Dont get fooled by High CTC offered by your employer

It was campus placement month, and although everyone declared that they wanted to do quality work once they were placed, they also harbored a secret desire to get placed at the highest salary. When we used to look at our pocket money and compare it with the salary “package” offered by companies, we used to feel we would sleep on bundles of notes.

The top students of my batch were placed at extremely high pay packages, and they were proud to have “cracked” it. However the average students and other not so lucky ones had to settle for lower pay packages.

The “Very Happy” and “Only Happy” students left for the next phase of their life. The bitter truth however, only emerged after a year or two – that the take home salary of most of the students was not that different from the rest. While the students who got high packages were obviously earning more than the others, the difference was only marginal.

The CTC (Cost To Company) numbers had fooled us!

What is CTC (Cost to Company)

What was happening was that the companies were exploiting our human craving for “Instant Gratification”. Job Seekers want big salary numbers – its’ a benchmark which they use to compare themselves with others. It feels nice to say, ”my package is 12 lakhs per annum”, even if you only get 58,000 per month in hand.

CTC or cost to company is what a company spends on you. If something is an “Expense” for a company because of you, its part of your CTC, as simple as that. So starting from the air conditioning you use at office, to the food you eat at office, everything can be part of CTC. Here is one how one of our readers Nandan feels

I fell for a similar trap while joining an IT MNC recently (from another which was equally good at inflating its VP compoment). It’s been only 3 months now since I joined this company and the worst part is that the take home I get now is almost same as that I was getting in my earlier company (though on paper the CTC is having 35% hike over the previous company CTC) – Link

5 tricks to increase CTC numbers and give wrong impression to employees

There are several ways companies can inflate the CTC Numbers and give you an impression that you are getting the best deal, only for you to realize later that the other job was better. Let me now show you some ways companies increase the CTC numbers.

Trick 1 – Including their EPF share inside the CTC itself

The first time I saw my salary slip, I was somewhat shocked to see that my employer was deducting the ‘employer’s share’ of EPF from my salary. I was wondering – “If it’s the employer’s share – why are they deducting it from my salary?” It was only later that I realized that this was merely a simple trick to inflate the CTC. They could have just reduced my CTC by an amount equal to employer share of EPF and could have paid it separately, but then my CTC would be lower– even though I would have been getting the same salary at the end of the day.

Trick 2 – Adding One time Bonus in CTC at the time of joining

When I joined my first job (and the last one), I was very pleased to hear my CTC; it was amongst the highest packages on campus. But then my salary in hand correlated poorly with the CTC figure. In my mind, I had divided my CTC by 12 on the day of placement and was on the top of world. Though what happened in reality was that I was supposed to get a one time joining bonus (that too after many months), and that figure was added to the final CTC – inflating the number substantially. It was only for first year, not a regular thing !

Trick 3 – Adding Stock Options in CTC

Another simple trick employers play is to add your Stock Options to your CTC. Stock Options again are not a regular payment source, however they do increase the CTC considerably. You can learn about stock options, RSU’s and ESPP here in this article.

Trick 4 – Adding Insurance Facilities, Food coupons, Transport Facilities to CTC

At the end of every month, we used to get food coupons from our company. We also had payments made by the company towards yearly life insurance and medical insurance. The thing is, you do not get these things as CASH, but instead as benefits. However, the company adds all these to your CTC figure, as it is paying for it.

Trick 5 – Putting Large chunk of variable component in CTC

Another famous trick played by companies (especially those in sectors that are performance based) is to add a considerable amount of variable component to the salary and keep the fixed part small. The CTC number is then provided based on an average performance assumption. For example if your CTC was Rupees 10 lakhs, it could happen that 4 lakhs of the CTC would be FIXED and the remaining 6 lakhs would be variable. The part of the variable component ultimately paid to you could go down or up depending on your performance or some parameter that supposedly would be under your control. It could be sales, the number of clients you bring in etc. etc.

Start-ups vs Giant MNC companies – Difference in Salary Structure

In my limited experience, pay packages offered by startups or smaller companies are more or less transparent, and artificial increases in CTC are limited. Dividing the CTC figure offered by them into a monthly number will get you very near to your take home salary – though it will obviously be lower. However, in the case of larger companies, the CTC number is inordinately inflated and your eventual take home salary might give you the feeling – “Seems like there is some mistake in the calculation”.

Joining other company for higher Salary ?

Just because you are getting a higher package in some other company, does not automatically mean that your take home salary will increase by the same margin. It may happen that your take home salary increases by very little, or in the worst case scenario, stays exactly where it was. What you should focus on, while moving to another job, is the additional increment in your take home component and not just the change in CTC.

