Its time for Portfolio Rebalancing

Are you thinking of entering the equity markets now? Are you thinking of buying some equity mutual funds? You must have heard by now, how the markets are back in action, reaching highs again.

Today, I am not here to discourage you and say “Don’t enter markets” or “Its time to exit” — because neither I or anybody else can predict it. We are here to take decision based on what we can control; and the market is definitely something, which no one has control over.

However we can control our actions, greed or fear! I am here, just to remind you about the last crash and how stupidly we all behaved out of greed or fear. (read my story)

The first thing you should understand clearly, is that it’s not the best time to enter the markets for the long-term, because markets are not back in action from last few weeks. It was back in action 1-1.5 years back when markets started rising from 8000 to current levels of 20,000.

It has already given 150% return on an absolute level or 100% CAGR 🙂 and the retail public is now waking up like always to enter with all its money for “long-term”.

Lets us see in this article some good practices and what you can do at the moment .

We, as investors have to be very cautious and not lose our control. It has been 30 years now, that markets are in existence and these kind of situations have come along loads of times. Let’s make sure, that this time we do not regret like we did before. IPOs have started coming in and we recently saw one of the biggest IPO of Coal-India in the history of Indian markets.

All the news channels are back with all the so-called analysts and discussion on how markets can reach new heights and logical explanations about economy booming, deep valuations and what not.

Good time to Rebalance your Portfolio

Markets are nearing an all time high of 21000! It has come a long way from 8000 to 21000 in last 18 months. For investors who bought equity funds or direct stocks at lowest points, it would be a good idea to book profits or rebalance their portfolios.

Look at your investments in Equity as growing a tree. When you invested 1 yr back, you had started with a plants which over these 1-2 yrs have grown to a tree and now is the time for you to pluck the fruit; at least book the profits partially if you don’t want to sell everything.

Note that it does not mean that markets will fall or should fall. But rather than trying to control what markets are going to do, concentrate on what you can (and should) do at the moment. Don’t loose your sleep over what will happen in markets, reduce your tension by booking your profits partially atleast.

Incase you had bought stocks, mutual funds randomly without any proper study, you should immediately get out of markets.

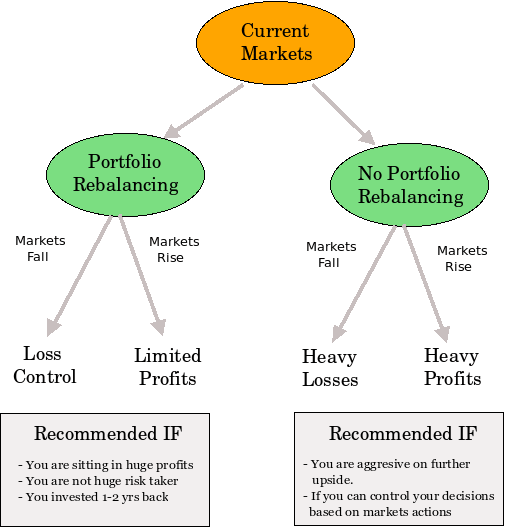

Two dimensional possibility in markets

Right now, there are two really important influences that can affect your investments. One of those is Market direction and the other is Self-Direction. Market direction is something you can not control and it’s almost impossible to predict.

However, self direction is something you can control. Let’s look at a couple of different scenarios and what they mean!

For simplicity purpose we will assume that following two things can happen in Markets-direction and your Self-direction

Market-Direction

- Markets can go DOWN by 50% in next 1 yr

- Markets can go UP by 50% in next 1 yr

Self-Direction

- Rebalance your portfolio from 100% equity to 50% equity and 50% debt

- Leave it 100% equity

Case 1 : Markets go Down by 50% in 1 yr

If your Rebalance :: In case you rebalance right now , you will have 1 lac in equity and 1 lac in debt, The equity component will go down from 1 lac to 50,000 and debt component will rise from 1 lac to 1.08 lacs. Your total worth would be 50k + 1.08 lac = 1.58 lacs. That would be a 21% loss overall .

If you Dont Rebalance : If you don’t rebalance right now, you will have 2 lac in equity and it will go down from 2 lac to 1 lacs – a 50% loss overall .

Case 2 : Markets go UP 50% in 1 yr

If your Rebalance : In case you rebalance right now , you will have 1 lac in equity and 1 lac in debt, The equity component will go up from 1 lac to 1.5 lacs and debt component will rise from 1 lac to 1.08 lacs. Your total worth would now will be 1.5 lacs + 1.08 lac = 2.58 lacs, a 29% profit overall.

If you don’t : You will have 2 lacs in equity and it will go up from 2 lac to 3 lacs – 50% profit.

Results

You can see by this small exercise that in one case you are going to see 50% loss or 50% profit and with another case you can see 21% loss or 29% profit. Now it’s your choice. Which situation are you more comfortable with? I personally feel, retail investors should concentrate more on limiting their losses.

