Difference between Gold Saving Funds and Gold ETF ?

Today we will see what is the difference between Gold Saving Funds and Gold ETF’s .

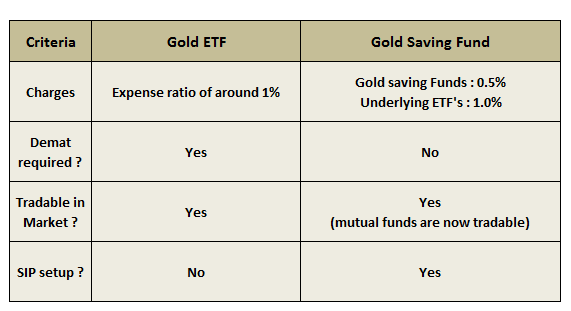

The biggest marketing pitch for selling the Gold saving fund is that one can invest in gold funds without a demat account and can set a SIP for the same, which is true.

However, the alternate option of Gold ETF’s doesn’t not allow investments and/or SIPs without a demat account. But most of the agents hide these details of costs and do not educate their clients on how things work!

Source : Kotak Website

As of today, Reliance, Kotak and Quantum have launched their Gold Saving Funds of Funds. All of these Gold saving funds are almost same. Lets take an example of Reliance Gold Saving Fund, which is nothing but a fund of funds which invest in their respective Gold ETF’s 🙂 Did you know that?

Difference between Gold Saving Funds and Gold ETF’s ?

Gold ETF’s :

Let’s understand this for a moment. In simple terms, these are financial products which invests in physical gold and tracks its pricing on day to day basis. These ETFs have their own expense ratio which is considered very high if compared to US market, but that’s the price we pay to invest in gold electronically.

You need a demat account to invest in Gold ETF and you can trade these ETFs through stock exchange.

Gold Saving funds

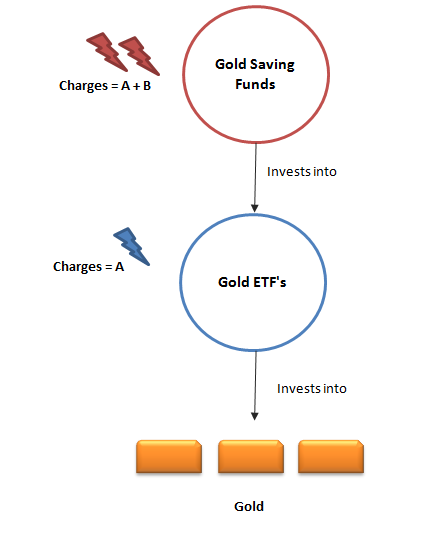

Gold savings funds are nothing but mutual funds which invests majority of its corpus (90%-100%) in Gold ETFs (of the same sister company), a small portion might also be in money market instruments or some short term debt products.

For example – Quantum Gold Saving Funds of Funds as per its mandate can invest anywhere from 95%-100% in the units of Quantum Gold ETF’s, and rest in money market instruments and other short term debt products.

But the important point you should note here is that the underlying investment is still gold, but not directly! It’s indirectly through gold ETF’s, and now as there are two layers in between, you pay charges two times!

So you pay charges for Gold saving funds and also for gold ETF’s, this part is generally not revealed by the agent who sells you these Gold saving funds. Also for the gold saving funds there are high exit load’s 🙂

So which one is better and which one you should choose?

We can’t make a general statement that one is good and the other is bad, because it’s not like that. If someone does not have a demat account and wants to automatically invest in gold each month through SIP, gold saving funds are the best option.

But for someone who is conscious about the expenses and can invest through his demat amount each month, Gold ETF’s are a good option.

But high charges will surely hurt in long run! One important point is that do not confuse gold saving funds with “gold mutual funds” which are mutual funds investing in gold mining companies, they are totally different.

Conclusion

A lot of investors are lured into these gold saving funds without giving any information on the charges, which is not right. Gold saving funds over a long-term can really eat away your returns because the high charges will cut a big pie out of the returns earned.

June 30, 2011

June 30, 2011