjoy life.

Thanks Friend.

hi manish,

i too come under d 2nd example of hw instant gratification affect my financial life.. i too had a couple of companies shares which were goin in loss day b day, n i was having one hope dat its better to hold d stock n one day it vl go up.. bt i was wrong.. i corrected my mistake when i read ur article 5mistakes i did…

thanks a lot for ur valuable article…

Salman

Thats good to hear .. Just remember one thing , You should be holding a share only if you are ready to buy it again at fresh level . So most of the time, if you are holding the stock , you will not buy it as you find out that its better to skip it

Manish

ya dude u r correct,

i vl definately remember dis.. thank u

salman

My Grandmother used to say when we preffered playing over studies that “zindagi maein bhagwan ne sab ko khane ke liye Channe aur Halwa diya hai aur ye dono sab ko khane hain. Ab agar pehle chane (which are hard) kha loge to phir aaram se halwa khana otherwise abhi halwa kha lo phir chane chabane padenge. Bas fark itna hoga ki tab tak daant nahin rahenge so make your choice abhi mehnat kar ke saari umr aaram karoge ya abhi aaram karke saari umr mehnat”. I have seen this story coming true everytime, in office, in neighbourhood, in society , in finances that a little hardship early on saves much of labour later on.

Pramod

Extemelly helpful analogy and explaination here 🙂 . terrefic 🙂

Manish

Hi Manish

One HDFC agent is recommending to buy HDFC Standard Life – Term Assurance Plan, is it worth to buy. please help me, I am 30 years old andrecently got married and we both are working.

hi,

Before taking a term plan, do collect /compare premiums from companies like S B I, AG RELIGARE, LIC ,kotak life insurance etc..

then only go ahead

never forget to add raiders like accidental death benefit and critical illness.

thanks

Hi

Thanks Srinivasu and Manish too. Finally i have make up my mind for Kotak life insurance…..:)

Dhiraj

Just make sure you fill up all info yourself and 100% correct .

manish

I think I do not wish to pay for financial planner is becuase they also suggest for ULIP and investment with insurance. I dont think they all have knowledgeable like you. Sometimes I feel I know better than them by reading your blogs.

This is very good article and going to take print out to make my friends read it.

why dont make small ebook personal finance guide.

Tushar

Tushar

thanks for your comment . I am not sure which all financial planners you have met , but there are good planners who are not into recommending ULIPs and endowments and only suggest for term plans and mutual funds . We are one of those planners at jagoinvestor.com

We will be making those e-books very soon . Thanks for your suggestions .

Manish

Hi Manish,

I have invested 1 lac a year for 3 years in Tata AIA Life Invest Assure Apex since 2009.. Please let me know if i should stay invested or withdraw entirely from this plan.. at present i dont see any signifanct increase in the investment.. and my agent keeps telling me to wait aleast for a period o 8 years… i am worried that if after waiting for a long period of 8 to 10 years also, i dont get anything significant, my will be loosing on precious time aas well as money.. looking forward to your precious guidance please…

Nilufer Dadrewala

Incase you are so concerned about the safety of returns, why did you invest in ULIP ? You should have gone with FD only . I would say get out of it .

You say “if i was so concerned about returns…” tell me if not for returns, what else is ULIP meant for… what should people investing in ULIP be looking for, if not returns….

If this product is such a failure for the investors why is it allowed to be put up in the market, in the very first place… if this product is being sold by luring investors with big percentages of returns, don’t you think these guys should be taken to court by all investors in unison for making such fraudulent claims??

After almost 4 years of having invested 3 lacs, all i am getting now is 2.5 lacs after deduction of surrender charges, which is a whooping 28 to 30,000/-.. tell me, will the surrender charges be applicable all through out the term of the policy??

I know that most of us ask such repeated questions most of the time on this forum, that it must be quite annoying to you at times.. but my heart bleeds to see my hard earned money going down the drain…

Nilufer

Nilufer

I said “safety of returns” , not returns . ULIP’s are not short term products (3-5 yrs is short terms) . Its a very long term products because its underlying asset class is equity. So Higher the time frame , higher the probability of his returns from the ULIP , same with equtiy mutual funds . Any good returns from equity products in 2-5 yrs is more of a luck or timing the market.

