How to use NEFT or RTGS facitlity even if you dont have Internet Banking

I have already written about NEFT and RTGS sometime back and how does it work exactly. However today, I want to share about using NEFT and RTGS transfer offline in bank branches. Even in today’s time, if some one has to send money from one account to another account, they use cheques and demand drafts. Even you can see a lot of people withdrawing cash and depositing it manually in other bank account. They are mostly people who had seen the banking era of 80’s and 90’s.

It might be your parents or uncles or anyone older !. And when you tell them they should have internet banking which has NEFT and RTGS facilities, they do not want to embrace it. But do you know that one can also use NEFT and RTGS facilities even offline by going physically to bank branches.

NEFT/RTGS are processes

NEFT and RTGS both of them are just a process/technology. Its just another fact that they are also provided as features in your internet banking account. If someone wants to transfer money from one account to another, one can always visit the branch in person and put a request to transfer money via NEFT or RTGS .

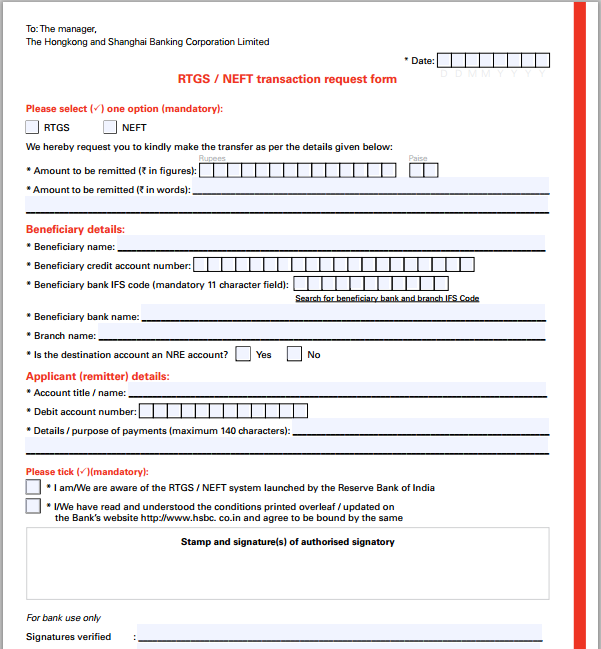

All you need is to fill up a NEFT/RTGS form (sample below) and all the details like Sender Account Details, Beneficiary Account details, amount to be transferred and IFSC code of the beneficiary branch. Then the Bank officer will punch these details on the system and the transfer will be initiated just like it happens online.

Incase you want to do a instant money transfer (not exactly instant, but can take 30 min to 1 hour) , you should be doing a RTGS transfer. One important point to remember here is that, if the amount is above Rs 2,00,000 , you would need to give a cheque leaf with the RTGS form, as part of the rules, but even if you don’t have cheque book with you at that moment – the bank generally arranges for a temporary cheque book in your name.

Recently I had to transfer some money from my wife account to my bank account and we asked for RTGS transfer, which was done promptly and the money was transferred in 10 min to my bank account.

The only pre-requisite for NEFT?RTGS transfer is that

- Originating and destination bank branches should be part of the NEFT network

- Beneficiary details such as beneficiary name, account number and account type, name and IFSC of the beneficiary bank branch should be available with the remitter

Charges for NEFT/RTGS at bank branch

RBI has not set any predefined charges, but banks are allowed to charge it as per their decision. Generally NEFT Transactions upto 1 lacs are not charges by many banks (like Central bank of India) , however some banks can charge for it. But for RTGS they generally charge anywhere from Rs 5 to Rs 50 depending on the amount. Higher the transfer amount, higher the charges.

So next time, if you meet someone who wants to transfer money by going to branch, tell them the option for NEFT and RTGS transfer via their bank branch.

August 22, 2013

August 22, 2013

I have forgotten my atm pin of SBI account. I don’t have net banking or mobile registered for that account but I have 10,000 approximately in that account. I have checkbook but that was issued in 2010, which is not in use today. How can I transfer this amount from my own older account to my another sbi account without going to my old account home branch?

I dont think its possible without visiting the branch now. You will need the cheque book or the internet banking for this.

Can I do transfer of money through NEFT/ RTGS from my account in Bank A to others account in Bank B… ?

I need fast transiction .. so which is the best option ?

Amount is <2 lakh

Plz reply

RTGS is better, IMPS is much better

Is it available even though particular holder donot have cheque book

No, you need to have cheque book to do NEFT

Can I transfer an amount of 3.5 lakhs without cheque by rtgs or neft by visiting SBI Bank in person

No, you need cheque for NEFT/RTGS

Sir,I am facing a problem here, My company transfer my salary on 12th Nov 2016 After noon and I waited to be credited for 8 hours But it was not Happened and waited for next day but remain the same the next day i.e Today But the same so I am confused I initiated my Finance Manager and also My M.D but it shows that its Debited from their end. I went to my Branch Bank of Baroda they told me to check with the branch that is Lakshmi Vilas bank. Please help me out in this.

Hi David

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir

Can RTGS be done from any other braches rather than home branch of an account

Hi Arjun

Yes , If the branch has RTGS facility available.

Yes, it can be done from any branch provided its connected with other branches !

WHAT SHOULD WRITE IN CHEQUE??

hiii i have doubt that what written in cheque time of RTGS???

can NEFT made in cash

YEs, its possible !

Dear Sir

can you explain me the process of NEFT in SBI Bank

I will be very thankful to you

Hi Himanshi

Here is the guide for NEFT http://jagoinvestor.dev.diginnovators.site/2012/09/neft-and-rtgs-transfer-charges.html

Can I make Credit card payment through NEFT offline(going to branch) ?

Yes, its possible !

Does the account holder personally need to go bank for RTGS?

If one wants to do offline, then YES

Otherwise one can just do it from netbanking !

Can rtgs be done without Cheque? In SBI

NO

Sir

My account is with ABC Bank Branch 1

I want to make inter bank rtgs

Can I go to ABC Bank Branch 2 which is closer to me and make rtgs ?

My bank is nationalised and CORE Banking

Yes, you can do that

I have mentioned wrong IFSC Code and all other bank details are right in CSAB now I will get my money or not in bank a/c

If bank details was wrong , then its going to be tough !

it was so great of you to reply

thank you sir for replying

sir as you told we can deposit cash into someones account even if we do not have bank account so whatare the details that we should fill in cash slip

You can get it in the bank itself . Go there and talk to the staff !

You wrote that “Infact you can do NEFT even if you do not have an account in BANK !” my query is

1. How it is possible to do NEFT without having a bank account? What is the procedure?

2.If I have Bank account say X bank. How NEFT is possible withouth cheque book of X bank? What document X bank will retain in case I don’t have cheque ?

Like you can deposit the CASH to someone account even if you do not have an account in a bank, the same way you can do NEFT transfer . When you fill up the NEFT form offline, you need to fill up the CASH SLIP

I was not aware of this facility. Thanks for the information.

Welcome Chetan !

Can we do NEFT transfer for fractional amounts through internet banking? for example, can I transfer Rs 4325.62 in NEFT? or just the whole amount only?

I am not very sure ,but I think its possible

Yes, it is possible. at least in SBI bank. no limit (min or max) for neft.

https://www.sbi.co.in/portal/web/customer-care/faq-rtgs-neft

Glad to know that Manoj ..