CIBIL Score 2.0 – An Improved version of Credit Scoring

CIBIL has recently come up with Cibil Transunion Score 2.0 which it calls an improved version of the CIBIL Credit Score. This new Credit Score will help in a better identification of new borrowers (having credit history of less than 6 months) and help classify them into risky and not-risky categories.

More about CIBIL Score 2.0

The biggest change here is that the CIBIL Score 2.0 is for new borrowers who have a short credit history, i.e. 6 months. So now there will be two classes of borrowers

1. Less than 6 months of credit history

Any borrower having less than 6 months of credit history earlier used to get a score of 0. But with CIBIL 2.0 , they will get a score in between 1 to 5, where 1 represents high risk of default and 5 denotes least risk of default. This score between 1-5 will depend on parameters like 90 days overdue in any given month (for last 24 months), credit seeking activity (number of loan enquiries you make), type of credit (secured or unsecured) and the demographic (age , location etc.)

This move is going to help a lot of people who are very new to credit and have recently taken credit cards or have taken some kind of loan and need another loan. There have been instances that due to their short credit tenure, they didn’t have any credit score and a lot of bank rejected their applications for loan just because they didnt have one.

2. More than 6 months of credit history

For those who have more than 6 months of credit of any kind, for them the credit score will be in range of 300 to 900 score, just like earlier. However, it seems like this scoring method will consider only higher scores like 800+ as the better score. As per this firstpost article, it says that an old score of 751-800 will now be equivalent to something like 662-697 in the new score version .

For borrowers with more than six months of credit history, the old scoring criteria 300-900 remains, but for the lower score you get. For instance, the old score of 751-800 will be equal to 662-697 in the present one.

The newer version is initially made available only for CIBIL’s 862 member banks and financial institutions, after which it will be available for the customers as well, he said, without giving an exact timeline for the completion of the process.

Cibil Score 2.0 is a better Score

This new CIBIL score is said to be a better indicator of someone repayment capability. It has been designed keeping in mind the Indian market and the way consumer behavior is changing from last some years.

“CIBIL TransUnion Score 2.0 predicts risk more powerfully as this scoring model has been customized for the changing Indian market and consumer behavior. This scoring model will enable banks to better identify good customers, thereby enabling them to provide credit to more consumers and increase credit penetration and financial inclusion in the country.”

– said Mr. Arun Thukral, Managing Director, CIBIL

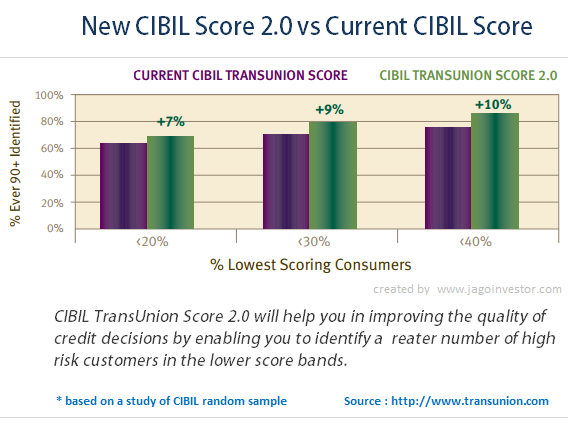

The new CIBIL score is tested by the company old random data and it seems to identify the risky customers in a more better way. Here is a snapshot of results I found out on transunion website. You don’t really need to understand this graph, just get that this identifies risky customers in an improved manner.

Now, The credit institutions that have adopted the new scoring model will decide on customer’s loan application based on this new score. So it would be interesting to watch out the credit score banks ask for giving loans .

What do you think about this new cibil score 2.0 and the changes which has taken place ?

We are happy to share that we have got a great response to our newly launched Jagoinvestor Wealth Club some days back . There are already 140 members and we are giving the discounted pricing to only 300 people . We are excited to share that we are moving towards our vision of creating a great dedicated closed community. Join the club if you feel you need to be present there.

October 18, 2012

October 18, 2012

Hi my CIBIL Score is 649 according to cibil trans union 2.0 .i heard that 750-800 is changed to 662-697 .is it true ?

Thanks

Ashok

Yes

Thanks Manish. So my score is good or ??

Its not a great score. You should target 750+

Hi,

My CIBIL score is 867. Is it good. I want to get a Home loan for 5 Cr. ?

Its very good

Hi Manish,

My CBIL transunion score is 662.

Is it a good score or bad one.

Will it be good to get a housing loan?

Regards,

Padmanabham

Its not that great score !

my CIBIL score is 708, am looking for taking a home loan? will it be approved? and where do I check for remarks in the CIBIL report?

