What is CIBIL report ?

What is CIBIL report ? Are you looking to check your credit score and want to know why your loan application was rejected ? Yes, if you are misusing your credit taking capacity, you are being watched at like never before in this country. I am talking about CIBIL here and in this article let me show you how your current behaviour related to credit card, personal loan, home loans are going to affect you in future in a good and bad way. Also see 2 real life cases where a person’s loan application got rejected because of Bad CIBIL report and how they didnt even knew about it ! .

What is CIBIL and why you should be concerned ?

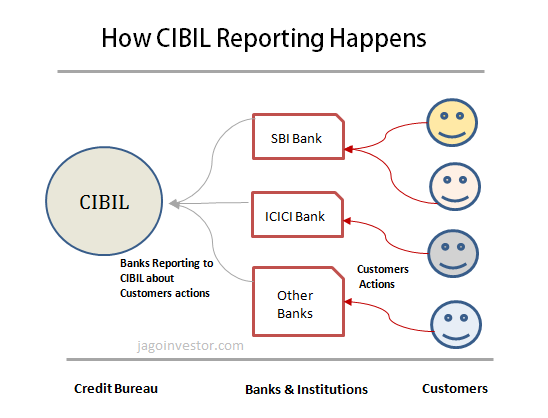

CIBIL is Credit Information Bureau of India Limited, which acts like a central repository of credit information in India. As many as 500 different banks and financial institutions are CIBIL’s clients and they report each of their customers (like me and you) actions to them.

So if you take a credit card from ICICI Bank, then ICICI bank reports to CIBIL about it. If you enquire about car loan to HDFC Bank, hold your breath! as even that enquiry is reported to CIBIL, if you can’t pay your EMI for home loan with SBI Bank for a particular month, that also gets reported to CIBIL.

Not just your bad actions, but even your good actions like paying EMI’s on time, paying credit card with punctuality also gets reported with CIBIL. You can see that this way, a history is maintained at CIBIL for each person, which can be good history or bad history depending on the case and this information is very useful for banks to decide if they want to give loan to you in future or not. All the banks are now looking at CIBIL report before taking the decision.

Good and Bad credit Report

CIBIL report is not always bad. It’s an extremely good concept which is now taking shape in India recently. If there are two people A and B and A is a good guy and B is a bad guy, obviously A should get better rates of interest, faster processing, first right to loan. Whereas, guy B should get loan at higher rate of interest (because he is risky) and may be banks can even deny entertaining him at all.

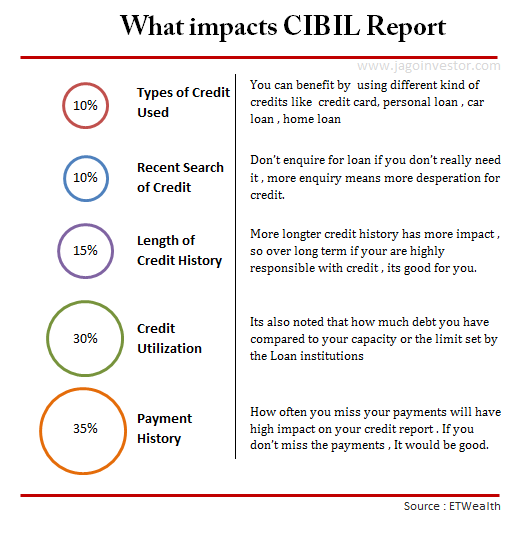

CIBIL gives us the power to build our credit report. So if you become responsible and use your credit effectively and with planning, you can build a good credit history with CIBIL, which will help you in long run. Also note that taking a lot of loans without having the capacity is also a negative thing and that can affect your credit report.

I would like to warn you that you have to be super sensitive and careful with credit card and loan repayment, because one small mistake or being lazy in this area can cost you a lot. I would like to share some instances of readers who faced a lot of issues in area of getting loans and finally they checked their CIBIL report and found that they were having bad history

Some bad experiences from readers

Rajaram mentions on our forum how his home loan payment was rejected because of his credit card late payment issues

I had two credit cards one from HDFC and other one from ABN AMRO.

In case of ABN AMRO, salesman told me that if I do purchasing of Rs.1000 within 1.5 month then the annual fees will be waved off. As per his instructions I did purchasing of Rs.1000 within that stipulated time frame. But still I got a bill with annual fees after a month. Hence I complained to the Call center executive gave the brief about my complaint. I also told him that I will be paying the amount which was spent by me and according I paid it through cheque. No further transactions done through the card and subsequently told them that I am returning it to them. But later on bills started coming with annual fees with charges. I again informed the call center executive and told him that I am not going to pay the annual fees which wasn\’t there. Later on bills stopped coming.

In HDFC case I had used this credit card for one year and in one month while paying the dues I dropped my cheque in their drop box 3 days prior to due date. When next month\’s bill received it came with late fee charges. I contacted to call center executive and told him that I had dropped my cheque 3 days in advance then how come this charges. He said it received 2 days later than my due date as was not having any proof I could not prove it. I paid the amount due to me excluding the charges. 2-3 month they sent the later but later on they stopped sending bills.

Above two instance happened to me and had forgotten also. But this year when I applied for Home loan from one of the housing bank then suddenly they put down one condition to give clarification about Credit card issues. They got this information from CIBIL which I was unaware of.

Now I need help to come out of this issue so that my housing loan clearance will be faster.

How Nihal credit report got messed up because he gave his pan card to his friend

One of my friends took a car loan from a nbfc 3 years back and he wanted a reference for this loan (i now realize there is no such thing as a reference for a loan) i obliged and gave him a duplicate copy of my pan card.

