70% investors are “Asset Poor” – What about you?

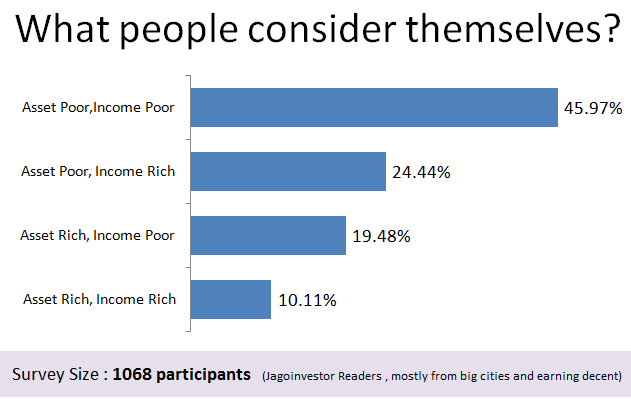

70% of people feel that they are “Asset Poor” as per my recent survey.

Are you one of them?

No matter how much you earn or how much wealth you have created until now, you will fall into one of the following 4 categories.

- Asset Rich, Income Rich

- Asset Rich, Income Poor

- Asset Poor, Income Rich

- Asset Poor, Income Poor

Suddenly one day, I thought how many people will consider them “Asset Rich” and “Income Rich”? So I thought of creating a survey which asked people just this simple question.

Survey with 1068 people

There is no good information available on this topic, hence I ran a survey for the last few weeks and I got 1,068 responses from various people who visit this blog.

Note that this survey does not represent the general population of the country, but those who work in big cities, have a decent income/wealth (probably) and are net-savvy. Basically our blog readers. So you can safely say that these 1,068 people are like you and me, hence these results are very relevant for you (our readers)

Before I discuss about each category and look more into it. I want to share with you the survey results highlights

- Around 70% people see themselves as “Asset Poor”

- Around 65% people see themselves as “Income Poor”

- Only 10% of people felt they were “Asset Rich and Cash Rich” both

Asset Poor, Income Poor

At the bottom of the pyramid are the maximum people who feel them to be both “Asset Poor” and “Income poor” at the same time. As per our survey, it amounts to 45.97% people, or 45 people out of every 100.

Think about this, a big chunk of people feel they are not earning enough to lead a great life, nor they have built enough wealth to call themselves RICH. This is alarming!

Also note that these people “feel” themselves as Asset Poor, Income Poor. So it’s all about their own perception about themselves. So even a person earning Rs 50,000 per month might feel he/she is “Asset Poor, Income Poor”. It has a lot to do about your relationship with money.

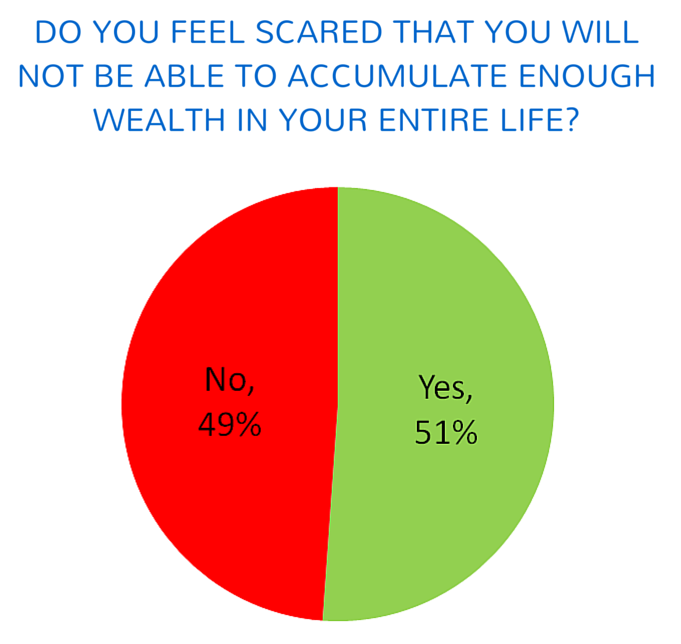

I think people falling in this category must be highly stressed as they might be surrounded by various people who either own some properties or if not, at least earn decent enough to enjoy various materialistic things in life.

