75% of EPF can be withdrawn just after a month of unemployment

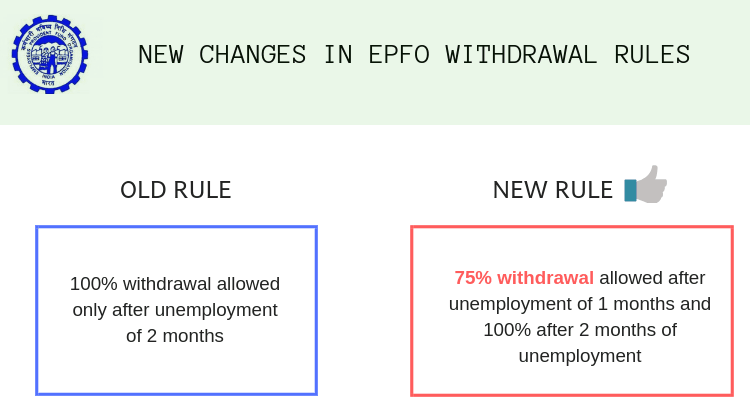

EPF is a long term retirement saving scheme. Therefore, it can be withdrawn fully(100%) only after retirement. And early retirement is not considered until the person reaches 55 years of age. However, if you get unemployed for a period of not less than 2 months, then as per the old rule of section 69(2) of the EPF act, you can withdraw 100% of EPF balance outstanding in your account.

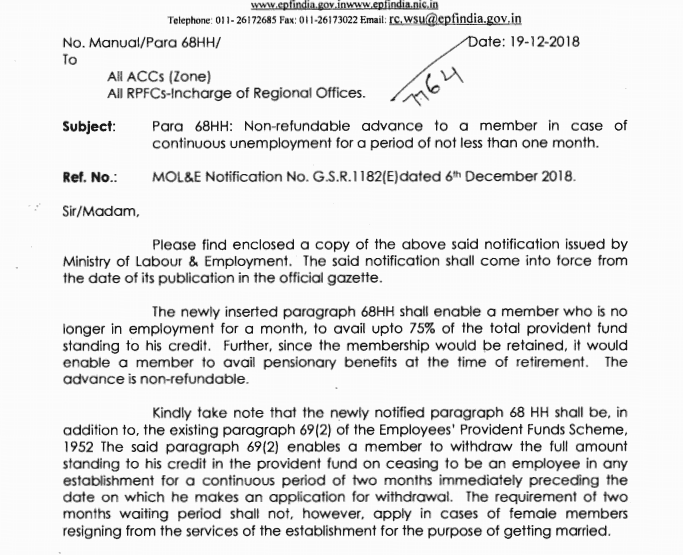

Now, EPFO has made the Employee Provident Fund withdrawal rules more flexible for cases of job loss and inserted a new rule under section 68HH.

A new clause, 68HH has been inserted after para 68H in the 1952 EPF act

As per this, If a person has been unemployed for a period of not less 1 month can withdraw upto 75% of EPF balance outstanding in his account as on date. The section says that, even after such withdrawal is made, the person shall remain part of the EPF and eligible for pension benefits. However, the advance cannot be remitted back into the EPF i.e. it will be non-refundable.

In addition to this, the circular clearly states that para 69(2) (old rule) is still continuing. That means, after two months of continuous unemployment, 100% of EPF withdrawal is allowed. However, the waiting period of 2 months does not apply in cases of woman retiring from services for the purpose of getting married. The snapshot of circular is given below,

Do you think this small change in the rule of EFP withdrawal, would be beneficial on a larger scale?? Let us know your views in the comment section.

January 8, 2019

January 8, 2019

I have completed 18 years of service in a PSU, I want to take VRS , am I eligible for Pension .If eligible , approximate amount of monthly pension

This info you will get from PSU only

Sir, it is showing that, claim against Para 69(2), since i was unemployed for more than 6 months, from the date of leaving of my job, how to resolve the issye?

What is the issue?

hi need suggestion for pf withdrawl

Yes, ask your query!

I want to withdraw my PF. The company is not approving my KYC. But my Aadhar is verified, Can I claim it manually by submitting hard copies in the EPFO Office?

Are you without a job at the moment? Because withdrawal is possible only when you are job less for more than 2 months, else you cant

Hi,

I was working in India for 6 years and contributed to EPF. I traveled to USA on Work Visa 2 years back

What will happen to my EPF Account if I stay in USA for few more years and should I withdraw it?

Thanks!

Hi Saket

Thanks for your comment.

Your EPF balance will be growing at the rate of interest provided. I would suggest let it be as it is and use it after your retirement. And as you are not unemployed so if you withdraw it you be liable for penalty.

Vandana

Hi, is it a good idea to withdraw your EPF and deposit the amount in PPF if I plan to leave job now.

Thanks!

Thanks for your comment Palak Sethi .. Please keep sharing your views like this..

Vandana

Hi,

There are 2 components in EPF 1. Provident Fund 2. Pension Fund. What happens to Pension Fund if we withdraw EPF?

Thanks!

Hi Saket

Thanks for your comment.

The portion of pension fund will be as it is. You can withdraw from pension fund only after retirement.

Vandana

Thank you for your reply.

Will it be a taxable income (Provident Fund) for that financial year?

Thanks!

Hi Saket

Withdrawal from recognized EPF is not exempt.

Vandana

Will this be applicable to Employee portion of EPF or both Employee and Employer portion?

Hi Vasanth

Thanks for your comment.

It is applicable to both employee and employer portion.

Vandana

Yes, change is beneficial.

Thanks for your comment Ashish A H .. Please keep sharing your views like this..

Manish

It may be great help during this period but wise decision is also important.

Hey Hirdesh

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

I assume even after partial withdrawal after one month, the remaining balance will continue to earn interest. So employee can plan for both his short term and long term needs

Thanks for your comment Jyothi .. Please keep sharing your views like this..

Vandana

Hello Vandana,

Is this amount taxable, if withdrawn post 2 months of unemployment

Hi Boom

Thanks for your comment.

No EPF withdrawal will not be taxable.

Vandana

Like

what about full EPS withdrawn if overall EPS tenure is above 10 year.? Any change in rule for same?

-Mahesh

Hi Mahesh

Thanks for your comment.

The rule is same for all irrespective of the tenure of service.

Vandana

what about full EPS withdrawn? If overall EPS tenure is above 10 year….Is there any rule change for same? Thanks in advance.

-Mahesh

Hi Mahesh

Thanks for your comment.

The withdrawal rule is same irrespective of the tenure of service.

Vandana

This change is good. Many employees can take benefit out of this.

Thanks for your comment ashish gupta .. Please keep sharing your views like this..

Vandana

Withdrawal from PF is not good till retirement.As this is a long term commitment. Hence even if there is a concession given by EPFO on withdrawal, it’s always best to keep adding in this account. Yes if there is nothing else possible then it’s a personal choice.

Thanks for your comment Sri .. Please keep sharing your views like this..

Vandana

Good decision. People are still unaware about the procedures to withdraw PF. Please share the same in next blog.

Hi Swapnil,

Thanks a lot for suggestion. Will take it into consideration.

Vandana

Will that 75% withdrawal is taxable?

Hi Vasundhara

Thanks for your comment.

The withdrawal from recognised EPF is exempt. So, its not taxable.

Thanks

Vandana

It is certainly a welcome initiative that will benefit the needy instantly.

Thanks for your comment RAJESH BAJAJ .. Please keep sharing your views like this..

Vandana