Have you linked your Aadhaar with PAN? If not PAN may be blocked soon…

Government has decided to make it compulsory for every individual to link their Aadhaar Card with PAN card by 31st July, 2017. This is part of the digital India campaign and an attempt to digitalize everything.

Why it is mandatory to link Aadhaar with PAN?

There is a great chance that there are a lot of fake PAN cards in India, because it can be easily applied online with fake identities and anyone with a little luck can get a duplicate PAN card. Hence in order to identify those fake PAN cards, govt wants to link Aadhaar card with PAN.

Because each person will have only one Aadhaar card, they will only be able to link it with a single PAN. Rest other PAN cards will be of no use after this process. This is an important move and is necessary for an orderly society and also to keep pace with the technology.

Importance of linking Aadhaar with PAN

PAN card and aadhaar card are the unique identification cards which can be used for verifying a person’s income and address respectively. Let’s have a quick view why this linking is important.

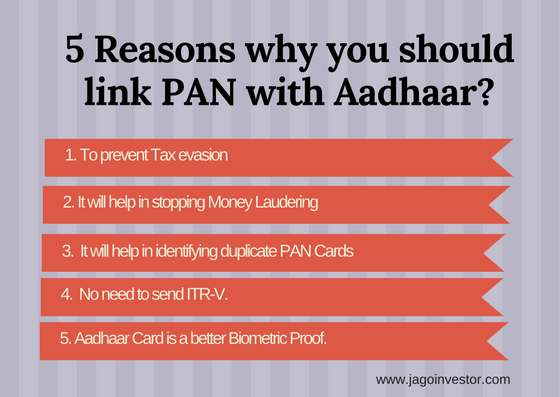

Some reasons behind linking aadhaar with PAN in details are as below:

- Fraud PAN cards– Because of this linking a person can use only one PAN card wherever it is necessary which is linked with his aadhaar card. Though he has any fraud/duplicate PAN card, it will be of no use.

- Tax Evasion – with the help of this, government will be able to track on the taxable transactions of an individual or an entity.

- Tracing money launders- Aadhaar card is a full-proof identification of an individual and it cannot be duplicated easily so that linking of aadhaar with PAN can also be useful for tracing money launders.

- There are fewer chances to have a duplicate aadhaar card as it is a more secured source of identification. Because Aadhaar card is the only identity proof which has all the possible information including Bio-metric. So it is little bit difficult to have a fake aadhaar card as compared to PAN Card and voter ID.

- Curb corruption: This is also useful to curb corruption to a significant level as the record of each transaction will be verified by the government.

- ITR-V: While paying tax, now you don’t need to send your ITR-V acknowledgement if your Aadhaar card is linked with your PAN Card.

Also, the government wants to get every individual identified by their Name, Address and also their income. A lot of PAN cards were very old, and many people have changed their address, contact details etc which were given to govt at the time of applying for the PAN card decades earlier. With this linking, all the data will also get updated.

What is the process to link aadhaar card with PAN?

If you are unable to link your aadhaar card with PAN, no need to worry. Here are the steps to link your aadhaar card with PAN.

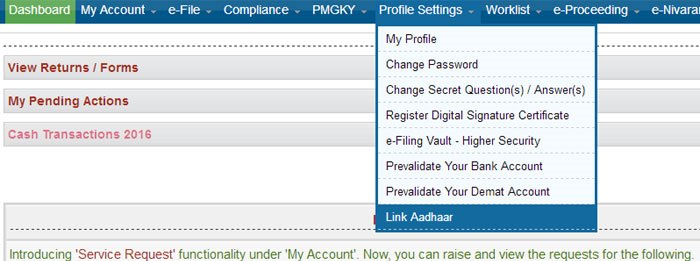

- Visit the page of Income tax e-filling portal & register if you are not registered with it. If you have your registration already then just login.

- Login with the details i.e. registration ID, Password or date of birth.

- Your PAN no. will be your registration ID

- once you login you will immediately get a pop-up to link your aadhaar with PAN

- If you don’t get a pop message then check the blue bar above and click on “Profile setting” and then on “Link aadhaar” in the list.

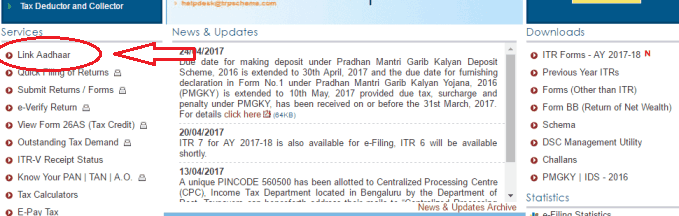

- Or you can also see the option “Link Aadhaar” on the left side of the site when you open it without logging in. Simply click on it.

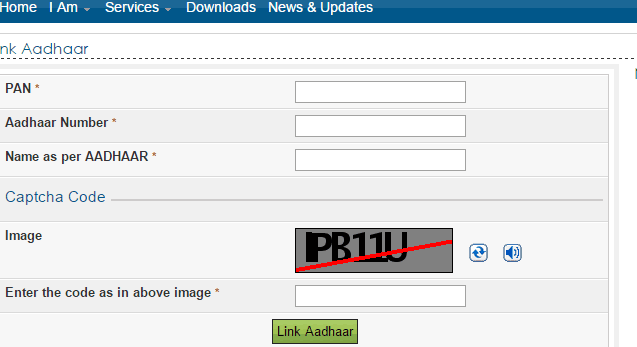

- The details like your name, gender and date of birth will be given there already as per the registration. Just check that the details available there are same as on your aadhaar Card.

- If the details match with aadhaar card then fill your aadhaar card number and captcha code and click on “Link Aadhaar”.

