What happens when you accidentally transfer money to wrong bank account ?

Have you ever wondered what will happen if you accidently transfer money online to some strangers bank account ? If you are thinking thats its a rare event, you are wrong. There are thousands of real life cases where a person transferred the money to someone account and then realised that one digit in account number has changed by mistake .

Do you get the money back ?

What are the rules from the bank side and what are your rights as a customer? We will look at this topic today, so that you know what you need to be careful about !

Before we go ahead, I would like to show you some real life examples and complains people have given

Real Life Example 1 – How Rajni transferred Rs 30,000 to strangers account

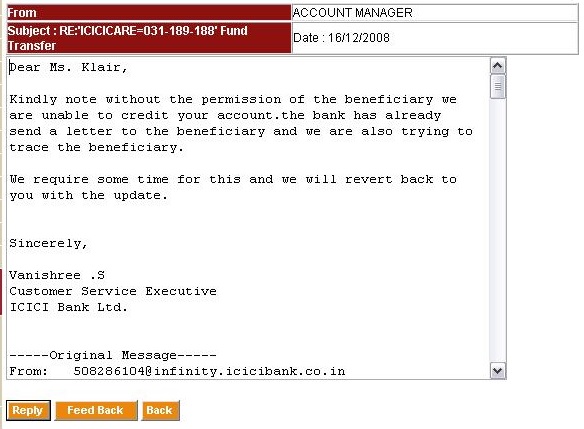

I did online transaction of transferring Rs 30,000 with ICICI Bank on September 30th,2008.By mistake I transferred money to wrong account number which I did not intend to .I wanted to transfer money to Adarsh Kumar A/C – 000501518633 but by mistake i transferred it to someone by name Virender Asati A/C 000501518366.I gave written letter to ICICI bank ,GT Road ,Jalandhar branch on Oct 4th which they are not able to trace and then I gave one more written letter to ICICI,Dwarka Branch ,Sector 5 ,New Delhi where I am holding the account in November and also sent several emails to them through net banking but ICICI back says that they can not transfer the money without Account holder’s permission . (Source)

Real Life Example 2 – How Vipin by mistake sent Rs 1,00,000 to strangers bank account

I am writing to you for a payment of 1 lac rupees through NEFT transfer on 2nd April 2012 to my sister Meena A/C . But due to a very high level technical mistake by HDFC my payment didn’t receive to my sister a/c whereas it had gone to other person account in some where. After few days when I enquired about that same we came to know that you have filled a starting digit incorrect that’s why your payment had gone to other person accounts. Here my question is to hdfc if anybody fill any information inaccurate, account will not be added as i know but in my case my all entries was correct except one digit error as you are telling us. It’s a universal awareness that there are so many mandatory requisite information criteria; when they not simultaneously completed transaction becomes failed like unmatched IFSC Code , unmatched city and even error of gender.

From that date I called so many times to customer care and visited the respective branch but I am not getting any proper answer from them and not knowing that what action is taken from your side. This is very sad to me that your are not taking any action and not giving me any assurance of my money. (Source)

Only “Account number” matters for online transfer

Let me give you shock of your life now.

Do you also think that if you transfer money to someone by adding their name, accounts number and IFSC code and if one of those does not match the transaction should fail and you should get back your money in your account. Right ?

