Everything you should know about Breaking your Fixed Deposits before Maturity

Today let me share the procedure and some points regarding the premature breaking of your fixed deposits. We have seen, that due to the ease of creating fixed deposits online, more and more investors create them if they are not able to find the right purpose of their surplus money and then in case of emergencies, they have to break their fixed deposits prematurely.

Procedure for Breaking Fixed Deposit Before Maturity

Now the procedure for breaking the fixed deposit is fairly simple and much faster. However, the whole procedure can vary across PSU banks and Private banks. The procedure can also vary if you take into consideration online vs. offline

When you create a Fixed Deposit or Recurring Deposit, the bank sends you Deposit Certificate or receipt after some days of opening it (In case of many PSU banks, you need to collect it manually by going to branch). This is just a receipt or a proof of deposit. Now you can carry this deposit certificate to branch and ask the bank official to break your FD, they should be able to process your request.

However in case you do not have the deposit receipt or have lost it somewhere, you don’t have to worry much, in that case, you will have to give them a letter or fill up a premature FD breaking form available at the bank branch, read further to know about it. Read about Requirement of Fixed Deposit on Opening Lockers here

Online Procedure of Breaking Fixed/Recurring Deposits

A lot of banks allow you to open create fixed deposits online from your net banking account. I have seen that most of the private banks allow you to break your fixed deposits online itself, all you need to do is go to “service request” section of your net banking and you will see a section where you can break the fixed deposit before maturity.

In ICICI, when you go to “service requests” section, on the right-hand side you can see “Fixed/Recurring Deposits related”, you can go to that section and choose “Premature Closure of Deposits” and then choose the FD/RD number and cancel it.

Your request will be processed in the next working day and you will get the money in your account. Check the screenshot below which shows you that.

Offline Procedure of Breaking Fixed/Recurring Deposits by visiting the Branch

A lot of PSU banks do not allow breaking your Fixed deposits or Recurring Deposits online. You will have to visit the branch itself and manually break it. Here is what you need to do

- Step 1 – Write an Application mentioning you want to break your FD/RD, mention the Deposit Number and account number where it should get credited. At times, you have to fill the premature FD Breaking form available at the bank itself. In almost all the cases, the fixed deposit is broken instantly, the bank official must be able to do it with a click of the button.

- Step 2 – Attach an ID proof (PAN etc). Private Banks have the Xerox machines inside the bank itself, so you just need to carry the original id proof and they will help you with the photocopy.

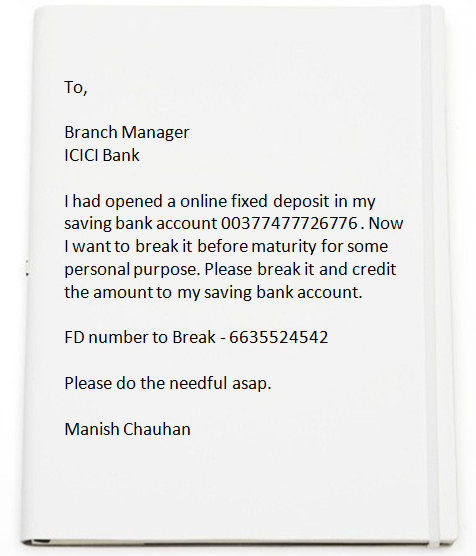

Below is a sample letter stating wish to break the fixed deposit or recurring deposit prematurely.

Do I need to pay fine on Breaking Fixed Deposits before maturity?

When you break fixed deposits prematurely before maturity, you will not get the same interest rate offered originally. You will get the interest rate which is applicable for the tenure you actually ran the FD for. For example, suppose you opened the FD for 1 yr originally, and the interest rate offered was 9 %.

Now if you closed the FD in let’s say 3 months, and if the interest rate for 3 months FD was 7%, then you will get only 7% interest for the period of your fixed deposit. Also in several cases, there might be penalty charges which are nothing but another reduction in your interest rates.

Like the bank, rules can say that if your FD was opened for 1 yr, and if you break it before maturity, you will get 1% less interest than offered. Many a time, there is no penalty for short-term fixed deposits.

Best practices before you create Fixed Deposits!

- If you already have few commitments in near future, avoid creating long-term Fixed deposits, create short-term FD’s

- Instead of creating one large FD (example 5 lacs FD), better create 2-3 FD of small amounts like 2 lacs + 2 lacs + 1 lacs. This way if you need a partial amount (let’s say 3 lacs or 2 lacs or 1 lac), you will be able to break the FD’s partially. It won’t affect the full amount

- You can take a loan against Fixed Deposit or overdraft against your FD.

Some Important points to know

- There is various kind of fixed deposits products, at times there are fixed deposits which also allow you to withdraw the FD money instantly through Debit Card itself, like for example Kotak bank Flexi-Deposit.

- Also, if your fixed deposit is under Sweep In Account, then you should be able to withdraw the money instantly without manually breaking it, read more about the sweep in accounts here.

- For some banks fixed deposits (private banks mostly), the some FD’s get broken if you issue a NEFT/RTGS transfer to some bank account. Like if you have a 2 lac FD in Kotak Bank (Flexi deposit) and if you transfer Rs 2 lacs in another account through NEFT/RTGS/IMPS, then the transfer happens and the FD is broken.

- In the case of companies with a current account, company seal will be required along with signatures of partners.

- In worst cases, your Fixed deposit breakage might require some approval from the main branch, but it should not take more than 2-3 days in worst to worst cases.

Share your personal experience about breaking the Fixed Deposit in the comments section if any!

