TDS Guide – Everything you want to know about Tax Deducted at Source

A lot of investors still do not understand what is the meaning of TDS (Tax Deducted at source) is and how it’s related to their taxation.

While the concept is very easy overall, I have seen that tons of investors still get confused when TDS is cut on their Fixed Deposits at maturity and they feel that they don’t need to pay any tax now, or feel that they don’t have to pay any tax on their Fixed Deposit interest just because it was below 10,000 and TDS was not cut.

So in this article, let me make sure that you are 100% clear about Tax Deduction at Source and what it means.

What is Tax Deducted at Source?

TDS or Tax Deducted at Source is a tax collection mechanism by Government of India, where at the time of transaction itself, the tax is deducted by the paying party and directly deposited to the income tax department.

It’s assumed that the receiving party (one who gets the money) will have some tax liability. Now at the end of the year when you find out your tax liability, the TDS amount is the tax you have already paid and now you need only pay the balance amount.

So in a way, Tax Deduction at Source is a good thing for 2 reasons. You automatically pay a part of your tax liability and income tax department receives their tax collection. So TDS is always a mechanism, to reduce tax theft. Let me give you some very simple examples of TDS collections

Example 1 – Tax Deduction Source cut by Employer

When a company pays salary to employees, you must have seen that they pay the salaries after cutting the tax amount.

So at the start of the year itself, after the employee declares his 80C investments, HRA, LTA and other tax deductions which he will avail, the employer ‘estimates’ what will be the tax outgo of the employee and then each month they cut a certain amount as tax and pay directly to the income tax department.

And then at the end, the employee calculates his actual income tax liability to be paid. If the Tax Liability is more than TDS cut, he pays rest of the tax money and files the returns. If the Tax to be paid is less than the TDS amount, in that case he can claim for a refund in the tax returns.

Example 2 – TDS cut by Banks on Fixed Deposits

When you open a Fixed Deposit, you earn some interest in a year. Now the rule is that if the interest amount each year exceeds Rs 10,000 on your fixed deposits (across the different branches of the same bank also), the TDS has to be deducted by the bank.

Now a lot of people confuse this by paying the tax. The rule is that any amount you earn as interest is taxable. Even if the interest is Rs 100 or Rs 1000, you still need to pay the tax on that amount. Just that if the interest exceeds Rs 10,000, the bank will cut the tax directly and pay the tax to govt.

That will make sure that you pay your tax in advance itself (you know how difficult it is to pay tax when you have finished that money at the end). Note that TDS is also applicable in case of Sweep in Accounts and MODs (Multi option Deposit Scheme by SBI)

What about NRI Fixed Deposits?

In case of NRIs, the sad part for them is that there Tax Deducted at Source is cut @30% on any interest income earned on NRO fixed deposits (no limit of Rs 10,000 interest.)

Even if they earn Rs 1,000 as interest, they still pay TDS @30%. Note that the Fixed Deposits in NRE and FCNR accounts are totally tax-free in India, hence no Tax or TDS. A lot of NRIs send money back to India and invest in Fixed Deposits in their NRO account.

If they have to pay tax at the end, well and good, else they need to file the tax returns and claim it back. NRI’s should read this article on TDS applicability in economic times and also read this article to understand how NRI’s can claim exemption on TDS is applicable for you.

If you want to know more about the tax applicable on NRE, NRO and FCNR account then watch this video:

Make sure you quote your PAN

A lot of times, PAN card number is asked by banks or at other places before the payment is made to you. Do you know that there is a reason for it? If there are any TDS to be cut, they first check if PAN number of the receiving party is available or not.

If PAN number was given by the party, then the TDS is cut at a lower rate, but if PAN number is not quoted, then TDS cut is high.

For example, in the same Fixed Deposit amount, do you know that the TDS is cut @10% if PAN number is given, but if PAN is missing, then its 20% Tax Deducted at Source? These are the numbers of individuals (not companies, LLPs or corporate bodies.)

You should also know that in this budget Tax Deducted at Source @1% is to be cut for any real estate transaction above 50 lacs!

I want to invest where TDS is not applicable

A lot of investors try to invest in bonds, securities or at those places where TDS will not be cut. They do not understand that TDS is nothing but paying tax in a different way. I assume that they thought that if TDS is not cut, they don’t have to pay any tax, which is totally wrong.

