How Insurance Companies Work – The Ultimate Guide to understand their Business Model

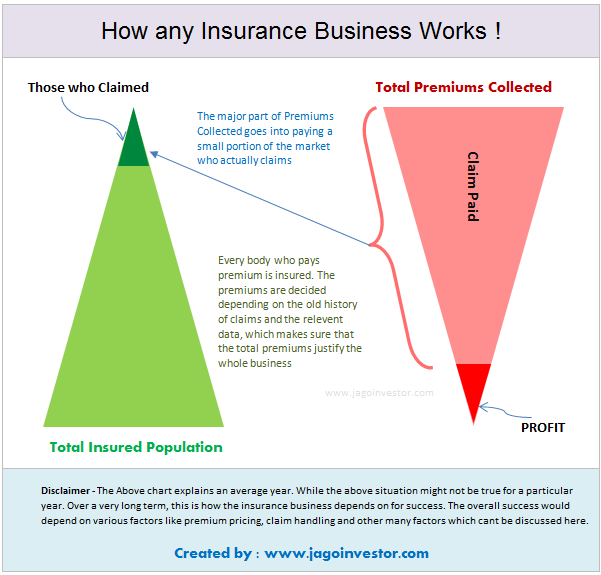

I have written almost every possible article on Life Insurance and even Health Insurance, but strangely I still find a lot of investors asking questions which clearly shows that somehow, somewhere they do not understand what is the underlying business model of insurance business and how are the products designed overall. Let me use simple stories and recreate some examples which will show you how things work in any insurance business. Lets move on ..

I see a lot of people saying something like – “How can these companies offer 1 crore term plan by charging just a small premium of Rs 10,000. Its surely a racket!”

Then a lot of people still feel that insurance companies are cheats and they will not pay out when a claim arises, just to make sure that they do not have to pay a big amount from their pocket. I am not advocating any insurance company here, nor am I saying that I have a solution to your doubts. All I can do is share what insurance is all about. This should surely help you understand the business model of insurance companies and how they make money. You can then choose to trust the system or reject it. Note that In our 100moneyactions program we have one of the tasks as completing your life insurance and health insurance with basic support system, So if you have still not registered for it, do it now.

Insurance Centuries Back – Lets go back in History

Insurance as a concept, is not a new thing in this world. It’s been in existence for centuries. Let me start with story which will give you some idea about insurance business and its evolution. Long back, there were businessmen all over the world, who traveled from one country to another for doing trade and business . They sent their stocks, inventories and material across globe on boats and ships. A lot of times when they used to send their ship from Point A to Point B, it so happened, that some ship drowned and everything on the ship got wiped out.

And this happened 10% of the time on an average. Out of every 10 ships which started from Point A, only 9 reached the destination and one businessmen almost surely went bankrupt. So you can see that the certainty was about the loss of 1 ship, but there was uncertainty about “whose” ship it will be (just like there is certainty that one an average 1-2 person will die in a city in accident for sure, but who will it be is not sure) .

So all the businessmen started to think over the issue and they found the solution. They started collecting 10% worth of the stocks from each of them, collected it in a bag. When each of 10 businessmen did this, the bag was full of money which would compensate any ship owner who was the unlucky one and lost his ship. If there was no accident and all the 10 ships arrived safely at their destination, there was no issue at all. But when there was a ship lost, the whole bag of money was given to the one who was affected, which meant that he didn’t suffer other than temporary shock and resentment.

So now if you see closely, you can relate this with insurance. These businessmen were doing nothing but mutually insuring their risk by pooling in the money (premium) and then compensating the unlucky business man in case of a disastrous eventuality (sum assured equal to 1 ship worth).

Any ship owner, who did not wanted to participate in this (thinking he would loose that 10% money if his ship was safe), was free not to participate, but then he was just taking a huge risk of wiping out everything he owned and going bankrupt.

So you learnt – What is Insurance exactly !