So saying that the product is not performing in last 3 yrs , is only going to disappoint the investor . Who ever sold you this product didnt explain it to you . Did you ask him these questions at the time of buying . What was the motive behind buying this product ? Tax saving ? Or something which was driven by fear or greed , like it always happen ?

Regarding surrender charges , its generally is upto 5 years , if you surrender after 5 yrs, you get 100% of your fund value , Its clearly written in the document policy. Didnt you ever have a look at it ?

I know the person who sold did you do his duty of the agent or advisor properly . But on the other hand, did you so everything you as an investor should have done ?

Manish

Thank you so much Manish, for taking out time to explain this to me in detail.. i definitely dont mind keeping the moniy invested for its entire term of 10 years, provided it gives me a good return.. having worked for mutual funds myself, i do know the concept of mutual funds and have SIPs in good funds.. but ULIPs is something which i am still learning about… My only regret is, I came upon your site much after having done my various investments in policies and in this one ULIP.. but as per your recommendations i have worked upon my policy part by making them all paid up… and now have decided to keep the ULIP for its full term.. Apex return Lock in Fund II is a balance fund (little above 50% in debt and little less than 50% in equity..) knowing my risk appetite, balance fund is fine with me.. ant if not much i can atleast expect a 15-17% return in 10 years time..

My heartiest appreciation on such a good job that you are doing on this forum by helping people like us, understand the various technicalities of such complex products… keep it up..

Rgs,

Nilufer

Welcome 🙂

Happy New Year to ALL!!

This is one of the best post in the blog! Any one can make it Power Point Presentation so that it could be must shown article in every Investor Meet?

Thanks to Manish!

Regards,

Chinmoy

Chinmoy

I will be creating it soon . thanks for the suggestion

Manish

Needless to say, but this is a great post Manish.

I loved your take on “Instant Gratification” by not taking/booking short-term losses. I have benefited by surrendering a Jeevan Anand policy I had & by forgoing tax saving last year when I didn’t go out of my way to make a ELSS investment as I wasn’t able to afford that & paid tax instead. I can relate to 6th one….would be glad when I can control that from hereon.

What I have been wanting but have been unsuccessful is the 2nd one! I think I need to treat this as a Jeevan Anand & get rid of them. Thanks for making this invisible thing visible…!

Santosh

Nice 🙂 . One good way to ask yourself if you do exactly opposite of what you do in #2 , will you be profitable ? Will you earn millions in coming 10 yrs from that strategy , that will convince you a bit and help you .

Another good way is to test one strategy in #2 , detach your self from execution of the strategy . Take the calls like buy DLF if it goes about 550 , but then dont do this execution yourself. Make the list of what is to be done and delegate it to your wife / brother or whoever . The excellent analysts bleed because of poor self-control and loosing patience , do only what you are good at and delegate the rest

Manish

Hi Manish,

You have become quite predictable with the sheer brilliance of your posts 🙂

Regarding the pt #1, I have actually stopped paying for my Endowment policies premium. I am not sure how to surrender it as the LIC agent through I purchased the policies is no more employed with LIC. Please guide me how to close the policies officially and claim my accumulated bonus (if possible).

Regards,

Pavan

Pavan,

You may directly go to the office where you policy docs present, with the original bond. Their you can surrender the policy. No need of agent in this. Contact the concerned person their, they will guide you in closing.

Pavan,

LIC started “Customer Zones” for better customer experience ;-). These offer face to face customer interections Personlised solutions. I am also planning to visit them this weekend to surrender the LIC policies I have. Go to their website and under Contact Us, search for your area’s Customer Zone.

Regards,

Arudra.

Hi Manish,

Nice article. I put he whole thing in NEEDS and WANTS way. Need definitely takes priority over WANTS.

Regards

Atul

atul g how u something as your need and other your want. well somebody need may be somebody want.

Neeraj

yes , you are correct to some extent . but its not very much tough to seperate needs . Needs which something which are important for survival , well being and basic neccessity like food , shelter , education , entertainment .

But then in each category if you go extreme , it becomes wants .

Like in food , having a healthy meal is a need , eating out 2 times a week in a plush hotel is a WANT .