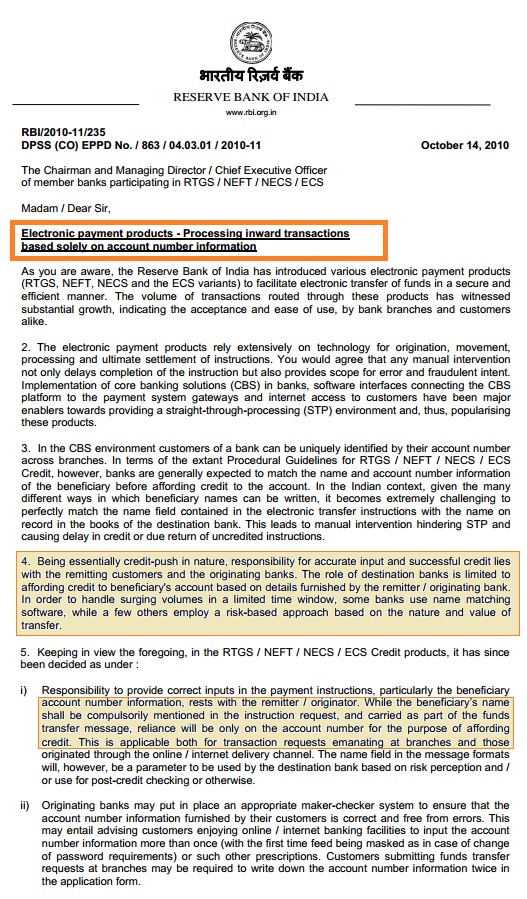

But its far from reality ! . As per RBI guidelines, at the end of the day only bank account number should matter and name of the account holder and IFSC code are additional information which should be ideally checked by bank on their end, but there is no rule like that.

If you mess up with the account number, the transaction can go through you the money will be transferred. Its totally a bank choice and a “suggestion” from RBI to banks that they should ideally match Name and IFSC code before the transaction, but its not mandatory.

Below is the RBI notification for you to read, which clearly states this. I suggest you read it fully to understand how the banking world thinks and works.

Responsibility lies with the remitter and not beneficiary

As per RBI directions, the final and sole responsibility of cross checking the account number, Name of the account holder, amount and every other detail lies with the remitter (the person who is sending money) and not the beneficiary (who is getting the money) . You can check numerous times before clicking the final button and after that no one else is responsible for your loss or transaction.

You as customer can not blame the bank to not check details at their end. There are thousands of cases where while typing the account number, one last digit got interchanged with another digit and the person did not realise this and their money is then at stake and in most of the cases , they never got it back. (You can learn more about NEFT and RTGS here)

If the account number does not exist, then surely the money will come back to you, because there is no valid destination to send the money. But if the account number exists and its active, then there are high chances that the transaction will go through .

What you should do if you have accidentally transferred money to wrong bank account ?

If you have made a mistake of transferring the money to a strangers account, then you should follow these steps mentioned below

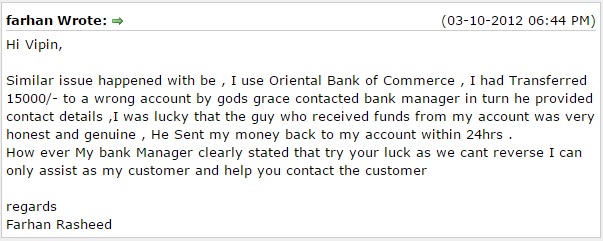

The first step is to make sure you inform your bank the moment you realise that unintended money transfer has taken from from your end. The bank will then contact the beneficiary account holder and try to explain the situation to them. They will ask the account holder to give them permission to reverse back the transaction. In most of the cases, I have read on internet that the recipient of the money have agreed for the reversal (We have good people in this world, despite widespread belief that world is evil) . Below is a real life incident where the person sent back the money.

In some cases, where the other party is greedy (when amounts are quite big) , the other person might not revert back at all or just delay the whole thing and withdraw the money or just don’t take any action . In which case you really are in a fix and it becomes almost impossible to get back your money.

You should then meet the branch manager of your bank, who can go one step further and talk to the destination bank and if they can help in this or in communication with the beneficiary.

One important point to note here is that bank cannot reverse the transaction from their side without the customer approval, because its a breach of agreement and is not the right thing. You never know what exactly is the whole story and who is saying truth (I can pay you and then just say, it happened by mistake)

3 Precautions you should always take while transferring money Online ?

Precaution is better than cure, I personally believe that we are ourself responsible for any money transfer done online. Nothing stops us from taking extra precautions while transferring money online.

Lets see few things you can do ..