All they are doing is taking the onus on themselves to pay the tax at the end. Or many might be finding ways to save the tax by various means suggested by their CAs.

A lot of investors also try to open a lot of small FDs and break it in the same bank but in different branches or in different banks too, but they do not know, that in this era of core banking, banks and tax officials can just punch your PAN numbers (yes, my CA told me this) and get all your tax-kundali and how much fixed deposits you have and how much interest you earned out of your investments.

So you need to pay your tax on those amounts anyway, whether TDS was cut or not. If TDS was cut, in a way it’s better because you pay the tax in advance itself and don’t have to arrange for tax amount at the end of the year. It really pinches at the year-end to arrange money and see it go into tax!

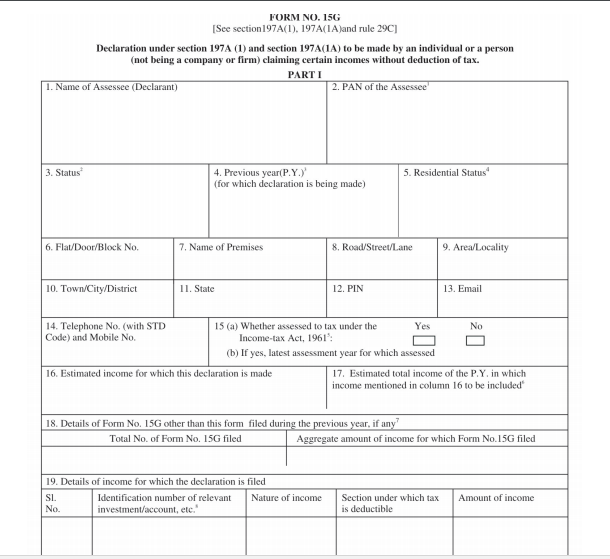

Make sure you ask for TDS certificates

Whoever cuts the TDS and pays it to income tax department has to issue you TDS certificates as the proof that you have paid the TDS. The document they give you is called the ‘TDS certificate.’ You would need this document if you want to show that the TDS amount is being adjusted in your tax payment.

Generally, as a rule, all the parties send the TDS certificates to you, but make sure you are proactive in asking’ it from them.

Myth: I don’t have to pay any tax if TDS is deducted

At a lot of times, it so happens that you don’t have to pay any tax at the end of the year and you already know it, but just because your deposits are earning more than Rs 10,000 of interest income, the bank cuts the TDS amount and then you have to claim it back by filing a return.

Case 1 – If Tax payable (TP) is more than TDS

In this case, if yearly TP is more than the TDS then the investor will have to pay the remaining amount left after deduction i.e TP – TDS = Remaining Tax Payable.

Case 2 – If Tax Payable (TP) is less than TDS

In this case, If yearly TP is less than the TDS then the investor will have to file for tax return because the tax which he was supposed to pay was less than the deducted tax.

Case 3 – If Tax Payable (TP) = TDS

In this case, if TP is equal to TDS then the investor will not have to pay any extra tax because the tax is already paid. However the investor will have to file for ITR toi show that he has paid the interest and is not liable to pay anymore tax.

All those people can simply submit Form 15G/15H to bank (each year) and then the bank will not cut the TDS (my father in law told me how Bank of Maharashtra guys in some particular branch still cut the TDS even if you deposit the Form 15G/H and how they are such a pain).

TDS tip – for salaried investors

Let me share with you a little tip which a lot of you might know already, but it will surely help new people. If you are a salaried employee, your employer must be deducting the tax each month already and you know that you don’t have to pay any tax at the end.

But now if suppose you already have made some fixed deposits or some investments, where the Tax was deducted, then you have already paid some part of tax liability.

Your employer is not aware that you have already paid some tax through TDS route. So in the Jan-Feb season when they finally ask for your investment proofs, you need to also give them form 192 and deposit the TDS certificates to your employer so that he can adjust the Tax paid and pay you back the extra amount. (March month salary is generally higher due to this money coming back and also because of HRA/LTA reimbursements).

I suggest you all follow this amazing thread on our Q&A forum where Ashal single has cleared so many doubts t on this topic

I hope you are now clear about TDS and how it works. If you have any doubts then put your query in the comment section.

