Everyone is so desperate to buy a child plan (example). The features of so-called children plan are bundled in a way that it looks magical, as if there can’t be any other product like a child plan and hence, we pay much more than the price it really deserves most of the times. So today we will see how we can create your own child policy by combining term plan and other investments like PPF, FD or a Mutual Fund.

When you hear “Child Policy”, It looks extremely attractive. It gives you money on your death, It gives yearly income and it also gives you money on the maturity of the plan (generally when you child is ready for higher education) . So the point is that a child policy is so much in demand and attracts investors because of its features. However there are some issues with child plans in market. They come with high costs, rigid structure and very less control over it. Traditional Children plans (which are endowment or money back type) mainly do not deliver of returns front and ULIP children plans come with high cost .

So what can you do now ? Can we create a child policy on your own by combining Term Plan and Investments in some separate instrument, in a way that the Term Plan will take care in case of your death and investments will take care of higher education cost in case you survive.

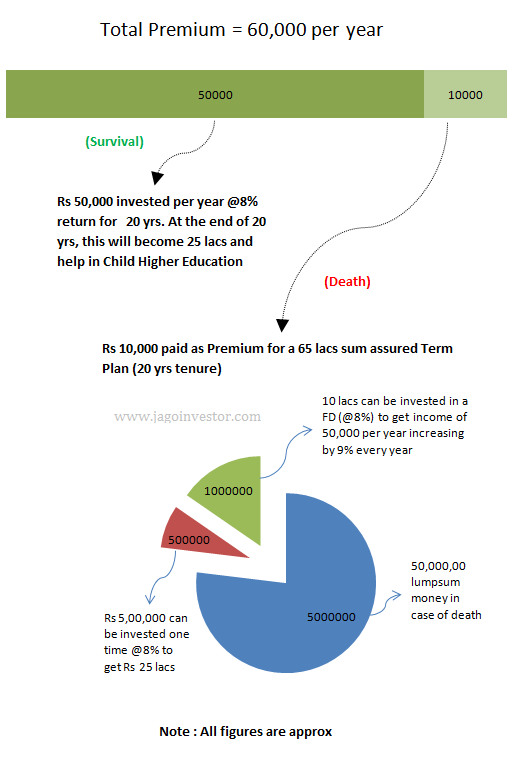

So just like you pay a yearly premium for a Child policy, even in this case you will pay a fixed amount every year. A part of it will go as Term Insurance Premium and rest will go into investments. But in this case the term plan will also open ways for yearly income, as well as future big time expenses for child higher education as well.

When you are not there, the amount received by family from term insurance can be invested in such a manner, that it can provide a yearly income + lumpsum money NOW + Lumpsum money in FUTURE. Lets us take an example and see how it will look like. Suppose you have a 1 yr old daughter for whom you want to create a Child Policy like structure, and you want to achieve these 3 things.

| 1. Lumpsum Money | If you are no more , family gets 50 lacs upfront as lumpsum. |

| 2. Regular Income | After your death, your family should get Rs 50,000 per year separately for your daughter education for next 20 yrs and this Rs 50,000 should increase every year by 9% (so that inflation is taken care of) and assuming this money will grow at 8% return (FD) |

| 3. Money for Higher Education | When your daughter turns 21 yrs old and is ready for her higher eduction, she should get another 25 lacs at that time. |

In order to achieve the 3 things mentioned above , you need to buy a term plan for Rs 65 lacs (Sum assured) and start investing Rs 50,000 per year in something which gives 8% return on annual basis. Apart from this, you will need to clearly define to your family what actions they need to do once you are no more (these are simple tasks like opening a FD or investing money in PPF or balanced funds). The yearly premium for this structure would be around Rs 60,000 (50,000 investment + 10,000 premium for term plan) . Lets us see how this structure will be helpful .

If case of death (Your family gets 65 lacs)

- 50 lacs can be taken out as lumpsum

- 5 lacs can be invested one time to get 25 lacs at the end of 20 yrs

- 10 lacs can be invested one time to get a yearly income of 50,000 increasing by inflation figures!

Incase you survive

- Your investments of 50,000 annually will create a corpus of 25 lacs at the end of 20 yrs anyways

Lets us see this same example through a picture, which will clearly illustrate how this 60,000 premium payment will create a Child policy kind of structure and how it will help you in case of death and survival.

So using this structure you can achieve what a child policy provides. However this whole method has its own pros and cons. There is a lot of flexibility in this structure which a child policy does not have. However this kind of structure would need some level of trust and you will need to instruct your family about it and what they need to do incase you are not around. I think if you are preparing a will, you can clearly mention what needs to be done with the term plan money, so that family members can take those actions.

Download the Calculator and Start Planning your child Policy

Below is a calculator which you can download and punch in your numbers, the calculator will tell you how much term plan you need to take and how much investment has to be done per year. The expected return and inflation is decided by you. So if you want your family to put the money in FD or PPF after you are there around, then put the return expected as 8%, if you want it to be in Balanced Funds put 10-11% and incase of Equity Mutual Funds, put 12-15%. Also note that the premium for term plan will depend on the company you choose for taking a term plan (LIC is coming up with its term plan in few weeks as declared by them recently).

Download Child Policy Calculator Here

Comparison with Child Plans in Market

It’s important to see what is the difference between the child plans in market and this custom-made child policy by combining term plan and investments

Comparing it with LIC Jeevan Ankur

Lets compare this with LIC Jeevan Ankur Policy. If a 30 yr old male has to take a 25 lacs policy for a tenure of 20 yrs, He will have to pay premium of Rs 1,00,000 per year (approx) . In case of death, his family will get 25 lacs + 2.5 lacs income per year till maturity + 30 lacs of maturity (assuming 20% loyalty addition) , incase the person survives, he will get 30 lacs anyways on maturity.

This same thing can be achieved if a person does a 60,000 per year investment in PPF or FD (assuming 8% yearly return) and taking a term plan for Rs 55-60 lacs for a premium of say Rs 10,000 per year (for most company, the premium is 5,000 but lets assume LIC online term plan is taken which will come in few weeks now). So he has to pay total 60k + 10k = 70k per year to achieve the same results, with a lot of flexibility.

Do you think this whole strategy of creating your own child policy is of any use? Do you think it’s too complex? Share your views.