4 benefits of a group health insurance cover from employer !

It is common nowadays for salaried employees working in big companies to have a group health insurance cover from their employer. Some firms provide health cover to the employee, his spouse, and his children while the more generous ones also extend this cover to the employee’s parents.

In this article, I want to help you understand in some detail, what exactly constitutes group health cover. I will also cover the benefits of group health insurance policies that are not available in the individual health insurance plans one buys directly from health insurance companies.

What is group health insurance ?

The concept of group health insurance is very simple. When you buy health cover policies covering big groups of 50 people or even 500 people, it is termed as group health cover. Normally big organizations would take these policies for their staff.

The good thing about these group health insurance policies is that it can be tailored to the requirement of the proposer (one who is taking the policy) and can be offered as a benefit to their employees. Insurance companies benefit from this arrangement, as they get massive premiums from a single source (imagine how much premium Infosys would pay yearly). The big ticket-size also allows insurance companies to offer more benefits at a relatively lower premium value (How Insurance works – The full business model).

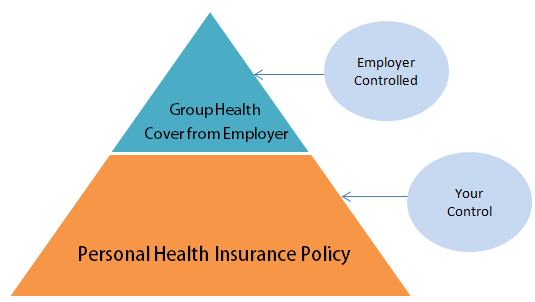

I recommend that everyone have his or her own health insurance apart from employer health cover, but that’s a different topic of discussion. The focus of this article is to highlight some of the good points about group cover and how you can benefit if you fall under such a scheme.

4 advantages of group health cover from employer

1. No Medical Checkup’s

The best part of group health insurance cover from an employer is that there is no requirement of undergoing a medical checkup – both for self and family members. Everyone is covered automatically in the group cover from Day 1 and you can completely avoid the hassle of a medical checkup.

2. Maternity cover from Day 1

This is going to bring smiles on lots of faces! From Day 1, maternity expenses are covered under group medical cover in almost all companies. So if you join a company and if you are part of the health cover benefit scheme, you will get maternity benefits immediately; unlike the individual health cover which has timing limitations.

3. No Waiting period Concept

Another great feature of group health insurance is that there is no concept of waiting period for any illness. Even pre-existing illness are covered under group cover. So if your parents are suffering from some illness such as diabetes or heart ailments, it gets covered from Day 1. This is never the case with individual health cover that you buy on your own. Again, this exception is only made possible through the dynamics of group health cover that I explained earlier.

4. More Cost Effective because its a group cover

Like I mentioned in the beginning or this article, because of economies of scale, the premium per insured person is very low for group health insurance policies. Hence, if your employer is providing you a group health cover, it makes sense to apply for it, even if you have to pay the premiums yourself.

How to fit in Group Health Cover in your overall Health Insurance Portfolio ?

So now the question is how should a group health insurance cover find a place in your overall health insurance portfolio? While we have seen advantages of group health insurance, in the same way there are lots of disadvantage of the group health insurance. The first importance should be given to having your own individual health insurance policy so that the complete control is in your hands, not your employer. While group health insurance from employer is great, but look at it as secondary option, not primary for the reasons I have mentioned in this article.

So, make sure you do not depend 100% on employers health insurance because it can stop anytime, it will not be available for long term after your retirement.

Do you want to share any insight on this topic or your views?

March 3, 2014

March 3, 2014

Hi,

I am looking for health cover for my family including my parents

details below and I want

Self age – 30

Spouse – 26

Son – 2

Father-61

Mother-56

Coverage for 5 lakhs and floater

Kindly advise some good policy

Medimanage – Worst Service by Medimanage Health Insurance TPA

Hi,

I am looking for health cover for my family

details below

Self age – 38

Spouse – 37

Son – 14

Daughter -9

Coverage for 5 lakhs and floater

I am a diabetic on medicines for last 5 years

Kindly advise some good policy

Sent an email to you on this

hi,

I,48 years Male, under went cardiac bye pass surgery 14 yrs ago. now i am covered in a group health insurance policy of Royal Sundaram (TPA- MEDI-ASSIST), which was provided by my son’s employer.