So you are still not clear about the concept of insurance with this small but simple story? Let me now rephrase it in modern terms.

Insurance is all about transferring the risk to someone else, by paying a small cost called a premium. The person who runs the insurance business (for profit!), takes care of all the research and data which makes the business viable in long term. Let me attempt to build a simple (imaginative) job loss insurance business right in front of you.

Job Loss Insurance for Software Industry

Let’s say, I decide to launch an insurance product called “Job Loss Insurance” for IT professionals . So, I research and find out that out of every 100 people in IT sector sector, 3 lose their job each year for some reason or the other, but then they are able to secure another job within 6 months (just an assumption). Now assuming that the average salary of a software professional is Rs 50,000 per month, it means that I can create a job loss insurance product which says –

“Pay a premium X each year and in case you lose your job, we will pay you 6 months salary to you, so that you can keep your mind cool and search for another job and pay your home loan EMI, children school fees and other commitments.”

Why am I suddenly feeling that some of the IT guys reading this really want this kind of product …

Anyways, so I know that out of 100 people, 3 people on an average will lose their jobs who would need 6 months of oxygen till they find another job (50k X 6 months = 3 lacs) . So, I would need 9 lacs to pay all these 3 claims which will arise each year. So now, I need a market of 100 people to whom I can pitch this product and generate 9 lacs of total money. Which means that I will have to price it as Rs 9,000 per person per year. In short 100 people will pool in Rs 9,000 and generate 9 lacs and then out of those 100 people, 3 will loose the job and file for a claim.

But wait, where is my profit ? I am not doing a charity ! Its a business for me ! . So for that reason, I will not charge Rs 9000, I will charge Rs 12,000 per year. So I keep a cool Rs 3 lacs as profit!

But , There is a problem …

Each year, its not that, only 3 out of 100 will loose the job! It could be 4 or 5 in some year and it can be 1 or 2 or even ZERO! in some other year. The 3/100 was just an average over long term . So while I know that a particular year can be very very bad or very very good, over a 10-20 yrs period, the average will be 3/100.

So, I will make sure that I keep sufficient capital with me before starting the business (what if in first year itself, there are 6 job losses out of 100). That’s the reason, why there are IRDA norms that a particular amount of net worth should be there with every insurance company before they get a licence and its called Solvency Ratio.

So now, based on their premium pricing strategy and overall experience in next many years, an insurance company is very profitable in long run (high probability) or they suffer a loss. That might explain, why most of the new insurance companies are in a loss at the moment (insurance is a long term business, very long term).

Premium Increase for some customers

Now a lot of people wonder, why insurance companies increase the premium for some customers (called as loading the premium) . Let me show you with same example.

Now as per my data research, There might be a category of IT guys who have a higher changes of 5/100 job loss and that one is Software Engineer whose company is not US based and they are into Embedded systems . So in short a IT guy who is into Embedded systems with a Non-US based company is more dangerous customer to me . While I will still give him insurance, but I cant charge him same premium like every other IT guy. So I would charge him not 12,000 per year, but 24,000 per year – because he is risky! .

While he might not get fired by his company, I am taking a very high risk against him and I deserve to be paid more, otherwise it does not make any business sense to me. Now if he hides this information from me and does not tell me before hand while filling up the form that he is working in embedded systems, that too with a company which is not US based (guys, just a random assumption, don’t take it seriously), should I be paying him any insurance money if he actually loses his job? the answer is rude NO. I can’t be emotional here and look at your tears! You cheated me, so you pay for it!

This might explain to you, why insurance companies apply loading, when you tell them you are a smoker, or you drink, or you are obese or you are working for the Army!. You are a high risk customer, and as per business rules, they will definitely increase your premium, even you will do the same, if you started up a insurance business. Wont you ?

Will company really pay me at the time of claim ?