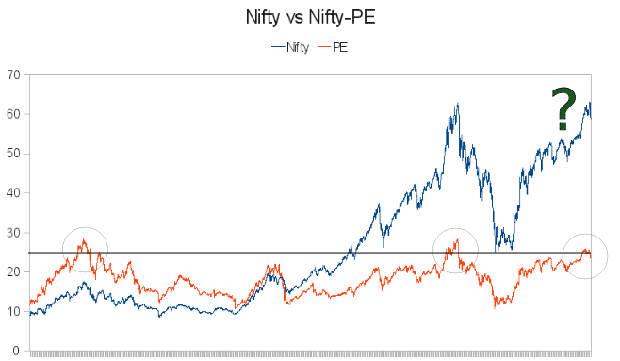

Where is Nifty PE ?

The Nifty PE has been a good indicator in the past to judge overbought and oversold situations . One problem with Nifty-PE though, is that it can’t give you precise a timeline, for when markets can start rising or falling. Nifty PE right now is somewhere around 25, which has proved to be an overbought situation historically.

In the past Nifty PE has reached this level before markets fell after few months. It happened in 2008 crash. On the other hand, a high Nifty PE also indicates strong momentum and can be seen as an opportunity to make some quick trades by entering on the weaker days.

So it’s your choice on how you want to look at the situation .

Note that Nifty PE at the moment is very much near that previous high’s of 25, where markets crashed, but it can still go to 27-28 or even 30 in worst case, which can take another 3-4 months and then market can fall ! severely .

Some views from Market Experts

“This current fall of 1200 points on sensex is an obvious downside which always happen after a spectacular upmove and it is nothing but a pure profit booking correction which has happened in last 1-2 weeks.

There is still 1 leg of major upmove remains in markets and unless Nifty breaks support levels below 5700-5800, instead of panicking its a good time to take some positions for short-term of 3-4 months, markets can break the previous levels and reach upto 25000-25000 levels” – As per Hemen Kapadia, a noted technical analyst (I met him at a seminar in Bangalore).

Another friend of mine and a technical analyst Nooresh Merani shares his similar views “Unless nifty breaks down by another 200-300 points, we can see it as a trend reversal pattern, and it still have steam left for another next few months, there after we have to look at charts again to give views”

So If you are an aggressive investor, don’t sell. Just ride the trend; you can also add some money when market cools off a bit and then ready for the move upwards again.

But anyway, you have to be cautious and make sure you have control on yourself. And you should be selling if there are major indications of markets being weak.

November 20, 2010

November 20, 2010

Hi Manish,

I am investing in FT India Dynamic PE Ratio Fund of Funds which automatically does portfolio re-balancing at the end of the month.

How does the scheme work?

The scheme changes its asset allocation based on the weighted

average PE ratio of the NSE NIFTY Index. At higher PE levels, it

reduces allocation to equities in order to minimise downside risk.

Similarly at lower PE levels, it increases allocation to equities to

capitalise on their upside potential. Historically, such a strategy of

varying the allocation of equity and debt/money market instruments

based on the PE ratio has delivered superior risk-adjusted returns over

the long term, although there is no guarantee that will be repeated in

the future. The equity component of the scheme is invested in Franklin

India Bluechip Fund (FIBCF), an open end diversified equity scheme

investing predominantly in large cap stocks and the debt/money

market component is invested in Templeton India Income Fund (TIIF),

an open end income scheme investing in government securities, PSU

bonds and corporate debt.

This fund will protect from losses and limit the upside as well, but then again it will deliver steady returns and build long term wealth.

Comments awaited.

Thanks

Amit

Amit

this question can take lot of time , a better place to discuss is http://jagoinvestor.dev.diginnovators.site/forum/

Manish, thanks for this wonderful blog.

I’m investing in Equity and Debt funds in 70:30. I invest 10,000/- each month and planning to continue it for another 25 years. I am expecting 12-15% return and planned my retirement accordingly. How often should I re-balance my portfolio? I have PPF, FD and Gold as other investment means. When re-balancing is it good to move money to these instruments so that I get an average return of 15% through out my investment period.

Please point me to articles you have published earlier on long term investment.

Raj

You can rebalance it every 1-2 yrs . You can read more on http://jagoinvestor.dev.diginnovators.site/archives , it has the list of all the articles till date .

For asset allocation and long term investing , you can read

http://jagoinvestor.dev.diginnovators.site/2009/07/power-of-asset-allocation-and-portfolio.html

http://jagoinvestor.dev.diginnovators.site/2009/04/asset-allocation-presentation.html

http://jagoinvestor.dev.diginnovators.site/2008/08/creating-weatlh-we-are-going-to-discuss.html

Manish

Manish, can u please tell me which of this 2 schemes is the best, a) Reliance Regular Savings Balanced b)HDFC Prudence

Kavita

Have a look at this : http://jagoinvestor.dev.diginnovators.site/forum/balanced-funds-which-one-among-these-to-chose/818/

Manish

hi Manish,

Can u Please tell me what are Balanced Funds? and Why do we need to invest in them.

Kavita

I will give you a analogy , some people like spicy food , some like totally non-spicy , but some like a bit of spice , not too much , so they put less mirchi and masala in their food , so they they dont burn their tounge, but still enjoy taste of mirchi and masala .