April 25, 2013

April 25, 2013

Hey Manish

What do I need to update and where if I quit my job and study for 2 years?

Hi Hrehaan

I am not clear on what is your question. Please repeat it with more clarity

Manish

thnku sr .it helped me so much . thi is the easy way to understsnd fr me , thnku

Thanks for your comment PRAKASH

Hi Manish,

I am a retired person. I have one (Aegon Religare) Pension Plan @ 35000/- per annum from 2010. I wish to dis- continue it in year 2019. There is no assured return on this but it is equity linked (hybrid) plan. The amount I receive from closing the policy may be (or may not be) more than (less than) the amount I paid as premium. My question is

what would be my tax liability in this case?

Yes, it would be taxable

Hi Manish

I am a medical student doing a postgraduate course in a private hospital. I am receiving a stipend which is supposed to be non-taxable, but my institute is deducting tax from my stipend and giving me TDS statement. Is there any way to get back this deducted tax as stipend is non-taxable??

Thanks

Yes, you can file your tax returns and claim for tax refund .

What is the procedure then? How should I proceed?

What is the procedure then? How should I proceed? In ITR forms there is no column for such type of claim. Plz guide.

Hello, My Uncle having Fixed Deposit in SBI without PAN number. Total Interest on Fixed deposits Paid Rs.9480 from 1st April 2015 to 17th Nov 2015. (i.e; doesn’t exceed Rs.10000), but, bank deducted TDS @20% on whole interest on Fixed deposits earned amount on 17th Nov,2015.

Why they deduct TDS on Fixed deposit as it doesnt exceed Rs.10,000?

What can steps to be taken against this to recover from Bank? Please help with legal information. Thanks. Please email me also [email protected].

You can recover it back by filing the income tax return and claiming the refund

Hi Manish ,

first of all thank you for helping us through this site .

My Mom has Two FDs and she is getting around 20000 Rs/Month . but these year i forget to fill 15 G and now my mom is getting less Monthly Income . Could i claim for income tax return ? Should I fill 15 G every year or should i claim returns ?

You need to fill the returns every year and also give 15G every year ..

I had opened a FD for my younger brother in BOI, since he had not applied for pan, tds was cut @20% in subsequent 2-3 years (we didn’t even get the tds certificate)

Now I have updated his pan in Bank and asked for tds certificate as I need to file his returns.

The bank says that they cannot give me those certificates. No specific reason is being given. I’m only being given vague answers like (sir uska nahi milega…)

Is this true? Or do I have any other way round this?

Please help me.

Hi Tejas Thakker

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

i joined in my company in August 23 2015 . They told tds we cannot start now . we can start this in April 2015 is that true or we can start now paying tds. Please reply as much as fast thank you

April 2016 not 2015

They cant start TDS means what ?

Hi Sir,

Sir, I have received around 10 lakh rs from my friend and my pan card was mentioned on every transaction. After 1 month I returned the money. TDS has been deducted at the source. Now, I am going to join a general insurance company and my salary will be less than 2.5 lakh per annum. Do I need to pay any tax in march 2016 or I am free from it. Please guide me.

If you have returned the money, then you are not liable for any tax. Just file the return and ask for refund

can tds certificates be used as acknowdegement in the court ofm law to cover the limitation

Hi suresh

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

i am a retired officer. my employer deducted Rs13000/- from my pension but remitted Rs10500/-to Govt.Form16 is not yet issued by my employer. how to set right.

Hi mallikarjun

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hello Manish

If I have a fixed deposit for 3 yrs.(start April 14, maturity April 17).

Now bank provide me income certificate which showing accumulated interest on above mentioned FD is 12000( as on 31 march 15).

Which is not withdrawn or transferred to savings a/c.

Now my question is should I consider this interest as other income for AY 2015-16?

Or total 3 yrs cumulative interest will consider on year 2017?

For FD, you need to pay the tax on the FD interest income . Its not required that you also got it

Dear Manish Chauhan,

Thank you for your efforts to clarify our doubts.

When I opened MOD with SBI, the projected interest for the FY was more than Rs. 10000. However, in due course, I made several withdrawals and by the end of the year, I could not earn interest up to Rs. 10,000. However, SBI has deducted TDS taking into consideration the Accured Interest amount as well. Can banks deduct TDS on projected interest earned at the end of FY? In this case, TDS is calculated based on the projected interest earned however, my actual interest earned is less than Rs. 10,000. My question is, is this as per rules and law? Thank you very much.

