Casualness Trap – Why Some People Never Build Wealth (part 1)

Meet Rahul: 35 years old, ₹1.2 lakh monthly salary, ₹3 lakh in credit card debt, ₹16 lakh personal loan, and zero assets. From the outside, he’s the picture of middle-class success – nice apartment, latest smartphone, weekend brunches. But peel back the Instagram filter, and you’ll find a financial time bomb ticking. I am sure if you’re honest with yourself, maybe a part of Rahul’s story sounds familiar to you or someone you know personally.

This isn’t an exception – it’s the dangerous norm for millions of urban Indians today. The scariest part? They don’t even realize they’re drowning.

Most people blame external factors—low income, bad luck, or family pressures—for not building wealth. But more often, the real reason is silent and dangerous: a casual, indifferent attitude toward money.

I call it the Casualness Trap.

It took me nearly ten years to realize this after working with thousands of clients and hundreds of our workshop participants

People who are casual about their finances usually show the same attitude in other areas of life. They often run late, make promises they don’t keep, and carry a certain “chalta hai” mindset—the belief that things will somehow sort themselves out.

How Delaying Decisions Can Derail Your Wealth

This isn’t about people being reckless or intentionally careless. It’s about the small ways we let important things slide, the way we avoid looking at the uncomfortable truths, and how we push big decisions to the future because they feel overwhelming today.

When it comes to money, this casualness shows up in phrases we’ve all heard—or even said ourselves.

- “I’ll start saving once my salary goes up.”

- “I don’t need to track my spending; I have a rough idea.”

- “I’m still young; I’ll think about investing later.”

- “Life is for living—I’ll enjoy now and figure things out down the road.”

These don’t sound like financial sins. They sound…normal. Relatable. Even harmless.

But that’s exactly what makes this trap so dangerous. It’s not rooted in bad intentions—it’s rooted in delay, in inertia, in living on autopilot. And wealth doesn’t get built on autopilot. It’s built when you act with intention. And when that intention is missing, every year that goes by becomes a missed opportunity.

Often, this mindset isn’t entirely your fault—it’s inherited. Many of us grow up in households where money isn’t discussed openly, planning isn’t prioritized, and financial decisions are driven by emotion or urgency, not strategy. If your parents lived paycheck to paycheck, avoided risk, or treated money as a taboo topic, it’s likely you absorbed some of that thinking. Without even realizing it, their casual approach becomes your default setting—until you choose to break the pattern.

Why the Casualness Trap Destroys Your Future

Casualness feels safe in the moment. You avoid tough conversations with yourself. You don’t have to confront how little you’re saving or how unstructured your finances really are. But life, as we all know, has a way of shaking you up when you least expect it.

- Maybe you lose your job.

- Maybe someone in your family needs sudden medical care.

- Maybe an unexpected bill lands on your lap.

And that’s when the cracks show.

There’s no emergency fund to dip into. No investments to fall back on. No plan to help you through.

So what happens?

You swipe the credit card, take a personal loan, maybe even borrow from friends and family. And just like that, stress multiplies, pressure builds, and financial anxiety becomes part of your daily life.

What makes this worse is that these situations aren’t rare. They happen all the time—to millions of people. And if you’re caught off guard, it’s not just your money that suffers—it’s your confidence, your peace of mind, and sometimes even your relationships.

But the biggest loss? Time.

Time that could have been used to build. To grow. To compound.

Because once compounding is off the table, catching up becomes 10X times harder.

You Start to Feel Lost, Behind, and Defeated

This trap doesn’t just affect your wallet—it affects your identity. Deep down, people stuck in this loop begin to feel like they’re failing at life. Like they’re the only ones not getting ahead. That creeping feeling of being left behind by your peers—despite working just as hard—starts to take root. And soon, you start losing faith in your ability to change your situation.

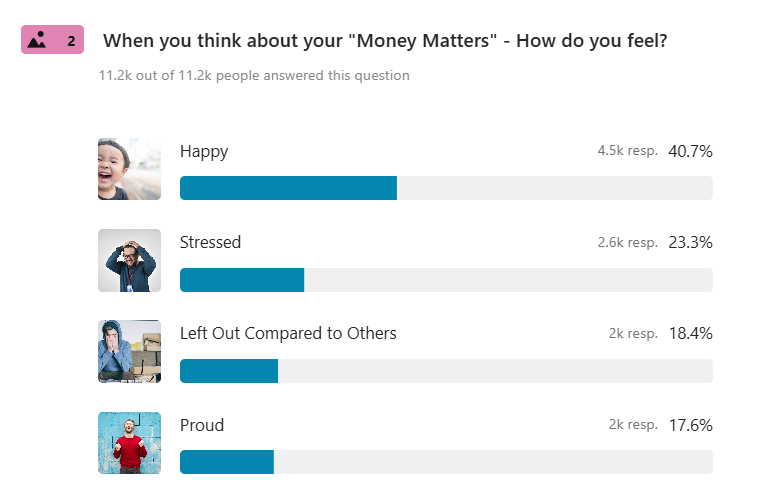

In our 25 questions financial health checkup, we ask people how do they feel about their money matters and around 1 out of 5 people said they feel “Left Out Compared to Others” .. That’s such a heavy feeling!.

But here’s the truth: it’s not too late. Not if you choose to act.

The first step is recognizing this pattern. The second is having the courage to break it.

Why Good-Income Alone is not enough

A lot of educated, urban professionals fall into the trap of thinking they’re “doing fine” just because their salary is increasing. But wealth isn’t about how much you earn—it’s about how much you keep, how wisely you invest, and how patiently you let it grow.

Without budgeting, without protection (like insurance), without long-term planning, you’re just burning fuel without direction. Income rises, but so do expenses. And you remain financially vulnerable, just at a higher lifestyle level.

The Emotional Cost of Casualness

Many people think of finance as a cold, logical area of life. But let me tell you—it’s deeply emotional. Living paycheck to paycheck, dreading the 1st of the month, avoiding bank statements, worrying about every expense—these experiences leave scars.

The regret of not starting earlier, the shame of not knowing where your money went, the fear of financial instability—they’re real. And they’re painful.

The Casualness Trap may feel harmless at first, but its consequences are far-reaching and long-lasting. It’s easy to ignore today’s financial decisions, thinking they can wait for tomorrow, but tomorrow is never promised. The good news is, it’s never too late to break free from this pattern. By becoming intentional about your money—starting today—you can turn the tide.

It’s not about earning more, but about doing more with what you have. The key is making conscious, proactive choices that build the foundation for a secure, prosperous future. So, stop letting “later” dictate your life and take charge of your financial future now. Your time—and your wealth—are far too precious to waste.

Wealth isn’t built by grand gestures—but by killing the ‘Chalta hai’ voice in your head, one intentional choice at a time.

If this piece struck a chord, maybe it’s time to stop delaying and start deciding. For some, DIY works. For others, expert guidance brings clarity and speed. If you’re in the second group, we’ve helped thousands like you build systems that stick. Do fill up this form and lets Talk!

May 10, 2025

May 10, 2025

This is such a powerful and relatable post. Rahul’s story reflects the hidden struggles many of us face despite a decent income. The “Casualness Trap” really hits home—it’s not about how much we earn, but how intentional we are with our money. Thanks for the much-needed wake-up call!

Thanks Piyush !