Trick #1 – Use CTRL-F to verify your account number

Most of the times, we are typing an account number which we have got in our emails, we look at the number (few digits at times) and then type it in other window when we are adding the beneficiary. What I personally do is once I have typed the account number (you cant copy paste the account numbers in all the bank website, as its disabled) . In that case you can just copy your account number from email, and type CTRL-F and paste the number there and you can visually see if it matches with what you just typed. Below is a screenshot I created for you to understand what I am talking about..

Trick #2 – Transfer Rs 1 first and test the transaction incase of big amounts

If you are transferring a big amount to someone, you can go one step ahead and first transfer Rs 1 and then confirm with the beneficiary if they have got it, and then on confirmation, you can trasfer the full amount. But I suggest to use it only in extreme situations when you really want to make sure if the account is genuine or not. At times, you might come across someone who gives you their account number and you are aware that they are careless by nature, and might have made some mistake while sharing account number, In that case you can take this extreme precautionary step ! .

Trick #3 – Verify the account number from right to left

Generally we are programmed to read left to right and we also match the account number that way, truly speaking, it might happen that we sometimes get fooled by our own confidence (4 zero , might look like 5 zero) .. So its better to also cross check the account number digit by digit from right to left. I personally cross check an account number digit by digit 2-3 times because I transfer any money online. I have never faced any issue of wrongly sending money to strangers account or sending excess money by mistake (One excess Zero in 10,000 and it becomes 1 lac) ..

Spend 1 extra minute to save your self big trouble

I hope you are clear by now that its your mistake if you transfer money to someone else account and you cant held someone else responsible for your mistake. Hence its always better to add the beneficiary account with precaution. Always cross check the account number 2-3 times.

I would be happy to know if you benefitted by this article and if there are any real life incidents around this area. Also please share anything related to this topic in comments section.

January 1, 2015

January 1, 2015

Sir, I have gone to bank for the transition of money because I have to deposit the fee of my college. IFS code, name of university, bank name was right but the account no was typed wrong in place of 33 they have typed 32 what can be done for this. Sir please tell me

Hi Sonu Kumar Gautam

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir.. i entered IFSC code wrongly.. i forgot to type one number but my account number is correct.. is it possible for transactions ?? Plz rply

Dont worry in that case

Hello Sir,

Today i added my uncle account as bene without entering the last 2 digit of the actual account no. Actual no is 15 digit but i entered only 13 digit IOB account. I enabled the payee and transferred the amount. The amount also debited from my account. After sometimes only i came to know that account in invalid. When i enquired in IOB bank there is no such account have only 13 digit. So the trasnferred money not went to other wrong account. I raised a complaint in my andhra bank. They have mentioned like it will take 7 days to credit back to my account. Now my query is surely my money will be back to my account or not.

IFSC code : Entered Correctly

Account no : Actual is 15 digit but i entered only 13 digit. Entered wrongly

Bene name : Entered Correctly

Acct type : Entered Correctly

In that case it will come back to you soon

sir ,

I transferred money wrongly to one account .Could you please revert back this money from ABB acoount.

06/10/2016 IMPS OUTWARD ORG IMPSTO XXXXXXXX3280 CTB REF NO:-628016241739 9,600.00

I have sent from my citibank account 5052452815.

Regards,

Praveen

How can I revert it back ? What powers do I have ?

Sir today i deposit my money in wrong account .. do u plzz tell me something . How i get my money back.. i also talk about thise to the same bank branch where i deposit the amount. so they only give the beneficiary mob no… but her mob no . Is switch off… so plzz tell me what should i supposed to do….

Could i go to the police??

very nice articles are provided by u.

Thanks for your comment Shishir

Hi,

In a NEFT transaction, the destination bank, branch, IFSC are entered correct. But the account number is mentioned as a 16 digit no. instead of 15 digits. One extra ‘0’ got added somewhere in the middle. Fund has been debited from the source account but not yet credited in the destination account. Kindly clarify the likely implications. Whether the money will revert to the source account automatically ? TIA

Hi Raghu

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I am one of the active readers of your pages. Wish that you continue to post valuable tips and information.

