EPF withdrawal made super easy – No Employer signature needed

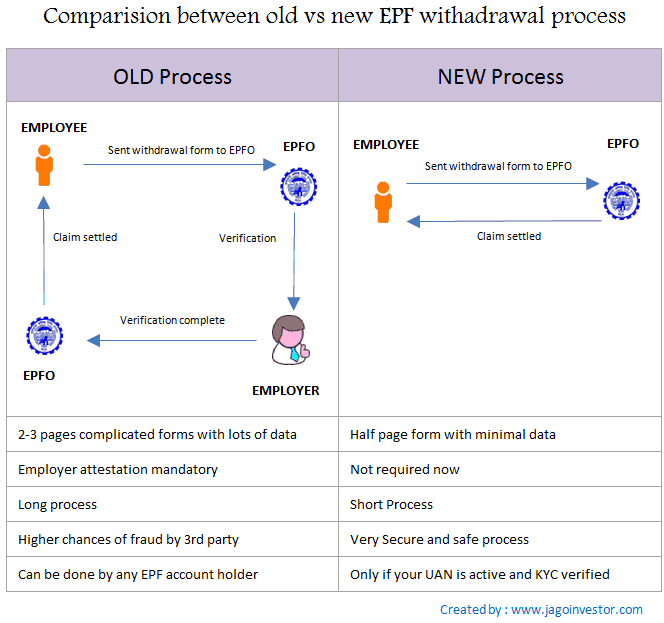

Here is a great news for all EPF account holders. EPFO has come up with new and revised forms using which EPF withdrawal process is now super easy and can happen without employer signature or any involvement. Now you can directly submit the EPF withdrawal forms and the settlement will happen directly into your bank account.

Earlier, the EPF forms were first sent to employer for their verification and signatures, which used to take a lot of time and many a times employers used to harass employees because they had the power to block the EPF withdrawal. However with these new changes, withdrawing from your EPF account is going to be very easy and fast and now it makes a lot sense, because EPF should not be linked to employer anyways. Few months back, with the concept of UAN, the EPFO had anyways delinked the EPFO from the employer to some extent, and this move looks like an extension to that.

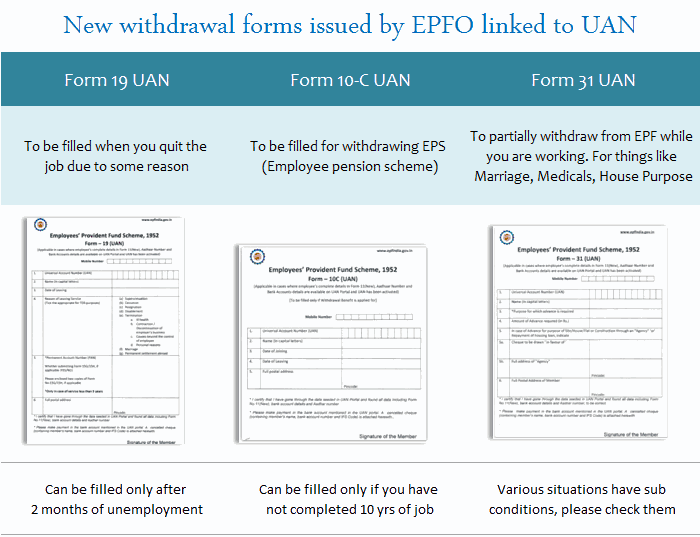

New Forms – 19 UAN, l0-C UAN and 31 UAN

EPFO has issued 3 new forms which will be used for as follows

- Form 19 UAN – You can fill this form to withdraw from your EPF at the time of retirement or leaving the job. Taking our money from the EPF is allowed only if you are unemployed for 2 months. So in case you just change a job and join a new company within 60 days, you can not offically withdraw from EPF, You need to apply for EPF transfer in that case

- Form 10-C UAN – You can fill up this form in order to withdraw from your EPS amount. EPS account is a seperate account linked to your EPF which is for the purpose of pension. Note that one is allowed to withdraw from EPS only if your EPF is not more than 10 yrs old.Check more details on this here.

- Form 31 – UAN – This form can be submitted if you want to partially withdraw from Employee providend fund (EPF) account for the purpose like marriage, house buying or medical emergency. There are different rules for different situations. You can check more details on this in this article

Note that there exist forms 19, 10C and 31 already (without the word UAN), but now the new forms end with the word “UAN” to differentiate between old and new forms.

Who can fill up & use these new EPF forms?