One of our old surveys shows that every 1 out of 2 people in India is stressed because of money related matters.

Asset Rich, Income Poor

This is an interesting category of people. A lot of people are asset rich, but Cash poor. You must be wondering how?

The best example of this category are some senior citizens who do not have any source of income, but they have good assets. However, they are either living in that property or it’s used by their kids now.

Another example for this category is families, which own ancestral homes in cities that were bought by their parents, and now those properties are worth crores, however, they still don’t have a decent income source. They might be into a small business or some kind of job, but they still earn enough to run the house.

Also in various smaller cities, there are many people who have a great amount of wealth, but their lifestyle if base minimum and they don’t spend enough on themselves. My own best friend who lives in Varanasi has wealth upwards of Rs 10 crore (total property worth), but they still run around all day each month trying to earn enough to meet the ends meet, because they can’t sell their lands just to enjoy life.

“What will people say”- is what holds them!

Asset Poor, Income Rich

Now comes the third category where 24.44% of people fall. These are mostly those people who have recently upgraded from the middle class to the higher middle class when it comes to income.

They are earning good salaries like 1/2/3 lacs per month (mostly in the IT industry), but they are still struggling to own a house of their own or to create any sizable wealth. Even if they own a house, it’s on a huge bank loan which ultimately makes them just rich on the left side of the balance sheet, but not in totality!

This category finds it very hard to build assets because their expenses are very high because of their lifestyle. As per this article which says “America is full of high-earning poor people”, most people earn a decent income, but they fail to save enough money to build wealth. I think many people in big Indian cities are going on the same path.

Asset Rich, Income Rich

This is simply the people who are at the higher end of the pyramid. With their several years of experience and discipline, they have created good wealth and also earn decent money each month. They are free from debt now (mostly)

A very high-level description for these people would be those who have

- A house of their own without any loan

- A good car without a loan

- A stable and secure income stream of upwards of 1-2 lacs per month

- Enough money lying in bank accounts or mutual funds/stocks

So what makes you Poor or Rich?

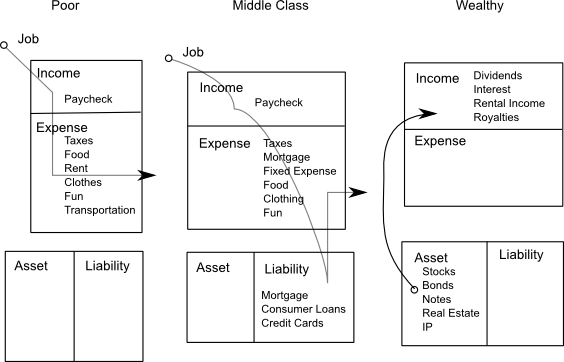

It’s all about how you structure your financial life and what shape you give it over the years. There is a big difference in the cash flow of Poor people and Rich people and the below diagram shows it in a very simple way.

Poor people – Earn and simple Spend that money on expenses, they keep doing this all their life and never build any assets

Middle Class – While middle class earns better income compared to poor people, still, they create enough liabilities which eat up all their income, if anything left after expenses

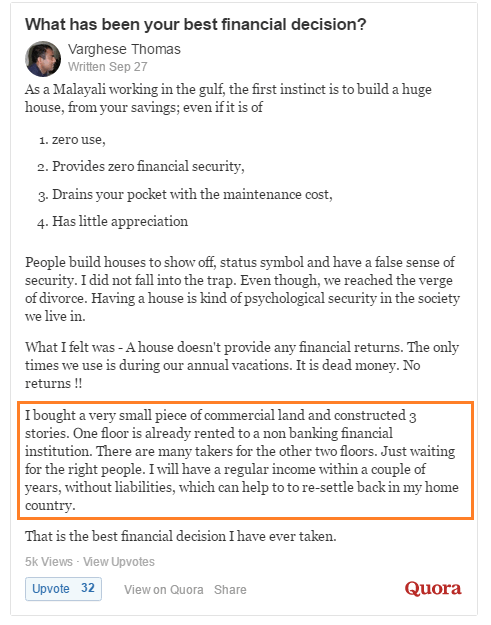

Rich People – Rich people do something different, they focus on creating assets that generate income for them over the years. It can be dividends from stocks, mutual funds or building real estate which gives income. I recently came across a very example of how rich mindset works and here is an example from Quora, where a guy “Varghese Thomas” is sharing his personal life example.