You can check it on CIBIL.com . NOte that apart from score, you need to first look at the reports remark

Hello Manish,

My credit score as of now is 744. I am planning to buy a house. What do you think is an ideal score to get approved for a home loan.

Also, request you to please share what all factors are taken into consideration when one applies for a Home Loan.

Thanks

Hi Nilesh

744 is decent score, but more than score, banks will check your CIBIL remarks.

Hi have score of 751 i am govt salaried employee can i get personal loan immediately with the cibil score of 751

Dear Sir,

751 is a decent score. As an industry practice, a score of 750 and above is considered to be a good score, but having said that lending institutions would also consider their internal credit policies and will have their own credit score cut off.

It is advisable that you check with the lending institution you are planning to apply for the personal loan regarding your eligibility and then proceed with the application.

Regards,

Credexpert

Its not the score, but the report remarks which matter !

what is procedure increasse cibil score “0” to up750 give me method

Dear Sir,

A score of ‘0’ means that you do not have enough credit history to build your credit bureau score. A lending institution with a conservative risk appetite might look at it negatively whereas a lending institution with aggressive risk appetite might approve your credit application.

We would suggest that you directly approach the bank you are planning to apply for a credit card and understand their eligibility criteria.

Also, using a secured credit card is one option you could look at to build your credit history and score. You could opt for a “secured” credit card. Since these credit cards are secured against “Fixed deposits”, you would possibly get one without any hindrance. Make timely repayments against it to build your score.

Regards,

Credexpert

Make sure you pay your due on time for next 2 yrs !

Hi,

I have taken Personal Loan on 2007 of 1,00,000 for term 3 years from the ICICI bank but i paid all the interests including the prinicipal amount and due to bad recession effected in the year 2008, i missed 6 EMI’s pending and still i havn’t closed my Loan account.

I’m receiving auto generated email communications from the ICICI bank including with the late payment and total out standing amount is now 50,000.

Can i get the PL,If i pay the outstanding amount in equal instalments and close the account successfully.

Appreciate your quick reply.

Thanks in advance,

Hari

Dear Hari,

First and foremost, we would suggest that you pay the total outstanding amount and close this loan account. Once this account is closed, you need to wait for 30-45 days for your account to be updated and then check you credit score and ensure that it is up to the mark.

As an industry practice, a score of 750 and above is considered to be a good score, but having said that lending institutions would also consider their internal credit policies and will have their own credit score cut off. We would suggest that you do not make any further applications until there is an improvement in your credit score. The rejection would only increase the number of enquiries appearing on your credit report which indicate a credit hungry behaviour and is viewed negatively by lending institutions.

Build your score by making all your credit card and EMI payments, if any, towards your loan accounts on time. Overtime your score will improve and lending institutions could consider your applications based on this.

Regards,

Credexpert

Yes if you pay full amount, then you might get another loan , but more you delay , tough will be the chances

IF my current CIBIL score is 788 on-8th oct 2014 how will u rate this please reply

Dear Vikas,

As an industry practice, a score of 750 and above is considered to be a good score – the higher the better. However, each lending institution will have their own internal credit policies on score cut-offs and negative remarks, based on which the decision to approve any of your credit application will be taken.

The approval of any of your credit application would be at the discretion of the lending institution based on their credit policies.

The general points to look for in your credit report are:

1) Late payments

2) High outstanding balances

3) High no. of unsecured loans

4) High no. of enquiries

Regards,

Credexpert

Does not matter

What matters is your CREDIT REPORT STATUS and remarks !

Dear Amit,

797 is a good credit score. As an industry practice, credit scores of 750 and above are considered to be good; the higher the better.

Each time you apply for a loan or credit card, the credit institution would obtain your CIBIL credit report to evaluate your credit worthiness. This appears as an “Enquiry” on your credit report. High number of enquiries are viewed negatively by credit institutions since it indicates a credit hungry behaviour. This also impacts the credit score.

We would suggest that you stop making any random applications for loans or credit card unless you genuinely need it.

Regards,

Credexpert

http://www.credexpert.in

Hi ,

I have a CIBIL score of 797. What that means. Way back i got call for Personal Loan and for fun I asked them to give me 10k of loan and they have reported to CIBIL. What this means. I checked my eligibility for car loan and later purchased on cash but that is also showing in CIBIL report. Please help me in understanding same. Will it effect my eligibility if i really require loan may be in future. I have one credit card with no issues in payments as max i use my debit cards.

