Auto Sweep Account – Enable it in your Saving Bank Account

POSTED BY ON March 31, 2011 COMMENTS (558)

Do you have a Bank Account? Off-course you do! How much money do you have in your account? 5,000? 20,000? or a few lacs? If you have a lot of cash, lying idle in your Bank Account, and at the same time you don’t want to commit to long-term investment, you need to enable the Auto-Sweep facility in your Savings Bank account. This will make sure you earn good interest on a major part on the cash lying in your Savings account.

What is Auto-Sweep Account ?

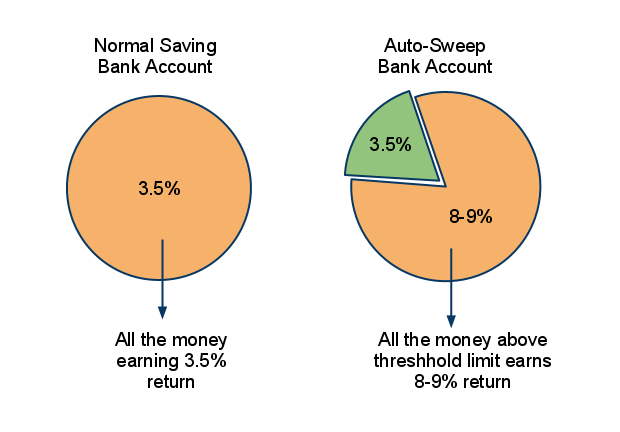

“Auto Sweep” is a facility which provides, the combined benefits of a Savings Bank account and Fixed Deposits. Auto-Sweep facility interlinks your saving bank account with a Deposit account and makes sure any extra amount lying in your bank account above a threshold limit is automatically transferred to Fixed deposits and you earn better interest on your money.

How ‘Auto Sweep’ works?

This is how Auto-Sweep works. You define a “threshold limit”, and money up to that limit will be in the form of cash in your savings account and any amount above this, “limit” will automatically be converted into a Fixed Deposit and you will start earning normal FD returns on that part of the money. At any point in time, if you need money more than is lying in your bank account, the money lying in the Fixed Deposits is Reversed-sweeped into your savings account and you can withdraw the amount you wish.

Example

Ajay opens a new Savings Bank account with SBI. He enables Auto-Sweep facility on his savings bank account and defines the threshold limit of Rs 30,000 . Now suppose he has Rs 10,000 lying in the bank, He will be earning normal 3-3.5% interest on this money. After that if he deposits Rs 60,000 in his account, his total balance would be 70,000. But as this is above his “threshold limit”, the extra amount of 40,000 will be converted into a fixed deposit automatically and start earning returns equal to normal Fixed deposits with SBI (for example 8%). This way he always has 30,000 in his account for his daily requirements, and he has 40,000 converted into Fixed deposits which again is available to him incase he requires it.

Now suppose he has to withdraw 10,000 from his account, he will actually withdraw it from the cash lying in saving bank , and his balance will reduce to 20,000. However on the other hand if he wants to withdraw Rs 50,000 . then in that case, as his account balance will be just 30,000, an additional Rs 20,000 will be auto-reversed from his Fixed Deposit and he can withdraw total 50,000 .

Opportunity cost

A lot of us don’t bother about how much idle money is lying in our account and for how long. This happens because we think “I might need it soon, so lets not commit to any investment.” But then, the money keeps lying in the bank for months and months and sometimes even years.

Suppose your account has Rs 1 lac for 1 year, it will earn 3.5% interest on it, which is Rs 3,500 for a year. However if you have auto-sweep enabled in your savings account with threshold limit of Rs 20,000, the additional 80,000 will actually be in form of a fixed deposit and it will earn an interest of 8% (assumption). In this, you will earn 3.5% of 20,000 which turns out to be Rs 700 and 8% of 80,000 which is Rs 6,400 , a total of 7,100 , which is almost 100% more than the first case .

A lot of people have much more than 1 lac in their accounts, not just 1 lac. You can earn some extra returns if you just enable auto-sweep on your saving account . So find out if your bank provides the facility, just do it, and get it right away!

Also note that different banks have different names for this facility. For eg., ICICI Bank calls it ”Auto Sweep” , HDFC Bank calls it “Sweep-In” account , and SBI calls it “Saving Plus.” . Here is a list of other banks and the name by which they call this Auto-Sweep facility (thanks for Gopal Gidwani for the info)

- IDBI Bank – Sweep-in Savings Account

- Axis Bank – Encash 24

- Union Bank – Union Flexi Deposit

- HDFC Bank – Super Saver Facility

- Bank of India – BOI Savings Plus Scheme

- Oriental Bank of Commerce – Flexi Fixed Deposit Scheme

- State Bank of India – Multi Option Deposit Scheme

- Allahabad Bank – Flexi-fix Deposit

- Bank of Maharashtra – Mixie Deposit Scheme

- Corporation Bank – Money Flex

- United Bank of India – United Bonanza Savings Scheme

Disadvantages of Auto-Sweep Account

Auto-Sweep has some disadvantages too. In general the interest rates of normal fixed deposit and FDs under Auto-Sweep are same, but some banks charge a penalty if the FD under auto-sweep accounts are broken before some duration like 1 yr and 1 day . But I think that’s fine. If not 8% , you will at least get 7%, still better than 3.5% .

Some banks are also known to give simple interest on the Auto-sweep Fixed Deposits and not compound interest as in case of normal fixed deposits .

Don’t over do it

While Auto-sweep is a wonderful thing for salaried class people who want to maintain liquidity, as well as want to earn more interest on their unused money, one should not over do it. If you are very sure that the money lying in your account will really not be used for long, better to use the normal Fixed deposit or Debt funds. Only if you are unsure of your money lying in bank and when you might need it, you should be using Auto-Sweep facility.

The way auto-sweep works, it makes it an ideal place to park emergency funds . So if you have kept 6 months of expenses as your emergency fund in Saving Bank, then you can enable auto-sweep facility and set threshold limit as 2-3 months of expenses, so that rest of the money can earn a better interest.

Comments: Did you know about Auto sweep account earlier? Do you think it will be helpful for you and do you plan to enable it?

How many sweep account sbi offers? i mean i already have two sweep account. now i have deposited some amount to the same account. but It doenst turn as sweep account. why? Is there only two sweep account allowed at a time?

Hi Hari

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir how much interest a candidate get on 4 lac rupees in 3 month in auto sweep mod account

Hi ashok kumar

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir i try saving account to sweep account online through Net banking but display this msg “There is no transactional account available with your username which can be converted into Auto Sweep for Corporate Salary Account.” please help in this regard.

This is complicated query , hence you need to contact your bank branch for this.

i received the same msg but activated sweep by going to requests and enquiries and then sweep creation for CSA

Hello Manohar, I am facing same issue. how did you resolve this issue?

If more money is deposited in the account where the auto sweep is already active, will the extra money also be auto swept automatically ? How will interest be calculated if the amount increases periodically?

What will happen if the additional amount (over and above the initial deposit) is withdrawn in between before 1 yr? Will it affect the interest rate?

Yes, it will be auto swept automatically !

Internet earned in auto sweep account is under TDS? Then can i give 15G/H for this tipes of acount? Is it possible or not?

Hi chandranarayan

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

will TDS apply on this?if yes,will form 15G/H BE APPLICABLE?

is there any limit for threshhold…?Suppose I want to set threshhold as 10/-.Will it be ok?

No, it has to be above a limit. check with your bank

Multi Option Deposit Scheme or auto sweep facility is not given to clients having their Saving bank account in CENTRAL BANK OF INDIA, I could not understand how this bank can over rule the directives of RBI.

I want to know is there any autonomy has been given to any of the banks to formulate such things.

You should then complain to banking ombudsman !

How can I view the Sweep Account ?

Hi Manish,

Thanks for the excellent post. Very clear and educational.

My query – SBI has created the Auto sweep accounts for me – without my permission – but I don’t mind that.

The excess amount from 25,000 in my savings is going into a different FD account every month and I now have 3 such accounts since this facility started in April 2016.

Is this what it should be? Shouldn’t it go into a singe FD account?

