Auto Sweep Account – Enable it in your Saving Bank Account

Do you have a Bank Account? Off-course you do! How much money do you have in your account? 5,000? 20,000? or a few lacs? If you have a lot of cash, lying idle in your Bank Account, and at the same time you don’t want to commit to long-term investment, you need to enable the Auto-Sweep facility in your Savings Bank account. This will make sure you earn good interest on a major part on the cash lying in your Savings account.

What is Auto-Sweep Account ?

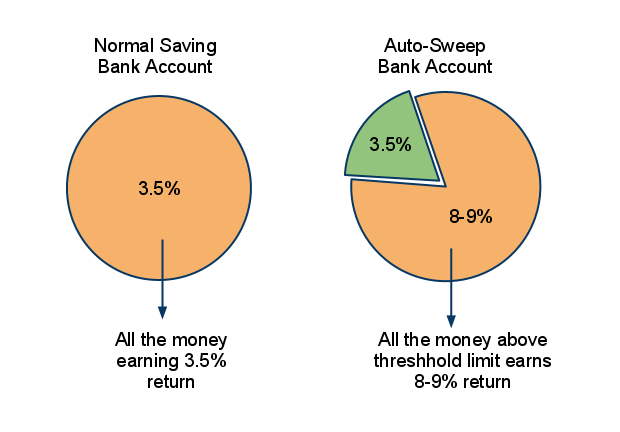

“Auto Sweep” is a facility which provides, the combined benefits of a Savings Bank account and Fixed Deposits. Auto-Sweep facility interlinks your saving bank account with a Deposit account and makes sure any extra amount lying in your bank account above a threshold limit is automatically transferred to Fixed deposits and you earn better interest on your money.

How ‘Auto Sweep’ works?

This is how Auto-Sweep works. You define a “threshold limit”, and money up to that limit will be in the form of cash in your savings account and any amount above this, “limit” will automatically be converted into a Fixed Deposit and you will start earning normal FD returns on that part of the money. At any point in time, if you need money more than is lying in your bank account, the money lying in the Fixed Deposits is Reversed-sweeped into your savings account and you can withdraw the amount you wish.

Example

Ajay opens a new Savings Bank account with SBI. He enables Auto-Sweep facility on his savings bank account and defines the threshold limit of Rs 30,000 . Now suppose he has Rs 10,000 lying in the bank, He will be earning normal 3-3.5% interest on this money. After that if he deposits Rs 60,000 in his account, his total balance would be 70,000. But as this is above his “threshold limit”, the extra amount of 40,000 will be converted into a fixed deposit automatically and start earning returns equal to normal Fixed deposits with SBI (for example 8%). This way he always has 30,000 in his account for his daily requirements, and he has 40,000 converted into Fixed deposits which again is available to him incase he requires it.

Now suppose he has to withdraw 10,000 from his account, he will actually withdraw it from the cash lying in saving bank , and his balance will reduce to 20,000. However on the other hand if he wants to withdraw Rs 50,000 . then in that case, as his account balance will be just 30,000, an additional Rs 20,000 will be auto-reversed from his Fixed Deposit and he can withdraw total 50,000 .

Opportunity cost

A lot of us don’t bother about how much idle money is lying in our account and for how long. This happens because we think “I might need it soon, so lets not commit to any investment.” But then, the money keeps lying in the bank for months and months and sometimes even years.

Suppose your account has Rs 1 lac for 1 year, it will earn 3.5% interest on it, which is Rs 3,500 for a year. However if you have auto-sweep enabled in your savings account with threshold limit of Rs 20,000, the additional 80,000 will actually be in form of a fixed deposit and it will earn an interest of 8% (assumption). In this, you will earn 3.5% of 20,000 which turns out to be Rs 700 and 8% of 80,000 which is Rs 6,400 , a total of 7,100 , which is almost 100% more than the first case .

A lot of people have much more than 1 lac in their accounts, not just 1 lac. You can earn some extra returns if you just enable auto-sweep on your saving account . So find out if your bank provides the facility, just do it, and get it right away!