Yes, it will. Because for you 1 crore at Rs 8,000 per year might look very absurd, its actually not . Because Insurance is a volume’s game. One individual case is not going to affect a company, because it was already factored in. It was known to happen. Thats why the premium was collected and you will be paid because thousands like you will NOT file for claim. My premiums might be used to pay your claims! . So Like in my example, when a person loses his job, I know that he is part of that small group which is surely going to lose his job. I will not be worried paying you 50,000 per month for next 6 months even if you paid me just 12,000 in a year. I know for sure, that the rest of the 97 people will not lose their jobs and I can surely pay you what you are insured for.

Amount Accumulates and grows into a big pool

If in the first year, less than 3 people lose the job, then I have extra money left at the end of the year and I can carry forward this money into future for those bad years when more than 3 people will lose the job. I can also invest this money, which will grow over time, and If I have done my research right, I am surely going to be profitable over long term.

But my research will be different than your research, you might find different kind of data, may look at the job loss data differently, may look at scenarios in other ways, which does not match my philosophy and hence you might charge Rs 15,000 per year and not 12,000 per year, or you can charge Rs 8,000 per year and not 12,000 per year like me.

Which explains why premiums are different for different companies.

Auto Insurance – They know all the data that if a car is older than X number of years, what the chances of it crashing into another one, and then how many premium makes the business viable and profitable.

Health Insurance – Health insurance companies know the data about the hospitalization charges, the probability of a person of certain age to get hospitalized in next X yrs and all those kinds of data. So when they price their policies, they are smarter than you. You might look at an individual case of yours and feel that you will profit from it (which can be the case), but surely its will not be a loss making proposition for the company either (over a long term, collectively).

Life Insurance – They know how many people out of 100, will die on an average in a year and within how many years. So if a big number of people pay for some years at least, it will be enough to pay the dead ones families.

Credit Card Insurance – There are insurance businesses around insuring credit cards. They know on an average out of 100 credit cards, how many are lost and on an average what is the loss amount. So they keep the premium such that they still make profits over a lot of customers.

Conclusion

I would like to conclude this article by telling you to understand the business model of insurance companies. Once you get it, suddenly all the doubts you had over years will go away. Insurance is a very strong concept which is a win-win model for the companies and for customers. At-least we used some stories and examples in this article which was just for illustration purpose and dont start arguing the data and numbers from examples 🙂 .

May 24, 2013

May 24, 2013

Hi,

How and where can I share my recent experience related to medical/ health insurance and how the hospital refused to perform the operation cashless (which was available) as well as even-when-I-offered-to-pay.

Citing that: if I file a reimbursement claim later, it will get rejected for sure, but also put the hospital into problem.

thanks

Jeevan.

You can share your experience here !

Thanks Manish.

Dear friends given the below experience,

Should we still buy health insurance or should we avoid SMALL hospitals?

Health Insurance providers only provide a list of cashless/ network hospitals but never the SoC?

Can patients demand to see the SoC of a hospital, before choosing one?

PS: my experience in the shortest of words – Relative was in acute pain and needed surgery ASAP. We were referred to a renowned surgeon (who immediately admitted him in & started pain killer treatment).

Looking at the factors (age, Diabetes, etc.) – told us it will not be a simple operation and so the cost will be at least 5 times the standard. The surgeons private “small 12 bed” hospital had a tie up for cashless service with our health insurance provider.

The hospital sent an estimate for the “standard cost” of the surgery for pre-approval and it was approved but as the surgery was complex and cost will be higher we were asked us to simply bear the balance – and NOT to even file a reimbursement claim with insurance company – the hospital claimed that experience has shown insurance companies do not entertain “costs” outside the pre decided SoC of a hospital. (Schedule of Charges) and the hospital could be de listed or subject to a lot-of-explanatory-paper-work.

The hospital refused to change their stand even when the Insurance spokesman, assured all, that the full amount will be approved, just send the revised estimate. But the hospital refused to send a revised estimate.

