4 kind of exclusions in your health insurance policy which are NOT covered

When health insurance claims are rejected, it disappoints the customer more than anything else. Its a disappointing moment for the policy holder, when his trust is lost in company and he starts feeling that he was a fool to buy the health insurance policy at the first place and waste his premium, because companies are just fraud, who wants to loot the customers, by giving silly reasons for not settling the claim.

They feel companies are coming up with unreasonable reasons to reject their claims. This situation is a big blow to customer financially, because now they have to bear all the expenses from their own pocket. This is exactly what happens with many customers who have no idea of what their health insurance policy covers and does not cover.

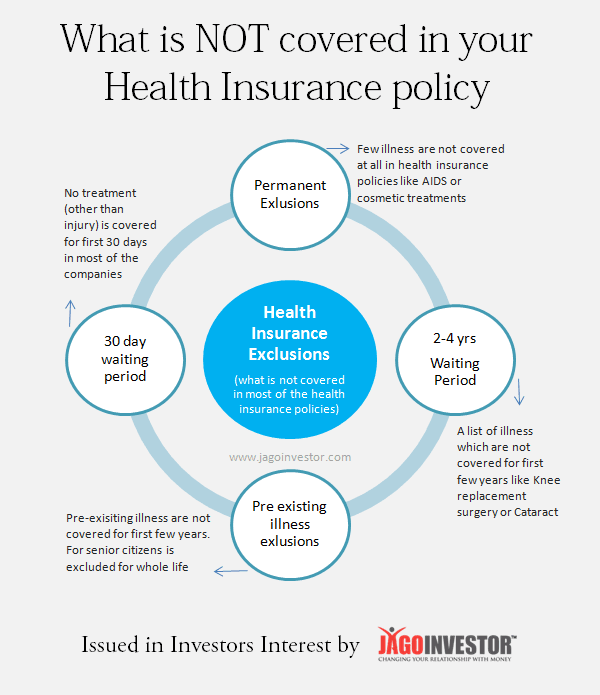

What does a Health Insurance Policy does not Cover ?

In almost all the cases where claims are rejected and customers are disappointed, its seen that it happens because companies reject claims based on the policy document rules and what is covered or not covered into the policy, however the customer disappointment is always there, because there was a lack of understanding of what is covered and what is not covered. There various clauses like waiting period concept or exlusion of pre-existing illness, which customers do not try to understand fully and see health insurance policy as something which will just pay their bills in any medical case. However thats not true.

In this article I want to make you aware about the 4 major clauses in almost all the health insurance policies which will help you understand how exclusions work in case of health insurance policies and when you will not be paid. This will help you and companies both to make sure you are on the same page.

Exclusion #1 – Permanent Exclusions

Permanent exclusions are listed category of treatments, which are never covered in health insurance policy for whole life. They are excluded permanently from the ambit of the health insurance scope. These permanent exclusions are clearly mentioned in the policy document of the health insurance product under section “Permanent Exclusions”.

Even before buying the policy, you can look at the PDF document of the policy which must be there on the health insurance company website. Almost all the companies have the same list of illnesses listed under this section, however you should anyways look at it.