Here is the catch!. The new EPF forms can be used by only those employees who fulfil following two conditions

- UAN must be active and should be linked with aadhaar number

- Your KYC details (especially bank account number) must be verified by employer using digital signature

If the above two points are true for you, only then you can use these new EPF withdrawal forms

Step by Step process of withdrawing money from EPF account

Let me help you with the steps of EPF withdrawal now. For the sake of explanation, we will consider the case of Form 19 UAN, which is used to withdraw the EPF money once you leave the job or are retired. The same process is used for the other forms as well.

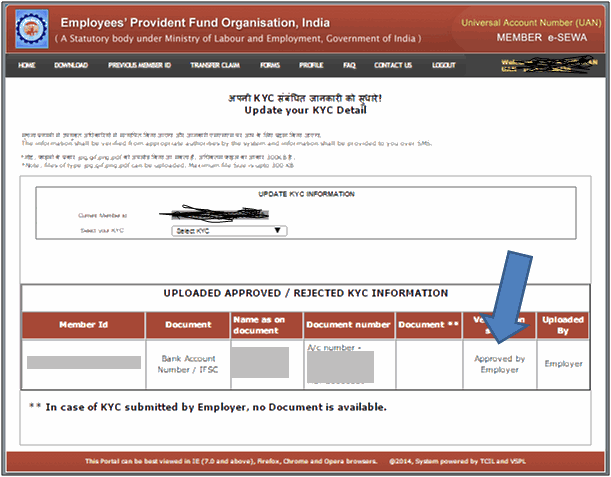

Step 1 – Make sure your UAN is active and KYC details are verified

These new forms can be used only by those whose UAN is active and all the KYC details are verified by employee as explained above.

Hence, the first step is to verify your eligibility. For that, you can go to http://uanmembers.epfoservices.in/ and login with your login and password and then go to Profile->Update KYC Information, where you can either update the details or check them. It looks something like the below example (thanks to my close friend who has passed his details to me for creating this snapshot)

In case, you have more than two UAN allotted to you, then you should discard one of them and should be using the latest one provided to you by the current employer.

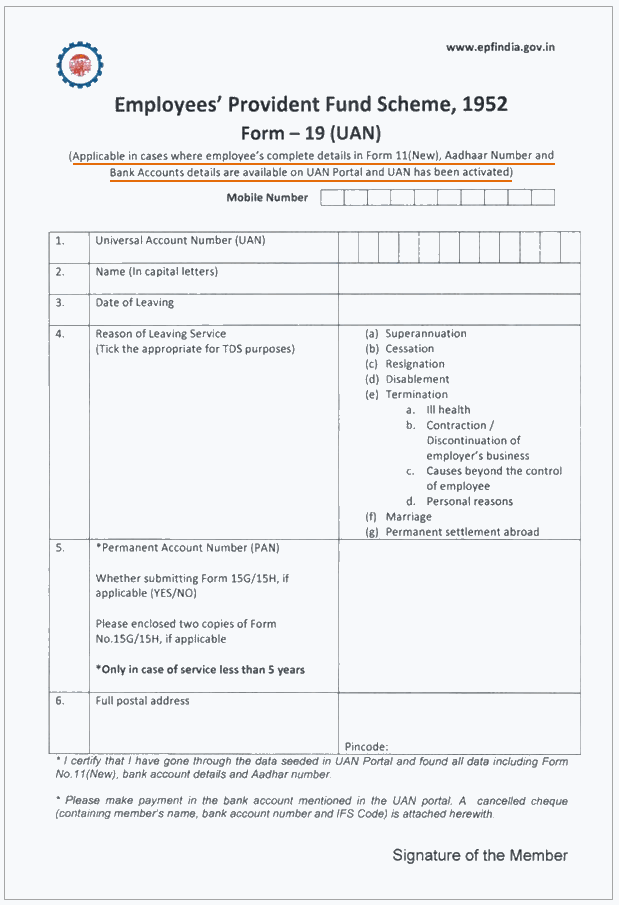

Step 2 – Fill up the EPF Withdrawal form and send along with cancelled cheque

Once you have verified that all the details are fine. You can then fill up the form. Below you can see form 19 UAN as an example. One has to provide the Mobile number, UAN number, date of leaving, the reason for leaving the service (make sure you choose it properly, because TDS will be applied depending on that reason),PAN & full postal address.

Note that apart from this form, you also have to attach the cancelled cheque of the bank account which is mentioned in the UAN KYC details.

