We attended Berkshire Hathway AGM (9 learnings from Warren Buffet inside)

On 4th of May 2019, I (Nandish Desai) got an opportunity to attend the Annual General Meet of Berkshire Hathway, hosted by Warren Buffet and Charlie Munger (I also attended the AGM last year)

As a student of wealth, it was a great learning experience for me and I would like to share my learning and insights with all of you. I will not get into companies he named or into the numbers or statistics; I want to keep it simple so that you can pick a few insights for your personal growth.

Here are some of the pictures from the AGM meet.

Background of AGM

Every 4th of May in the city called Omaha warren buffet holds the Annual General meet of his company Berkshire Hathway. It is a global event where more than 30-40 k people travel from all over the world to attend the same. It is more like a celebration where people come to hear his view and to learn from his school of thought. Currently, one single stock of Berkshire Hathway is approximately around 3,00,000 USD ( or maybe more)

9 Lessons learned from the sharing of Warren Buffet

I am putting 9 points I learned from Warren Buffet which I made out of what he spoke in the AGM.

#1 – On Happiness: This one was an eye-opener for me. Most of us equate money with Happiness whereas Buffet made a point, happiness is not a place to reach rather it is a place to come from or operate from. If you are not happy with your current net-worth you won’t be happy by adding a few more lakh or crore to your net worth. He is asking us to focus on things that make us happy in the right now moment.

#2 – On Workability: The bold statement made for investors was very profound, “ All you need is to do is figure out what works and just do it”. Every investor has to discover his or her own process of investing. During the journey keep your eye on what is working for you. For example, in the area of health if going to the gym is working then go to the gym every day, and if yoga fits in your schedule then do yoga regularly. The focus is on bringing workability and staying engaged with the sport called wealth creation. There can be various ways to build wealth, you need to figure out what works for you.

#3 – On Building Competencies: Warren insisted on building and expanding one’s personal competencies. He insisted on investing in one’s own self more than anything else. The future belongs to masters and not to incompetent individuals. He also gave some examples of professionals you will never approach just because you doubt their competency level. You can do your own SWOT Analysis, find your strengths, weaknesses and it will help you to explore newer opportunities and will help you to eliminate weaknesses.

#4 – On Human Behavior: There are many books written on warren buffet and his investment style, however, he insists on reading people more than books. The real insights about human behavior can only be learned when you sit with someone and have a deeper conversation. Every human being is like a book filled with experiences and he invites everyone to spend more time with other beings.

#5 – On Investments: Price has the power to make or break any investment decision. When you buy expensive it can turn any deal into a bad deal. Maybe he was pointing towards buying when markets are low and having a hold strategy. Once a stock is bought, you can’t reverse or do anything if the price falls down.

#6 – On Making Investment Mistakes: Warren was generous enough to admit some of his mistakes on a public platform. In the world of investments, you are bound to make mistakes and going wrong is part of the game. Berkshire Hathway was a late entrant in the technology front and they admitted the same. They are slowly moving out of their old school of thought to match with the new shift happening out in the world.

#7 – On Succession plan: Some Questions in the AGM also came around his succession plan and asking to hand over the stage completely to his team of managers. As a person sitting in the audience I felt, it is a bit hard for Warren to leave the limelight but in next 1-2 years his managers will lead the AGM and will find space on the stage rather than sitting in the first few rows of the AGM

#8 – Big NO to IPO: He advised investors to stay away from hot IPO’s that float into the market. His logic is very clear, these companies may have huge growth potential but they have yet not shown or generated profits. There are few companies he named as well who show growth potential but the numbers they are generating are not sufficient for him to make any investment decision.

#9 – Focus on the BIG picture: He used a very interesting metaphor of owning a stock with owning a farm. By simply owning a farm and watching your farm every day won’t yield you any returns. One has to work hard on the farm to deliver the output. Similarly, by watching the stock price every day won’t serve you, the stock price will grow only when the company delivers performance over a period of time. He is again asking you to buy the right stock or equity or fund and hold for a longer time. Some people check the NAV very often, now it is not a good practice at all (stop watching your farm).

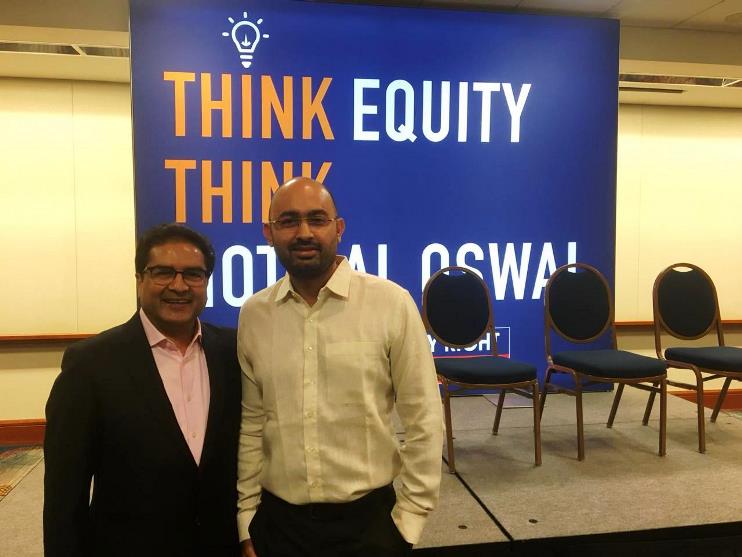

Off the stage, things learned from Mr. Ramdeo Agarwal

Ramdeo Agarwal the co-founder of Motilal Oswal has been attending the AGM from the last many years, he looks up Warren as his Guru and he makes a point every year to attend AGM without fail. In an informal set-up, we got a chance to hear his past AGM Experiences, I also met his first PMS client, some fund managers from the US and Singapore.

Signature on One Dollar Note

Mr. Ramdeo shared that at the start when the crowd was small warren use to sign on a dollar for his shareholders. The queue started to expand in the subsequent years and slowly the tradition of giving signature stopped. He still carries the one-dollar note with him when he met Warren for the first time.

He personally checks the arrangements: Even to date, Warren visits the AGM venue one day in advance to check the arrangements. It shows how committed he is to details and giving a pleasant experience to people attending the AGM.

What I learned personally from the event:

- Operating from a vision: I and Manish Chauhan, we started jagoinvestor with a vision of spreading financial awareness. The event helped me to ground more powerfully with our life’s vision and mission.

- Life Force: Both Warren and his partner are 87+ of Age and they are full of energy and enthusiasm. This is because they see age as a number, they hold their life force high and that keeps them going. Take good care of yourself, exercise regularly, eat well and keep the enthusiasm scale on a high note.

- Statue of Compounding: If you look at the wealth graph of warren buffet it has compounded after he crossed the age of 55. Compounding really works, equity markets are sensitive by nature but when you hold good funds or stocks it compounds and helps you to produce wealth. I placed my net worth on paper and I created a game for the next 30 years.

- Keep Re-inventing: Warren and his team are constantly re-inventing their approach and style. They are now stepping into companies that are more technology-based. It was an important lesson for me as well, the way we run jagoinvestor and its operations we will continue to re-invent every year. It will be a ritual for us to meet once in a year to introspect and to explore the unknown territories.

- Investors meet in a stadium: Yes, it is a dream to fill the entire stadium with investors. It is a dream I saw while I was in the AGM, Questions that kept hitting me were, what can I and Manish do or be to attract people to a stadium. What kind of financial discipline we will have to cultivate to inspire the investor’s community? What kind of content we will have to produce to create space in people’s hearts? The AGM gave me a dream bigger than who we are.

- Power of Partnership: I saw Warren and Charlie on stage, two people working on a common mission and both having a very different style. I would like to create the same Magic with my partner Manish Chauhan. We both have qualities distinct from each other, our styles are different and together it helps us to create magic. In the AGM I could learn that partnership creates magic. We need to partner at a deeper level with each other, with our team, business partners, clients, readers, and other interested parties.

My recommendation

The next financial year if you get a chance to listen to the AGM, they show the event live on yahoo finance or if you are in the US I highly recommend you attend the AGM. It is a great space to be in, people get together to celebrate wealth.

I was accompanied this time with some Big time investors, fund managers and the co-founder of Motilal Oswal Group and I see Mr. Ramdeo Agarwal as one of my mentors. He is amazing to be around, spending time with him was a great learning experience.

During the Trip, I made many friends, met many interesting personalities, overall it was a life-altering experience for me.

Our upcoming sessions in Hyderabad and Chennai

One more point – I am going to share some of my learning’s in our two upcoming sessions in Hyderabad (29th June) and Chennai (30th June), if you are in any of these cities, do book your seats for our 3-4 sessions.

June 6, 2019

June 6, 2019

Hi Nandish,

Congratulations that you got an opportunity and you made it.

Thank you for Sharing your learning’s – Precise and motivating.

Regards,

Amol

Thanks Amol

Nandish,

Thanks for sharing your experience and your learning.

I agree your thoughts on keep reinventing then only any business can sustain. I am looking forward to see from Jagoinvestor reinventing every year

Thanks for your comment P Sundaram

Nandish, thanks for sharing this experience, great article

Thanks

HI Jago team,

It will be great if you can conduct a session in Dubai very soon. I had been following you since you started Jago. But have moved my base to Dubai 5 years Back. I would like to know if you can have these sessions in Dubai too. Would like your guidance for NRI customers like me here in UAE.

Regards

Adhish

Hi Adhish

We would actually love to do a session in Dubai, however the only challenge we have right now is a number of participants there. We mainly advertise the sessions we do to our existing readers and they come to these sessions. So we are not clear how many people will turn up. And given the costing (travel, stay, banquet etc), its a big risk to expect the session to fill up ..

We would need some help in this area from someone who is there (like you) who can assist us in the whole thing and also gather the crowd who is ready to pay the participation fees 🙂

Manish

Quite eye opener information

Thanks for sharing

Welcome !

no Manish Pics..

Hi Hari

Nandish attended it, not me !

Manish

Thanks for sharing, awesome learnings

Thanks

Awesome.

Out of curiosity, how much did it cost you to attend this event?

Close to 2.5-3 lacs included everything !

Keep up the great work.I have read all yours and Manish’s books.Honestly it was because of jagoinvestor I started my own blog even with a busy professional life.Following you on the journey.

Thanks Amrita !