No more sending ITR-V by post after income tax filing – Verification with aadhar card introduced

There is a good news to taxpayers. CBDT recently announced that taxpayers who filed their income tax returns online will no longer have to send the ITR-V paper acknowledgement by post to CPC Bangalore, if they have aadhar card which can be used for verification purpose.

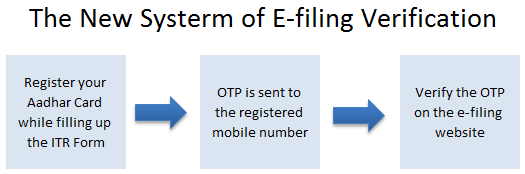

Instead of manual verification, a new Electronic Verification Code has been introduced to verify the e-returns. For that one will have to mention their aadhar card number in ITR form, and tax-payer will get an OTP number on their mobile for verification, which needs to be completed on the website of tax filing.

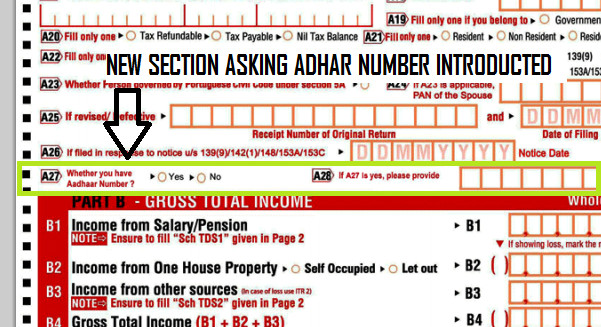

Below is a snapshot of the new ITR form where aadhar card number is asked in case you have it.

Issues with the old system

Earlier the process was like this. Once you e-filed your tax returns, you then had to send the acknowledgement copy within 120 days to CPC Bangalore. Only those who had signatures could do verification online, but it was very rare, hence millions of tax-payers had to take the pain of manually sending the form.

However, the old system was not robust and a big number of people used to get messages that their acknowledgement has not reached tax department and other manual errors used to happen.

With the introduction of this new system, things will be simplified and even faster. Now the process will be as simple as filing the tax returns online and they will get a one time password for verification purpose on the registered mobile number, which has to be used for verification on the website of tax department. That would complete the process of verification.

But I don’t have Aadhaar Card ?

Don’t worry. You can always send the physical documents ITV-V to CPC, Bangalore like you did earlier. You can do that even if you have aadhar card. This new system of verification is just an alternative way for those who have aadhar card.

What do you think about this new system?

Write us your opinion on this in our comment section.

April 19, 2015

April 19, 2015

Hi,

I have a query.

I e-verified my ITR using Aadhar OTP. the status shows that EVC accepted and it is successfully e-verified. Now, my doubt is that since I am due for a refund, do I have to still send ITR V/acknowledgement copy to CPC bengaluru? Because my ITR still not processed. Also, on the acknowledgement it is written in bold letter n red ink that DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC BENGALURU. Please help! What should I do?

to be on safer side, why dont you send it !

i have return form with wrong assesssment year.what to do now? should i have to again e file my return for right assessment year?or there is some other method?

Hi Inder

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

i have forgot to fill the column DESIGNATION OF AO (ward/circle) in itr -1 (sahaj) . other things are correct. itr 5 has been gfnerated and e verification has also been done . will i face any problem .

Hi arun

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

I had successfully e-verified via netbanking and did not send the acknowledgment to CPC Bangalore. I received SMS in Jan 2016 that ITR return is still not submitted.

Does it mean i should still send ITRV to CPC ? but why then there is the process of e-verify.

Hi Balu

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Thanks Manish. I raised the query already to CPC and they asked me to ignore the S:S as it is wrongly sent from the system. I inquired here in the forum just to know if its common problem,

ok , I am not aware of this actually 🙂

Balu, how did you raise the query? I have sent ITRV’s twice and still it shows not received.

Send it through Speed post or registered post

Hi, I have done aadhar verification at the time of filling the return 2015-16 & not send the copy to bangalore. Now when I am going to open an account, bank ask for ITR V, What should I produce to bank now? Any friend, Please help me. Thanks.

Hi Javed

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

My ITR-V has been already reached bengaluru and status has been changed to ITR-V Received

Now I heard that if we done EVC, the refund will be in 7-10 days.

Is there any chance to Everify again in my case?

Hi sathyaraj

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

everification can be done thru netbanking as well.

I could not link aadhaar card. i efiled my return online.

Subsequently, I opened my SBI a/c via net banking; When I click efile tax option, it takes me directly to efile page where it is mentioned tax return submitted and alongside eVerify link.

