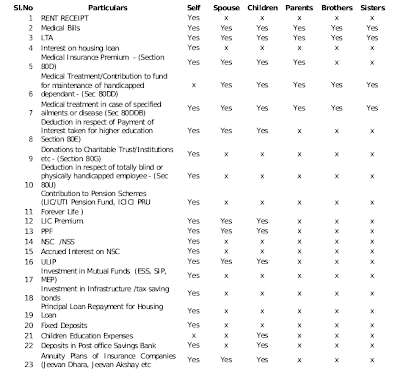

Tax Exemptions Rules , Who is included and who is not

Following is a chart showing the list of people for whom you can claim deductions for tax exemption. For example, if you pay the LIC Insurance premium, you can claim if the got premium paid for.

- Yourself

- Spouse

- Children

For further details … see this table … Click to enlarge it.

To know about the tax slab and an example for calculating tax .. see : http://finance-and-investing.blogspot.com/2008/04/tax-information-for-2008.html

To know about the tax slab and an example for calculating tax .. see : http://finance-and-investing.blogspot.com/2008/04/tax-information-for-2008.html

January 5, 2009

January 5, 2009

It’s very useful Manish.. Thanks a lot!!

Welcome

Good one and chart is comprehensive.. Keep this good work in month of hightest tax saving done my Indian Salaried class to save tax.

Thank you for sharing and giving details about how to claim deductions for tax exemption.It is very helpful and useful.

IRS Deductions