Please guide

Your answer here – http://jagoinvestor.dev.diginnovators.site/2012/10/cibil-score-next-version-improved.html#comment-142856

Hello Manish & Credexpert,

I am reproducing a query what i put in a forum so that the answers given may benefit anyone who reads this article.

I have the following observations from my CIBIL report.

a) Only credit cards i have used were included in the report. My existing home loan was not reflected in this report .Should i file a dispute with CIBIL for this or do i need to contact my bank ?

b) The credit cards include the corporate credit cards issued in my name which was used when i had to travel overseas . Now if my company had not settled dues on time would it have reflected badly on me?

c) The credit card not in use anymore do not have anything written against the status

suit filed/wilful default: –

written-off status :-

written-off amount(total):-

written-off amount(prinicpal):-

settlement amount:-

This means that the cards were closed properly after paying all dues right?

d) DPD had entries 000 or XXX . XXX means bank has not given information to CIBIL. will this be considered a negative?

Thanks,

Roshan

Can you also give the forum link !

Hello Manish,

Link to the forum as requested : http://jagoinvestor.dev.diginnovators.site/forum/how-to-improve-the-cibil-score

Thanks,

Roshan

Thanks

Dear Mr. Roshan,

a) Every lending institution has to be a member of any one credit bureau. Thus it is a possibility that the bank from where you took the home loan is not a member with CIBIL but a member with any of the other credit bureaus- Experian or Equifax. Therefore it is not being seen on your CIBIL report. However, you may check with the bank if they are a member with CIBIL and in this case you can raise a dispute with CIBIL for updating your home loan information. Make sure you raise the dispute within 60 days of accessing the credit report.

b) Yes, since the credit card is on your name, you need to make sure the dues are being paid on time by you or the company. Late payments on credit cards with your name will reflect on your credit report and will be viewed negatively by lending institutions.

c) Firstly, you need to check if the remark ‘Date Closed’ has a date on it. If not, you need to ask the respective bank to update the same. Only then it will be considered as duly closed.

d) Yes, XXX means the lending institution has not reported the information to CIBIL. Had you been paying the dues on time, it could have worked negatively for you as lending institutions would view on time payments positively. Whereas if you had not been paying on time, it could work positively for you as lending institutions would view late payments negatively.

Regards,

Credexpert

Hello Manish,

I have got my credit report this week and it is 797. Is this CIBIL 2.0 score? Is this good enough for takeover of home loan? what was surprising is that my existing home loan was not listed in the report at all !!!

Thanks,

Roshan

Dear Roshan,

Your existing home loan should be reflecting on your credit report and score . If you have been repaying on time, then the reporting of this account would help improve your credit score.

Although, 797 is a good credit score, higher scores are always advisable.

If you have been making timely repayments and have a good credit behaviour, then we do not see any hindrance to your application. However, the bank would take its decision based on its credit policies and hence cannot be commented on.

Regards,

Credexpert

http://www.credexpert.in

Yes , its 2.0 .. note that most of hte banks check the status in report and not much the score ! .. its secondary ..

797 is good btw

Next, check with your bank why they are not updating your EMI’s payment for loan with CIBIL ?

Hi Manish,

I have got my credit report last week and it is 751. I had missed out few credit card payments last year, in-total 4.

Now I am planning to apply for a car loan of amount about 6L. I am planning to get it from SBI.

Is my score good enough to get me loan?

Thanks,

Nishant Saket

Its not score, but the STATUS on your report . If you have missed some payment, its CAN have an impact on the decision of the lender . Have you missed on the full payment ? Did you finally pay the full amount or not ?

750 is a good score overall

Hi Manish,

I got my credit report last week and it is showing 751. I had missed few payment of credit card in year 2013, total of 4 (including my Citi and Standard Chartered CC).

Now I am planning to apply for car loan of amount around 6L.

Is my score good enough to get the loan?

Dear Nishant,

As an industry practice, 751 is a decent credit score. However, each lending institution would have its own credit score cut off basis which it would either approve or reject an application.

Late payments are viewed negatively by lending institutions and more recent they are, higher is the impact.

The best way to find out is by applying to the lending institution and awaiting their response. In case of rejection, kindly do not make any further applications unless there is an improvement in your credit score.

Regards,

Credexpert

http://www.credexpert.in

Hi Credexpert,

Thanks for your response. One more thing I wanted to clarify, like if a apply for loan and it gets rejected. Then what would be ideal time that I should wait to re-apply, assuming I will keep all my credit card bills cleared on time. As since last one year around my credit card is clear, with no remark or late payments.