August 12, 2013

August 12, 2013

I want an application format for withdraw fb before maturity

Its available in bank

i hv deposited at out of state bank as F.D. I want to cancel for the same in home state. is it possible.?

Hi prasad

I am not clear on what is your question. Please repeat it with more clarity

Manish

He/She is asking that if the person had opened a F.D. account in one state and wants to break it in another state of the same country.

Is it possible?

It will depend on the bank , if its linked with other branches or not. I think it should be possible at most of hte banks these days.

Correction , It will be Rs 402236/- only

I have opened FD of Rs 4020236/- on 25.09.2013 for a period of 5 y at 9.25% interest with monthly interest payable in SBI bank. Now I like to withdraw prematurely. How much i will be penalised or how much I will get back on withdraw? Pl help me.

Thanks

A K Banerjee

I have a fixed deposit in bank of india of ₹35,000. For 3 years. And now i want to break my FD .

It is only 2 months mature

And problem is that i want money tommorow only and also i have lost the FD RECEIPT

NOW PLEASE tell me how can withdraw my money urgently

I dont think it can be done this way. Banks have process and they need to be followed. Talk to bank one this .

pls sir… i just got a letter from my bank dated 3rd sept 2016, stating a roll over of my FD for 6% as against 9% which I initially fixed to for a period of months (10million naira) without any authorization from me what do I do in such a case… am not interested in that rate of FD. pls advice thanks

I am sure they must have given a choice to stop your FD’s in that case, so better stop them if you want to move ahead !

Hello sir, i went to icici bank to break my tax saver fd but they refused and said it cannot be done before completion of 5 years. what should i do

Yes, it cant be done !

When we want to premature one Fixed Deposit for Rs.100000/- at Allahabad Bank the banker ask one request letter with proper reason signed by two holders, discharge over back of the Receipt with two Revenue Stamps duly signed by two holders, inform us that the premature proceeds will transfer in the name of said two holders only through bank account or draft. Please inform RBI / IBA guidelines about premature payment of Fixed Deposit.

Not sure . BUt you can ask them about this and give a written proof on this . Mail them

hi sir one of my relative is opened FD in muthooth fincrop as a monthly interest scheme for 6 years, as on date 1 year is completed, now she wants go for premature withdrawal due to emergency, but the muthooth people says its locked for 6 years, till mature date we cont foreclose the FD. please please please tell me how to get money from them and whats the procedure.

Your relative must have read the terms and conditions of the document which he signed. Right ? Please check what is written there!

HI..

my fd is in uco bank and it is joint fix deposit .

….nd now it’s maturity is completed but its recipt were in custody of my partner what shall i have to do now…..nd how i can get my money without that fd recipt

Reciept is not mandatory always . Say that you lost it ..

sir,

then how can i get fdr without partner because i don’t have any proof regarding my fd…branch manager was try to get that to put my name…but nothng outcome was come…

You FD was created along with the account linked right. Its there ! .. Just that you dont have a document . Thats ok . Check with manager what is the way out !

sir, i find out my fd account number and details about fd ….

sir …in that fd first account holder is my grandfather and after that we both nd my grandfather was passed away he was no more in this world….sir ..now give me some suggestion what to do….for break that fd

First check about this with Bank. I dont think its going to be very straight forward to break that FD as it has your grandfather as a holder!

Hey I want to break my fd early due to some urgency but fd account was created by offline proces can I break that online??

You cant break that offline !

I have a fd of sbi which has been completed in 2012 after that it was not possible for me to renew my fd because I had shifted from that city. Now I am in another city and I want to break my fd please tell me the procedure.

Thats bank specific and you need to check with them only!

Hi sir,

I have a FD account in SBI for a tenure of 5yrs.(tax. saver FD account), opened nearby around jan’16,but due to some emergency reasons I want to break that account. Shall I be able to do this or not….

Yes you can do that, but then your income tax deductions will be reversed !

can you please explain me the process of breaking tax saver fixed deposit? i have urgent need of money and i have multiple tax saver fixed deposits which i want to break, (deposits opened in 2014,2015 and 2016) what is the exact process?

You need to check about this with the mutual fund company !

Hi Manish, is it possible to break tax saver FDs and NSC bonds due to some urgent requirement of money..?

Yes you can break it , but your tax deductions you enjoyed will get reversed

Hi Sir,

I have deposited 1 lakh in X bank , i have requested for monthly interest rate, FD was for 3 months, i would like to break it now due to personal emergency, Do i need to pay penality?

Not exactly, just that you will get less interest ..

Hi my father recently expired and he had few fd ‘s in sbi bank which we have settle but two days back got a txt on his cell about two more fd’s which ll be maturing on 2 and 3 May but I’m unable to find their deposit receipt with which I can withdraw as I don’t want to renew the fd . He doesn’t even have online banking so what can I do in this situation where I only got messages from bank on his cell regarding the fd and have no papers to show in the bank

Its fine if you have lost it, Check with bank on what needs to be done and what documents is required?

Sir,

I m a banker, i hv a small query , Can i accept an original FD receipt today from our customer which has be closed on fututre date. Or advice him to come on that specific date.

plz advice.

Hi pravin

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

i have removed some amount last month from my fd can i remove some amount of money in this month too

Why not !

Humne ek fixed deposit karaya tha 10 lac ka bank of maharashtra me.ye three year ke liye tha.isme monthly interst milta h but mujhe use break karna h .but bank refuse kar raha h .vo ise close nahi kar rahe h .please help me

Ask them the reason for it !

Dear Sir,

Pls suggest me.

I had open fd in sep. 2014 and maturity date was 31-3-2016

It has auto renew how can withdraw of this

Yes