Hi anup

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

hi Anup,

Depending on your bank, FDs get created periodically(usually it is monthly for banks like SBH,SBI) and a separate FD account gets associated with each FD. This will make sure that when you withdraw funds in excess of your existing savings a/c outstanding balance, only the latest FD is broken(since interest accrued would be lesser than older FDs.

Hope this helps.

Regards

Chaitanya

hi Manish

i have 8-10 auto sweep account in SBI, during part term breakout or interest paid TDS has been deducted. i m not understand one thing when i pay income tax yearly, then why should i re-pay for the same in the form of TDS in auto FD’s. is any provision to save this deducted amount.

Hi Pankaj

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi Manish,

As you said there are some disadvantages of this facility. Can we transfer money from Auto Sweep account to Saving account? I am asking this because it cuts some amount from account if there is less money in Saving account.

E.g. I have 50000 in my Auto Sweep account and 1000 in Saving Account. If I withdraw or transfer 20000, it will cut 10 rs + 1 or 2 rs TDS from the amount.

Also, how to increase threshold amount for the account?

Regards,

Vijay

You need to check about this with the bank only because each bank has its own rules

Sir,

Suppose threshold limit is 25000/- for MOD with Autosweep facility in SBI. My expenses like ECS, credit card payments and withdrawing cash is 50,000/- then how will it work.

RK Singh

Hi rk

I am not clear on what is your question. Please repeat it with more clarity

Manish

As you give exapmple of a person Ajay. lets assume he withdraw a amount of 50000. now i am confused on that remained 20000 money. remained 20000 will be on 8% intrest or 3.5% intrest? what will be the a/c balance? or remained 20000 will be fixed deposit or not?

That remaining ₹20k will be considered as savings account balance n u ll get 3.5% return on that (as ₹30000 is the threshold limit).

And ₹20k will be now considered as savings balance.

Amount in saving account will be at 3.5% only

sir

Will my EMI ECS dishonoured if saving balance is not enough but MOD is sufficient to clear it.

E.g. I have SBI MOD @ 8% of 100000 from Jan upto Dec . In March my balance falls below 20000 which is my EMI .

Will the ECS be cleared from MOD?

how much interest will i get on that 20000 and the remaining 80000?

I am not very clear of the answer here !

Hello sir,

I need to ask you that if any bank interest which is received is not shown in pass book..can we ascertain it with the help of mod balance…that whether it has been credited in bank or not..?This is related to TDS work so please if you can help me out of it.

Hi Lakshita

Thanks for asking your question. However we do not have answer to your question.

Manish

Hi Manish,

Good explanation with instance.

I have a problem with MOD balance in my sbi account.

The available balance is rs.5000/- and my MOD balance is rs.1,00,000/-. Now, I want to pay my credit card bill of rs.65000/- through online by selecting the SBI in the netbanking. The transaction getting failed stating record not found. What could be the reason for this? I guess, the remaining 60k should be taken from MOD balance but its not happening.

I am not sure on this. You will have to check it with SBI itself

Rk, is your problem resolved by SBI? I have chosen auto pay for my bills. I’m afraid I might get into the same problem.

Lets say I have idle fund of 50K for 3 months…which is better Sweep account or Debt fund ???

Hi Manish,

Thats a great post and thanks for sharing it. Can we enable this Auto Sweep account with Salaried Savings account ?

Thanks,

Dinesh

Yes you can do that !

I HAVE IDLE CASH OF RS 70000 SO HOW TO ADJUJSTI IT TO AUTO SWEEP WITH SBII SAVINGS ACCOUNT.

AND ALSO GUIDE ME LIKE WHAT SHUD BE THE DURATION FOR IT

Hi AJAY

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Dear ,

Really you made a good explanation of this scheme. Thanks. I have enabled an auto sweep facitility in my SB account with SBI. But one doubt, can one change the threshhold limit later?

Yes, you can change the threshhold limit later if you wish to

Suppose i have enabled swwep in facility in my SB account with threshold limit of Rs. 50000.

1. Now if i require Rs. 70000 (i issue a cheque of Rs. 70000, then Rs 50000 would be taken from my SB a/c and Rs. 20000 would be sweeped in from my attached FD account. So after that my account balance would be zero right.. But as most banks have minimum balance requirement, will sweep in also sweep that minimum blalnce portion from sweep in FD account?

2. Suppose i have a SB sweep in account with threshold limit of Rs 20000. And I wanted to withdraw Rs. 25000 from my ATM withdrawal.. Would it also sweep in from FD when required for ATM transaction?

3. Also, I have an EMI payment evry month. Suppose I have a sweep in SB bank account with threshhold os Rs 50000. My current balance in SB account is Rs 25000. And My EMI is Rs 35000. When the date of EMI comes, would the system automatically adjust to pay my EMI with Rs. 25000 from my SB and and rest of the Rs. 10000 from my sweep in facility for EMI payment.

1. No bank forcefully keeps the minimum amount . SO yes, full amount will be deducted

Hello Sir, Thanks for information. I have a doubt. As you said, we can set a threshold value above which our money will be treated as a FD money. Then one who wants to use this facility, should set the threshold value as low as possible (for example Rs. 100) so that his maximum money will get FD interest most of the time. Am i correct? Or Do i have some misconception about this facility? Please explain..

Thanking you in anticipation….

Hi Sandeep

It works differently in all banks. I suggest put a mail to the specific bank where you have the account.

In PNB no correct informations are getting. Management to look it in to very seriously . Nex time I will give wide publicity

PNB SB A/C at Pashan Branch

Thanks for your comment SR Shinde

Sir,

I want to sweep my saving account of PNB. level for Saving balance is to be 5000 & fix deposit for sweep account is 70000. is this facility is available in PNB.

It would be there, but with some new name . Check with them

I was not aware of this feature..!! Thanks…!!

Hi,

My available balance is 16k and available balance is 5k, does that mean that the total amount in my acc is 21k..

Sorry mod balance is 16k and available is 5k

It means you can withdraw up to 5K and if you try to withdraw >5K, your MODS will break.

No , its only 16k

Sir i am not able to convert my sbi saving account to sweep account.

After click sweep account there showing a message ” there is no transaction account with your username

Please give me best suggestion

Thanks

Hi Raj

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi Manish,

I have savings account in SBI with home loan attached to it means, every month my home loan EMI will be deducted automatically from my savings account. If I put my EMI money in the account and enable sweep-in facility, whether that can be transferred from flexi FD to EMI automatically when my EMI date approaches??

I think dont do it . It will get complicated

What I can withdrawn money anytime through atm if my account is auto sweep account and if having money also available in my account ? Sir please given information me !

Yes

I have an auto sweep account with SBI. How do you find the total balance in savings account? And also, beak up of how much is in sweep account and how much in savings account?

Hi Shishir

You need to get the records and find out yourself , There is no auto mated way of doing it

On onlinesbi.com login into your account. Go to account summary.

In Transaction Accounts “Click here for last 10 transactions” then MOD Balance will be your total AutoSweeped Money

Also in Deposit Accounts the AutoSweep and Normal FDs booth are displayed.

Does federal bank provide sweep in facility ?

How much is the interest rate for the amount that gets sweeped in SBT?

Hi AJIN

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Dear Sir/Madam,

i am a Salaried Person with Montly income of aorunf 25000 and 1 lakh maintained in My Sbi Account. I will have loan amount of Rs 100000 in my Account. I am interested in Converting into Sweep Account. So is it Benificial to Convert my Account into Sweep in as i have to Use Most of the Loan amount.

Pls Suggest.

Yes, you can do that

Dear sir i have rs 80000 in my sbi saving account i want interest on it but i cant do fd of it cause in some emergency sitution i need it alll money so wht shall i do ? can i convert it into sbiplus account ? and can i get all money from sbi plus account when i need it in emergency setuation? so plz guide me i m so confused sir

Its better to make 50% of it in FD and rest in cash in saving bank

Thankyou it was really useful to know about it… Intrestingly the disadvantageous part

thanks for the info..

i want to know is there any acknowledgement for the amount that is available in fixed account???

as one cant remember the total amount that is getting sweeped///

I am not sure on that

Yes, there’s an acknowledgement for the amount that is available in fixed. It is shown in passbook separately with other liquid balance. For example, ” Closing balance 25752 and 5,25,000 in mods / sweep / FD.