Also note that different banks have different names for this facility. For eg., ICICI Bank calls it ”Auto Sweep” , HDFC Bank calls it “Sweep-In” account , and SBI calls it “Saving Plus.” . Here is a list of other banks and the name by which they call this Auto-Sweep facility (thanks for Gopal Gidwani for the info)

- IDBI Bank – Sweep-in Savings Account

- Axis Bank – Encash 24

- Union Bank – Union Flexi Deposit

- HDFC Bank – Super Saver Facility

- Bank of India – BOI Savings Plus Scheme

- Oriental Bank of Commerce – Flexi Fixed Deposit Scheme

- State Bank of India – Multi Option Deposit Scheme

- Allahabad Bank – Flexi-fix Deposit

- Bank of Maharashtra – Mixie Deposit Scheme

- Corporation Bank – Money Flex

- United Bank of India – United Bonanza Savings Scheme

Disadvantages of Auto-Sweep Account

Auto-Sweep has some disadvantages too. In general the interest rates of normal fixed deposit and FDs under Auto-Sweep are same, but some banks charge a penalty if the FD under auto-sweep accounts are broken before some duration like 1 yr and 1 day . But I think that’s fine. If not 8% , you will at least get 7%, still better than 3.5% .

Some banks are also known to give simple interest on the Auto-sweep Fixed Deposits and not compound interest as in case of normal fixed deposits .

Don’t over do it

While Auto-sweep is a wonderful thing for salaried class people who want to maintain liquidity, as well as want to earn more interest on their unused money, one should not over do it. If you are very sure that the money lying in your account will really not be used for long, better to use the normal Fixed deposit or Debt funds. Only if you are unsure of your money lying in bank and when you might need it, you should be using Auto-Sweep facility.

The way auto-sweep works, it makes it an ideal place to park emergency funds . So if you have kept 6 months of expenses as your emergency fund in Saving Bank, then you can enable auto-sweep facility and set threshold limit as 2-3 months of expenses, so that rest of the money can earn a better interest.

Comments: Did you know about Auto sweep account earlier? Do you think it will be helpful for you and do you plan to enable it?

March 31, 2011

March 31, 2011

How many sweep account sbi offers? i mean i already have two sweep account. now i have deposited some amount to the same account. but It doenst turn as sweep account. why? Is there only two sweep account allowed at a time?

Hi Hari

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir how much interest a candidate get on 4 lac rupees in 3 month in auto sweep mod account

Hi ashok kumar

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir i try saving account to sweep account online through Net banking but display this msg “There is no transactional account available with your username which can be converted into Auto Sweep for Corporate Salary Account.” please help in this regard.

This is complicated query , hence you need to contact your bank branch for this.

i received the same msg but activated sweep by going to requests and enquiries and then sweep creation for CSA

Hello Manohar, I am facing same issue. how did you resolve this issue?

If more money is deposited in the account where the auto sweep is already active, will the extra money also be auto swept automatically ? How will interest be calculated if the amount increases periodically?

What will happen if the additional amount (over and above the initial deposit) is withdrawn in between before 1 yr? Will it affect the interest rate?

Yes, it will be auto swept automatically !

Internet earned in auto sweep account is under TDS? Then can i give 15G/H for this tipes of acount? Is it possible or not?

Hi chandranarayan

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

will TDS apply on this?if yes,will form 15G/H BE APPLICABLE?

is there any limit for threshhold…?Suppose I want to set threshhold as 10/-.Will it be ok?

No, it has to be above a limit. check with your bank

Multi Option Deposit Scheme or auto sweep facility is not given to clients having their Saving bank account in CENTRAL BANK OF INDIA, I could not understand how this bank can over rule the directives of RBI.

I want to know is there any autonomy has been given to any of the banks to formulate such things.

You should then complain to banking ombudsman !

How can I view the Sweep Account ?

Hi Manish,

Thanks for the excellent post. Very clear and educational.