This took up 3 days, and we finally took a discharge and admitted patient into a big hospital (at least 2 thousand bed), and post appropriate insurance approval, the surgery was performed. The insurance company till date has sanctioned an amount which was 3 times the standard cost. The patient is still in hospital so do not know the complete cost as yet.

Note: The first surgeon at small hospital, is very renowned in their specialty and the big hospital was surprised that we took a discharge instead of treatment.

thanks

Jeevan

Jeevan

So are you saying that one should go to big hospital and not small one’s ? If one has health insurance ?

Manish

That is exactly what I want to know, Manish.

What should one do?

Could their be any regulating/ controlling agency (like IRDA) who can look into such matters?

As not all big hospitals provide quality treatment – and

it seems good doctors are operating their own “small scale private consultancies” – as maybe big hospitals do not pay them their worth.

I dont think IRDA has anything to do with it, because its related to hospitals. IRDA does not regulate hospitals , they can only deal with Insurance companies!

Dear Sir

Is it possible to invest grand father in gardson LIC as Grand Father is pensioner and pension is taxable is he able to claim same for deduction under 80c what is your opinion about children money back and Jeevan Tarun

Thanks lot for your guidance your article are really informative and useful to enhance financial literacy

YEs, its possible

Dear Manish,

Clearly understood the sector. Whats more inspiring to me is your passion, involvement, patience and commitment as you reply/respond to every comment/suggestion/doubt whatever on an article. Way to go Manishji…

Regards

Kamalakar

Thanks 🙂

Dear Manish,

A very illustrative well written article and a must read for all people who buy insurance.

I have a technical query regarding Health Insurance.I would appreciate any feedback.

Normally when we buy a health insurance policy we answer a questionnaire and fill in our personal details and on the basis of this form an Insurance contract is generated.The life insurance companies always provide a written contract which needs to be preserved and submitted during claim or at maturity.

Do health insurance companies issue a written contract ? I have never seen a Health Insurance contract by any of the 4 government run insurance companies wiz United,National,New India etc .

Is this contract with Insurance a new contract every year or existing contract is renewed every year with payment of premium ?

What about terms of contract,can it be changed by insurance companies without written intimation to customers ?

Does Irda have any guidelines regarding this matter?

Thanks.

Samir Shah

Not sure how you have not got it . All the insurance companies provide the Written contract (Brochure) . How you have not got them till now !

excellent insight 🙂 insurance companies knows that the odds are stacked in favor of them similar to how casinos operate 🙂 and are least bothered about claims because they know for sure that in long term they would be profitable !

Yup , you got the real essence !

Hi Manish,

Read my all reply seriously ,you will find my question I hope.

Regards

Dayal

Hello Manish,

My age is 28 and i need health insurance for me and my MOM(52) & DAD(57) can you please suggest which plan is better.

As usual nice article on insurance.. You have already written to lot more articles on insurance. This one really cleared how insurance companies work. Tnx a lot!!

Welcome Chetan !

Hi Manish

Thanks for posting this brilliant article. One request Please post the must Do”s and Dont’s for easy claim settlement for any unfortunate situations as pointed out like Puneet.

Its mostly in the start of the period when you take policy . Just make sure you disclose all the info correctly

HI Manish

Where do the insurance company get data from ?

So that they can decide what premium is to be charged..

Thanks!

That I am not sure

Premium are calculated by Actuaries of the company by preparing Mortality table which reflects the amount of premium to be charged against specific age group, gender, lifestyle and habits etc.

Rates differ from company to company depending upon there individual calculation.

Brilliant article Manish, nicely written and explained in layman terms..!

Welcome Ram !

Hi Manish

Good Article. I had one point. Agreed, they are a pure business model. They make money on the premiums we give them. Since I am giving them a business by taking a insurance, why they dont have a clear SLA (Service Level Agreements) for claim settlements? Isn’t it the job of IRDA to lay down the claim settlement SLA? I have paid them premium on time, don’t I deserve claim on time?