I OPTED FOR SAVING PLUS ACCOUNT. AFTER ONE TIME SWEEP TRANSFER MY MONEY IS NOT BEING SWEEPED TO SAVING PLUS ACCOUNT. BRANCH MANAGER SBI. BHOJPUR COLONY, RAM LAKHAN PATH, NEAR BY PASS ROAD PATNA IS SAVING I CAN’T DO ANYTHING. Where should I contact for help

Hi Ramakant

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Do you have any idiea about the facility providing by SBI? As i went there to inquire , but still not got clear picture, though now i am clear very much after reading this article . I just want to know about the SBi service.

Hi Nitin Singh

I am not aware of the exact name they use. BEtter check their website or talk to customer care. In worst case, find out from RTI !

Hi Nitin

I found this service also in SBI.

If you have net banking in your SBI A/C you can activate this facility online no need to go to bank.

For this logon to your sbi and go to fixed deposit tab and then you will found Auto Sweep Option

click on that select your account and enter OTP & fallow next steps as you wish.

Hope this help you……….

I want to know like i hav a bal 50000. Then sbi sweeped 25000 then the bal was 25000. Now i withdraw money all. But my account show nil balance. When and how my money will get into my account back?

I think the moment you try to take 50k , it will be in your bank account

Manish

in which bank there is minimum saving account deposit to maintain this feature

I think any PSU bank will have a lower limit

in SBI my threshold limit is 25000. So i want to know that whenever my balance is crossed the limit then the extra amount is sweeped? or after a particular time the money was sweeped?

I am not clear on your query

Either on month basis or week basis. Whichever you opted for while opening this account.

can i get a separate passbook for the auto sweep account in sbi?

Only SBI will be able to answer that

SBI – Does “saving plus” a/c passbook says – Saving Plus ?

As I have regular saving a/c with SBI. Opened new saving plus a/c too.

Both passbook . 1st page , a/c type says – Saving a/c

Doesn’t it should say “Saving Plus” in case of saving plus a/c ? Also since it is autosweep , should it open FD / eTDR automatically ?

Hi Abhi

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish

Thanks Manish.

For my SBI saving plus a/c. autosweep worked automatically.

Indian banks don’t differentiate a/c type on passbook. There should be column on passbook where it should clearly say a/c type – regular , premium, saving plus , titanium etc etc ..

Glad to know that Abhi ..

Hi Manish,

Very useful information. I have few questions reg this MOD and when I was searching on google I got a chance to visit your site. I hope u will be able to help me in understanding these MOD in a better way.

I am holding a account in SBI which is a salary account.

First thing, the bank didn’t even inform me about this account and on a fine day I saw that there is some discrepancy with my amount. Went online and saw that the 15000/- was moved to a different account. I called the cust care of the bank and when enquired they said that it is a MOD account without giving any further information they closed my call. Now when I was reading the article and few comments, I see that a form needs to be submitted (15G 0r 15H). Can you please help me understand what is these form and is these MOD really useful or will I face any consequences when I really need the money back.

Please Yaar, help me in understanding.

Thanks,

Chauhan

Hi M Hari Krishna Chauhan

Please read this on Form 15 – http://jagoinvestor.dev.diginnovators.site/2011/06/avoid-tds-form15h-form15g.html . I am sure this will help

HI,

FIRST OF ALL THANKS FOR THIS VERY USEFUL ARTICLE. I HAVE 2 QUERIES –

1. EVERYTIME MY A/C EXCIDES Rs.10,000/-, A NEW E-TDR WILL OPEN. SO, WILL I HAVE TO SUBMIT SEPARATE 15G / 15H FOR ALL E-FD A/C ?

2. MINIMUM DAILY BALANCE SHOULD BE Rs. 10,000/-. SO IF I HAVE ,SAY Rs.1,00,000/- IN MY MOD A/C AND I HAVE Rs. 5,000 IN MY NORMAL A/C FOR AN ENTIRE YEAR, WILL I HAVE TO GIVE THE PENALTY ?

PLEASE CLARIFY .

THANK YOU.

Thats the problem with auto sweep in account

Manish

what number of transaction(withdraw) is allowed in saving account per day or per month @ SBI as i do mobile top up a lot using net banking sometimes 2 top up a day?

There is no limit on the number of transactions !

thanx manish!

what can i do for more interest want in saving a/c or f.d

If you want safe returns, then nothing better than FD .. else you can put money in equity for long term !

Very informative article Manish. It will help many.

This will help many individuals who usually keep more amount in Savings account for short term needs. This is a good option for keeping the emergency fund which ensures better return and easy liquidity using the ATM card.

Thanks Melvin !

what is the name scheme for auto sweep FD in BOB, Dena Bank and Canara bank?

Search for it on google

Thanks for the detailed explanation about the Auto Sweep functioning in banks, because this is the first time i got a message from banks that my account was debited and the transfer is somewhat sweep tfr in sbi. at 3 o clk early morning. i was shocked , because i did not done any transactions on that day. i was confused and strucked for a while .

after that i thought , y dont we search about the problem in internet and browsed . nw i am clear about the auto sweep function in banks.

Thanks for the detailed blog

Welcome Arun !

Very nice article Manish.

I have enabled MOD in my SBI savings account. Sweep in works absolutely fine. The problem is with the sweep out i.e money above a certain threshold being converted into an FD earining 9% p.a. I have 35k currently in my savings account, rest of 1.2 lakh is already in mod. I have no idea when the bank will automatically sweep out 25k from my account into MOD account? I have called up customer care and they say they have absolutely no idea about the dates when sweep in happens. But he told me thatthe threshold amount is 10k. Do you have any idea about the date when the excess amount in my account will be swept into my MOD account? I read on a site that it happens on the 30th of every month, another website says 15th and 20th of every month.

Thanks.

I have no idea on that Rishabh !

Hello,

Very knowledgeable information

I want to active sweep in facility in CANARA BANK. How this possible. I contact to bank but bank not provide me satisfactory solution.

Regards,

Pravin

Use RTI and ask this question !

@Marshal/Manish,

I have recently converted my SBI account to SBPlus, now every Wednesday, They will sweep excess amount,

Now problem is in internet banking under deposit accounts i can see only first two SWEEP DEPOSIT Accounts, Although i have total 4 Sweep deposit a/c s now, Visited several times to branch but seems they are not able to help.

Was this the same case with you, if yes any settings in onlinesbi which hides it ?

*In main SB account i can see total MOD balance but not separate SWEEP ac/s

Please help.

As its with SBI , you can take help of RTI !

Very Informative Article. Good Work. Thanks !

I want to activate that to my existing account. I want to know what if the total amount above threshold level is with drawn after 2 months. Will the interest credited?

What are the charges for Sbi for mod, if any.

Hi Bala

There are few things, which you can get info about only from the customer care of SBI

I already have a saving bank account with HDFC Bank. Can I take the facility of auto sweep with my existing account or I would need to open a fresh account.

Yes you can, contact HDFC bank and talk on this .

Lets say , I opened a MOD (100000/-)in SBI on Jan 1 , 2013 for 1 year.

I withdrawn 50000/- on 28 of march 2013(after 3 months).

I withdrawn 30000/- on 30 of june 2013(after 6 months).

I widhrawn 20000/- on 30 of september 2013(after 9 months).

Amount in first 3 month , 100000/-

Amount in 4-6 months, 50000/-

Amount in 7-9 months,20000/-

Amount in 10-12 months,0/-

How will they calculate interest for this premature MOD?

When will the interest credited back to my Savings account(only after one year from the date of joing or after 9 months or after each transaction from MOD account)?

Hi Prashanth

This question is for our forum http://www.jagoinvestor.com/forum

done.

Actually my bank took 36hrs to convert a/c into mod , now i can see my mod balance.

I have applied for SBI MOD at branch on 24/03/2014 but till now i cant see any MOD balance on account statement page online . I set threshold limit 5k and my current Saving account balance is 23K.

please help regarding this issue.

but my account description changed from SBCHQ-SBP-GEN-PUB-IND-NONRURAL-INR to SBCHQ-SBP-GEN-PUB-IND-ALL-INR but mod balance is 0.

BEtter open a question thread on our forum – http://www.jagoinvestor.com/forum

Hi,

Its the first experience with saving plus account in sbi, with min threshold of 5k.

I had 35k in my account on 28 feb.

But today on 1 mar 14, it is main bal INR 5598. and i get MOD balance of INR 30k.

I am looking for the following answers in context of SBI bank.

1. with main Bal 5598, MOD bal 30k. If i deposit 4k. Will this be credited into MOD or main bal?

2. with main bal 5598, MOD bal 30k. If i withdraw 4k, will this be debited from MOD or from main bal? If from MOD, then oldest FD(of 10k as mentioned in sbi website) will be broken OR the latest multiple FDs (of 1k as mentioned in sbi website) will be broken?

3. with main bal 5598, MOD bal 30k. If i withdraw 10k, Which FD will be broken? latest one or oldest one? If there is any penalty for it (as withdraw > 5k). If so what is the panalty?

4. with main bal 5598, MOD bal 30k, if i withdraw 33k, What will happen to my account? what will be main bal and MOD bal? Will there be any panalty? If so what will be the panalty and for how much period? How much period will be given to me for deposit more than 5k and avoid any further panalties?

Thanking you.

Waiting for your answers on mail or here.

Ramesh

Hi Ramesh

Please ask this on our forum http://www.jagoinvestor.com/forum

I recently had a shocking experience with SBI Saving plus account. A fixed deposit of some initial amount(I don’t remember what was the exact amount) was auto-generated in my saving plus account. I kept on withdrawing money from it. It’s maturity was on today , 1st March, 2014. The amount remaining in this FD was Rs 1000 and the interest which I was going to get was Rs. 90. But, after the expiry, only Rs 792 were credited to my main account. It is showing Rs 382 as the tax deduction. I saw it through internet banking under Closed accounts section. I don’t understand how can tax of Rs 382 can be deducted on Rs 90 interest?

I live in a different city from the one I am having this account in. So, I can’t go and ask about it in the branch. Can anybody explain what might be the reason behind this deduction?

Thanks,

Sumit

Yes, this is weird . its not right to comment on this without knowing more details. Its best to talk to customer care on this and talk to them about the reason. Let us know what they say ?

Iam able to withdraw money gone into auto sweep account through ATM. But when i want to do internet transaction /payments etc the money in auto sweep account is not available so i can’t make payment more than that is available in the savings account, even though i have balance kept in auto sweep account. How this issue can be solved?

I dont think that will work . You can only withdraw from ATM for this bank of yours . Can you check with bank on this

Hi Manish,

I went to deposit some money in SBI and the manager who works there suggested to convert it into savings plus account and he did all the formalities. While noticing the procedures he did I found he added two threshold limit, one for Rs 5000 and the other for Rs 1000000. Please clarify as to why there was two threshold limit if you have any idea about it.

And also I told him that all the money I deposit in this savings account is from my salary and I have TDS at office, so I don’t want any tax to be deducted. The manager gave me FORM 15-G and asked me to fill and give once the savings plus account is activated(he said if I fill that form and give they will not take any tax and just see if we pay the taxes from our PAN number) he suggested me to submit the FORM 15-G. This form should be submitted every year April 1st week to avoid tax deduction it seems.

Great work done by you in educating people about financial planning!….

Thanks,

Abinaya

Thanks for sharing that. Yes now no tax will be deducted directly from bank account.

I have no idea on those two numbers filled by him at this moment, its good to get it clarified it from him itself !

If i have opened a RD in my account, apart from the sweep facility turned on, and there is a standing instruction for RD, but there is not enough money in my account. Will the money be reverse sweeped into my account so that the RD premium can be paid? How does SBI handle this?

I am not sure on this , its very specific query for SBI .. Better ask it at their customer care !

Hi,

Yes bank has enabled sweep in facilty on FD. Like if one does an FD for 2 years for 2 lakhs and after 1 year is in need of 50K. So sweep in facilty can be enabled online on FD and 50K can be withdrawn from it (Interest on 50K will be for 1 year and 1.5lakh will remain in fd). This could also act as a emergency fund as in 5-10 mins i was able to withdraw money from my fixed deposit.

Does any other bank gives this sweep in on FD?

Which one is more beneficial opening a saving account and enabling auto sweep or opening a FD and going for sweep in case of emergency ?

Hi Manish

If YES BANK has this facitlity ,then I think its a good idea to open a FD and enable Sweep in with that, Note that consider this as your emergency fund only 🙂

Manish

HI,

I do not know how to set the threshold in SBI. I tried to make Multi Option Deposit Scheme in SBI and it is asking amount..I thought it is thresold, but after making the deposit, it is showing as Principal amount. Whereas i have more than 80k in my SB account.

So, please guide me how to set the thresold in SBI..

Hi Ashok

I am not having SBI account, better put this query on our forum so that other SBI account holders can help you – http://www.jagoinvestor.com/forum

How can I set threshold limit using SBI Internet banking ??

Hi Manish,

Thanks for this blog… a really helpful one for me. I have converted my main savings a/c to an auto-sweep a/c after reading your blog. Can you clarify me the following please:

1. I have set a threshold limit of 10,000/-. My savings balance is now Rs 5000/-, and the sweep-in a/c has balance of about 50,000/-. Now if I withdraw Rs 15,000/- then my savings a/c balance will be 0/- and the Fixed-deposit a/c will be debited by Rs. 10,000/-. So will the remaining 40,000/- in FD a/c, go on earning interest at the FD interest rate?

2. Will my savings balance increase in future? If so, how?

Yes, in most of the cases this is what happens . 40k deposit will again be there and earn FD interest , but you have to enquire at bank level how they handle it .

Note that all banks deal with this concept differently at minor level

Manish

Thanks for ur reply. Thanks a lot. Well, should I treat my mod a/c as an investment in FD / or it’s a basic misconception?

The auto-sweep a/c interest will not enjoy 80TTA Tax benefit, whereas, to get benefit under that section, interest rate will be much less [S/b a/c rate ~4% in SBI]. So how should I make the trade-off during threshold value decision?

Well, I want to invest for wealth creation. Pls let me know what should I consider, and how can I build up a good investment portfolio with minimum risk factor.

Yes its true that you will not be able to get the exemption , but then even with tax your returns would be close to 6.5% in the FD

Thanks Manish! Your suggestions and way of speaking is superb!

I want a chat session with you, so that I can ask you regarding how should I build my investment portfolio. Please let me know how and when can we chat.

sir,

i want to know that any demerit or problem will occur during withdraw and once we withdraw all amt. then again when we deposit it then auto sweep will active automatically or not…..!!!!!!!!!!

Yes, it will get created again even if you have withdrawan it once !

So what is the banks profit in this ?

They get FD ! . they can use the money to lend others .You need to understand how banking works !

Thanks Manish 🙂

Hi Manish,

Thanks for this info.

Unknowingly I had enabled this option while opening my SBI account. I was shocked to see my balance suddenly going away and that’s how I reached this blog (Thank you so much for helping people).

But seems now I cannot move the fund back in my regular account via netbanking (in case I require to transfer an amount online to somebody from my SBI account). I raised a ticket with SBI and they are asking to contact local branch!

My questions:

1). Can I move back the fund online back to my regular account? (The e-FD options says there are no FDs for premature closure).

2). If I issue a cheque to someone will the bank be paying the amount (from my total actual deposited fund)?

Thanks in advance…..

I think you cant break it online (only offline) , but if you issue a cheque or want to withdraw the money through ATM, then its possible .

If I had 3-4 FDs in form of MOD, and I withdraw some amount then which FD will break ?? The first one or the last one ?? as already the amount of interest accumulated in the first one is higher….

It should be first one logically

Hi,

Do MOD scheme is only applicable to Salary Account Holder in SBI. Cant it be open by Saving Bank Holder

Regards,

Pawan

YEs, you can open it

Hi,

Lets take a example : I have 50,000 and the threshold limit i have given is Rs 10000, now the remaining 40000 will be treated as FD. Now will i continue to get interest of savings account of Rs 10000 and suppose 1 day i require Rs 45000 then as said the FD will not be applicable so after that will i continue to get interest rate of saving account or not.

Regards,

Pawan Kumar Shah

You will get FD rates for the time its created as FD and when it gets broken, it will get Savnig rate

Very informative article.

I am unable to find details about it after logging in to my icici personal account.

Anyone with an acc in ICICI pls tell me the path for available options for autosweep.

rgds,

Anurag.

Talk to customer care on this

Really these are valuable information for common people. Many persons are not aware of these type of information.

Thanks

Hi Manish,

That was again a neat and detail post by you.

I would like to open savings account in Yes bank and get a sweep-in option attached to it. How exactly my sweep in option works if i give threshold limit of 1 lakh, consider i am having 2 lakh in my account (above 1 lakh, they are giving 7% interest).

i am little bit confused as to opt for sweep in to get 7% interest (min) or to park my amount in savings bank itself to get 7% interest (guar)??

please guide me in this context.

In case of YES bank , anyways you get 7% interest I believe ?

So in this case, bank savings interest is best when compare to sweep in option correct Manish??

Yes, it might be a little less, but worth!

Hi Manish,

I have SBI saving+ a/c and my auto swap has happen exactly 23months back. Now, I have withdrew all my money after 23 months.

Bank has calculated interest of 8.5% for 1st year and the same has been credited to my account after completion of 1 year, however the rest of 11 month the interest paid was only 5.5%.

I think I have been cheated by this saving+ ka thing…because my money was there all 23 months with the bank and I should have been paid interest of 8.5% for entire 23 months ..what is your opinion on this?

Thank You..

Can you check if this was a yearly FD which gets auto renewed ? Because if thats the case, then for next year it was not FULL year. Check for the explaination by bank on this !

Thank you Manish for prompt response…

Yes, It was yearly FD which got auto renewed last time once the previous year was completed. Now, I understand why it was not considered as full year. But I wondering how this has happened because I have not given any guideline or instruction of one year FD.

But definitely, I will check this with the SBI home branch .

Thank you for help..

Manisha

It mush be DEFAULT 🙂

i have a/c in sbi and want to start this scheme.for this i need other new a/c or this facility can be start in old a/c?????

It can be started in same account. BUt before anything, check is SBI has this !

Hi Manish,

your explanation gave me a very good idead about mod balance and saving plus account but i have one issue to discuss

i have opened a saving plus acccount last month with 75k, now its having 50k, with mod balance showing 50k, now i have deposited 20 thousand into my saving account but it is not seeping to FD as my thresold amout is 5k only as they said when saving plus account opend.

does it takes time to seep to FD from saving or i need to ask to customer care?

thanks

Hi Amit

this is very much an issue which only bank can explain . Kindly meet someone in bank and tell them you need answer else you will move to banking ombudsman

Hi,

how to transfer money from the sweep account to my savings account.. i want to pay online bill.. so i need more money than i have in my savings account.. in this case how we can use sweep amount..

You will have to break your FD in that case !

Autosweep scheme is a very good scheme

Hi Manish, It was nice article. I am using this facility and earning interest so need to pay tax also, so I searched many places that how should we pay tax on below case.

I have salary account and after threshold limit all amounts are going into auto sweep FD. So whenever I am withdrawing amount more than threshold amount then by default my Auto sweep FD is getting break and then I am getting interest for the days money held at bank(with penalty) and even they are deducting 10% TDS also.

Now here is my query I have to pay the remaining 20.9% tax (I am in 30% bracket). But from April to Jun suppose I get only 4000 interest then do I need to pay any advance tax on 15th July and if yes then how much? Should I pay advance tax for projected interest (assume 20k) for financial year or only for 4000/-

Thanks in advance

Surya

You should open a thread to discuss here – http://www.jagoinvestor.com/forum/

Hi Manish,

Your article was simply written for something which all bank account holders should be aware of. I came here as I was looking for more info on how this works… {you know the lack of trust when something seems simple.. you wonder how the bank makes money on it… hence the lack of full trust 🙂 }

So, I thought I will add another question to this, as I couldnt find it in the comments too…

Scenario….

I keep Rs 1 lac in my Savings account, which another Rs 1 lac is in ‘sweep-in’ FD of HDFC … 6 months latest, I withdraw 1.5 lac from my savings, so Rs 50000 gets ‘swept-in’ and now I am left with Rs 50000 in my FD… As I understand, Rs 50000 (remaining) earns a full FD interest (say 8%). While the other Rs 50000 (withdrawn in 6 months) earns me either (a) no interest , or (b) savings account interest, or (c) FD interest rate

.. I am keeping the case of the penalty charges separate.. but if we include that in the scenario also, how will this plan out?….

Note – I am thinking of the Sweep-in facility, but I know I will have complications in opening it up through netbanking, coz my account is held jointly. Till then, the clarifications will help.

Looking forward to the clarification….

Raghu

Hi Raghunath

This needs discussion , please open a thread on our forum – http://www.jagoinvestor.com/forum/

Is there any restriction for a minimum balance one must have before opting for auto sweep? If so what is the minimum amount? During this transaction what amount would be showing in SB pass book when I am having total balance of Rs.80000/= and leaving Rs.5000/= rest I opted for auto sweep.

Pratap

It can be told to you by your bank only. different banks have different limit

@ Nanda & Swathi

You can not do it with internet banking.You must visit your home branch and ask for auto sweep application form.In that form those two data is to be filled up.You have to submit it to that branch.

Thanks

Pinaki

Auto sweep is a great option to earn more interest . and also thanks for explaining it in a very simple manner

Welcome Rajesh

Hi Manish,

Nice article. Auto Sweep-in is an excellent service , I was not aware of it.

Thank a ton for this post. I have a question here…

Can an EMI payment(through ECS) can auto reverse the amount from FD or the emi payment will be dishonoured due to insufficent balance?

Thanks,

Sachin

I am not very sure on that Sachin.. you will have to enquire this from bank itself .

How can i set threshold amount and sweep date in SBI.

kindly please say the steps.

Thanks!

Not sure of the exact steps. did you find it in internet banking or not ?

no i dint find it.

i need to set the threshold amount and date.

Please can you say how should i do it?

Hi Swati… Did u find out the solution for this??…

I am also waiting for the answer…

Kindly lemme know if u know the steps for setting threshold limit

Thanks a lot

Thanks very much for this informative note.

I was searching to know about the SBI Savings Plus account and i found this very useful.

I have a doubt.

I have started a SBI Savings Plus Acc.(Salary Acc.) and set the threshold to Rs.15,000. and sweep time as 10th of every month.

My question is that, When will the bank calculate the surplus amount that is to be tranfered to FD? As soon as I deposit more money than threshhold limit (in my case money above Rs.15,000) or only at the auto sweep date(10th of every month).

What is the significance of this auto sweep time?

I think it will happen as soon as your balance goes up ..

So is there any importance in the sweep date??

It is asked in the account registration form rite?

It might be the date when the actual creation of FD happens

It happens on sweep date.. not when balance goes above threshold

In your case the money will be swiped 10th of every month at 24:00 hrs.

I want to start this facility for my PNB acount . I checked this link

( https://www.pnbindia.in/en/ui/PNBPrudentSweep.aspx ) for information but couln’t get it. Can you please explain by an easy example. your help would be greatly appreciated 🙂

What point are you not getting there ? I think its clearly said that above 40k , it will be converted into FD’s .

How do i make an accounting for Auto sweep transaction in my books.?

pls suggest some guidelines

thanks in advance

Yes that will be a little tough , just track your monthly statements !

Sir,

My Saving Bank Account No. 30840499305 present in SBI, Lohaghat, District Champawat (Uttrakhand). It is therefore requested to provide Auto Sweep facility of my account please.

You have confused us with SBI bank I guess , we are not bank 🙂

And you should not disclose your Account Id like this publicly.

Thanks Manish for this great article.

I had my SBI savings account converted to “saving plus account”, back in 2009. My experience with the facility was quite good as I generally deposit in the account, and withdrawals were few and far between and through cheques.

Problem starts from Feb 2012, when the auto sweep stops suddenly without any notification. I did not tried much to restart it, as I can create FDs through net banking. But recently when I made a written request to break the linked FD accounts the problem resurfaced. The bank officials are saying that, they are trying to resolve it and have sent the matter to “data center”, but were unable to provide any timeline.

open a ppf acount

Ask them a deadline after which complain to banking ombudsman !