When I click I get OTP in my mobile. Once I fill that status changes to eVerified success. So NO NEED to send to bangalore even if NO Aadhar.

Hi Subramanian

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I have invested in LIC after declaring my investments for FY2014-15. I am eligible for refund. Do I need to send the investment proofs with the ITR V by post?

No , you dont need to give investment proofs !

I had the same issue in year 2011-12. But I had to deal with loads of headache to get the money refunded. As I didn’t send the docs.

Dear sir,

Last financial year I had not submitted my savings declaration in my company as a result of which my total tax got deducted, what should I do while submitting my itr to get the refund on my tax. pls help

Hi sachinbhoinallu

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi,

I have filed income tax using online java utility. But I have some refunds as well. I want to know if I need to send my investment proofs to IT dept so that they may process my refund. Or how else will they verify if my investment is genuine (if I do not send photocopies of my investment).

Thanks,

Gaurav

Exactly what is on my mind as well. Let’s see if someone comes for our rescue here.

You need not sent any investment proofs to IT department unless they ask for it

You dont need to send any investment proofs !

Hi,

I did e-filing and chose option 4 for verification initially and got ITR- V and after sometime I did e-verify through netbanking. Do I need to post ITR-V to CPE or not required?

If your income is less than 5 lacs and you have verified, then no need to send it view post

I have alredy sent the ITR V by post to CPC some 5 days back. whether E verification can be done now, If yes, how?

Yes it posssible

hi , i have E-verified my return online through Netbanking and also sent ITR-V through post to CPC Bangalore . Will I face any problem by using both online and offline (by post) options .

No

Hello Manish,

I always enjoy reading your informative articles. Considering the fact that government has added considerable changes to IT forms this year, I expect another detailed article from you ! I would like to ask you a question regarding this year’s IT form (I am sorry that it’s not in line with the theme of this article). I work in an MNC and I have few ESSP shares of my company in E-trade. Should I declare this as foreign asset while filing IT return ? Thanks in advance !

Regards,

David

Hi David

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

I had a refund from my itr. My income is under 5 lakh. I had efiled through OTP based verification. I read that whosoever having no refund to claim can go for online filing. Now will I get my refund in this case.

Hi Gaurav

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I have invested in PPF after declaring my investments and closing of Form C for FY2014-15. I am eligible for refund. Do I need to send the investment proofs with the ITR V by post?

YES

Greetings of the day

My CA filed my ITR and also linked my AADHAAR number. I did not get OTP on my registered mobile. So he send my ITR-V by post.

However last year when there was no AADHAAR card link, I got OTP.

What could be the reason for this?

Thanks and regards

Arun

I am not sure on that Arun, it might happen that your CA has changed the mobile number and kept his own !

Thanks Manish

I will confirm from my CA

Arun

Hello Manish,

Does EVC method still valid for the gross total income more than 5 lacs?

I already send the ITR V to bengluru, it’s around 6-7 days and it hasn’t reached yet. Should I go for e-verify still I’ve sent manual ITR V copy?

Yes, as of now .. still one has to follow that !

Its a good step taken by CBDT digitalizing the ITRV acknowledgement. It can even save paper and in turn trees.

Thank you!

Thanks for your comment Rakesh

Hi All,

I want to share my experience. After filing i got my ITR V to mailbox, since i wanted to see alternatives to avoid sending the paper,was surfing and found i can do EVC, mine was a EVC through net banking since i had refund.

Step1) File you returns. (Try to give Aadhar if you have)

Step2) Go to eFile > eVerify Return

Step3) Click on eVerify link

Step4) Choose you option appropriately. Mine was Option2 (If you are not sure google for ‘e-Verification User Manual’)

Option 2: “I do not have an EVC and I would like to generate EVC to e-Verify my return”

Step3)Once i selected Option2, It prompted “EVC Through NetBanking ” ( since i had to get a refund)

Step4) It will show list of banks available for verification with netbanking .

Login to you Bank if its listed and you have Netbanking.

Step5) Every bank has its own link for Tax e-Filing .

Mine was ICICI and navigation was Payments&Transfers > Manage Your Taxes > Income Tax E-filing.

Step6) Once you confirm to agree and Click Submit , you will be redirected to the Income Tax website asking for your Confirmation on the Electronic Verification.

Step7 and Final) Return Successfully Verified ,Download Acknowledgement. ..Awesome.

You will also get a mail with your acknowledgement.

Hurray….Happy Ending

Steps could vary but this is high level journey.

Regards,

Krishna

Thanks Krishna for the Navigation. I filed my IT returns and couldn’t find out where to verify.

I verified using my aadhar linked phone number

Hey Krishna

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Guide me to upload ITR-V form online

Hi Praveen

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish