Gift Tax in India – Everything you wanted to know about rules and exemptions

Do you know that, when someone deposits some money in your bank account, what is its taxation angle ? A lot of people take some loan from their friends for few months and then return it back, but never think twice about it from taxation angle? Your parents deposit some money to your bank account because you want to pay the down payment of your house. While it’s a help from your parents, have you ever thought if you have to pay tax on that amount or not?

In this article lets see all the aspects about these kind of transactions, when money comes and goes out of your bank account and what are the rules for income tax on gifts received from relatives or other people in India .

Let us first see what kind of situations we are talking about ?

- You swiped your credit card for your friend Rs 20,000 purchase and then your friend paid back money to you by transferring it to your bank account.

- You asked Rs 50,000 from your friend as loan and paid him back after 1 month.

- You got Rs 50,000 cheque from your relative on your wedding.

- Your father transferred some money you your bank account as help for some purpose.

These are few instances, which happens in our lives. But its very important for you to understand the tax implications in various scenarios and the possible issues which can come up in the future, if income tax department decides to scrutinize your income tax returns for example. By understanding the gift tax rules and precautions to take, you will be safe. So now, let’s look at 5 points which will help you understand rules about incomes tax on gifts in a better way.

By virtue of Section 56(2), any sum of money exceeding Rs. 50000 received without consideration by an individual or an HUF from any person is chargeable to tax as income under “other sources” subject to some exclusions . Below we are going to see all those exclusions and gift tax rules.

1. Upto Rs 50,000/year is not taxable

The first major rule which every person should know is that there is no tax to be paid on gifts received (cash or kind), if the amount of the gift is upto Rs 50,000 in a year. However if the total amount crosses Rs 50,000 . Then you will have to pay the tax on the total amount received (not additional). For example – If a friend of yours gifts you Rs 30,000 in a given year, you don’t have to pay any tax on that amount, as its below the limit of Rs 50,000 .

Now suppose you also get Rs 20,000 after that, still you don’t have to pay the tax as the total worth of the gift you got in the year was Rs 50,000 till now (less than the limit of Rs 50,000) . But now, if someone gifts you another Rs 10,000 . Your total gifts in a year is Rs 60,000, so you will have to pay tax on the total amount of Rs 60,000 , not just on additional Rs 10,000 . This Rs 60,000 will be included in your income and you will have to pay tax on this Rs 60,000, as per your tax slab. Note that this is exactly how the written law is.

Since 1/10/2009, Section 56(2) has been amended and the scope of ‘’gifts’’ will include even immovable properties or any other property besides sums of money under its ambit.

2. Any amount received by relatives is not taxable at all

Another rule for income tax on gifts, is that any amount received from specified relatives is totally tax free in the hands of recipient. So if a relative gives you gift in form of cash/cheque or in consideration, you will not have to pay any tax on the amount received.

Following is the list of relations which are considered as “relatives” for this

- Your spouse

- Your brother or sister

- Brother or sister of your spouse

- Brother or sister of either of your parents

- Any of your lineal ascendants or descendants

- Any lineal ascendant or descendant of your spouse

- Spouse of the persons referred in above points

Example – So if you want to buy a house and your father/mother/sister/brother etc transfer Rs 20 lacs to your bank account. You don’t need to worry about the taxation part, because its a gift from your relatives and you will not have to pay any tax on this amount. However its a good practice to do the documentation for this, if the amount if pretty big like in this example. All you need to do is document this transaction on a paper which clearly states that who transferred the money and the reason for it, along with the signatures of both parties. In future, if there is any income tax scrutiny, this small piece of proof will be handy and will help you a lot.

Important – Note that, there is no income tax to be paid on the money received from relatives, however at times income clubbing provisions may apply, for example, if a husband gifts Rs 10,00,000 to wife, there is no ta to be paid by wife on Rs 10 lacs received, however when she invests that money and if any interest income is generated, it will be clubbed with husband income. Read all about income tax clubbing rules here.

3. Any amount received as Wedding Gift is not taxable

One of the few advantages of getting married is that any amount you get, as wedding gift is not taxable in your hands, either from relative or non-relative 🙂 . So even if you get Rs 1 crore as wedding gift from someone in your wedding, it’s not taxable in your hands.

Lets see some examples –

Suppose if your spouse parents give you some gift worth Rs 10 lacs on marriage, it will be treated as a wedding gift and will not be taxed. However, it is not clear by provision, whether the gifts should have been on the exact date of marriage, or a few days before or later. Normally, it should be sufficient if the gift is given just on the occasion of the marriage, means either on the day of the marriage itself or a day or two before or after. Practical common sense view would prevail in such cases.