In the same way Pure Equity (shares and equity MF) are like mirchi , if you have too much of it , you might burn your taste, so people who still want to taste it but not too much , go for balanced funds which have limited exposure to equity like 60-65% , rest 40-45% is in debt , which is safe, thats why they are called Balanced ! . I hope you got it !

Manish

thanks manish for your valuable advice and simple explanation.

hi manish, i wanted to ask u something regarding my carrer… as nw i m studing in bba 2nd year n i m very much intrested in learning abot stock market, mutual funds..etc.. and also i m workin as a insurance agent for sekking knowledge and also for my pocket money.. i do invest in stock market and mutual funds throung sip but very small amount… in future i want to do mba in finance.. n i also heard abt d ncfm modules.. is it good for giving dat modules.?? does it make ane impact on my resume aftr my mba whn i apply for a job in mnc? how much impact does it make??? if it is good to give dat modules exam, den pls tell me wich wich shuld i give first n so on..?? or else tell me some other courses or certification dat i should i go for for makin my resume much powerful n get a well sound pay job… thank u..

salman

Thank you 🙂 The calculator is pretty useful in general. I’ll also try to prepare one using excel…

Regards

Aparna

Hi Manish,

I’ve been following your blog for quite sometime. I like your views. I’ve been investing since 2003 september (I got job in 2002 July) and I wish I had your blog then! Just like you, I am also system engineer in one of the s/w companies.

I want to save 30k to 50k per month(This amount will increase with time) and buy a home btw 5 to 10 yrs from now. The home that is of my interest costs me around 80L today. My goal is to pay of 70% of the price at the time of buying. I assume that home price will be doubled in 5 yrs from now, in the worst case. Assume I have no cash reserve now, what is the investment tool I can use to meet my goal? I am familiar with MFs and equity, but a bit scared to put such a huge amount into equity SIP or equity MF. I am not the kind of person who would do daily trading, still I am not sure whether with SIP I can invest such a huge amount and be sure of returns. Your suggestions will be really helpful.

Thanks

Aparna

Aparna

See how much money you need to invest per month to achieve a goal in certain time frame using this goal calculator : http://jagoinvestor.dev.diginnovators.site/calculators/html/Goal-Planner.html

If want to make better returns than plain FD’s or risk-free investments, you cant say “I cant take risk” ! , you have to take it !

Manish

Hello Manish,

I strongly believe that if one is going to invest for a very long term , say, 20 years, then the level of index(sensex) does not make much sense.. because during those 20 years there will be frequent bull phases and bear phases, over which an individual investor has no control whatever. However if an investor’s time frame is say 3 years then it makes sense. Also there is no valid theory to prove that portfolio re-balancing can give better returns. Portfolio re balancing is only a method to minimize the risk ( and not to maximize the returns) .

Sreedhar

I am not sure on your statement “Portfolio re balancing is only a method to minimize the risk ( and not to maximize the returns) .” . I think its portfolio diversification which helps in minimizing risk , portfolio rebalancing would yield better returns than plain buy and hold depending on what time frame one is rebalancing .

Manish

Hi,

Pls go through the following link :

Thanks Sreedhar for a very good article.

Ramesh

Hi Manish,

Personaly, I have sold all stocks that are above their intrinsic value and sitting on cash mostly. I have put some on floating rate funds with a clear intention to switch to equity when opportunities arise. I am sitting mostly on cash. I do not really believe in this mathematical rebalancing per se. My principle is always go for an asset class that is cheap (based on its intrinsic value) with good return potential for future. If you do not find any, sit on cash or put your money in FD and wait patiently. Action does not equal performance. Sometimes we are better off doing nothing than just acting for the sake of it. As I said, this is my personal choice and folks should do what they think is best from their perspective.

Regards

Ravi

To me your strategy looks weak in the sense, there is no counter-strategy. WhatIf the markets go up or remain nowhere for next 1-2 years? 🙂

Hi Ramesh,

Its a probability game. If you know that market can go up by 20% from here and you give it a probability of say 30% and if there is a chance that market can down (reversion to mean of long term PE of nifty) by say 20% and the probability is 80% then the outcome is +0.06-.16 which equal to -0.1. When you see the total outcome you lose. We are better off not investing when the total expected outcome is negative. As I said before, these are individual decisions and there is no one strategy that fits for everyone everytime. Great performing managers have one thing common. They dont play just for the sake of playing. They bet only when odds are in their favour else they sit on cash. Warren Buffet, Charlie Munger and Seth Klarman are good examples who do not mind sitting with 40% cash at times.

When I say sit on cash, I meant floating rate fund or any instrument that provides some safe return but gives you the liquidity to switch when the opportunity arise. It is okay for me if I can just make the current interst rate rather than having a big probability to lose my principal.

Regards

Ravi

One small correction to the last comment, the market probability of going down should be 70% (as going up was 30%) and the total expected outcome would be -.08.

In the probabilities game, the chance of markets going up is 50% and the reverse is also 50%. That means total outcome is zero! Corrections and rallies are part of all types of markets. Only with a hindsight bias, you can say that this was a normal bull market correction or start of the bear market and vice versa.