My query – SBI has created the Auto sweep accounts for me – without my permission – but I don’t mind that.

The excess amount from 25,000 in my savings is going into a different FD account every month and I now have 3 such accounts since this facility started in April 2016.

Is this what it should be? Shouldn’t it go into a singe FD account?

Hi anup

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

hi Anup,

Depending on your bank, FDs get created periodically(usually it is monthly for banks like SBH,SBI) and a separate FD account gets associated with each FD. This will make sure that when you withdraw funds in excess of your existing savings a/c outstanding balance, only the latest FD is broken(since interest accrued would be lesser than older FDs.

Hope this helps.

Regards

Chaitanya

hi Manish

i have 8-10 auto sweep account in SBI, during part term breakout or interest paid TDS has been deducted. i m not understand one thing when i pay income tax yearly, then why should i re-pay for the same in the form of TDS in auto FD’s. is any provision to save this deducted amount.

Hi Pankaj

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi Manish,

As you said there are some disadvantages of this facility. Can we transfer money from Auto Sweep account to Saving account? I am asking this because it cuts some amount from account if there is less money in Saving account.

E.g. I have 50000 in my Auto Sweep account and 1000 in Saving Account. If I withdraw or transfer 20000, it will cut 10 rs + 1 or 2 rs TDS from the amount.

Also, how to increase threshold amount for the account?

Regards,

Vijay

You need to check about this with the bank only because each bank has its own rules

Sir,

Suppose threshold limit is 25000/- for MOD with Autosweep facility in SBI. My expenses like ECS, credit card payments and withdrawing cash is 50,000/- then how will it work.

RK Singh

Hi rk

I am not clear on what is your question. Please repeat it with more clarity

Manish

As you give exapmple of a person Ajay. lets assume he withdraw a amount of 50000. now i am confused on that remained 20000 money. remained 20000 will be on 8% intrest or 3.5% intrest? what will be the a/c balance? or remained 20000 will be fixed deposit or not?

That remaining ₹20k will be considered as savings account balance n u ll get 3.5% return on that (as ₹30000 is the threshold limit).

And ₹20k will be now considered as savings balance.

Amount in saving account will be at 3.5% only

sir

Will my EMI ECS dishonoured if saving balance is not enough but MOD is sufficient to clear it.

E.g. I have SBI MOD @ 8% of 100000 from Jan upto Dec . In March my balance falls below 20000 which is my EMI .

Will the ECS be cleared from MOD?

how much interest will i get on that 20000 and the remaining 80000?

I am not very clear of the answer here !

Hello sir,

I need to ask you that if any bank interest which is received is not shown in pass book..can we ascertain it with the help of mod balance…that whether it has been credited in bank or not..?This is related to TDS work so please if you can help me out of it.

Hi Lakshita

Thanks for asking your question. However we do not have answer to your question.

Manish

Hi Manish,

Good explanation with instance.

I have a problem with MOD balance in my sbi account.

The available balance is rs.5000/- and my MOD balance is rs.1,00,000/-. Now, I want to pay my credit card bill of rs.65000/- through online by selecting the SBI in the netbanking. The transaction getting failed stating record not found. What could be the reason for this? I guess, the remaining 60k should be taken from MOD balance but its not happening.

I am not sure on this. You will have to check it with SBI itself

Rk, is your problem resolved by SBI? I have chosen auto pay for my bills. I’m afraid I might get into the same problem.

Lets say I have idle fund of 50K for 3 months…which is better Sweep account or Debt fund ???

Hi Manish,

Thats a great post and thanks for sharing it. Can we enable this Auto Sweep account with Salaried Savings account ?

Thanks,

Dinesh

Yes you can do that !

I HAVE IDLE CASH OF RS 70000 SO HOW TO ADJUJSTI IT TO AUTO SWEEP WITH SBII SAVINGS ACCOUNT.

AND ALSO GUIDE ME LIKE WHAT SHUD BE THE DURATION FOR IT

Hi AJAY

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish