CIBIL introduces Subscription Services!. Get 4 quarterly reports at Rs 1,200

CIBIL has now started subscription services for its customers. Now you can get bimonthly or quarterly CIBIL Reports if you want to track your credit score on an ongoing basis, then this service is for you.

How to apply for the CIBIL report on a subscription basis?

Earlier you only had an option to buy your CIBIL Credit Report on a one-time basis by paying fees. Now you can buy it on a subscription basis if you wish to.

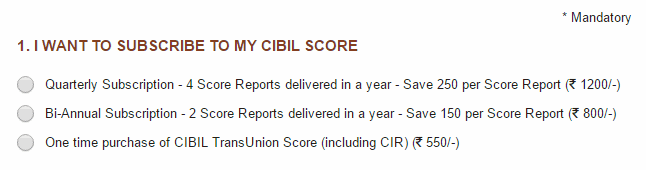

You need to visit https://www.cibil.com/creditscore/. There you will see 3 options which have 1 report (one time), 2 reports (half-yearly) or 4 reports (quarterly). One can choose any one of these options and fill up other authentication-related details and then make the payment online. You will start getting your reports on email.

Who should opt for the CIBIL subscription?

I think all those investors who are going to apply for loans in near future and want to keep a watch on their scores or those investors whose CIBIL Reports were bad earlier and they have taken steps to improve their scores, can apply for CIBIL subscription so that they get the periodic reports. However also note that from the coming year, CIBIL will provide one FREE report anyways

At this point of time, the one-time CIBIL Report + score costs Rs 550, if you apply for another report within the period of 12 months, then your total cost anyways will be Rs 1,100 , where as the quarterly subscription cost Rs 1,200. However if you are the first time applicant, I suggest only buy the one time report.

September 12, 2016

September 12, 2016

Hi Manish,

From when the free report is going to start. Is it from Jan 2017 or Apr 2017 as we (Indians) follow Apr – Mar as the financial year?

I subscribed on 5th May 2016 and got 1 report that time and got 2nd report on 5th August. The service is good from CIBIL.

CIBIL service is very very bad. I have subscribed to the plan. It is almost 4 month, still now didn’t get 2nd report. No proper response from customer care too.

its not working anymore thanks first study before posting

Interesting reactions.

I feel there should be no two opinions on whether this data is to be gathered or not. As banks are public institutions, it is in the interest of public that banks / NBFCs lend to eligible customers only. What is the metric for eligibility. CIBIL score is supposed to be one such metric. However, it is debatable why it can not catch big defaulters like VM upfront. Here it is pertinent to keep in mind the famous quote on stock market “Past experience is no measure for future performance”. This applies equally here also.

As regards whether some one needs to check it regularly, it is like routine medical tests. If one takes precautions proactively, one is good with a check, once two or three years. If not, one has to check very often.

Whether subscription service, i.e. regular paid updates are required, well, to one his own.

You posted an article earlier saying CIBIL was going to provide 1 free Report a year. Has that plan been scrapped?

As per RBI’s mandate, from January 2017, you will be able to access one detailed report in the electronic form free of cost once a year

I subscribed to the 4 Quarterly CIBIL Transunion Score and Credit Information Report on 24 May 2016 by paying INR 1200/- and received my first CIBIL Transunion Score and Credit Information Report on the same day. But after that I have not received my CIBIL Transunion Score and Credit Information Reports. When I am trying to log into their web site using the username registered at the time of registration, I am not able to log into the web site and I am getting the message “Credentials provided do not match with our database.” I think CIBIL is just fooling us.

what about free cibil report every year ???

Not ethical. A third party agency collects credit information of every borrower, and wants to charge public to know their information? I feel the info should be free to anyone via some type of authentication.

Hmm.. I am still not sure on this .

I know its painful to pay for some data, but how can we say that its UNETHICAL ? Its a standard thing all over the world and running from last many decades. Its a business, and they are giving you some analysis of your numbers, if you are interested to get it. If not, you can choose to not take it.

All they are doing is collecting the data from various lenders about you and putting them in one single report. This is mainly for banks . They charge banks for this. Now if you want this report, then it will depend on the business (CIBIL) if they want to at all provide it to you or not. Or if they want to give it free or not .

After all its all defined by regulations/RBI . There is an ACT passed by Parliament and its all legal.

So they are allowed to charge as per the ACT. If tomm, the Act changes and if there is a minimum amount imposed, then they will have to fix the amount.

Manish