@SujabB

The timeline and experience you shared exactly matching with mine.My branch also not able to restart it.But they will not accept that it is their fault.They repeatedly asked me for address proof showing ridicules theory that if KYC is not proper auto sweep not possible.Even after multiple times of submitting the document they could not start it.Every time I visit they will make storm with keyboard and tell from next threshold date it must happen. As usual one month will pass with no result. By this way one year is gone.One of my co-worker complained it from SBI site. After one month SBI closed the complain without resolving it.

I asksed PNB & BOB for opening auto-sweep accounts but they says that they have discontinued those type of account. Only ICICI and HDFC can open this kind of account but with TnC way impractical.

With this experience I am getting a signal that banks are intentionally discouraging autosweep in non transparent way.If it is their policy they should disclose it also.

Requesting Mr. Manish Chauhan to please investigate and update this topic if required.

Thanks

Sir,

My Saving Bank Account No. 30446182309 present in SBI, Kathghat, District Moradabad (UP). It is therefore refquested to provide Auto Sweep facility of my account please.

How can we help you , we are not the bank !

Might be helpful

http://wealth.moneycontrol.com/yourstartupkit/bank-deposits/making-your-savings-and-fd-account-flexible-/10881/1

Hi Manish,

Thank you for your simplest explanation after reading your article I have changed my SBI savings to SBI savings plus which means MOD in SBI this month. I have given threshold of 8000.Bank has confirmed that it is done.I have following queries.

I want to know how can I check the same online?Still I cannot see any new account created.

Also please let me know can I transfer funds from that account to own accounts or other accounts online in case of urgency?as we have option to withdraw anytime the all amount from ATM.

If I withdraw my MOD will continue or will be closed?

Thanks in advance

It will still continue if you withdraw more money in emergency ! .. For more details , better read all the comments , its already discussed somewhere or just start a new thread on our forum – http://jagoinvestor.dev.diginnovators.site/forum/

what is the difference between mod account and savings plus account in sbi

Better ask it here on http://jagoinvestor.dev.diginnovators.site/forum/

I have a 555 days FD which is maturing next month. How can I know if it will be 1 time investment or auto renewed for another 555 days again?

You should have choosen that at the time of opening. By default its just one time and not auto renewal . Talk to Bank customer care , they will tell you about this !

please send me a link about how to generate auto sweep facility in state bank ok india online

Which link ?

Hello

Today I called in ICICI to enable autosweep in my account & was informed that ICICI has discontinued this service. This service was introduced in 2008 & is now discontinued. Executive informed me that they have introduced a new scheme money multiplier instead of auto sweep, Which is similar but we have to create temp. FD’s manually (Yes, Its a turn off) I didnt opted for that, because I felt creating FD manually everytime I have surplus is too much.

More info is here http://www.icicibank.com/Personal-Banking/account-deposit/savings-account/moneymultiplier.html

that might be the latest development ! , thanks for sharing it with all of us !

Hi Manish,

Tell me about re investment plan.I have seen this chart in SBI.ex Rs 100 6 months 103.5306.what does it mean?If I want to invest Rs100000 for 6 months.what will be maturity amount? please clarify.

Bikash

What plan is it , kindly explain a little detial

Hi,

I have seen the RD do not attract TDS by banks. some banks offering variable RD. if i give the 1st installment of Rs 300000 and then Rs 100 in each month will it attract TDS. Is is better than to invest Rs 300000 in FD to avoid TDS? thank you

I dont think variable amount is possible in RD , for FD TDS is always there if your interest is more than 10k in a year !

Hi Manish,

Variable RD is possible in some banks like UCO, INDIAN BANK etc.In UCO bank the scheme is known as UCO SOWBHAGYA RECURRING DEPOSIT SCHEME. ?Now you please clarify your answer.

Ok , never knew that ! .. thanks for that information !

Hi Manish,

I have opend a FD of Rs 150000 at 9.75 interest rate for the period of 1 yr at the middle of a financial year and opted for quarterly interest payment to my SB account.That mean i ll get two installment of interest payment and that ll be less than Rs 10000 in the current financial year.will the bank deduct TDS in this case?

No , it will not 🙂 . good tip !

Thanks for posting the article. However when I checked with my Financial advisor he adviced me to go for IDFC liquid funds rather than the sweep account as it gives better rates plus tax free and easy to transact also(just by sms). Can u throw light on this?

Soma

Yes he is correct in a way .. Note that this article just gives information , its not a comparitive article

Dear Manish,

Return from liquid fund is tax free? Pls guide soma properly.

No , its not like that .. Its taxable

I have heard about this and was not aware in details.

This article is very much helped me to know more about auto sweep.

Yes I will enable this option for my account by this week end itself.

welcome 🙂

Dear Manish,

I have SBI Auto sweep Saving account. I have a query regarding account balance.

As My MOD balance is showing: 390000 rs and my account balance including all deposite account is 324425 rs. How they are not same. And i have even calculated and add the intrest as well. But still the figure is not matching. plz reply.

thanking u

amit baheti

Amit

Can you explain in more detail .. I request you raise this query on Forum : http://www.jagoinvestor.com/forum

Hi Amit,

i am also facing the same.My MOD balance shows 20k more then the sum total of all deposit and account balance.

if you know can you let me know how system calculate MOD balance.

Regards,

Pankaj Sharma

Dear Manish,

I am banker and impressed on your suggestion regarding solution on banking problem is very much attractive.plz continue in this way as u r having .

one thing can u provide me ur cell no when i will be in need i may contact u,

thanking you

p k singh

Thanks

Hi Manish

Thanks for the previous answers.

I have a “minor” account for my daughter and it is operated by me.

Can I enable Auto-Sweep (Multi Option Deposit Scheme) in Minor acct?

Also I’m not able to create eSTDR/ eTDR for the Minor acct. Can you help me?

-Sheeba

There are a lot of restrictions from banks on minor accounts , whatever banks say about your question should be considered as FINAL .

Hi Manish,

Thanks for this beautiful article with a noble cause of educating the normal savings account holder about auto sweep facility. In the comment section there are some geeks challenging the efficiency of this product comparing them with MFs (non equity) and more attacking you as less known person. Hope and believe this will not bring you down and keep you away from good initiatives in future.

Let me share my experience about auto sweep account in SBI. I am using it since 2008. So far it was fine experience. I find two issue with them.

1> By default they will enable it for 12 months. There is no option ( though in papers) to me to select activation period. After using it for 4 years in different interest rate scenario now I can guess the reason. You have to apply for renewal every year. If interest rate is low they will kindly approve. If rate is as high as 9.25% (as it is right now) they will not reactivate it. Surprisingly they state ridicules reason for this (obvious all verbal) like a> system is not accepting right now. B> your KYC is not proper (even after submitting all document three times) c > you must have another SBI account in India where same PAN no is given. I came to know informally (from bank only) they have management directive to discourage customer to use auto sweep.

2> They will never update 15G form in system. So whenever FDs breaks they will deduct tax. In last three year in these way lot of tax is deducted at source. In my case it counts. Upon asking they are telling they accidentally missed my form to enter. When asked how that happened all the last three years they were silent. Actually if you use if well there will be new account every month. So you have to deposit 15G every month. For these case they even have the system such that if you give 15 G in the beginning of a financial year all subsequent mod accounts need not 15G separately.(to believe it you should not ask for the source because the system software SBI is using developed by software giants and are most unlikely to miss that out). Knowing the existence of this also they will not provide this facility to customer saying this facility does not exists. Only intention for this behavior to keep you away from auto sweep account. This will only change if interest rate going down.

3> Due to my recent frustration on SBI I am now looking for another bank who may provide auto sweep without any charge to its savings account holder.

Thanks

BKM

Better move to another bank , but i would say you also have option to complain to banking ombudsman about this behaviour from SBI and I am sure it will be heard , it can take some time though ! 🙂

what is the basis of interest payment under MOD scheme and when the interest will be credited in my saving account?

my saving a/c is salaried a/c.

Please ask your question is more simple manner with simple language

How can I withdraw money / break a specific SBI – MULTI OPTION DEPOSIT ACCOUNT?

Sheeba

You can just go to the branch and ask them for the breaking of the FD , Is there any issue you are facing in this ?

Hi Manish,

Do I have an option to break it on-line?

-Sheeba

Sheeba

If it was created online, I am sure it should be breakable online too

As you state, when e-STDR is created on-line, hope it is breakable on-line.

But will be it part – broken if I withdraw cash as similar to auto-sweeped MOD?

It would depent how many FD are created and of what amount . If there is only on FD , then it will be broken even if you withdraw a small amount

Hi ,

Thanks for having this forum.Really,could gather a lot of information.

I am having few queries regarding MODS account for SBI.

1. If the minimum balance in MODS account is 5000,and if I try to withdraw 2000 then my savings amount will be 3000.In that case I will be charged a penalty for not

maintaining minimum balance in the account.

2. It I try to withdraw 16000 and I am having a FD of 50000 then what will be my savings amount left.Will it be 0 and MOD balance=39000?Also in this case I will be charged

the penalty amount.

So the conclusion is if I withdraw money from this MODS account then I will be charged penalty..So is it really flexibel at the end of the day?

Abhijit

You can withdraw the money from your account or FD , but you also have to adhere to the minimum balance guidelines !

Thanks Manish.I just wanted to know if the 2 points given below are correct.

1. If the minimum balance in MODS account is 5000,and if I try to withdraw 2000 then my savings amount will be 3000.In that case I will be charged a penalty for not maintaining minimum balance in the account.

2. It I try to withdraw 16000 and I am having a FD of 50000 then what will be my savings amount left.Will it be 0 and MOD balance=39000?Also in this case I will be charged the penalty amount.

So in order to avoid the penalty charge one has to replenish the withdrawal amount.Is this correct?

Abhijit

This should be best answer by SBI customer care, their info will be too the point and more authentic and reliable

Hi Manish,

Needed one information. I have opened a sweep account and gave a threshold limit of 5000. I was in a impression that threshold limit and minimum balance in my account is two different thing. Now the issue is i have kept less than 5000 but higher than 2000 in my account for a quarter. Bank has deducted 225 saying that the minimum balance of sweep account is the treshold limit 5000. This was told by the SBI branch manager. Could you please let me know if that is correct or is there any way i can raise this concern as branch manager himself is denying that.

Waiting for you advice

Sushant

It might be true .. most of the saving bank account have minimum balance of Rs 10,000 , so if you keep a threshhold limit below that then you are keeping low balance and on quarterly basis , you might face a penality

Manish

it is very good deposit for every person for future saving account

Deepak

Its not any new deposit account, its just a feature .. thats all

Vinayak

10 are too much , why not just 2-3 FD !

24th comment by Mr Jayprakash Reddy has answered most of my queries. i just wanted to know one more thing. i want to put about 50ooo rupees in this account. so should i create m m fd of 50ooo in one go or should i make 10 accounts of 5ooo. as i m not sure when i will need this money. which would be more beneficial

Hi Manish,

This article was very informative and definitely creates awareness about auto sweep facility. You have mentioned not to overdo or overuse this facility(in disadvantages section). Can you let us know whats wrong in over utilizing(because in any case we are gaining profit).

I am planning to utilize this facility in SBI. Kindly let me know if SBI charges penalty.

I have some doubts like

1)what would be the term of FixedDeposit?

2)what happens if we withdraw FixedDeposited amount prior to its maturity?

will they charge penalty

Vijay

Overuse here means that take this facility as added advantage, dont try to make an FD using this way if you can yourself create the FD manually.

1. That has to be decided by you and in most of the cases its more than 1 yr and if you break the FD , there are heavy penality charges

2. Yes

Thanks for the info, Manish 🙂

i could not find autosweep in icici online account so i have started using moneymultiplier account in icici bank. it is the nearest thing i could find with sweep in facility. it has 2 format: standard and special. i have gone in for special with 590 days deposit and 9.5% interest rate. i hope its the same thing that we r discussing in this platform. please correct me if i m wrong.

Vinayak

I am not sure if its the same thing , because in auto sweep, you dont create the FD’s directly, it gets created on its own once your account balance goes above a level. Anyways , see if you are ok with what you have choosen , thats what matters !

Manish

thanx for reply. i was bit confused as the customer care were also not helping much and on website also they have given fixed deposit and money multiplier account as 2 different things.

Hi Vinyak,

ICICI has stopped Auto sweep facility in their S/b account ( I dont know the reason) .What u gone for is standrad FD ….

I’ve been fighting with icici branch mnager for past 2 months to re intiate the auto sweep in sb.

Last week i become frustated of icici bank and end up opening a new sb account in Yes bank and transferred all my money from ICICI to Yes bank as interst in yes bank savings is 7% and had also written an email to ICICI Sr management about my action. I’m waiting for a reply from them.

regards

Manish Awasthi

thanx for informing.

I would like to know whether this kind of account is treated as a PURE SAVINGS ACCOUNT? As the Govt has notified that customers earning interest upto Rs.10,000/- on Savings Account need not file IT return, so will it apply to this kind of accounts as well? Does the customer need to fill-up 15G/15H form to avoid tax deduction by the banks?

Sujan

The condition is not just that you should have upto 10k interest , you should also have income of less than 5 lacs to not file the tax return .

Also these are saving bank account only , just that above a threshhold , your money will be earning FD interest

how can i gate the auto sweep facility???if i want to activate the auyto sweeep facility in my account then what will i do??

Just talk to your bank ! and ask them to activate it

Hi Manish

I have SBI SAVINGS PLUS account.

My threshold limit is 5k. I have some queries:

1. If i withdraw 2k from ATM, my fd will remain unaffected and savings balance will be 3k ?

2. My savings balance is 5k and i ve 2 FDs of ist — 65k and 2nd –41k. Can i withdraw 10k from atm ? If so, what will be my savings balance and fd balance? I mean , will my 2nd FD of 41 k break , or only 5 k will move from FD and 36 K FD will remain ?

When do we get interest credeited to savings account? In my account it shows 9.25% interest and maturity period s 12 months.

AB

1. Yes

2. I am not very sure how it will work in SBI , but one of your FD should break and then above 5k , the new FD should get created.

Manish

I am having an account in SBI, i haven’t started by Online Account due to some reasons and bad support of SBI.

I am just a graduate and working in a company, so don’t have much spending’s.

Recently i am having 30,384 Rs in my account, on 2 March i got my salary, 17,056

and my total is 47,440 on 2 March i checked this through SMS banking facility at around 10.40PM on 2nd March.

But on 4th March i.e today, when i check my account it shows balance of 5,440Rs

I get nervous what happens now, i thought someone has taken my money from my account but how?? i haven’t shared anything with anyone.

I go to SBI ATM and have Mini Statement its shows

42000 — DEBT SWEEP

i called SBI Toll-Free Number they told me that they transfer my money to MOD account.

But why they have done so, without my permission, is it the normal case.

I will go my Branch Office tomorrow and ask them.

Right Now i am having 5440Rs in my account, suppose i want to withdraw 10,000Rs.

How can i do so, Pls explain me, is it okay, Nothing to worry case.

Arun

There is nothing to worry .. Your account seems to have “auto sweep” activated 🙂 . so any amount excess to some point , that gets converted to FD , actually in a way its good for you if you are not going to use the money for a lot of time , but if you are uncomfortable with this option , please ask them to disable it

Manish, I have Rs. 31000 in my SBI Savings plus account. The account description is shown as “SBCHQ-SBP-GEN-PUB-IND-ALL-INR”. My banker told me its a savings plus account. But my MOD balance is still Rs 0.00 Do they create the FDs without showing it on the internet account? Is there a specific date in the month on which they do that? What should i do? How do i know the amount of which FDs have been created?

Sachin

This question is very much specific to SBI PLus , better you discuss it on our forum : http://www.jagoinvestor.com/forum

finally got autosweep enabled after 2 months(better late than to never come at all!)..manish i have a ques. suppose i have 10,000 minimum thresold mark and i have to pay 40.000 via debit card for online bill payment…now i have a MOD of 50,000 does the reverse sweep is true for online transaction also?? or have goto atm or write a cheque for that??