4. Gift Tax on Movable/ Immovable properties

There is a valuation aspect involved in gifting of immovable properties

- If the property is gifted without any consideration then if the stamp duty value exceeds Rs. 50000/-, stamp duty value will be taken

- If the property is gifted for a consideration, then the actual value of the property will be taken

In case of other properties:

- If gifted without consideration and fair market value exceeds 50,000, then the fair market value will be taken as the final value

- If gifted for a consideration and the Fair Market Value (FMV) less consideration is greater than 50000, then the FMV less consideration amount will be taken as the value of the gift.

5. No tax on the amount received through WILL or Inheritance

When any sum of money or any property is received under a will or by way of inheritance, it is totally exempt from Gift Tax. So if you get a real estate worth Rs 50,00,000 and some other things worth Rs 30,00,000 through inheritance , you will not have to pay any tax on that amount received.

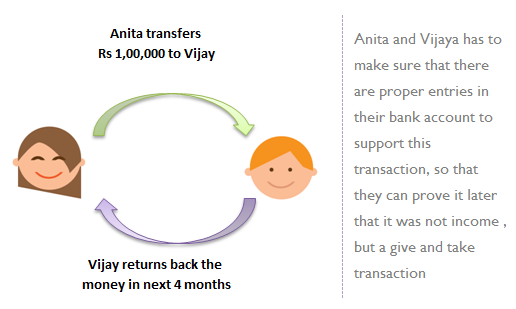

Be cautious about the take and give transactions

At times, we ask for money from our friends for some purpose and then give it back. One of the examples I can give is what I heard from one of the readers in comments section. He swiped his credit card for a friend for Rs 50,000 and then asked his friend to pay him back through online banking. Here if you see, the amount came to his account, however it was a reverse transaction and not actually a gift, so ideally this transaction should not be considered at all.

If its a small amount and can be justified with proofs, there is not much to worry about this. But in this case, lets say there is a income tax scrutiny, and tax inspector asks you about this “Rs 50,000” coming to your account. Now – You can clearly say that the money you got from your friend was a amount which you got back because you paid Rs 50,000 to him through your credit card. But just saying this will not be enough, He will ask you to prove it. Then you will have to bring your credit card statement, and prove to him that this was done by you for your friend and no one else.

The point here is – no matters how truthful you are, there should be something you can show to income tax officers in case this is questioned. So for any transaction like this, which involves a big amount, its always a good idea to have a proof, like in the example I just gave, the credit card statement will be handy along with a small note, where you friend signs saying that you swiped your credit card for him and he will pay back the money through netbanking.

In this same case, If you ccan’tprove that this money was just a “reverse entry” , you can imagine the situation. Even if you were clean, the whole amount would be added to your income and you need to pay income tax based on your tax slabs on the ground of unaccounted income.

Another point, worth noting is that just because you have a reverse transaction, the other party can get into trouble. For example, suppose you give Rs 20 lacs to your friend, who wanted the money for buying a house and then your friend gives back those Rs 20 lacs in 3 months. Note that now there is a clear entry that you gave your friend Rs 20 lacs, so in future income tax department can reach you through your friend and ask you about this Rs 20 lacs and from where you got so much of money. They can ask you to justify the source of this money. So always keep these points in your mind.

How to document Gift transactions, Registered Deed or plain paper?

A gift deed is a deed, that is executed and delivered in which the donor transfers title to the receiver without any payment or considerations. It a document which transfer the legal title of the property to the donor, where the consideration is not monetary but is made in return for love and affection. There is indistinctness with respect to compliance of the gift deed at times, Whether a gift deed is required to be made in every circumstance

When it is required to be stamped OR get registered?

Gift made by way of cash or cheque does not mandatory requires to be executed through a gift deed. Writing a plain typed note on a paper will generally suffice. It is not required to be stamped and registration is also not needed. You may simply mention the names of persons, their relation and that the gift is being given out of love and affection.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court, and registration of gift deed is not required in this case. For the purpose of making a gift of immovable property, the transfer must be effected by a registered instrument signed by or on behalf of the donor. Gift of immovable property which is not registered is not valid as per law and cannot pass any title to the receiver.

Conclusion on Income Tax on Gifts received

As far as you make the transactions which can be justified, there is not much to worry, however its always a good and safe practice to document things on a paper with proper signatures. This will help you because income tax scrutiny can go back to many years of your life. The stronger your documentation and proof, the smoother will the situation be.

Thanks to Rishabh Parakh (www.rishabhparakh.com), a chartered accountant who helped me while this post and gave his inputs. He is founder director of Money Plant Consulting (www.moneyplantconsulting.net ) a leading Tax & Investment Advisory service provider in Pune.