For atleast 2 years i have been applying for credit cards and getting rejection letters from all the banks. I finally was fed up with this and decided to get my cibil report and was shocked to see that i was the co-applicant for the car loan my friend had taken 3 years back. He had defaulted on this loan which was reflecting on my cibil report and that being the main reason for me not getting any credit card.

Like i mentioned earlier i had given my friend a copy of my pan card but i had never signed any loan application form, so i followed up with my friend (who still claims that i was supposed to a reference for this loan) and also with the customer care at the NBFC (who i must say were extremely rude). I managed to get the loan application form from the NBFC and i’m a cent percent sure that my signature has been forged on the form. Now my friend (would not want to call him a friend anymore) claims that the person who gave him this loan never told him about me being a co-applicant and he always thought i was only a reference.

How Ganesh faced issue with CIBIL report because of his credit card outstaning bill

Yes, I checked my cibil report last month because i had a suspicion and it was proved right.i had a c/card from icici which for a meagre sum of rs.2000 which i lost track because i was transferred to different city and didnt notice the bill. i also didnt use the c/card at the new place, as i had another card with c/limit of rs.45,000 which i started to use(sbi).

after 7 months, when i tried using the card again, it was getting rejected. when i checked with icici, they said the card is blocked. then only i came to know of the card outstanding, which by this time due to interest, and fine/charges etc had come to about rs.4000. Immediately, it was settled in full and closed the c/card a/c.

Now my cibil report shows “810″ with “history of more than 6 months outstanding 7-12 months back”

i feel cibil should consider the fact that the outstanding was settled in full – including fine/interest/etc…. and give a good score….

so i feel the system is flawed and i am paying a price for it.

my other loans – 2 wheeler loans and other sbi c/card a/cs – was showing prompt payment, either payments finished or under regular payments.

i dont know why i am still given a defaulter score when i have settled in full.

is there any way to reset my score with cibil.. pls advise…

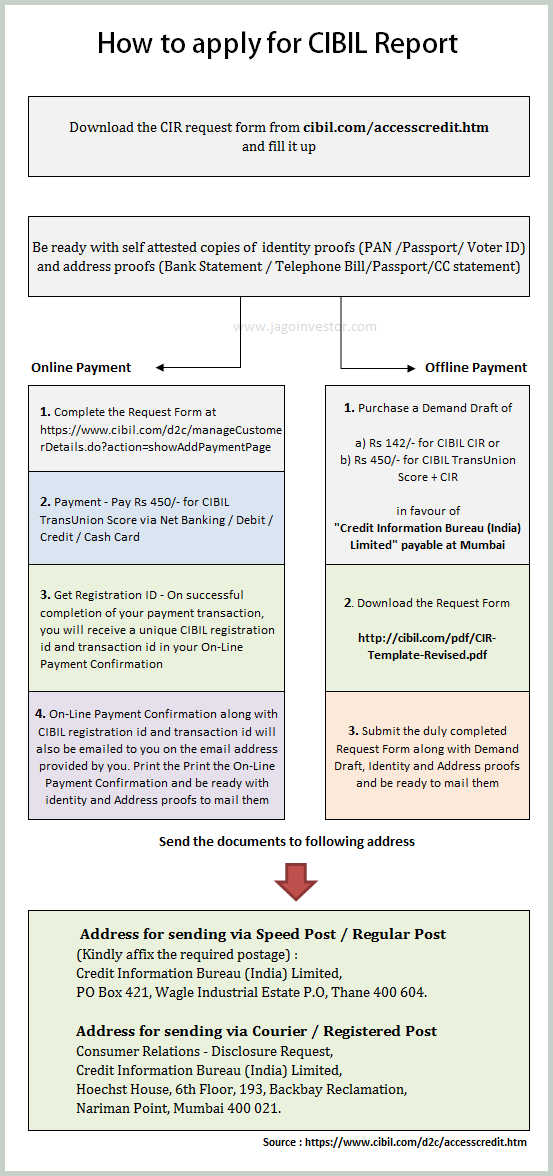

How to get your CIBIL Report Offline

There are two kind of reports which you can get from CIBIL . The basic one is called CIR Report which is nothing but a basic information on how is your credit history and what kind of information is there with CIBIL . This is called CIR report and it costs Rs 142 . This is good enough if you just want to check your status with CIBIL .

Update : Now you can also apply for your CIBIL Report Online

The second thing which you can get from CIBIL is your Credit Score which is called as CIBIL TransUnion Score and ranges from 300 – 900. This is number which scores your credit ranking . A lower number means your credit score is bad and you will be considered as Risky ! . If its 900, you are doing great, Higher the better . The cost of CIBIL TransUnion Score along with your CIR report would be Rs 450 . I would say this is not at all expensive if you can get this vital information at such a cost . If you are facing any rejection for loans or if you fear that your past history can haunt you , then its a good idea to check the CIBIL report each year and find out how does it look like. I have created a step by step procedure for you on how to apply for CIBIL report . Have a look

Can you fix the CIBIL report have wrong Information?

A lot of times Banks makes mistakes in Cibil Report and it is mostly manual mistakes or lot of times delay in communicating the details . If you check your CIBIL report and find out any problems , please ask your bank to communicate it to CIBIL as soon as possible . Also if based on your CIBIL report, if you clear some loans , make sure you ask your bank to communicate to CIBIL that you have cleared the liabilities , so that it can get updated in CIBIL report. CIBIL report is your lifeline for future , don’t do anything which makes its dirty, else that will affect you in long run .

July 21, 2011

July 21, 2011