Hi Manish,

I really like your article.i just have one question what is the difference between saving plus and saving premium a/c in SBI and which one is better. I have applied for saving plus in sbi and also for gold international card but they have not mention 50000 minimum balance for this.As per sbi 5000 minimum balance for saving plus.I have one more doubt what is the total benefit for bank in this case if we can withdraw my money at any time and still we are earning higher interest without any penalty.i have applied for joint a/c with my husband and i am the primary a/c holder but i am not working right now. who will be liable for tax over interest.

thanks

Meera

Meera

You will be liable for tax over interest . I am not sure about the difference myself , better ask at http://jagoinvestor.dev.diginnovators.site/forum/

Hi

Thanks for the article.

Whether the Auto sweep account is accountable for TDS and if yes how can we releived from it.

Thanks

Soman

Hi Manish,

Thanks for the great info. I’ve recently opened and SBI Savings account and was inquiring about the Saving Plus (auto-sweep) there. To my surprise the staff there told me the minimum amount/threshold limit to hold a Savings Plus account is 50,000. Is the amount stated legally right or they are seeking it for their business to run since the branch is fairly new.

I’m a salaried employee aged 28 with monthly income of 45K and my wife has a similar income. Below is my query:

We are planning to divert about 20K each month into our SBI acct…(with intention of having a Savings Plus). In such as case will it be very cluttered and complex since each month a FD will be started. Assume we have a 50K threshold in the Savings Plus.

–Kiran

I just opened a new SBI Saving Plus account and minimum balance required is 5000 and not the 50000!

However if you need GOLD INTERNATIONAL DEBIT card they will want to have minimum balance of 50000

Minimum balance for SBI Premium Account is 250000

can we draw more than available balance from atm in auto sweep facility at SBI ATM.Iam SBI account holder.

Sanjay

You must have overdraft facility for that

Manish

Hi Manish,

Superb article. I just came across your site today and am thankful to you for providing excellent information.

However, I have some queries. Lets divide this Auto sweep facility in 2 parts.

(1). Amount above threshold limit is automatically debited from savings account and deposited to a fixed deposit.

(2). Amount withdrawn from this fixed deposit in case savings account is running short of cash.

I hold HDFC account. On their website they have mentioned only about part 2 above. They have not mentioned on the amount being automatically debited from savings account and deposited in a fixed deposit. No mention of threshold limit. I am also bit concerned if they open new fixed deposit account every time the threshold is crossed or will they deposit in the existing FD account.

If we infer from HDFC site it shows we need to first open a FD and then convert it sweep-in with savings account . This is only the part 2 facility as I have mentioned above how does the part 1 actually works ?

Deepak

What is written in article is a general thing .. all banks their own tweaks in sweep in , in HDFC bank it can be differetn , go through comments .. there is lot of talk on HDFC there

Hi,

I have 10Lakh rupees in my AUTO DEBIT SWEEP ACCOUNT and I do not want to take it out for an year. The Online Account shows I can earn upto 94000 Interest. My question is what is the tax implication on this earnedinterest? If it crossess 10000, I have to declare it and I will be losing 30% of it.hence i will get only 65800, which will be 6.58% and not 9.4 %. What is your opinion?

Murty

Its your wrong belief that the tax is applicable only if interest from bank deposits are above 10k in a year .. its not the case , even if you earn Rs 100 , it has to be shown in tax return and tax is to be paid .. If interest is above Rs 10k , then the TDS is cut by bank , else not , so advance tax is paid by bank on your behalf if interest is above 10k .

So even in this case, whatever interest you earn will be added to your income and taxed . If you are so clear that you will not need the money in 1 yr, why dont you do a FD ?

Manish

Even the interest earned on FD will be subjected to Income Tax. What shall we do?

Murty

yes .. the interest on FD is always taxable , what do you mean by “What should I Do” , you cant do anything here… you will have to pay the tax, there is no alternative

Manish

When I ask you what should I do, I mean to say to look for other avenues which generate more than this rate of interest! When you get 6.8% pot tax, for a honest declaration, the effort is not encouraging enough. if you are in the middle age, and you don’t need that fund, I think PF/PPF/VPF would be much better, as it has an EEE mode of taxation. RIght? Or, rather, put 50% into FD, and the rest into PF accounts, the returns would be tax exempt.

On the other hand, can we avoid tax and still get decent returns, legally?

How would you weigh the auto sweep against the recurring deposit? Say the tenure to be maintained is 1 year , then i guess RD would yield better returns ? Also is the intrest also taxable from auto sweep facility ?

Sushil

RD will deliver better interest but its done when you know about the cash flow in future .. sweep in accounts are for fuzzy future where you are not sure what amount of cash will be there in your account .

Manish

Hi manish,

thanx 4 the really nice article.

i have a savings(not saving plus a/c) account in SBI since 2005.after reading ur article i went to my home branch and enquire them abt it.they did ask for pan,votter card,ration card xerox etc.submitted it all on 7th dec 2011.they told me i can chek the mod,avail bal etc in my passbook.till today my passbook is showing the same saving bal,no mod bal.when i asked abt it they said there are some “menu setting” problem for which this facility cant be started.they simply didnt utter another word abt it.i tried 2 search it in google but no satisfactory result come in the official website or others.

my question , is this facility for opening of new savings plus a/c only or it can be started on existing SBI savings a/c

regards.

Which banks dont charge any penalty for sweep in facility in these type of accounts??

Preeti

Almost all banks do ..

Thanks. Its better to take short term FD then, if i know i am going to withdraw all money say after 6 months.

Preeti,

Open an ICICI B2 account, they don’t charge any penalty on premature withdrawl from the flexi account. Only TDS is deducted.

This account can be opened online at http://www.b2.icicibank.com

Can anyone tell me clearly about HDFC sweep out facility. I was thinking to apply for this. Do they charge 1% penalty when the FD is broken??

Preeti

This 1% penality means that you will get 1% less interest on your FD , you dont have to pay anything from your pocket

Manish

Without informing, IDBI bank started charging for NEFT and also imposed Quarertly Average Balance (QAB) on savings and current accounts. All this despite of voluntarily maintaining over Rs 50,000 daily balance on zero balance savings and current accounts.

Really feeling cheated after getting friends to open accounts with this bank.

IDBI is no longer a friend to all

A lot of banks have started that .. NEFT charges are now applicable

Manish

A wonderful information given in detail… Thanks for that.. I infact searched for many sites to get information about savings plus and got goodly from here only. Thanks a lot.

Dr Shreyans

Good to hear that .. finally you got what you wanted . So finally you are clear on everything ?

Manish

Sir, give the name of PNB saving scheme that offers above the same

like SBI MOD account.

i have SBI and PNB A/c

i already opened SBI MOD account but i also want to open same for PNB

but don’t know the scheme name

Rahul

Just search on the PNB website , you will get it

Manish

Sir,i have saving a/c in sbi.pls suggest me for the min threshold amount in sweep a/c.means if i crossed the threshold thn wht wil loss for me.

Preet

The threshhold has to be decided by you

Manish

Manish,

I want to have a repeat confirmation that ATM WITHDRAWLS can continue in SBI savings plus scheme as in normal savings bank a/c irrespective of the threshold limit as long as money is available in the related MOD deposits.Also con firm that ATM withdrawl limits remain same as in normal saving bank accounts.

Mahavir

yea . .thats true .. what are the answer given by the bank on this ?

Manish

Hi Manish

It’s for Tax saving.

You told that there are some plans which would be better than others.may i know which plans are good ?

Regards

Laxman

Laxman

Which plans and which comment of mine are you reffereing to ?

Manish

Hi Manish

Please let me know which insurance company ULIP plan is good.

regards

Laxman

Laxman

Why do you want to invest in ULIP’s .. there are some plans which would be better than others , but in general common investors are not suitable to handle a ULIP

Manish

good one.

Hi Manish,

Can someone do open more than one SBI account at different branch and City or within city?

It is valid/legal to have more than one account in same bank?

– Shan

Shan

Yes, its legal

Manish

but don’t hide your deposits from income tax….

Hi Manish

I have not received any reply from you,pls let me know.

Laxman

Actually your question is not very clear . Please rephrase it in simple sentence

Manish

It is related to Sweep in account

Yes Manish..

Manish

Thank for the articale….it is very helpul.

1)Is there any Mode balace facilities in Canara Bank.

2) will get interest on monthly basis or anually for mode balance ?

Laxman

Is this related to sweep in account ?

Manish

what is difference between multi option deposit scheme and premium savings account in SBI?

Amu