All the 3 persons that you have mentioned are astute investors within subsets of value investing and their performance is rare. But I will be very surprised if any of them looks at the indices and says that this is the time to sit in cash. They will search and search for severely underpriced assets and buy them, and only if they do not find such assets will they sit out. All of them look far far ahead in future. As should all investors if they really want to make money.

Ravikumar

Good point , Technical analysis is based on this point only .It tells us good points where on can take trade bases on high odds , like when market went to 6300 recently , the chances of downside was very high and upside was limited, so the overall expected outcome was negative if you combine both upside and downside . So it was worth taking a call.

Also you have assigned probability for upside or downside, but not “side-ways” , you should better take into consideration the time also . If might happen that upside is there in next 1 week , but high downside in next 1 month !

Manish

Ramesh

Yea .. Even though there is no counter-strategy , it gives a mathematical way of investing and I feel technical analysis actually does that only , coupled with proper rules like stoploss and time horizon , one can take that path ! 🙂

Manish

Manish

I do not have anything against Trading analysis. But for long term “non-technical” investors, this kind of micro-management just increases the hassles without any statistically significant long term outperformance. The rule of stoploss is only for technical analysis, and actually goes against the tenet of long-term investing. 🙂

Ramesh

Ramesh

Ok , i see the point . 🙂 . I personally like to mix them still 🙂

Manish

Hi Manish,

A very good post to suggest rebalancing the portfolio. While, the whole rebalancing idea has been posted well, I thought this kind of one size fits all kind of rebalancing of equity:debt does not seem to be advisable to be applied in this scenario that we currently are in. Look at what is happening to the asset classes around us. Debt, Realty, Equity, Commodity and any other asset class we can think of, are all at its peak. Its a liquidity driven market where the stupid decisions taken by FED (US) is driving this cheap money towards all these asset classes (including emerging markets). The macro picture is that its a bubble that is building up everywhere (this includes debt). So, you should assume that the debt (aka debt mutual funds and bonds) are as risky as equity and that could fall 50% (hypotethically) too if the inflation takes off (which is very likely given the scenario). What I am trying to come too is, people should not be under false impression that debt is safe. It is not. Better advise would be to sit of as much cash right now as possible. Put the money in floating rate funds or keep it in liquid fund or safely in bank or under the mattress. Wait for the correction to happen and then deploy in the right place. This is the most difficult advice to follow but the right one at this juncture. I think that is the right kind of rebalancing advice that we should give right now.

Please note that these views are personal and are not meant to say you are saying something wrong.

Keep up the great work. This blog is very informative.

Looking forward for more posts.

Regards

Ravi

Ravi

So what do you suggest in that case ? Sell and sit on Cash , which might be comfortable situation for many 🙂 .

Manish

Hi,

I am still bullish and expect market will reamain stable if not increase. Hence i am ramin silent and doing my SIP regularly (it will average automatically). Please advice.

Prashant

There is nothing to advice in this case . Looks like your risk appetite is pretty good and you seem to be comfortable with markets going down . Thats fine I guess , what levels on nifty do you feel might bring some downside ?

Manish

I reread this article again and it seems to me that it applies only to those with max exposure to equity 100%(which is crazy!) to say 70%?

Not sure if someone with low risk tolerance and with only 40-50% equity exposure should decrease it further. Can you clarify?

The other issue is as rightly pointed out by Sundar (whose comments are awesome btw) is tax implication of debt funds. If someone decreases exposure to equity and invests in debts and they finds a few months later the sensex at 8000 and revert back to equity what are the tax implications. This seems messy to me.

Pattu

Yea .. taxation while moving to debt is one point to take care of , I should have noted that point in the article itself . So one has to take care of taxation part while moving to debt . Considering that moving to equity back will happen in next 1 yrs after moving to debt , it would demand some tax to be paid , one has to consider the overall gain by doing portfolio rebalancing minus the tax paid , and if that looks a considerable amount , that would make sense . Again this whole portfolio rebalancing thing on basis of nifty-pe should not take place more than 5-6 times in a 10 yr time frame .

Manish

manish this article is contradicting to all your previous posts or rather i say principles on long term, not to time market, equity for 10+yrs, stay invested, SIP etc.

Marshal

No , you have not explored every part of my articles in that case . Portfolio rebalancing actually enhances the returns in long term not decreases it.

read http://jagoinvestor.dev.diginnovators.site/2009/07/power-of-asset-allocation-and-portfolio.html and

http://jagoinvestor.dev.diginnovators.site/2008/07/portfolio-rebalancing-today-i-am-going.html

Manish

“Dont Time the Market”.

I seriously disagree with this article.

1. Rebalance the Portfolio. There is no good or bad time to rebalance. It should be done at a more or less fixed interval, say quarterly or half-yearly or yearly. To do it according to market levels is absolutely wrong. If it is time to rebalance now, was anybody doing it at the time when markets were at 8000. 🙂 At that time, everybody was saying this is doom time and your equities are going to get bust, etc, etc. People stopped their SIPs and investment in equities at precisely the best time for investing in them.

2. Two dimensional Possibility – Actually, there are 4 dimensions to capital markets. Either there will be Up-a-lot, Up-a-little, Down-a-little and Down-a-lot scenarios. Except for the 4th scenario of Down-a-lot, one should remain majorly in equities. That means 3:1 possibility and not a 1:1 possibility.