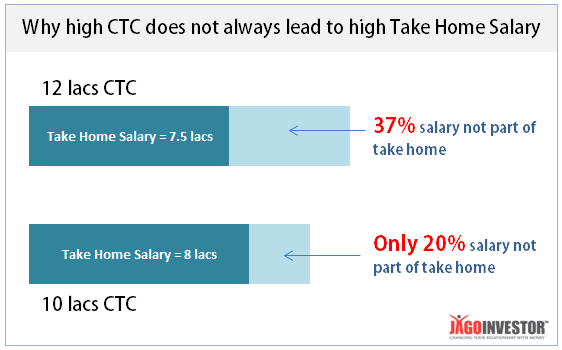

In the image below you can see how a job with low CTC can lead to a higher take home salary – all because the package with the higher CTC was inflated by injecting various components.

I hope from now on, you will focus more on the final take home and not be fooled by CTC numbers.

Any personal experiences?

September 2, 2013

September 2, 2013

Hi ..can term insurance & medical insurance be kept out of CTC as per request.

What do you mean?

CTC means cost of company .. its the definition .. How can you keep it out of it ..

It is different in company to company.

Mostly service based companies adds everything in package but if u check package for most of product based org , they shows only in hand and your pf contribution in salary package. They never adds medical, variable and gratuity in ur ctc

Thanks for informing ..

Can you somebody please help?

I am looking for legal law link which tells what is the maximum limit of percentage company can define as Basic salary and HRA in pecentage.. My company is giving me 70% basic and 18% HRA and saying its as per law?

I am looking for legal document or law link, so that i can raise my concern back.

PLEASE RESPOND ASAP.

HRA is decided by govt rules. BASIC is decided first and then rest of the components are added, not vice versa !

Hi Manish,

Just recently I have selected in one of the reputed Furniture Design Field Company, and when I request to HR to give me a minimum 30% hike as compare to my previous salary, they included Variable performance pay in as part of my salary and they are not offering any additional Incentive or Bonus to me and I really don’t have any idea that, is this the way company give the hike?

KIndly guide me.

They told me that, I will eligible for bonus if I perform extremely high and if my manager recommends.

My break up of salary is something like this:-

Base Pay – INR per month

Basic- 16,042

HRA – 6,417

Conveyance Allowance – 2,000

Special Allowance- 18,104

Total Base Pay- 42,562

Reimbursements

Medical Reimbursement (Payable half-yearly) 1,250

Telephone/Mobile Reimbursement (Payable half-yearly) 1,250

Total Reimbursements- 2,500

Retirals

Gratuity (Payable as per the terms of Gratuity Act, 1972)

Total Retirals – 771

Total Fixed CTC – 45,833

*Variable Performance Pay (Payable annually) – 6,250

Total CTC- 52,083

Additional Benefits

Insurance – Group Mediclaim: INR 300,000 of sum insured

ii. Insurance – Personal Accident Policy: INR 900,000 of sum insured

regards,

D Patel

Sir, the simple answer is the company will decide how they want to give HIKE. If they dont want to give they will not give.

All you can do is continue with them or leave and join other place. Only that is in your control

when we are moving to new company and for negotiation on salary we need to ask hike %age on fixed pay or on fixed pay+variable pay what we are getting in the previous company??

Thanks for sharing that sravan

[…] expenses (including the parties) which you spent for this education. Further, these job offers are all actually CTC (cost-to-company) figures. There will be a lot of components in the salary which do not at all translate into money in your […]

Hi Manish,

Even though i have consulted the HR regarding the take home part, He didn’t actually calculate the exact amount. I am little worried about the take home part. Can you please go through the below mentioned details and let me know the net take home each month. Would be really kind of you.

my break up of salary is something like this:-

A: Basic Salary (Base Pay) Basic Salary ( Base Pay) 363,607

B : Non Basic Salary (Non Base Pay)

House Rent Allowance (HRA) 181,804

Transport Allowance 19,200

Medical Reimbursement 15,000

Food Coupons 13,200

Leave Travel Assistance 30,301

Bonus / Ex-gratia 19,572

Special Allowance 396,194

TOTAL (B) 675,271

COMP 2: TOTAL (A+B) = 1,038,878

C: Retirals

Provident Fund (Company’s contribution) 43,633

Gratuity (Company’s contribution) 17,490

TOTAL (C) = 61,122

Total Gross Compensation: A+B+C = 1,100,000

Additional Benefits:

– Variable Incentive Plan upto INR 87,000/- p.a.

– Shift Allowance upto INR 115,500/- p.a.

regards,

Rakesh

Hi rakesh

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Shift allowance cannot be calculated under CTC. Rest other parameters are usually there. Variable pay should not be 0 in any case. It should have some logical range. Like we have 0.5 – 2 ramgey

Hi Manish,

Let we know the current Bones and Ex-Gx rule..

No idea on that

Hi,

My CTC is 6.3

5.16 fixed + VP remaining.

In my recent appraisals my hike% was calculated on only fixed part not on my total CTC.

I was disappointed, Is that how hike Is calculated?

There is never a fixed rule for these things. It varies from company to company. Even the hike % varies from year to year. It’s all based on the company’s performance or atleast that’s what they.