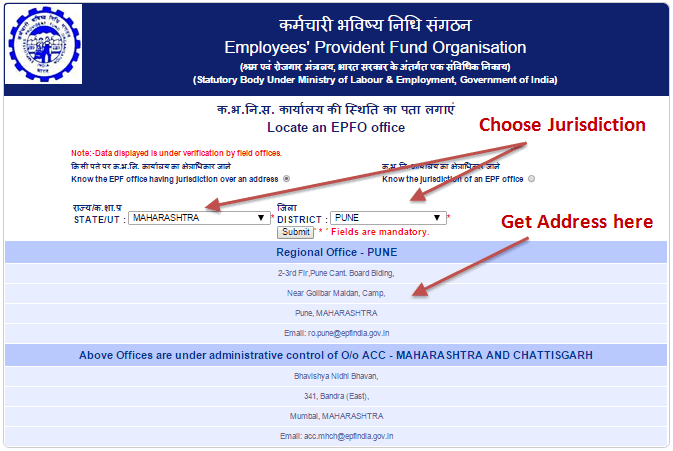

Step 3 – Send the form to the EPF jurisdiction office

Finally, the last step is to submit this form, along with the cancelled cheque to the EPF office which comes under your jurisdiction. The simple way to find the exact address of the regional EPF Office is to go to http://search.epfoservices.org:81/locate_office/office_location.php and enter your state and district of the office where you work/worked. You will get the full address. You can then courier the documents to that address.

The above 3 steps will help you to withdraw from EPF money easily. If you want to withdraw your complete EPF amount, then you need to fill up form 19 UAN and form 10-C and send both of them.

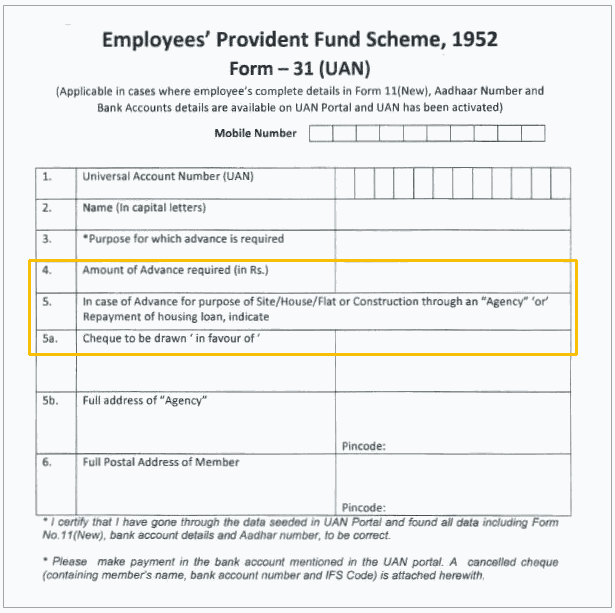

BONUS – Fill up form 31 UAN to withdraw from EPF for purpose of buying house

Let me also share one very important thing related to buying house or repayment of house loan through EPF amount. Form 31 UAN can be filled for partial withdrawal for the purpose like buying house, repaying home loan or things like medical emergency or marriage at home. For more on this, please look at this article.

You can see the snapshot of form 31 UAN below. If you look at 4th and 5th point, you can clearly see that you can take the money directly in the name of the “agency”, which can be the builder or the company which is helping in construction of house. The cheque can be taken for that.

EPF Withdrawal process to be online very soon

I hope you are now clear about these EPF withdrawal forms and how to fill them up. Note that very soon these facilities will become online, it’s just a matter of time. Once that happens, the process will be much smoother and fast, because things will become online.

Let me know if you have any doubts or any questions on this topic. Do you think these forms will help in EPF withdrawal a bit faster?

December 9, 2015

December 9, 2015

hi… I have to submit pf form in pf head office does it compulsory that I have to go to office or my husband can submit. because my due date is near I can’t travel so far…

I am not very sure of this.

how to fill up my epf details ?

Where?

Hi Manish

I have completed 9 years and 11 months in previous organization. Can I withdraw my pension funds. As per our Trust 9.11 years will be considered as 10 years and I can’t withdraw the same. Please suggest.

It might be the case, as you dont qualify as per rules !

I left the company in 2014 and submitted the PF withdrawal form in 2016 and waited for almost a year nothing happened so went to my company and they said its with third party management and now they are asking me to submit form 15.I don’t have a UAN number.what to do now. Confirm me how to get UAN Number.