Thanks,

Nishant Saket

Dear Nishant,

Ideally you should reapply after a period of 3-5 months. Assuming you are repaying your loans/credit cards on time, your credit score would improve gradually over this period of time.

Ensure, that if you are rejected once, do not reapply unless you work towards the improvement of your score.

Regards,

Credexpert

http://www.credexpert.in

Hi Manish,

I have generated my Cibil score on 18th Dec score should be 697. Is this the good score?

Am I eligible for Personal loan?

If not what is the minmun score to eligibile to apply personal loan?

Dear Pratap,

As an industry practice, a score of 750 and above is considered to be a good score, but having said that lending institutions would also consider their internal credit policies and will have their own credit score cut off. We would suggest that you do not make any further applications until there is an improvement in your credit score. The rejection would only increase the number of enquiries appearing on your credit report which indicate a credit hungry behaviour and is viewed negatively by lending institutions.

Personal loans are high interest loans (unsecured) and our suggestion would be that you analyse your monthly cash inflows and outflows along with any existing EMI(s) you have been paying. Apply for a loan amount that you think would not burden your monthly budgets.

Build your score by making all your credit card and EMI payments towards your loan accounts on time. Over time your score will improve and lending institutions could consider your applications based on this.

Regards,

Credexpert

http://www.credexpert.in

Dear Pratap,

As an industry practice, a score of 750 and above is considered to be a good score, but having said that lending institutions would also consider their internal credit policies and will have their own credit score cut off. We would suggest that you do not make any further applications until there is an improvement in your credit score. The rejection would only increase the number of enquiries appearing on your credit report which indicate a credit hungry behaviour and is viewed negatively by lending institutions.

Personal loans are high interest loans (unsecured) and our suggestion would be that you analyse your monthly cash inflows and outflows along with any existing EMI(s) you have been paying. Apply for a loan amount that you think would not burden your monthly budgets.

Build your score by making all your credit card and EMI payments towards your loan accounts on time. Over time your score will improve and lending institutions could consider your applications based on this.

Regards,

Credexpert

http://www.credexpert.in

I think its a low score from personal loan point of view. you should have above 750-800 and a clean report !

Dear Sandeep,

No, credit scores are not valid for any specific time duration.

Any credit activity undertaken will have an impact on the credit score – positive or negative. Some examples include – closing of loans/credit cards, late payments, enquiries, high credit utilization etc.

801 is a good score but there could be a increase or decrease in your score depending on your credit behaviour. To minimize any possibilities of rejection, we would suggest that you could obtain your credit report and score before applying for loan.

Regards,

Credexpert

http://www.credexpert.in

Thanks Credexpert for your inputs.

Hi Manish,

I received my CIBIL on Jul 21,2013 and It was 801.

How can i be sure if i apply for loan after sometime, the score will be the same?

Do i have to apply for online score again?

Is there any specific time period till which this score is valid?

Thanks in advance.

The score changes each month .. but the change will not be very big if you do not do something wrong ! .. So if your score is 801 right now .. I think you can apply for loan assuming that the score wont deviate 5% up or down .. !

Thanks Manish as always.

Hi,

I have checked my score on Jan 2013 and it is 671. In that report I came to know that there is some outstanding in ICICI credit card. Then I have paid that full outstanding immediately.

After that they offered me an Instant Credit card based on Fixed Deposit to improve my CIBIL score. Now am using that card only for paying bills from last one month.

Now am planning to go for Housing loan in Jan 2014. Is it possible for me to get the loan or it will get rejected?

Please answer me.

There can be a straight no or yes. Check your score again and see what remarks are still lying on your report ?

Dear Madhan,

Only your credit report and score could give details about the updation of the account and the improvement in your credit score, if any.

It would be best to avoid any speculation in relation to your credit score. Kindly obtain your credit report by visiting https://www.cibil.com/online/credit-score-check.do

Regards,

Credexpert

http://www.credexpert.in

I got my CIBIL report on 2nd aug 2013 and score was 708. then applied for loan from SBI and they again got the cibil report on 29th aug 2013 but this time score was 624 only.

from 2nd aug to 29 aug i have not applied for any loan or credit card. and both report contents are identical.

so how can the score be different in the same month if both the reports are identical.

Contact CIBIL on this . Not sure why the scores are different !

Dear Mr. Singh,

The time gap between the dates of both the credit report is almost of a month.

We note that you have not applied for any credit facility in this gap but any other credit activity like non payment of dues, high utilization of credit card etc. could be one of the factors that could have resulted in this difference.

Kindly ensure that both the reports are identical in terms if all these minute details as well. This would help to understand and evaluate the cause for the drop in your credit score.

Regards,

Credexpert