If you are looking for only the next year or the next-to-next year, dont be in equity markets. Have everything in debt or something related. But, if you want to maximise the growth of your money, put majorly in equity markets. Be diversified but still majorly in equity markets.

3. Do you think there is a bear market ahead since Nifty is such and such level? Every bull market has corrections and vice versa, but if you look at long term data, they look like blips. So dont be myopic. 🙂

4. If you say rebalance now, I would like to ask you when will you repeat this thing in future. That is, when will you say it is time to get back in markets. At 18000, 15000, 12000 or 8000? Or is it time to rebalance again at 19500?

5. Chartists/Traders work in different ways than investors. If you are in for short term only – work like a trader. If you are in for long term, work and behave like an investor.

Ramesh

1. Why do you think one should not do relabacing based on market levels, one can always make their own rules of rebalacing , i agree that it should be on fixed intervals , but you can make your own overbought/over-sold levels and do rebalancing , it all depends how much involved you want to be . The article even though says rebalance it now as markets seem to be high , it also indicated that you should be moving back to equity when markets are very down and the very same 2008 crash example also qualifies as a rebalacing time .

2. may be you are looking at some 4 rules which are based on text books , I just made my own 2 dimentions and wrote about it .

3. Yes , I agree with you , so only people who want to time the markets , should be doing rebalancing , as its a passive way of timing the markets . For anyone who doesnot want to be involved they should just be invested for long term .

4. as per this example, I suggest using nifty-PE as a indicator to find over-bought and over-sold points . For some one who believes its not the right way of doing it, should ignore the approach or make their own . Its just a suggestions and an idea for discussion , I can see historically this has given betten than buy and hold . Much better !

5. I am mixing fundamental and technical at very long time frame, it cant be done every week or month , these kind of scenarios arise 5-6 times in 10 yrs . Even an investor has to be active some times and this approach will only make him active quite a few times in years . Even though it looks close to trading , I consider it close to investing for long term only .

Manish

I agree on most of the things. I think these explanations should have been part of the main article.

Rebalancing should be seen in relation with the whole portfolio and not just of the equity funds / stocks. If a person has a big chunk of his portfolio in FDs, savings accounts, endowment policies, PPF, etc and his equity portfolio is already small (most of the Indians have that), then decreasing the already small part of your equity portfolio is not going to help you. The first impression from your article is that since the Nifty PE has reached this particular level, it is either time to get out or dont enter at all (though you have tried to emphasize on rebalancing the portfolio, but most of the people would not understand that part). I have serious objections with the pointing of “particular” levels. Thats all.

I dont disagree with using technical and fundamental parameters for timing the market. Use as much as you can to get the best possible return at the least level of risk. ! Your use of Nifty-PE as a indicator is good. My suggestion is if you have identified a overbought condition (as nifty PE increases above 25), then why to balance it to 50-50, go to 20-80 or even 0-100. Why not? Same with a low level, goto 90-10 or 100-0. If possible, that is what we should be doing. And nothing wrong with it.

Regarding rebalancing one should also consider the cost of transactions and taxation. Calculating returns without taking into consideration these costs can lead to serious mistakes.

My example of 4 scenarios is based on a book but that is a logical thing and not an arbitrary scenario.

I would like some good evidence of your approach of rebalancing (include the taxation and other costs) vis-a-vis a buy-and-hold. I am all for a healthy discussion.

Ramesh:

Very interesting discussion going on this most important subject. Let me add my bit.

I like your first para where you state most people will not understand P/E ratio etc. One general strategy suitable for most people would be as follows:

1. Estimate total cost for your normal living per year. Add items like insurance premiums, mediclaim premiums and other incidental/accidental expenses and even add cost of cremation. Now invest that much of money to cover the above in stable source of income like PPF/FDs etc.

2. Remaining money be invested in 4 or 5 best Equity Funds as recommended by Manish earlier.

3. Every year after 365 days take out only that amount of money which is needed to match the inflation in your expenses. However if the market is bear grip then don’t withdraw so much. If the markets are at top like now withdraw for next 2 or 3 years increase in expenses and keep it in safe instruments.

4. After above withdrawal become Rip Van Winke. Sleep well and wake up after 3 years and do the above.

Not a bad strategy at all. this is called KISS (keep it simple, stupid). 🙂

Thanks for such a nice suggestion.

Thanks for the compliment. I hope more readers will benefit from unbiased suggestion in such good blogs like Jago Investor. Financial Planners (who are actually agents of Funds drunk on their commissions) will be put to shame when they read Jago Investor where real unbiased advice is traded by readers themselves.

Sundar

Thats a compliment for jagoinvestor 🙂 . Yes , the stars of this blog are readers who make an awesome community and shares knowledge in parts to make a complete set of knowledgebase for others .

This is a collective knowledge area 🙂

Manish

Sundar

Thats a great strategy ! . Easy to understand and implement !

Manish

Ramesh

Thanks for your excellent counter question , which would add further value to this conversation ! . The quantam of rebalancing definately lies on the risk appetite of the investor , one can do 50:50 or 0:100 . I would go with 20:80 for myself ! .