March 4, 2013

March 4, 2013

Me and my wife are buying one property and taking 60 lac money from my father(which is his retired ppf amount) and 10 lac from father in law into my account. Do we need to pay any tax on this. What steps i need to take to avoid tax department enquiry.

No tax to be paid.

You can just take it in your account. You take from your father and wife takes from her father in her account.

IT will be treated as GIFT to you .. No tax angle for you!

Manish

Hi,

My Father deposited around 11 lakhs in my bank account. He received the money from the sale of the property last year for which the return has been submitted. The purpose of depositing money in my bank account was to pay off student loans.

Will it be considered taxable for me when I am submitting the ITR?

No, its not taxable in your hands as it can be considered a gift from your father. BUt your father must pay tax if its applicable!

Greetings of the day!

I am a working professional, and the following is my situation:

1. I pay HRA to my grandfather (maternal), let’s say INR 6 lakh.

2. My grandfather (maternal) send this money to my mother’s account as a gift.

3. My father sends me the same amount (INR 6 lakh) from his bank account, i.e. both my father and mother have a different bank account, and consider it as a gift.

This way I can, indirectly get the money back that was paid for the claim of HRA. Will it be legal ? Do I have to pay any tax in this scenario?

Thanks, looking forward to your response.

You cant claim TAX DEDUCTION for full amount of HRA actually.. Most of the times its lower than HRA amount.. So how are you benefitting ?

Because you will anyways pay the tax applicable .. After that you are sending this to grand father and getting it back from father. I dont see enough benefit

Manish

Hello Sir,

I am a student and i have a hypothetical scenario that i want to clarify, suppose A’s brother/sister wants to transfer 20-30 lakhs money to A’s son/daughter who we can imagine is an adult who is an income tax payer. in that case what needs to be done and as this amount is more than 50000 does A’s child be required to pay any tax or something. Sir i am a law student and this was the question asked to me in one of our exams, i could not answer it, can you please let me know the answer to this question ?

I dont think the kids need to pay any tax in this case!

Manish

Hi,

Thank you so much for the detailed post.

I have a question and I really want you to answer it.

I am an IT professional working since 2 years and my father is in Indian Air Force he was posted to another state.

We were buying house in Delhi worth 32 lakhs, and due to covid I am working from home in Delhi (we currently live on rent) and here builder is asking for money partially in online and some in cash. So what we have decided is to transfer some amount in my bank account and I can pay him using online transaction as it was easy and I can verify details and everything as he lives here only. So my father transfer 15 lakhs to my account in small installments and I paid the builder using net banking. Is there any kind of tax related scrutiny can happen on me ?? Like so much money inflow and outflow in 2 months only…etc etc..

and Also, If we pay rest of amount in cash is it legal on our behalf ?? Because I know builder want that part in cash because he wants to evade tax but should we be worried for taking cash from our bank account ??

Thanks.

The scrutiny can surely happen as tax department just looks and numbers. But you dont have to worry much because there is no tax angle here.

You can tell them exactly what happened .. that your father just transferred it to you and you are paying it. Nothing will happen

The only thing which can happen is that they can ask your father if that money is white or not and if your father has been paying his taxes and returns properly and can justify it then there is no issue.

Also if you pay cash to builder, its again not an issue for you. Paying and taking cash is not a crime. Not paying tax on the income is crime. So its the builder issue if tax department finds about that.

Manish

Thank you Manish,

I appreciate your super fast reply.

And regarding my father paying taxes yes he is paying because in Defence services they deduct it and then give salary.

Thank you so much for the answer.

In that case you have nothing to worry as everything can be explained ..

Hi Sir,

My name is Jaek and I’m an Indian. I work for UK for past 5 years. There is no office in India and the only office is in UK. I work for them (IT professional) from India. They are sending money thru Money Gram. I receive nearly $10000.00 per year. How to pay tax? what would I do? How much should I pay tax? after they sent money through Money Gram, I will reach local finance service and then they would transfer through IMPS. Ex : IMPS transaction from xxxx finance. So, it does not show that where exactly that money would come from. it should be local finance service send an IMPS transaction. Please help me. Thank you.

There is no confusion.

Its your income in India and just pay it as per your slab.. Check with a CA if it gets complicated!

Manish

Hi Manish,

I earn 10 to 15 k Rs in share market per month and for that i am paying profit sharing with one broker company regularly.

due to every week/month transaction with those broker, is there any legal action will take place or it is all legal.

your reply is appreciated .

