Govt restricts EPF withdrawal amount to employees share only till retirement

Indian Govt has brought a new amendment in the EPF rules, according to which the members will not be able to fully withdraw from their EPF before they reach the retirement age.

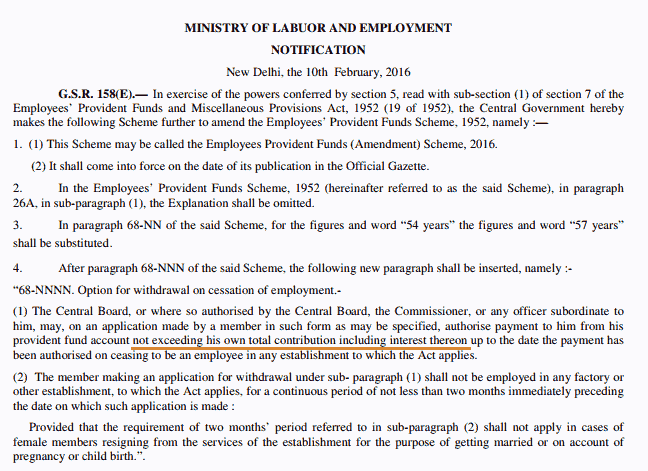

The maximum one will be able to take out is their own contribution and its interest (which was raised to 8.8% recently), and that can be done only after 2 months of ceasing employment.

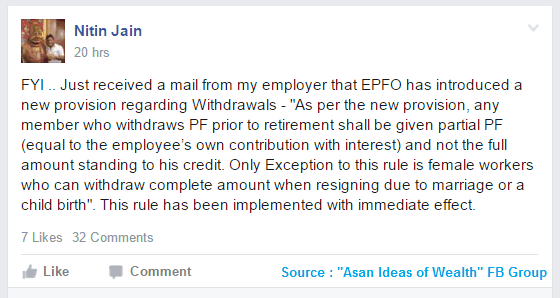

The only exception shall be made for female members resigning for the purpose of marriage or pregnancy or child birth. I came across this news from Nitin Jain when we got an mail from his employer about this notification. Thanks for Nitin to send the notification PDF to me.

Below is the snapshot of the exact wordings taken from the notification which was released by the govt recently. please find out the PDF of the notification here

So whatever your employer is contributing to EPF and the interest on that part will be retained in EPF till the retirement age and you will be able to use it only at the end.

Many investors when they change jobs withdraw from their EPF’s and till now they used to get the full amount. But this is not going to happen from now onwards. What this means is that if you have an EPF account, your relationship with EPFO is lifelong now, because your account will be active till you retire (or die)

This is not a sudden decision taken. It was properly planned many months back itself and there was news about this restriction coming up in future, however that time, it was said to be the limit of around 75% of the total amount, but now it’s close to 50% only (employees share only).

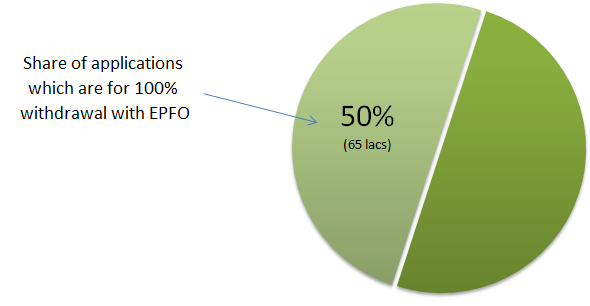

Also note that as per the stats from EPFO; out of the 13 million annual claims pending with the EPFO, over 6.5 million claims are for 100% withdrawal, that’s 50%. This means that out of every 2 claims which EPFO gets for withdrawal, 1 of them is for full withdrawal.

This means that a big portion of claim withdrawal applications was coming from people wanting to withdraw the full amount. Now with this new rule, the number of applications to EPFO will also reduce drastically.

Is this new change in EPF withdrawal rules Good or bad?

From an employee’s point of view, the flexibility to withdraw the full amount (the painful process) has gone and now you can’t just take out full money like you used to do earlier. EPF is a social security measure, and was designed keeping that in mind, but people used to apply for withdrawal the moment they changed the jobs most of the times, now with this new change, it will not be possible and in reality one will be forced to keep a part of their wealth in EPF till their retirement

No matter how much I try to think like an employee, my experience of working with thousands of investors tells me that it’s a good move. PDF is the only saving at the moment, which happens by default for a salaried person, and even though one does not touch it for years, eventually a big percentage of the population always thinks of withdrawing the money on job change and the money gets utilized somewhere.