Living in a decent house is a need, but keep on wanting bigger and bigger house which is much more than you need is a WANT .

Going out with family , occassional holidays , watching moving is a NEED . but spending too much on lavish holidays in europe is WANT , nothing wrong with it , just that go for WANTs once you have taken care of your Needs well 🙂

Manish

manish g very very much important article, which is of utmost important in every body life. i also suggest readers to read Rich Dad Poor Dad from which i learnt the things u mentioned in your article. those who cannot read this i want to share this thing…. every body wants to be rich but not every one knows definition of richness, what richness means to me is the day your returns on your investments are sufficient to meet your monthly expenses you become rich.

Neeraj

Great thought . The day your returns can meet your expenses you become rich . I can write a post on it now !

Manish

No one delved on positive side to impulse buying. My close friend went with instant gratification of buying home as soon as he entered the job followed by buying one more home with pay rise within 2-3 years. He then bought a car to showcase that he is arrived on scene to have everyone to emulate. Ofcourse string of other investments/expenses came along like ULIPs/Braded items with Credit card/Gold and marriage. He almost went broke and taken personal finance from 9 sources (banks, individuals) . Literally he started to live on credit every month and I thought he is sinking.

But I & everyone underestimated what the crisis teaches a lesson. The crisis forced him to look for higher income. His target salary was clear and he searched diligently for a year and secured overseas employement of 4 times the current salary. Today he does not have any loans and infact started to have positive cashflow into equity/MFs and so on. I am sure if he would not have gone overboard with the purchases, he could not have looked for higher income job. Instant gratification mindset also works wonders on few of the persons. It all depends on how the individuals deals with the situation. I see similar trend in equity as well. People who lost, some never returned licking wounds, some continue to make losses in hope of future and some made profit with vengence.

Krish -your friend was fortunate 2 get a higher paying job but suppose if he could not…

Krish

You have highlighted a great point . However see what is the percentage of people who get into that situation the way your friend got it . But there are learnings from it !

Manish

Good article. Unfortunately, its very difficult to convince people with this

argument. I have had many discussions with my friends with regards to

delayed gratification and invariably the response would be “no way”. The most

common reasoning would be:

– I have only one life and I want to live it in style

– I don’t want to be an “old man” before I start splurging.

Arun

Thats fine , when they say these things , they are making a choice in life , its having a bad financial life at some later point in life at the cost of today , unless a person has millions coming from some other place later .

Manish

Hi Manish,

Awesome article, very well written, and very gripping! Writing this must have taken a lot of your time!

I completely agree with you about people not paying for financial planning – people don’t realize what kind of damage they would sustain financially in the long run!

Fortunately, I do see attitudes changing these days – young people especially are more inclined towards paying for good advise.

Keep up the good work…

Raag

Thanks for your comment . I agree that many people are ready to pay for paid advice , but its still small or I would say a drop considering the whole market.

There is a huge change in mindset required regarding the price barrier .

Manish

one more excellent article, manish..

i think you should write a book

anyway, my personal take

#1- Rejected the ULIP after reading this blog for the first time 2 months back. Thanks

#2- Have not tried shares directly, mutual funds are much better and safer

#3- Again ran away from ULIP

#4- why do so when you are providing such excellent service free of cost !!!!(just joking)

#5 and #6- Fortunately i have always these 2 temptations.

So maybe following these 6, i will become rich!!!! (thanks to you)

Dr Firoz

Nice to see that you have not fallen for instant gratification 🙂 . regarding Book , lets see !

Manish

Manish,

I feel paying thru credit card isn’t that bad, it has helped me to track my expenses also it earns me the points so that i can exchange those points for free petrol. Which are too expensive now a days 🙂

Krishna

Krishna

No doubt about it .. I never said its bad , I just highlighted that it can become a reason for Instant gratification for many people and it is . Not sure if you have heard horror stories related to how people have fallen in Debt mess just by keeping accumulating interest and not paying credit card bill not just over months but years ! .

Its a double edged sword , you can use it to save some one or cut some one’s head .Its on you

Manish

Manish,

I Completely agree with you, Yes I have seen people taking personal loans to clear credit card debt.

Krishna

Great work Mr. Manish.

Regards….

Harpreet

thanks 🙂