Here is the answer – http://jagoinvestor.dev.diginnovators.site/2015/02/uan-epf-guide.html

Hi Manish I was working for a company for 4.5 years than I had to leave and join another company I did that without serving my notice period

And I tried linking both my epf acc with my uan acc however I m not sure weather this happened actually

Coz both my companies have a different dob of mine

Can I withdraw my epf from the previous company

I think this will have your answer – http://jagoinvestor.dev.diginnovators.site/2016/11/duplicate-uan-problem.html

Hi Manish Please help me

Mera PF withdrawal nahi ho raha maine company june 16 main chod di thi aur company mera form PF office nahi bhej rahi hai aur Maine direct PF office bhi form bheja tha UAN wala form wo return agaya reson ki apka UAN activate nahi hai magar mera UAN activate hai aub main UAN cheque karne kai liye side par ja raha hu to open nahi ho rahi hai please help me.

Hi Sovit Gupta

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

hi I am Karthik,

I worked in HCL for nine months after that i moved to new job in 2011. for the nine month pf deductions has been carried out by the HCL . Actually i dont know the PF account no. how would i get the pf account no of the past employer.

It should be there in your salary slip, Ask them for the PF number

Where can I get these forms?

From EPF website

Hi Manish, I need few details regarding my online pf withdraw. I have two pf account numbers( One to bangalore & second to Chennai) linked to my UAN.

Also there are employee pension scheme deduction added to my second employer. My KYC has been verified and approved by both the employers.

I understand for pf withdraw I need submit form 19 and 10C is required for pension withdrawl.

To submit my above mentioned forms for pf withdrawl,I need to submit by forms to both the offices( Bangalore & Chennai)?

Please let me know me know your inputs.

Hi Raj

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

The article is very informative and helpful

Thanks for your comment Datta

This is great!!could u pls tell me how much it will take to get the amount. I mean approximate time once we submit it in the pf office..

The timeline from PF office is 3-4 months !

Hi,

I Want to Know my Pf transfer claim status I have submitted the form 13 I did get any reply or no response plz help me…

Hi KOMATHI

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi

Plz tell me which form I should submit to withdraw PF…

Hi KOMATHI

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi

I have left my previous organization in Feb 2016 but relieving date was 2-Mar-2016, later joined new organization where in joining date is 3-Mar-2016 so will i be able to withdraw PF Amount?

If not how can i transfer it to my current organization?

Thanks In Advance 🙂

Regards

Sandhya

You need to fill up the transfer EPF form for that.

Hi! Manish,

Please help me

1) I left my job on 31/08/16 two months passed my employer is not paying my settlement and conveying if f&f is not clear they cannot process my pf. Is wat they are saying is correct?

2) may I apply myself for my own pf, then what is the process

EPFO processed the EPFO money, not your employer. To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Hi, i worked in an office for 1yr nw i need to withdraw my pf. Wt are the forms to be filled. Im unemployed for more tgan two months.

Hi Kumarr

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Manish,

I am Pooja from kolkata. Your article was very helpful. I resigned from an organization on 3rd Nov 2016 and wish to withdraw money upto Rs.50000 due to marriage and i have active UAN but Aadhar is not linked to it. Can you please help me on this, how to link aadhar card to UAN and where do i have to submit Form 11 and form 31.

Thanks,

Pooja

Hi Pooja Joshi

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi Manish

I left the my pervious employer 1 year back & I didn’t with draw my 7months PF till know, Can I will with draw my balance know with out help of my pervious employer ?…..I have my PF number with me.

Hi Kalesha

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Manish, First i would like to say my sincere thanks for this information. I need some more information. 2 months back I left a job and immediately joined a new one. But I do not want to transfer the amount. I would like to withdraw the amount from the previous PF. Is it possible? I have a UAN number and the same bank account now & Phone Number.

Is it possible to withdraw without any issues?? and please help me out with complete procedure…

Hi Mahesh

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Sir, I have Aadhar card problem… My name & details are completely wrong on the card due to negligence of the adhaar card agent in 2010. Is it necessary to link with my eyes portal….

Yes it is

I am worked in private ltd for 11 years.now I am claim EPF but pension scheme not interested. So i need to full amount claim get or not pls reply

Hi kalidoss

I am not clear on what is your question. Please repeat it with more clarity

Manish

Is there a simple way to transfer PF from old employers to new employer?

No , there is no simple way 🙂

You need to fill the transfer form and do it traditional way only