I know he is an NRI and some people might say that because he is an NRI, it’s easy for him to think like that, but still it’s all about the mindset and how far your thinking goes.

How to become “Asset Rich”?

While this is a topic which calls for a separate book, I will want to give an attempt to talk about it briefly.

To become Asset Rich, you need to first become Income Rich. There is no other option here, unless you have a rich relative who might leave his fortune to you 🙂

So you need to first move to the “Income Rich” category from “Income Poor” . When I say Income Rich, I mean you earn enough money each month, which helps you to save good amount of money after all your expenses and EMI’s. Because unless you keep investing good amount of money each month, becoming rich will be tough.

Even if you are generating very good returns like (12% or 15%), you will not build enough wealth if you do a SIP of Rs 3,000 per month. I hope you get my point.

The amount or quantum of money you put in each month is highly important.

So you need to upgrade your skills, work on increasing your income, save a good amount of it with discipline and take decisions which at least doesn’t lose you money, if not make wealth for you. I don’t want to go into details here, because this is a big topic.

What are Assets and Liability?

I really feel you should once watch this 2 min video from Robert Kiosaki where he explains about Assets and Liabilities. This will give you some really good background to start thinking how you want your financial life to shape up.

I hope you got some good insights into how people think about themselves and their financial situation. We would like to know what is your plan for moving to the upper category in the future? Please share more insights on this topic in the comments section.

October 4, 2016

October 4, 2016

Hi, very informative article.

I am a prospective investor and was looking for profitable options to invest. I wanted your views about Peer to peer lending and is it a viable option to invest?

Peer to Peer lending is more of a short term lending opportunity and not a proper investment vehicle. Also as its a new area, you have higher risk with it .

Manish

Thanks Manish. I would like to add that peer to peer lending is something that Indian investors will be talking in some months. It is quoting very promising interest rates. People need to get aware about it. I recently read this blog which has an independent section just dedicated to peer to peer lending. You can check it at http://www.loankuber.com/content/peer-to-peer-lending/attractions-of-p2p-lending-to-lenders/

Thanks for sharing that

Hello Seema,

As you looking for profitable options to invest I will suggest you to take the services of professional wealth management company which will guide you with the help of experts and help to manage your funds.

I am a 45-year-old male working as a content editor for an advertising agency in Bengaluru. My monthly salary is Rs.30 k and my wife is a teacher and she gets Rs.11 k salary. I have 3-4 LIC policies and I pay an annual premium of around Rs. 33 k & an annual additional Rs.8.5 k towards health insurance policy. I also save Rs. 2k every month in PPF a/c in SBI. These are the only savings. Sometimes I feel very disgusted when I see my friends (who were less intelligent and less luckier than me earlier) have flourished a lot and are in top positions (probably because of their hard work and good luck of course). I have already changed 5-6 jobs (maybe bcoz of my inefficiency). I like one suggestion mentioned by you i.e., ‘we have to improve our skills to increase our income’, which I have been doing and am striving at. I seek your help whether there is any other good way of savings (of course I know I can’t stop paying my insurance premiums)

Why cant you stop your insurance policy premiums ? Whats stopping you ?

Do you know what will happen at the end once you have paid all premiums ?

All classes of people are captured in a nutshell and explained beautifully on ways to overcoming it, Kudos

Thanks for your comment Ganesan

Dear Manish Sir,

Very informative article, I have two doubts.

When I can say that I am asset rich or asset poor ? what is criteria for that ? and same for income rich and income poor.

Its a subjective thing and its about your thinking, not some money in bank .

The problem is we normally plan to spend and we never plan to save. What if we always save 50% of our increment from day one we start working. The logic is, we were able to manage with out the increment and once we get the increment, why should we spend the whole increment. If we strictly follow this, we should have a decent savings after say 10 years.

Very true … there is a research on this same point and which tells that people were able to save a lot of money if they saved 50% of the increment

very informative

I was going through all the #comments#. I appreciate and respect their opinions.