Now, i want to know that in case of my hospitalisation, will exclusion on basis of pre exixting dieseses apply.

pl guide me

Not really.. most of the group health cover are very liberal, but check the brochure document once for exact wordings !

Hi Manish,

I have a Group Medical Insurance of Rs. 5 lakhs from our company. I wanted your advice on whether we should still have another Insurance as a back up?

Thanks for your time in answering this.

Read this one and you will get your answer http://jagoinvestor.dev.diginnovators.site/2012/07/group-health-insurance-policy.html

Hi Manish,

I have simple question in my mind that these are the very useful benefits, then why should not all the company have Group Insurance?

What is the reason that employers are not interested to take Group Insurance?

DILIP

Because they have to pay premiums .. its COST !

Manish

But employees are ready to bear the premiums from their salary then i think it would not be a problem, right?

Yes, but then company should be offering it . They need to talk to health insurance companies and ask for it !

Thanks a lot Manish

Good article Manish. One thing I observed is some of the employers still cover parents of the employee (upto 3 family members including parents). Getting health insurance for senior citizens would cost very high. However thru employer health insurance, this comes automatically without any issue. I felt this is one of the unique feature. However these days employers have become clever and they are negotaiting with insurance companies to remove parents from employee health insurance policy which is bad.

Yes, I think majority of employers dont have it , only some do !

Hi Manish, I have health insurance of 1.5 L provided by my employer without any premium. Do employers charge any premium from the employees?

Its their WISH , they can or dont .. If they are not , its good 🙂

The claim process is certainly more hassle free with group insurance. A friend had to undergo a minor surgery while travelling. She couldn’t inform the insurance provider but submitted all the bills etc with the her office after almost a week or so….no further follow up required, no annoyances faced, no further forms required….the claim was settled in less than a month…

Great

Thanks for sharing this with us !

Yes, claim is very fast and easy. But main role is again of the concerned employee. No interference required by the HR of the company. Just contact directly to claim department at every situation i.e. receiving of courier, reports correctness and claim status through customer care and concerned department. The employee definitely receive the claim amount at the earliest. I got sanction the claim amount less than 40 days from oriental group insurance, but got credited amount little bit late like 10 days from my HR department again after regular follow up.

Thanks for sharing that ! 🙂

if one’s employer d’t provide with group insurance. one can be part in others’ like offered be certain financial institution viz,. cards, mutual funds, advisory services etc.

Obviously again as said control ‘ll lie with a proposer as they change terms coverage, insurance agency etc. or might stop partnership.

for that case i think it is better to have a mix of personal(30-40%) & group insurance

Yea .. what ever you choose, its fine .. just make sure you understand and accept the long term implications of it 🙂

thnx manish ji.

long term implications? is there any CATCH in it.

obviously i m trying to reduce premium along with a backup(in case one d’t wrk out). what i had suggested is based on observing past track for ex. if u r associated to a card(without default) as long as u r part of it u ‘ll certainly get these benifits. and in case of casulties shall be born by both though i have seen somewhere IRDA had passed a regulation that instead of settling claim in parts 1 company has to process every thing & other is compleed to share its share with first company.

what do u say abt this.

No no , I just meant to say that understand what you are doing, and what are its effect, thats all .. no negative comments on that!

Informative and well written. Your post and related articles does its bit in creating awareness on the benefits of health insurance and group policies, especially in a country like ours where only about 15 % of the total population have a health cover.

Thanks 🙂

Does 15% population really have health insurance ? From where do you get that number ?

Can u suggest which company offer best group health insurance plan.

Our employer is looking for group health insurance for 113 employees.

Hi Dipak,

Oriental is the best company to have group insurance. Because they are at no.1 for hassle free claims and easy to the employee for their feedback. Premium is very low as compare to others.