Regarding proof or some kind of study , here is a comment from a reader Pushkar who did some analysis of investing using Nifty-PE . worth taking , I have listed his comment below, but the link is this : http://jagoinvestor.dev.diginnovators.site/2009/06/value-investing-by-using-nifty-pe.html#comment-2657

—–

Hello Manish,

I have read your post and I have done some analysis with the nifty PE sata since 1/1/1999(the PE data is available only since then)

I have done the following analysis(all are paper trades):-

Case 1. SIP in nifty since 1/1/19999 and sold all yesterday…calculated the returns

Case 2. Entered the market at PE of 11 or below. Kept on buying every month until the PE was under 15. Stopped buying ones the PE is above 15. Exit all at PE 27. Re-entry only at PE at 11 and then buy every month until PE is below 15…and so on.

Case3. Case 2 + I shorted the mkt at PE 27 and covered all at PE 11, rest all is same as case 2.

Returns:-

Case1. 18% CAGR i.e. 18% per year cumulated annual compounding for 11 years.

Rs 100 per month became Rs 37000 after 11 years. net profit is Rs 25000(Rs 13200 is investment amount)

Case2. 30% CAGR. Rs 100 per month became 78000 after 11 years.

Case3. 38% CAGR Rs 100 per month became 122000 after 11 years.

Please note that in cases 2 and 3 when I am not able to enter each month, I keep those Rs 100 in Fixed deposits, one my entry level comes(either for short or for long, I liquidate my FDs and enter the markets) so investment amount in all the 3 cases is exactly the same.

In these 11 years there were not more than 4-5 buys and 2 sells in case 2 and 3.

Case 3 outperformed case 2 and case 2 outperformed case 1.

My questions:-

I plan to implement this strategy for my investments. I want to know how safe it is to go short at 27. Isnt it possible that nifty PE might just move into some different range, maybe the next time when the fall comes after say 5 years, maybe nifty PE could be 32 or 33…is that possible? Case 3 gets into a very big risk if this happens.

Regards,

Pushkar

*******************************************************End of Summary************************************************

Attaching below the xls sheets that I have prepared to complete the calculations, summary is already mentioned above, in case you want to see the details, here they are:-

Case2:-

100

1-Jan-99 11.62 890.8 0.11 1

1-Feb-99 12.48 940.15 0.11 1

3-May-99 14.95 970.75 0.10 1

3-May-99 14.95 970.75 0.10 1

0.42

Total invested amount = Rs 11 years*12 months*Rs 100 = 13200Rs.

9-Feb-00 27.4 1689.65 Sold 0.424 nifty @ 1690 = 716Rs.

out of the market in feb 2000, total money left Rs 716 + 700(7 months@100Rs) = 1416Rs.

Enter market in May 2003 amt = Rs 1416 + rs 4000(40 months@100Rs) = Rs 5416

2-May-03 10.86 938.3 5.77

2-Jun-03 11.59 1015.15 0.10

1-Jul-03 12.32 1130.7 0.09

1-Aug-03 12.95 1195.75 0.08

1-Sep-03 15.16 1375.95 0.07

14-May-04 14.66 1711.1 0.47

1-Jun-04 12.14 1508.75 0.07

1-Jul-04 12.9 1518.3 0.07

2-Aug-04 13.69 1618.7 0.06

1-Sep-04 13.67 1628.45 0.06

1-Oct-04 14.84 1727.95 0.06

1-Nov-04 15.03 1800.1 0.06

3-Jan-05 15.57 2059.8 0.10

1-Feb-05 14.34 2008.3 0.05

1-Mar-05 14.88 2060.9 0.05

1-Apr-05 14.84 1993.7 0.05

2-May-05 13.32 1941.3 0.05

1-Jun-05 13.93 2072.4 0.05

1-Jul-05 14.26 2169.85 0.05

1-Aug-05 14.36 2303.15 0.04

1-Sep-05 14.92 2337.65 0.04

1-Nov-05 14.32 2352.9 0.09

7.51

Sold everything in dec 2007@5974 price. 7.51 nifty = Rs 44864 + Rs. 25months@100Rs = 2500Rs.

Total money in dec 2007 out of the market Rs 47364

12-Dec-07 27.69 5974.3

Oct 2008 with Rs 47364 + 10 months@100 = Rs 1000 total = Rs 48364

24-Oct-08 10.99 3234.9 14.95069399

3-Nov-08 13.33 2684.6 0.04

1-Dec-08 11.76 2654 0.04

1-Jan-09 13.3 2922.2 0.03

2-Feb-09 13.12 2849.5 0.04

2-Mar-09 12.7 2762.5 0.04

1-Apr-09 14.49 3108.65 0.03

15.16

CMP on 23 dec 2009 = [email protected] nifty = Rs 77983 + 7 months@100 = Rs 700

Total money out of the market = Rs 78683

Initial investment Rs 13200

recurring ROI:- 30%

flat ROI:- 496%

NIFTY SIP returns:-

Total money out 37551

Recurring ROI:- 18%

Flat ROI:- 184%

Case3:-

100

1-Jan-99 11.62 890.8 0.11 1

1-Feb-99 12.48 940.15 0.11 1

3-May-99 14.95 970.75 0.10 1

3-May-99 14.95 970.75 0.10 1

0.42

Total invested amount = Rs 11 years*12 months*Rs 100 = 13200Rs.