However, I have a point to make. The purpose of this article is to highlight the point-Saving more will only make you wealthy overtime.Today you may not be able to save due to different compulsions/responsibilities, however, time will come when your responsibilities will come down. Adopt a different attitude towards money. Some people are born rich and others make it themselves. Lets accept our positions(poor/rich) and work towards getting financially smarter and healthier. It takes time and immense discipline(not as easy as the 2 min video). It took warren buffet 20-30 years of work and discipline. Point is-get the attitude in ourself. Atleast your kids will find them on better grounds and it gives them larger scope to take it up from there.

Hi devgolchha

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Asset rich and income poor also depends on your family background, I have seen people who are earning less than me but they have created good assets because of their family background, if your parents are earning income, have their own house, than in that case your expense is less, you don’t have to pay rent, you don’t have to give money money to manage family expenses, in this way you have surplus income, whereas for majority of people who come from lower middle to middle, from 50k salary they have to pay rent of 10 to 20k per month, family expenses per month will be 10 to 15k, few loans for your sister or your marriage where the emi will be in the range of 7 to 10k, like this others can give other list of expenses, so its not people intentionally don’t create assets they don’t have sufficient income to create assets, even after earning 50k or maybe 1 lac per month..

Last but not the least if you lose your job whatever little saving you had that also is wiped out.

one of my friend bought a house of 1.2 cr in Mumbai his salary was 30k per month and I was earning 40k and I bought a house with HL and cost of house was 18 lacs that also I found very expensive and its far away.

People who say don’t buy the house is illogical because they have good house which they inherited from parents majority are not like that, they may not a house at all, even if they have it may be in worst condition.

So family background matters a lot in wealth creation that what I experienced, giving eg of few people who are exception don’t become a benchmark, you have to check on average what people are able to do with the resources they have.

You have put very good point and a very different angle to this discussion !

Well said.. As Dharmchandra said, salary is not increasing nowadays as like the inflation

Thanks for your comment ashok

Thanks for sharing the insight. This helps to understand that i am not the only one who feels that making more money is being more rich but it is your assets. As a 27 year old, let me share that what my beliefs are now as compared to what they were 4 years back when i started my corporate life was different. As a early 20’s something with a salary in a IT firm i felt that the ones who have a higher taste in life, spend more money, improve on the quality of life are rich and wealthy. Although i saw things on the outside however what i didnt know was that the rich have something which i didnt back then or even now – INCOME GENERATING ASSETS. articles like this are like a nail and an anvil which will go in the minds of young readers like me slowly and steadily.

Glad to hear your thoughts on this topic Raghav . You are right. When we start our life, we feel like what you felt, but over time we understand the real meaning on being RICH !

Polls like this have a tendency to be biased and inaccurate. That’s because most people who happen to be both Income Rich as well as Asset Rich still think they are poor in both categories. There’s always someone richer than you and you feel are poor in comparison. You can never have enough money right? Call it greed or materialistic nature of people but that’s how it is. Very few people are happy with what they have even though they may have enough.

Also age is a major factor here. Young people are likely to be in the asset poor and income poor category. I believe most readers of this blog are below 40s. Not many people below 40 have much to show in the assets column and obviously Income is poor because nobody gets rich working for someone else and it takes time to climb the ladder.

Yes Anjan

I agree that it will depend on the age. But we just wanted to know out of 100 people randomly selected how many people “feel” (not ARE) Asset Rich and Asset Poor

Really interesting facts of people of India.

Reason behind why people feel that they are asset poor and income poor..even they are earning more then Rs50000 per month or 1 lak per month..

Only reason is In cities People of India ,specially job class,their salary not increased as expense increase due to inflation…

In Manmohan time ,Inflation increase 10 folds but Income increase only 1 folds..

Just see the some example

1.rate of property in 2004 and 2014

2.rate of home consumption items rate in 2004 and 2014.

Its my observation.

May be wrong or right.

Dr Manmohan Singh has nothing to do with this. At least people used to afford Daal & rice during his tenor. India survived once in a century kind of economic crisis without much damage, Salary increased at faster rate than inflation.