Religare is also good after Oriental, because they have more features in their group policy. But it depends on your company’s requirements. I will suggest you to choose the Oriental Insurance Company.

Thanks

Good article, though the group insurance has its drawbacks like individual limits. Also, unlike in US where you have company insurance cover for 1 year after you leave the job – in India the cover goes off the moment you leave the job.

True ! .. thanks for sharing !

Unfortunately, the company in which i am working do not offer any group medical insurance facility for its employees though it is the largest telecom company of India and that too backed by Govt of India……….Yes i m talking about B**L which do not have any such facility

Hey Sushil, I came to know from one my friends that B**L is providing the INsurance. His DAD is working in that and is aviailing that. Please approach the proper channel. Good luck .:)

Sir which City you are reffering to?

Andhra Pradesh…Vishakapatnam..

Hi Manish/Mahavir

I had a family floater policy from my employer(for which i had to pay a premium).

My last working day in present company is 4 march 2014.

My mother hospitalized and undergone a surgery on 28-2-14.

My cash less claim was approved.

I need to know what happened if mother is not discharged on/before 4-3-14.

Does I get coverage upto 4-3-2014?

Whether I have to inform hospital that I have resined from 4-3-14?(Does there any complication after cashless approval in future)?

Please give me a reply asap.

If cashless claim is already accepted , I dont think you need to worry .. becasue you can always tell hospital , the once the cashless is accepted, then company will pay that !

Thanks Manish for sharing this. I have a question here. Is Giving Group Health insurance cover for their employee mandatory for an organization? Is this comes under any rule derived by government?

Dhinesh, I think in India it is not Mandatory for an organization to provide Group Health Insurance..

No its not mandatory

Hi Manish,

I am looking for a Heath Insurance for my Family for 5 lakshs (Me , spouse and2 year old Daughter) . When i enquired about the claims in some hospitals as said by sreeni i came to know that many Govt sector Insurance companies are not providing proper approvals.

I am looking for the below points.

1) NO Room charges. Complete coverage of room charges

2) Complete coverage of ICU Charges

3) Organ donar Charges to certain extent

4) Medical Checkup every Year

5) NO Claim Bonus

I feel below suits best.Please suggest

1) Apollo Munich

2) Max Bupa

3) Religare Care

I am bening towards Religare care as it is covering all above mentioned points and also the premium is reasonable. Please advise.

Dear Narasimhareddy,

Yes, you are right. As per your requirement RELIGARE will suits you the best.

From your above 1st point what i could understood was that in case of room rent, you do not want any kind of restriction.

If that is the case then let me tell you that RELIGARE is have capping in room rent in term of “ROOM CATEGORY” which is better than capping in terms of % of sum insured

Thanks Dinesh Jain.

I have also heard baout L&T Health Insurance. Does it a right option over Religare Care. Please share your ideas if you have any on L&T.

Thanks

NarasimhaReddy

Sir,

I would rather stick to Religare instead of going for LNT

True that if you directly deal with govt companies, some issue will happen because of the govt thing .. But if you have a good TPA in between , then there should not be a lot of issue . So from that angle, have a look at Oriental .

But surely Religare is one very good option !

Hi Manish,

Taking personal health insurance is always better and we have tax benefit as well. Self its 15,000 and for parents 20,000 we can claim for tax.

Which health insurance policies you would prefer for personal? Apollo near my home said Govt insurances like Oriental & New India would not approve immediately. Better to go for Apollo munich or Bajaj or Icici Lombard or HDFC Ergo

Many Thanks, Sreeni Jakkula

Hi Sreeni,

I think in group insurance tax benefit is also there for parents case. My company provides that.

Thanks and Regards

Kranti

this is just not true . Oriental is not bad like its projected by them (mainly the agent I guess) . Oriental is surely a very good option

Nice artice..I too agree with the Manish…It is very beneficial to have group insurnace and at the same time have a persoanl health Insurance on the safer side as said at any time u may not have the Group insurnace … Company may take away that policy..or you have resigned and you are about to join the another comnpany and in that transition period some thing has happened or etc…

True !