I think they have done the right thing

I had changed my job 3 years ago.

I have some fd in my old SBI bank account and they have deducted TDS only on interest paid and not on interest incurred.

Moreover they have charged me 20 % TDS in last two challan (confirmed after checking my 26A form)

On printing interest statement from internet banking on all accounts and cross checking it with form 26 A, I found that there is one TDS entry missing in form 26 A but is present in interest statement.

DO i need to consider that missing entry also as income from other source and pay the tax or I have to pay tax on other sources according to form 26A

But my new salary account in SBI bank, Mumbai had deducted 10 % TDS on FD on both interest paid as well as incurred.

So can bank deduct TDS on incurred interest also ?

Kindly guide how shall i fill my self assessment tax ?

Hi Dolly

If TDS entry is missing , that means that part of tax is not paid, hence you need to pay it yourself and then file the returns !

My bank has deducted tax on the full cumulative interest amount on my recurring deposit in the current financial year as recurring deposit got included in the ambit of TDS. However if I calculate TDS on the interest earned fortwo months in this current financial year it comes to only 1/5th of the tax deducted by the bank. I have shown this interest in the previous years though no tax was deducted by the bank. How correct is the bank to deduct on the full amount of interest pertaining to interest earned for previous years. My salary is too low and is below the 3 lac bracket.

The TDS is deducted for full year, because whatever interest you have earned is your income and you will pay tax on that!

Dear Manish Chauhan,

What special rules apply to people who are not residents of India and are citizens of other countries? I am not allowed to submit form 15G or 15H, so the 30.9% TDS is mandatory. However, my situation is that the bank has not deducted any tax yet. The bank told me that when the FD matures in that NRO account, they will cut the TDS then and credit my account with the net interest. First, is this legal or allowable? Second, will I be delinquent with IT department because the payer is not deducting on accrual basis and crediting the government to my PAN? When looking at my 26as, I see that the tax liability (according to my calc) is around 120,000 INR, but for 2014, the bank TDS was only 300 INR. When reading the India Income Tax website, it says that banks can pay in subsequent year and not be held in default? Can you clarify all this?

Amit

I will have to dig deeper on this and get back to you

i have a bank account SB and a Fixed account in SBI. the interest earned from the savings account is 5000 per year and the interest earned from the FD is 11000 per year. so pls tell me, on how much amount do i have to pay tax?

Add the 11k in your income of the year . And then pay as per your tax slab . If you are in 10% slab , then tax is 1100

Hi,

My question is very simple…

My mother wants to gift me about 15lakh to buy my flat, and she will be transferring that amount from her savings account, of course she is senior citizen and has no income except from farming.

when she is gifting me this amount, will she be paying any TDS? and what are the tax implications for me i.e. do I pay any tax on this amount?

Thanks

Pravin

Pravin

No tax to be paid by anyone . She can legally give tax to you as her son . No worries . Enjoy ! .. Just make sure the payment is done via cheque/neft , so that there is a clear entry showing the transfer . Do not take any cash !

you meant “She can legally give money to you as her son . ” right?

And also thank you very much for such quick response… Highly appreciate your efforts…

Yes, I meant that

And any TDS charged to my mother this transaction??

Thanks once again on this…

hi manish

i am from payroll devision.

last month due to wrong payroll input we have paid excess bonus amount to an employee which we are going to recover from this months salary and we have remitted tds as well.

how employee will get refund on extra tax deducted and which documents will need to show.

siddharth

He will have to now apply for the tax refund when he files the income tax returns

sir,

i wanted to file a 15G/H form on my dad’ account with a private bank.but the banks is suggesting to open a FD, before accepting to take a FORM 15G..

how are these related or is the bank trying to find a reason not to accept it.

what part of the year is right time to file the FORM 15 G/H? is there a deadline for it as well..

also, given the 2 lakhs exemption limit for 15G/H , lets say if i give my projected income to be 1.5 lakhs and if for some rentals the annual income exceeds 2 lakhs, will i be charged for this 2 lakhs as well or only on the income that is above 2 lakhs??

You are filing form 15G for what ? Is there any deposit already there ?