- Once you submit you will get a pop-up that your aadhaar has been linked with your PAN successfully.

What happens in case of name mismatch between Aadhaar and PAN?

UPDATE: Now you can link your aadhaar card with PAN without changing your name as the option “Name on Aadhaar” has given there.

Now it’s suggested that you first decide what is the exact name you want to keep for future, in case you have different names on various documents.

If your aadhaar card has the name which you want to keep, then you should change your name in PAN. However if your PAN has the desired name, then change it in Aadhaar card.

Now, for those who want to change their name in aadhaar card, they can follow this process or watch the video below.

And if you want to change your name in PAN, follow this link

We really feel that one should have the proper name in Aadhaar card, because it’s going to be the universal documents in future.

UPDATE: New Feature by IT department

Besides this, there is also a new option on the e-filling site from where you can link you Aadhaar card with you PAN card without changing your name.

Only date of birth, Name and Gender on both the documents should match, however we feel that as a long term solutions it’s a good idea to have the same name on both the documents.

What to do if I don’t have one of the documents (Either PAN or Aadhaar)

Now a days, almost all the people at least in urban areas have both aadhaar and PAN, very rarely it happens that someone does not have both the documents. However incase one of the documents is missing, here is what you should do ..

For those who do not have PAN

If you don’t have PAN card, then this rule is not applicable to you right now. You don’t need to take any action at the moment.

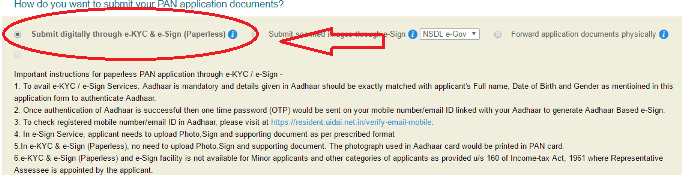

When you apply for PAN in future, at that time you can give your Aadhaar details as the address proof while applying for PAN offline or you can choose an option called digital e-kyc and e-sign, where you will be asked for aadhaar number and it will be automatically linked to your PAN. Below is a snapshot of the e-KYC looks like.

What do you if you don’t have Aadhaar?

If you don’t have Aadhaar card then you should apply for it soon, because anyways it’s going to be the universal mandatory documents very soon and every PAN has to be anyways linked with aadhaar. You can apply for aadhaar card by online or by visiting its office and providing you essential documents.

How to Check whether your PAN card is linked with Aadhaar card or not?

For some people their PAN might be already linked with Aadhaar card. To check this you just have to visit the official page of e-filling and click on the login button on the right corner of the site. Fill your PAN number and captcha code and click on OK.

If your card is already linked then it will show “Your Aadhaar is already linked with PAN” and if your card is not linked then it will show “User ID does not exist”.

Below is the demo of this process

Is it safe to link your PAN details with Aadhaar?

Recently there was a news that M. S. Dhoni’s Aadhaar details were leaked somehow, which shows that aadhaar details are not 100% secured. If this can happen to a big celebrity, this can happen to anyone.

Many people are wondering if it’s safe to link their Aadhaar with their PAN?

- Will their bank details be exposed ?

- Will there be any fraud involved?

- Will others get access to their income tax data ?

- Will others get access to my personal data like Mobile number, Email and Bio-metric details?

But, you don’t need to worry!

The solution to problem is here. There is no need to worry about the security of your PAN after linking with Aadhaar. UIDAI has introduced safety features of aadhaar Card.

Now there is a facility of “Lock” and “Unlock” of aadhaar details.

If you “Lock” your aadhaar details, all your data will be freezed and the access to any third party will be blocked. All you will need to do is, verify the OTP which is sent to you when you apply for this “Lock” feature online. If you want to get details about all the safety features, you can download this PDF.

What will happen if your Aadhaar card is not linked with PAN card?

- As per this amendment if a person do not link his aadhaar with PAN card then there is possibility that he could lose his access to the PAN card after December 31,2017 as per Hindustan Times.

- You will be unable to file IT returns and pay the dues or claim the IT returns.

- It’s been also said that the use of PAN cards may stop in upcoming days as Aadhaar card will be the unique Identity proof. So if you don’t link it now you have to link it with your PAN in future in any ways.

- Because your PAN card will be blocked, and for higher value transactions PAN is mandatory, you will not be able to do many high value transactions online as the bank will keep asking for PAN

UPDATE: What if I have both the documents but don’t have any Income Tax Returns?

If you don’t file any Income Tax Return then this rule is not for you. It will not affect either you link your Aadhaar card with PAN or not.

But if you have both the documents, we suggest to link the documents.

UPDATE: What if I’m an NRI and have only PAN card?

NRI’s can also apply for the Aadhaar card. The procedure and documents required for NRI and Foreigners are same as Indian residential’s. Only thing is they have to be physically present at any of the Aadhaar card center in India.

But it is not mandatory for NRI’s till date because as per Indian Government Aadhaar is an unique identity for the person who is living on Indian soil. Read this PDF by UIDAI.

How can I apply for Aadhaar if I’m out of India?

If you are not in India currently and wanted to apply for Aadhar crad then the procedure is almost same. But you should have an introducer who can introduce you by providing his/her own Aadhaar card.

The verification of your identity will then become the responsibility of the introducer.

So, what are you waiting for ?

You should quickly complete this whole process as it’s just a 5-10 min work. Not completing this can impact you in negative way, so do not wait for the last minute.

Also you should spread this news among your friends and help others to complete this important step in their financial life.

In case you have any questions, I will be happy to answer them in comments section

May 9, 2017

May 9, 2017