9-Feb-00 27.4 1689.65 Sold 0.424 nifty @ 1690 = 716Rs.

out of the market in feb 2000, total money left Rs 716 + 700(7 months@100Rs) = 1416Rs.

Went short 0.837 nifty @1690

Exited shorts in May 2003 0.837 nifty @938. gain from shorts = 1690-938 * 0.837 nifty = Rs 630

Enter market in May 2003 amt = Rs 1416 + 630 gain from shorts rs 4000(40 months@100Rs) = Rs 6046

2-May-03 10.86 938.3 6.44

2-Jun-03 11.59 1015.15 0.10

1-Jul-03 12.32 1130.7 0.09

1-Aug-03 12.95 1195.75 0.08

1-Sep-03 15.16 1375.95 0.07

14-May-04 14.66 1711.1 0.47

1-Jun-04 12.14 1508.75 0.07

1-Jul-04 12.9 1518.3 0.07

2-Aug-04 13.69 1618.7 0.06

1-Sep-04 13.67 1628.45 0.06

1-Oct-04 14.84 1727.95 0.06

1-Nov-04 15.03 1800.1 0.06

3-Jan-05 15.57 2059.8 0.10

1-Feb-05 14.34 2008.3 0.05

1-Mar-05 14.88 2060.9 0.05

1-Apr-05 14.84 1993.7 0.05

2-May-05 13.32 1941.3 0.05

1-Jun-05 13.93 2072.4 0.05

1-Jul-05 14.26 2169.85 0.05

1-Aug-05 14.36 2303.15 0.04

1-Sep-05 14.92 2337.65 0.04

1-Nov-05 14.32 2352.9 0.09

8.19

Sold everything in dec 2007@5974 price. 8.19 nifty = Rs 48927 + Rs. 25months@100Rs = 2500Rs.

Total money in dec 2007 out of the market Rs 51427

12-Dec-07 27.69 5974.3

shorted 8.6 nifty @ 5974

Exited shorts in oct 2008 8.6 nifty @3234. gain from shorts = 5974-3234 *8.6 nifty = Rs 23564

Oct 2008 with Rs 51427 + 23564 gain from shorts + 10 months@100 = Rs 1000 total = Rs 75991

24-Oct-08 10.99 3234.9 23.4909889

3-Nov-08 13.33 2684.6 0.04

1-Dec-08 11.76 2654 0.04

1-Jan-09 13.3 2922.2 0.03

2-Feb-09 13.12 2849.5 0.04

2-Mar-09 12.7 2762.5 0.04

1-Apr-09 14.49 3108.65 0.03

23.70

CMP on 23 dec 2009 = [email protected] nifty = Rs 121912 + 7 months@100 = Rs 700

Total money out of the market = Rs 122612

Initial investment Rs 13200

recurring ROI:- 38% recurring ROI:- 30%

flat ROI:- 828% flat ROI:- 496%

NIFTY SIP returns:- NIFTY SIP returns:-

Total money out 37551 Total money out 37551

Recurring ROI:- 18% Recurring ROI:- 18%

Flat ROI:- 184% Flat ROI:- 184%

———

Manish

Manish

Two things for the above post.

1. As per me, this is the so called “datamine”. You bring out data and do some analysis and say this is the return. Without actual real-time performance. Case 3 in point, naked shorting an index (the data looks like that) is very risky and can simply wipe you out leaving with negative returns. Case 2 shows the power of asset allocation but the present example assumes you put money only when the PE is below 15. What if in future, the PE remains above 15 only for say 3-4 years (With recent liquidity, that can happen), then you would not be having any equity exposure! Best of luck with that scenario. Two correct predictions of Severe bear markets in Feb 2000 and Dec 2007 – if I am lucky with even 1 of them, I will get a 50% boost in my investments.

2. Counter datamine – If I had put money in Reliance growth fund from 1/Jan/1999 to 1/Dec/2009, my annualised SIP and non-SIP return would be 37% (data from valueresearchonline). Included are the initial 2% upfront charges and annual FMC, as well as all bull and bear runs. 🙂

My points are continuous innovation is a must. Different investing styles work in different world scenarios. and KISS.

Ramesh

Ramesh

Yea .. Even these strategies are not for common man . If one has to take least interest and dont want to waste time ,mutual funds are the best bet.

A very good article on Market future here

http://www.cnbc.com/id/40131748/

Jeremy Granthem has a 48% accuracy. So take his comments with a pound of salt.

http://www.cxoadvisory.com/gurus/

Manish,

What to do if we have started investing in ELSS fund (monthly SIP mode) 2 years ago. We have 1 more year to go. what are the options we have?

-Anitha

Anitha

You have no choice but to sit queit . One thing which you can do is to invest your further money in Debt instruments to automatically rebalance your portfolio .