Assuming they need more to investigate the case, shouldn’t they compensate by providing interest for these extra days they deviated from their SLA? Also, one imp question is, are the members of IRDA from the insurance companies? If yes, it would defeat the purpose of formation of the IRDA. Please share your thoughts.

You have a point . But there are already SLA’s . They have number of days defined if all the documents are clear . But if not, they again have the SLA . ALso for policies less than 2 yrs and more than 2 yrs are defined.

However incase the company is unfair in paying the money , you can always reah tch to IRDA and Insurance ombudsman and there are many cases where they have awarded the compensation.

Ok. Time to get some realty check.

I’m not trying to downplay the importance of getting life insurance. It’s a must and everyone needs this.

But this is how things work out: (assuming all declarations are true in insurance form)

-> Life insured gets sudden severe illness(stroke, heart disease whatever). Family takes them to hospital.

Case-1: Dies on the way. Hospital declares “brought dead”. Refuses to give death certificate as death dis not happened in medical care. Death certificate is must for life insurance claim. Try dealing with police to get this. They would insist on post mortem report. Family starts dealing with government hospital corrupt staff to release post mortem report to police. Bribes ensue (in lakhs). Police demand bribe to release report and death certificate. (in lakhs).

Now insurance company will take their sweet time to do their own enquiry to settle claims. No ETA defined.

Imagine the sufferings of the family in this situation. They have to deal with so many people to get simple claim, that too in case of life suffered is not cheated o r lied. No reason to believe insurance company would definitely take advantage of the system to not pay the amount.

Case-2: Life insured encounters an accident, dies (either on the way to hospital of during medical care at hospital). Police opens case, post-mortem ensues, bribes at multiple levels..etc. you get the idea.

I am yet to read about any one who has been successfully and seamlessly able to get a claim for term life insurance plan.

Manish, do you know anyone like this?

Puneet

I agree with you

regard

Dayal

It is OK to be pessimistic about something, if one wishes to. I partly agree with the points too.

How ever, Insurance is one way, by which one can protect ones dependents, incase of sudden event and is advisable that one go for it, based on need.

Hi Puneet

Can you share what happens in this case ? I dont know personal cases, but I have agents contacts who have done it for their clients family and there are many cases like that.

I’m not sure what happens but I’m very skeptical about all this.

Does that mean one should prefer buying Insurance from agents instead of buying them online? (specially traditional term insurance plans) 🙂

That would contradict a lot of wisdom I have gathered from your blog so far ….

Also, to be clear, I have ample of term insurance coverage already.

Puneet

then go with your gut feeling 🙂 . Better to have peace of mind !

Dear Mr. Manish,

thanks for the promt reply. what difference the profession make in health insurance policy. it should make only in life and accident insurance policy.

The company may be factoring in some metrics based on the risk at work, one doesnot know.

even if it is not there, company can reject the claim based on fasle info ensuing a legal fight and addiitonal trouble to the kin of the deceased.

Better ensure info provided is correct.

thanks Mr. Srinivas for the reply. I have informed the company about my proffession now they came back and said they are cancelling my health insurance policy with in next thirty days. reason mentioned is “occupational risk” Because i was not mentioned my proffession correctly in the proposal form. But the unfortunate part is i will lose all my no claim bonus. The form was filled up by the comanies employee only. they themself call an expert. Iis there any way i can restore my policy. If anyone has incorrectly mentioned their proffession then the best thing what you can do is quietly change the company using the portability benifit.

any suggestions from anyone.

Hello Shaji,

If ok, can you let me know what is your occupation/profession?

Dear Mr. Mahavir,

I’m working in the merchant navvy/offshore indusry as chief engineer.

can you or medimanage help me in this matter..

Dear Mr. Mahavir.

i have already posted my query to medimanage , please have word with Mr. Abhay singh. Kindly have a look at my case.

Obviously it makes. depending on your profession ,your hospitalization probability will matter !