Retirement Age increased from 55 to 58

Another change in the notification is that the retirement age is increased from 55 yrs to 58 yrs, which means that one can now only consider themselves to be retirement from the EPF point of view once they turn 58 yrs. One can also apply for a pension only at that point in time.

This is a good move if you think long term. Consider a person who is 28 yrs old, and his salary is Rs 30,000 per month. Assume that his basic salary is 40% of the gross amount, which here comes to 12,000 per month. Now on this, he will get 12% of salary deducted as for the EPF and another 12% will be added from the employer which would total Rs 2,880 per month.

Now if the salary increment happens @7% per year and the return on EPF continues to be 8% per year, the person will retire with 80-90 lacs of EPF corpus at the time of retirement, provided he does not withdraw anything in between. However now even if the person chooses to withdraw the money in between, with this new rule the employer contribution is going to the restricted and one will bound to have 40-50 lacs at a time to retirement (with the assumptions above). Below is the chart which shows how the numbers move.

Note that the above chart is only for illustration purpose, The only point I want to make it a decent amount of money will be there at the time of retirement because of this new forced rule.

Please share what you think of this new rule. Do you think it’s good or not? How do you react to this?

February 24, 2016

February 24, 2016

This restriction is postponed until 1st July 2016 and there will be in depth look on this restriction.

Thanks for sharing that !

The comments are displayed in ascending order, it should be in descending order so last posted comment will come first

I have made that change . Now recent comments come first

Are you sure about that sir ?

This restriction on PF withdrawal has been revoked on 19th April 2016. Now anyone can withdraw complete PF balance.

Hi Abhishek

Yes, I just saw that news yesterday . Will write an article on that in few days to inform everyone !

Hi,

I worked for an organisation for 2.5 yrs and left that in June 2015. Now i want to withdrawal my full PF amount. Do i need to fill any other form except 10C and form 19?

No , that should be enough !

Dear Manish,

If I have to withdraw money for buying a property, will I be entitled for withdrawal of both Employee and Employer contributions?

Please clarify.

Praveen

From what I understand, you will not be !

Dear friends,

Please sign the following petition against this unfair restriction on the PF withdrawals.

https://www.change.org/p/why-should-we-wait-till-58-years-to-withdraw-employee-provident-fund-noepfwithdrawallimits

What happens if i am laid off?I should be able to dip in my pf till i get a new job

Yes, you can withdraw your own contribution after 2 months of unemployment !

Hi Manish

The exemption for female members seems to be interpreted incorrectly in your article and by Nitish Jain’s employer.

From reading the govt. notification, it is clear that female members are exempt only from the “2 month waiting period” not from the withdrawal restriction. It looks like the withdrawal restriction applies to both males and females.

Pasted the relevant section from the govt. notification below:

“Provided that the requirement of two months’ period referred to in sub-paragraph (2) shall not apply in cases of

female members resigning from the services of the establishment for the purpose of getting married or on account of pregnancy or child birth.”.”

Article from Livemint confirming that the withdrawal restriction applies to everyone both male and female

http://www.livemint.com/Money/Gpv3sPve39HTei7HsNmgKJ/DYK-You-cant-withdraw-employers-contributions-to-EPF-befo.html

Thanks for your comment Naren

Hi Manish,

I have made PF withdrawl request from my previous employment and would not joining new employer atlease for next 4 month.

My queastion is, as per new notification, if I can withdraw only my contribution ( not of the employer), Can I transfer the remaining amount (employer contribution) and EPS ( not requested EPS withdrawl request yet) money to new PF account whenever I join new employer.

Regards,

Virendra Sancheti

You can only take your own contribution and nothing else till retirement

Thanks Manish. But can I transfer (not withdraw) remaining amount i.e EPS and employer contribution against EPF to my new PF account

Yes, you can always transfer the amount !