I have an issue with HDFC Life and HDFC Bank with regard to AUTODEBIT of yearly premium.

I have been a TERM Insurance Policy holder with HDFCLife for the last 13 years. My renewal premium (annual) was due on 26th July 2016. Since I decided to discontinue this TERM effective from 26th July 2016, I called up HDFCLife in May and Jun 2016 to stop the renewal of policy. Customer Support Executive has taken request and when I asked them do I require to send a written mail, she said that there is no NEED. On 20th Jul 2016, I received an SMS alert from HDFCLife to keep sufficent balance in the bank towards renewal premium payment. Then I immediately sent out a mail to both HDFCLife and HDFCBank to stop AUTODEBIT of premium since I requested for discontinuance of policy on its expiry ie.,26th July 2016. And I also called up customer support and informed that please DONOT send an AUTODEBIT Advice to bank. There was no reply from HDFCLife to my mail and HDFC Bank sent me a reply on 25th July 2016, advising me to go to nearest HDFC Bank and give a STOP request in person. Accordingly I went to the Bank and gave a written request to stop AUTODEBIT on priority basis. However, on 26th Jul 2016, I got a SMS message from Bank that an amount of Rs.11,248/- was debited. I immediately called up HDFCLife, they mentioned that there is no payment reflected and even if the payment is received the same will be reversed since there was a request NOT to renew the policy. On 28th July 2016, HDFCLife sent me an electronic payment receipt. I got annoyed and immediately called up HDFCLife Customer Support and Bank Relationship Manager, they should reverse the transaction and credit the debited amount. I have been following up with both HDFCBank and HDFCLife since then to get my money back. HDFCLife is claiming that since amount is already AUTODEBITED, the same cannot be refunded. My argument is here that – any renewal is subject to acceptance by policy holder / insurer. AutoDebit is one of the methods of facilitating the payment which is usually claimed on start day of the grace period of 30days. My claim is that since I already requested NOT to renew the policy, the insurer should refund the money without any questions asked. What is your opinion? How should I approach to get my premium amount refunded. What actions I should initiate with HDFCBank and HDFCLife. I cannot simply forego an amount of Rs.11,248/-. Kindly suggest.

Yes, you seem to be right here . If you have already told them not to renew it, That request must have got recorded .

I think you can complain against them to banking ombudsman and also insurance ombudsman once. If I were at your place, I would have made sure I dont have sufficient balance around that time when the auto debit was suppose to happen, just to be on safer side !

Manish

Thank you Mr.Manish.

I will send a notice before complaint. Then I lodge my complaint with banking ombudsman and insuranace ombudsman.

Can I also file a case before consumer court for deficiency in service.

Yes you can , but I would recommend first going to ombudsman

Hi. Today I transferred Rs 5000 to my brother by using online banking bt instead of bank account no. I wrote his atm no. which is 16 digits and his name and ifsc code is correct. money deducted from my account BT not received by my brother. is it transferred to any others account who have atm no. as his account no.is it possible? If that account no. not exist then it will created back to my account. Plz tell me what will happen to money can I get it back. Thanks

If there is an existing account with the account number you mentioned (card number) , then you might have tough time to recover it. Otherwise it will be back in your account.

Sir. I intended to transfer money from a cheque to my account but in the form i filled all the details correctly but by mistake i wrote my father’s account number. Now what will happen to the cheque. Will they keep it on hold? Can i get the amount.

Yes, it will not go through . As the name and cheque account number does not match . Now issue a new cheque

I transferred money to an account where the account holder is on verification because of various scam associated with the account,how do I revert it and how long will it stay

Hi Jephthah

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Very informative,thanks

Thanks for your comment Vignesh

Hi Sir, i am entered wrong IFSC code but entered correct account number transaction go’s to Corporation bank to SBI but amount is not credited to SBI account but amt was debited so what can i do further transaction date is 10/08/2016 please help me sir thanks you

Check with them where the amount went. Mostly it will be back to you in some days

Manish

I had made online transaction of ₹3600 but i entered wrong debit card expiry date.As usual an OTP arrived at my mobile phone and completed that transaction.My account debited but money not reached its destination. I CONTACTED TO BANK AND THEY SAID MONEY WILL AUTOMATICALLY CREDITED BACK TO MY SOURCE ACCOUNT WITHIN 7 DAYS BUT IT IS 15 DAYS NEITHER MY MONEY CREDITD TO MY ACCOUNT NOR TRANSFERRED TO ITS DESTINATION. PLEASE SIR HELP ME TO GET MY MONEY BACK.