Manish

Hi Anitha,

Even if you are investing in a SIP in a ELSS fund, you dont need to run the SIP for three years. You can stop the investments immediatly if you prefer to(Not that i am advising you to do so).

What the three year lock in for ELSS means is…Each of your SIP installment is locked for three years. In other words, the units that you bought in 2009 March is locked till 2012 March…And the units that you bought in Nov 2010 is locked till Nov 2013.

The SIP can be stopped and you can start a SIP in Debt funds instead(or a Recurring Deposit if you are in a 0 or 10% Tax bracket)

Timely article with great take-home message: “Nobody can be sure whether market will go upwards or downwards from here. But one thing for sure is that this is the opportune time for portfolio rebalancing if ur investment is in LTCG bracket”

Jagadees

Jagadees

yea .. Its nothing but timing the market through portfolio rebalancing . Just like MF are passive way of entering markets , Portfolio rebalancing is a common man way of timing the markets !

Manish

Portfolio Rebalancing should also take into account tax implications.

If you have made LTCG in Equity Funds then you can rebalance now. If you have STCG in Equity Funds then calculate if it is worth taking the call.

In my considered opinion the best option is not to do anything now if your risk tolerance is not breached. If not just reduce the equity component to more acceptable levels.

In Indian condition yearly rebalancing after 365 days is the best option irrespective of market conditions.

Sundar

Thats a good point I didnt cover in the article , thanks for mentioning it here 🙂 .

Manish

There is no issue for LTCG in Equities or Equity Funds. Luckily markets since Oct. 2008 have been on up swing and most investors would have made gains in Equities.

But for Debt fund investors Tax laws are not friendly. In the past 2 years the Cost Inflation Index has risen sharply. Interest rates have been very low. All Debt mutual funds when indexed have given heavy losses. If some one had to sell Debt funds for rebalancing he will make heavy losses after indexation. Fortunately that is not the case for today. But how can he recoup his losses in debt fund. Tax laws says it can be carried forward for next 6 years and adjusted only against LTCG in Debt Funds or Property or Gold. Of course International Equities FOFs offered my Mutual funds are considered Debt Funds. But how many are investing in such funds? In this scenario Gold Funds makes Sense.

Sundar

What are the numbers for those “heavy losses” after indexation ? Is it deep negative numbers like 10-20% ? Or just 2-3% ?

Manish

Value Research shows 6.9% annualised return for Income Funds for the last two years. That is about 14%. Cost Inflation Index published by CBDT is 582 (08-09), 632 (09-10) and 711 (10-11). Now you can calculate the losses. 8% loss for the two years. If you were unfortunate investor in Gilt Fund you will be crying a lot as those return were just 10% in two years.

Sundar

Thanks for the data, I will look more and see if this can be an article . Want to help on article ? guest article ?

Managing a Debt Fund is equally challenging as managing a Equity Fund if not more difficult. Most Fund Mangers fail miserably in managing Dynamic Debt fund. They cannot take call if the interest rates will rise or fall. In the current scenario with interest rates on 10 year benchmark at about 8%, what call one should take on Gilt Funds? Is it a buy (expecting inflation to moderate) or is it a sell (expecting QE2 Money to flood India and there by prompting inflation).

Sundar

I got more insight on challanges of managing debt funds . I guess if this is so much messy , periodic rebalancing cant be for a common man on a very short period . I hope govt makes the profit arised from moving from debt to equity tax exempt !

Manish

That is a wishful thinking and will never happen. Govt. under no circumstance will make is so easy especially in a country like India where most of the National Savings (95%) are invested conservatively and is source of cheap funds for legal or illegal purposes as well as source of revenue for the Govt.

In India where there is no Social Security, each person has to plan for his own self. To beat inflation, there is no escape from taking risk in Equity or Real Estate. In my opinion under no circumstance Equity exposure should be less than 20% for even most conservative investor. We are lucky that like Zimbabwe where cost inflation goes up by 1% per hour. Neverthless our inflation rate is high by international standard. If you want to avoid paying tax from moving from Debt to Equity then only option is balanced fund. Here Funds Don’t have to pay any tax on rebalancing. The other option is just develop your own mind set to accept high risk tolerance. I will go for the second option.

Thanks Sundar for bringing out such good data to point out the deficiencies of debt portfolio. You have rightly pointed out the problems with debt fund taxations.

Also, if Cost Inflation index is taken into consideration, the returns from ANY debt portfolio becomes dismal and absolute capital protection scheme actually becomes a “real” serious capital erosion scheme. 🙂

Sundar

Yea . I agree . I should cover this part some time next when I write an article, good catch 🙂

manish

Hi, Manish

I want to enter in the Market with investment of Rs.10000, I have HDFC & IDBI accounts which one should I prefer?

Is Service charges are applicable for buying shares or it comes at selling time only? If I incurred losses Do I need to pay service charges??

Nitin

You can buy the shares from any , no preference .

You pay brokerage charges while buying and selling both , brokerage is not dependent on profit or loss .

manish

Thanks Manish.

One more thing I would like to ask about Service taxes. Do I have to pay it even if I incurred losses??

Nitin

Which service tax ? You dont pay it in stocks or mutual funds .

Manish