You are justifying yourself .Fools only justify themselves for any mistake.First learn how to behave with others. Character is important for any person’s life.

hi manish,

dis is sashi frm andhra. today i made intraday sell order first for digjam at 8.92 , total 13500 shares.. as the price is not moving further up or down, i tought it would b squared off by3.15 pm. But my fundsindia advisors telling me, as i made sell order first and then didnt make buy order Sebi wil take penalty of nearly 25000 rupees… can i overcome tht?? please reply soon

I have no idea on that

Manish,

agree that PF corpus to be maintained till retirement than supporting full withdrawl. with 2016 budget where the new guideline is to tax the interest acrued out of PF corpus, this is ridiculous that the hard earned savings are being aimed for tax .. PF is no longer a ideal tax free option ..

Thanks for your comment Srini

Sir Myself (D.O.J 21.02.1983)with salary deduction with FPF Contribution left working on 14th Nov 1995 more than 10 yrs and now aged 55 yrs and not worked later. Am I going to be eligible for Family Pension under Family pension SCEHEME 1995.my employee code 071402082 PF NO 032 and pension a/c WB/15008/186.Hope my resignation on 14th NOV will not affect my pension and if I can start my pension on reduced rate being 55 yrs now.

Also my husband with Employee code no is 2938 and FPF ac no is W.B/15008/P-118. who worked for more than 20yrs and was deducting FPF took early retirement on 31st Dec 1994 is eligible for Family Pension under the scheme?How can we get his FPF transferred from Jaipur to Kolkata as per his FPF. No RJ/2482/1898. Whose responsibility is to transfer the funds to one place to start the Pension.Is it on us or Employer or PF OFFICE.Can I get advise on Mail as I am not very Computer savvy and may not be able to locate this site again am afraid.Pl help and tell me whom to approach as we are not getting any pension.

Hi RDG

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

What is the option for the employees who is permanently leaving the country?

I was working for a Central Govt Educational Institution through Outsourcing Employer and EPF Contribution was remitted below the Wages Percentage and huge amount of difference was later deposited by the Outsourcing Employer after raising Several Complaints with Ministry of Labour and Employment.

The Best Suggestion would be make EPF as optional and those who require to contribute can contribute the same as huge amount forgery is being done by both the Primary Employer and the Outsourcing Employer.

Thanks for your comment tiwari

hello,

in last month i filed claim for withdrew my EPF money , and my application is under process , can it affect by this new decision ?

yes

New withdrawal policy is a difficult pill to chew for many but this is absolutely in favor of both – Govt. and employee in long term prospective. I appreciate this move and we are in pretty much in line with western nation’s policy of the social security. In US or developed countries, one can withdraw the social security savings but hefty fines and tax implications.

** This is my view.

Thanks for your comment Prashant

In my opinion it is good move. Peoples will realize when they reach retire.

Peoples start thinking of withdrawal and spend lavishly.

EPFO is going on-line, probably in future, there won’t be much problem in managing it.

Thanks for your comment Raja

Hi,

Now if decide not to work after let say 45years, will i get interest for full amount till age 58??

I think so. If there is no interest , then no use.

Hello Manish, I had the same question. What if some one decides to quit his job by 45 years or for the sake of argument say any time before the stipulated 58 years. When there is no more contribution flowing into such an EPFO account with the holder being unemployed. What happens in this scenario? Would the interest still be getting credited on the Principal + Interest amount accrued so far year on year till 58?

Manish please clarify this? Most people has this doubt including me

YOu will only get interest on the employers contribution part, because thats locked. For the employee share you have choice to take out if you want. So no interest on that after 3 yrs

INterest will still be there for the employer contribution !

Only on employer contribtuion !

Dear Manish,

Thanks for this post.

Just a quick question – “Employee share” would include any amount contributed as voluntary provident fund, right ?

Sorry, just saw the comments, you have already answered.. Thanks.

Yes

Its good move. It helps at the retirement time as it is intended for. I hope restriction on only withdrawal amount and age limit, keeping all other conditions same. It is good if Pension age limit they would have maintained same.

Thanks for your comment RevansiddappaPH

I have recently quit at 52.

Under older rules I would have received interest for 3 years in my dormant account.

Now the interest will accrue until withdrawal even if my account is dormant ?

At age 58, I can completely withdraw both employer and employee contributions , right?

Thank you for this v timely post.

From what I understand the interest wil be there on employer contribution only

Thank you.

Some interest being better than none at all!