Nothing is illegal here .. Just that its your income so you are paying the tax on the whole thing.

Hello Sir,

I received 4lacs rupees from my father as a cheque which I invested as a NSC for 5 years. Am I required to pay any tax on amount received from my father?

No you are not. It will be treated as GIFT ! .. nothing to worry!

Hi,

I have been a regular reader of Jagoinvestor articles and highly appreciate the quality of content provided. I have one query that “if son gifts ‘x’ amount to mother and mother gifts the same ‘x’ amount to his son’s spouse, will it be illegal as son gifted to mother and mother gifted to daughter-in-law? What would be tax implications or clubbing provisions in that case?

Thanks and Regards

Yes, there will be clubbing provisions applied here..

Its clear that husband is just giving the gift indirectly to wife only to avoid taxes using the pre-text of gift rules.. This will attract gift tax!

Hi Sir,

In case a adult child receives a cash gift from a grand parent, then will the income he earns on that gift amount be clubbed with the income of the grand parent?

No, it will be the child income.. income tax clubbing will not apply

Hi Manish

Is money gifted by maternal grandmother (i.e. Naani) to her grand son (i.e. Naati) taxable at the hands of her grandson?

IF I GET A GIFT BY CHEQUE FROM MY REAL MARRIED SISTER, WILL I HAVE TO PAY TAX AND WHAT ARE THE FORMALITIES TO BE COMPLETED, IF ANY, FOR SUCH GIFT. IS THERE ANY LIMIT OF AMOUNT TO GET GIFT FROM REAL SISTER

No tax .. And no limit

Someone has sent me a gift as $ 45000. Someone has call from Mumbai.They are saying that I have to pay 78500 rs. registration fees. Do I really have to pay this fee or will I get this amount directly and somewhere it is not a fraud

Its a fraud !

Why have they given you this money, Why do they love you so much !

Sir, I want 70 lac money from my relatives and friends in partly for purchase of house property. They transferred the money in to my saving bank account. Will I pay the tax of same amount? Any query ask by the income tax department to me.

no tax.

its loan.. not income

Hi Manish

My mother given a cheque Rs. 10 Lakh for gift , any personal use. I need a Gift Tax laiability.?

NO tax for you !

Can i need to submit proof on that?

Hi Manish ,

My wife has given 3 l to her sister as gift which her sister has deposited in her account .My wife has got this money from saving which she does from household savings over the years from monthly money which i give her in cash .

Now her sister has received income tax notice asking about this money . Will this come under gift ?

Yes this is GIFT .. Your sister will not have to pay any tax. However tax authorities might ask your wife how did she get this money and tax is paid or not. For that you should be ready !

Hi Manish,

Does the gift amount have to be reflecting in Income Tax Filing. If so, under what header/section?

Hi Abhishesh

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

A brother who is a citizen in US sends one lakh per month to her sister and Rs. 2 Lakhs to

his mother thru bank account. is it required to file a ITR for a mother and sister as it is a gift exempt under sec 56. if not filed, what are the consequences

Yes, they need to file the ITR. Even though tax will not be there, but ITR has to be filed and gifts needs to be mentioned!

Manish

My wife is working in abroad and sends me 50-60thousand monthly do I need to pay tax

No , its a gift

My sister’s marriage and my son’s Janoi was on 1st to 5th of February 2013. At this occasion we received big amount of cash as gift from our relatives in form of covers and chandla, can I deposit this amount in bank, is it taxable?

Yes, you can ..

Just make sure you make a list of all people and amount given by them.

I got money worth Rs.5,00,000 from my father in law in August 2015 on occasion of my marriage.I’m deposited that amount in September 2016 as fixed deposit.Is it taxable or not?How can I show this amount in my assessment.Plz reply.

Its not taxable, but the interest you earn will be taxable. You need to talk to CA on this .

Sir, I am working in private sector with annual income of 4 l per annum, for which I do pay the tax, but along with this my sister sends money Into my account twice or thrice a year(around 1.5 lacs)..I use this money to prepay my home loan and to invest In mutual funds.. do I have to pay the taxes for this gifted amount.. and also for this do I have to take any actions specifically.

No, you dont have to . It will be considered as GIFT

Hi Manish

My father sold a land for an amount and the market value is of 5 lakhs. Buyer would prefer to give it via Check.

This money is needed for my sister marriage

How could i exempt this money from tax, I heard about giving this cheque to my sister acc would relieve me from paying tax as a gift for her marriage

NO,

The amount you gift is AFTER TAX income, so when you sell the land for 5 lacs, first you need to pay applicable taxes and whatever remains can be gifted. I dont think there is any escape from this.