Dear Mr.Manish,

I have one doubt. I have taken appolo munich optima restore policy, but while filling up the form agent filled up my profession as accounts manager. Actulay i’m working in the merchant navvy which is considered to be a high risk job. when i clarified the same with the agent he said profession is not important in Health insurance it is important only in Accidental policy ans life insurance policy.

Can you clarify this matter.

Its a lie. Your claim will surely be rejected on this ground . Better inform this to company

As usual an informative article again highlighting importance of taking insurance.

Good work Manish.

Thanks 🙂

Good but simple .Insured parson do not fear about claim because of small premium high term insurance .they fear because of medical test which almost all insurer do not want to do according to their /irdr rule I mean insured does not know who is the medical officer ,whose identity, signature and there is a pathologist whose role is the same as medical officer. T.P.A does not want insured to singe before the medical officer and pathologist even if insured forced.So knowing all these farces insured fear about high claim insurance

Regards

Dayal

I am not sure how true is that . Its only in the interest of the insurer to get medicals done . And as far as I understand, they do it properly . There can be cases where things have messed up , but not sure how one can generalise it .

Manish,

There are two thing in all thing. 1) Theory 2)practice, you are no drought good theoretician about insurance but in practice you have something lack in your comment.There is no sure or unsure about truth. you can only believe or

disbelieve. Or neither you believe nor disbelieve.To know what happen in practice, ask irdr to collect data from all insurer how many polices unaccepted, accepted with extra premium and with exclusion.Take an example of medical fees of L.I.CI for 25laks insurance that it gives to its T.P.A. 1)Lipidogram Rs-170 2)HIV test by Alisa method Rs-1000 but market rate is for 1) Rs-340 and for 2) Rs-2000.Knowing the comical rate of the taste that you will get from the website, ask yourself can there be a real medical test?So if you regard insurance over all you have think over theory practice both collect proper information from where can come to the truth

regards

Dayal

Thanks for your comment My Dayal

But which point of mine are you commenting upon ?

Manish,

Upon no point of your article I was trying to comment but to open the another door of insurance that is insurance practice as the name of your blog is jagoinvestor.But you close the door by telling” as far as I understand, they do it properly ” Because this type of comment likes all insurers

Dayal

Still not sure what is wrong in our comment or article, which part we didnt do properly ?

Manish,

” Its only in the interest of the insurer to get medicals done”It should be in the interest of the insurer and insured both to get medicals done but it is theoretically correct . but practically what happen that does deepen upon” as far as I understand, they do it properly” .

Regards

Dayal

I didnbt get your question ?

Manish,

Are not you intelligent enough to realize what my question is?

Regards

Dayal

Hi Dayal

Actually I didnt get it really. Some words have mixed up in the whole sentence in a way that I could not understand what is exactly you want me to tell .

Can you rephrase your question please ?

Manish

As usual nice and clear article Manish.. i am gaining knowledge from your articles.

Thank you soo much ….

THanks for share that Radhika 🙂

Manish,

One small request …. can i get about ratios and its analysis about balance sheets and profit and loss account statements… that is what i want to learn … if u already posted the articles, please let me know how can i get that Thankful to you in advance.

Hi Radhika

We are pure personal finance blog . Not sure if we can do those kind of articles

Now, all this process being a zero sum game meaning, either the insurance company will make profit or the investors collectively will make profit (probable amount an investor might get * number of investors). Next, if I assume the school of actuaries (those who do these calculations) are more intelligent and has done a good research, which in most cases is true, the insurance companies will make profit. Isn’t it wiser not invest in insurance?

The risk of calamity is highly unprobable for an individual and he should rather keep that money, which he pays as premiums, in some guaranteed returns (fixed deposits in banks). Just in case he is the unlucky one, he can reap those deposits and use that during calamities. Isn’t this opinion correct?

+ Say in a special case, if all my family members are earning (wife, brother, parents) or if we have a business, and in case a person dies, that risk shall also be mitigated since there are many who can support the family after him.

What do you mean by “investing in insurance” ?

Good one Manish!