Company has decide its own rules !

Hi,

Can EL (Earned Leave) be part of CTC component ?

Thanks.

I am not sure on that !

Hi, currently I offered from aricent with 6 lpa include 60k per annum variable pay.Actually I have offer in hand with 5ctc fixed pay.After this 5 cycles offer I got another offer from aricent 6 lpa that I mentioned above.Is it good enough for me? My designation is SSE. In my salary breakup v.p included.

Thats something we cant judge from our side.

Dear Manish, while getting into an interview process with any company, the first question is the hike expected by the candidate and the generic answer is 30-40% industry standard. Please advise on what an employee should quote (smartly) or ask for (I am keeping everything else constant – Designation, years of experience, role etc) considering the manipulations (difference may be a better word) in CTC that HR/new organization may do? So, in other words, what is the ideal way to negotiate to ensure that one get ~30% hike on take home?

Hi Sameer

I am not the right person to talk on this point.

Manish

Hi Manish,

Recently I’ve joined a Company which has 24×7 work environment. So, I’ve to work in Night shifts also. In my CTC, they have mentioned Special Allowance of Rs. 5000/- per month.

When I asked about my Shift Allowance I have been told that the Special Allowance what is mentioned in my CTC is the Shift Allowance and I’ll not be getting shift allowance separately.

But, how they can include Shift Allowance in my CTC? As per my understanding, Shift Allowance is paid separately and it also differs from shift to shift.

Please guide me.

CTC has everything . Thats why its called CTC . Cost of company . I dont think company is at fault here !

Thanks for your reply.

But, in the CTC breakups, they have not mentioned Shift Allowance and nowhere in the offer letter. Company said, the Special Allowance which is in my salary breakup is the shift allowance. How is it right? Can I fight on this point?

That is how they play with the Offer letter lingo, special allowance is being used as anything-else-that-is-not-mentioned-exclusively (read shift allowance). I am not sure if you can fight on this, get a legal opinion on this matter.

Correct !

its cheat. You should get shift allowanace separatly.. I t can not be included in CTC.

So is it good to have a VP as zero for 10.5 lacs package?

That cant be answered 🙂

Hi Manish,

True that all hiring companies highlight the CTC amount, however on selection and during offer negotiation, the candidate is free to ask questions on his salary components, know the periodicity of pay for those components, understand the performance linked variable pay scheme and calculate the “in hand” salary excluding income tax. It is up to the candidate to ask these questions before taking a conscious decision to join any organisation.

That correct, but 90% are ignorant on this in the start of their career .

Hi Manish,

Is there a ratio to set the Variables according to Total CTC or is it common %? Kindly advise.

No ratio like that

[…] I fell for a similar trap while joining an IT MNC recently (from another which was equally good at inflating its VP compoment). It’s been only 3 months now since I joined this company and the worst part is that the take home I get now is almost same as that I was getting in my earlier company (though on paper the CTC is having 35% hike over the previous company CTC) – Link […]

Every company does the same problem…especially when top MNCs rely on consultancies to get the job done by hiring candidates, they say its so much lakhs that candidates with open mouth accept it, when joining in a concern finds that they get half of the pay which is highly and cleverly cheated by MNCs.

Thanks for your comment Boby

the EPF thing is i guess done by every IT company…its very common..is dat a wrong thing at first place ?

No , its not wrong as such , just that one should be aware that it happens like that 🙂

In Wipro, Gratuity is part of your CTC which is only paid after 5 years. This is crazy as this company is supposed to be one of the most ethical companies in the world.

Why is the government not penalizing these organizations that are really openly cheating their employees?

Firstly, Why should I be bother how much I cost to the company? It is totally irrelavant to me as an employee.

Secondly, Why should variable pay be part of the CTC when it is unknown because it is variable, then how would that be cost.

Thirdly, Every employee should know how much he is going to take home (ofcourse after deductions, taxes etc).

This is just a tactic and does not help anyone but the corporates. This is what will happen when you have Jurassic age labor laws.

Regards,

Yes Vipin

Thats the reason why one has to ask for the in hand pay package !

I joined a company recently n in my salary break up gross salary and ctc is same i.e, 30088 where 1800 is deduction of PF from employee side n same from employer side also. result as result there is deduction of 3600 from my gross.

what can I do, plz suggest.

Most of the employer put their contribution also in CTC, hence they are deducting 1800 for you and 1800 as their contribution. This is how it happens in most of the cases

Manish

My Company have a Cycle for Variable Payout. I joined in the month of Dec’14. But to get my variable payout I need to earn it…Like Apr-Mar is the Cycle to earn the points, The Payout will happen twice-Apr and Oct, I will get my variable payout in the month of Oct only (the points earn from the month Apr-Sep’15) …There will be nothing for Dec-Mar…I am so disappointed with this way of calculation. It was never said or mentioned by HR at the point of negotiation.

Welcome to the world of HR tricks !