Only your bank will be able to help you on this. Its purely a banking related issue.

A month back my ex-company transferred my gratuity payment to a wrong account. They didn’t inform me when the transfer was made. I came to know about it today. Looking at account details, it seems that the account is of Gulbarga. However, the ifsc code provided is of an branch in Bangalore. What are the chances that this transaction might have failed ? What should I do?

I have a big amount at stake.

I dont think its your problem. Ask your old company to fix it ! .. However if you have provided wrong account number to them, then its your mistake. Check with bank on this

Manish

Hi Manish,

I have received some huge amount in my PPF account from an unknown source that too almost close to a year now, but no one contacted me in this regard. Neither bank approached for wrong transfer. But it is someone hard earned money, I can not keep it like this. What should I do, how to reach back to the money owner.

Thanks,

Deepali

Check that with PPF office and ask them to find out about it !

I have transferred 15k to wrong account instead of my MIL by IMPS,Which she required for her medical bills settlement at hospital.one of the account number digits was wrongly entered. Mine account in Apna sharakari bank and beneficiary account Bank of India

COntact bank !

Hi Manish,

Thanks for the article, as always.

I am facing a similar problem. Y’day I was trying to purchase mutual funds from the UTI website. The Billdesk payment gateway connected to my Kotak Bank account, debited the account, but then errored out. Now, I am in a situation where my account is debited, but there is no transaction showing on UTI. What should I do ?

Thanks,

Sanket

Its a common issue. All you need to do is check with UTI on this and also send me the screenshot of your account where the debit is clear.

They will resolve the issue. Either the money will be back to your account or the units will be allocated.

Dont worry. happens at times.

Manish

Accidentally on the ppf maturity form i wrote my last 4 digits of account no wrong. Now the maturity amount has been transferred to someone else. What do I do??

Plz help

Inform the office immediately on this.

hello sir,

I received a caution money cheque (ACCOUNT PAYEE CHECQUE OF SBI BRANCH)of Rs 4000/- (Four Thousand) from my college after completion of my course..

I had deposited that checque in an E-CORNER of SBI and after two days i received Rs 40,000/- instead of Rs. 4000/-

What can be the possible reason for it. It has been approximately 15 days now since the credit but i havent got a call from the Bank and the college.

Also, I am not willing to tel my college by my own as they had looted me for 4 long years and gave this caution money cheque after 7 years.

It might be a mistake mostly. I suggest better keep the amount as it is anyways for quite some time, so that incase its deducted back you dont face any issues!

thank you sir…..

1 more query….can the credit amount through checque be reverted back without the permission of the beneficiary???

Hi subhash

Looking at your query, I think your case is complicated and you should discuss and consult a financial planner, because just a random answer will not help you at all.

If you are interested, I suggest you look at our financial planning service also and fill up the form there to have initial discussions

http://www.jagoinvestor.com/services/financial-planning#fill-form

ManishHi subhash

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hi subhash

I am not clear on what is your question. Please repeat it with more clarity

Manish

Sir while doing online transaction using sbi quick transfer to a syndicate bank account i entered only 13 digits of the account number instead of 14, ie. I missed a zero in the middle. Is there any possibility of such a number to exist. if the number doesnot exist will i get my money back???

No, All account has similar digits, if you mentioned 13 digit, you money will get rejected. Only Corporate account has different series of account no, but in those account also digit count is same.

Thanks

Atul

I dont think there is a possibility. You should check about this with your bank