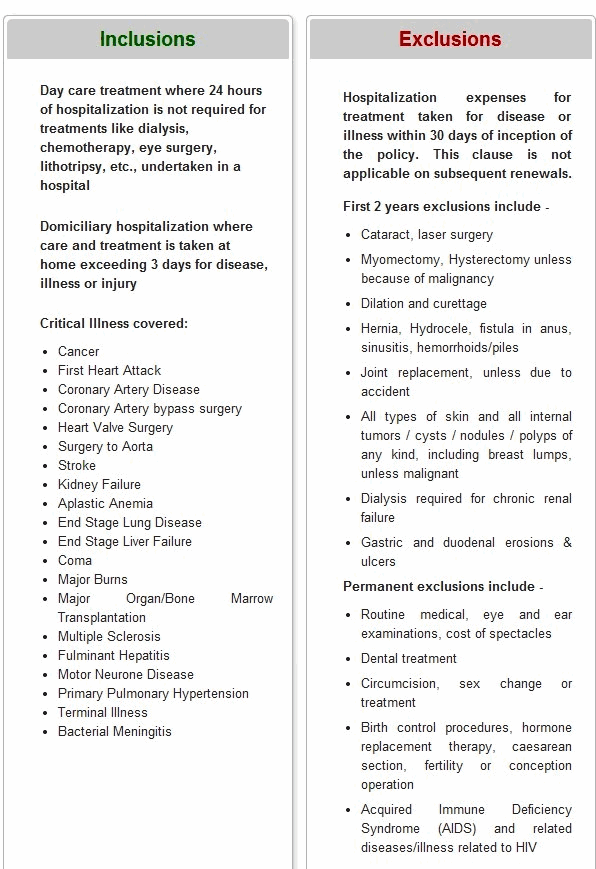

Here is a sample list of some of the permanent exclusion taken from Religare Care Health Insurance policy(not the full list)

- Any condition directly or indirectly caused or associated with any sexually transmitted disease

- AIDS

- Any Treatment arising from or traceable to pregnancy, miscarriage, maternity, abortion or complications of any of these.

- Any Dental treatment or surgery unless necessitated due to an injury

- Charges incurred in connection with cost of spectacles or contact lenses, routine eye and ear examinations

- Any treatment related to sleep disorder etc

- Treatment of mental illness, stress , psychiatric or psychological disorders

- Any Treatment/surgery for change of sex or gender reassignments including any complication arising out of these treatments

- All preventive care, vaccination, including inoculation and immunizations

- Non Allopathic treatments

- Any Out Patient Treatment

- Treatment received outside India (unless its part of the policy)

- Act of self destruction or self inflicted injury , attempted suicide

- Any Hospitalization primarily for investigation or diagnosis purpose

- Cosmetic and aesthetic treatments

- plus, there are many others – which you should read in policy document

Here is an exact snapshot from Bharti Axa Health Insurance page

Exclusion #2 – Waiting Period Concept for selected illness

Each Health insurance policy has the concept of “Waiting Period” for a selected list of illnesses, which means that for first few years(which can be anywhere between 2-3 years) will not be covered under health insurance and only after that period they will be covered. So if waiting period is 2 years in some policy, and you take the policy in year 2014, the illness covered under waiting list will be covered only after 2 yrs are over.

This is one thing which customers do not pay attention to while taking the policy and if they get hospitalized due to some illness which is not covered under waiting period, their claim is rejected and then they feel cheated and complain about the company. Here is a real life case on our forum

Here is the list of some of the illness and diseases which are part of waiting period in most of the policies

- Arthritis , Osteoarthritis , Osteoporosis , Spinal Disorders, Joint replacement surgery

- ENT Disorders & surgeries, Deviation, Sinusitis and related disorders

- Cataract

- Dilation and Curettage

- Piles, Gastric Ulcers

- All types of Hernia , Hydrocele

- Internal tumors, Skin Tumors , cysts

- Kidney Stone , Gall Blader Stone

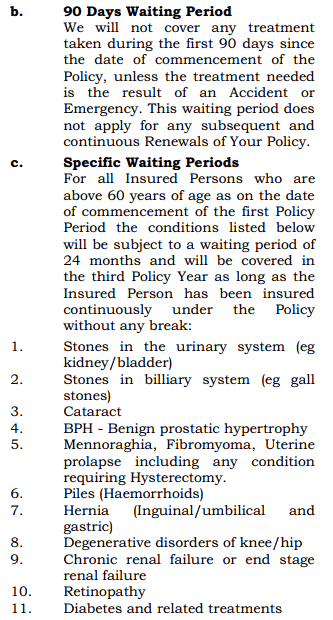

Some policies might have the specific waiting period for senior citizens, like in case of Family First policy by Max Bupa, there are few illness which are under 2 years waiting period for senior citizens, but not for young customers.

Exclusion #3 – Pre-Exisitng Illness

Another exclusion is “Pre-existing illness” in all the policy documents of all the health insurance policies. Pre-existing illness are those illnesses which are already detected for the patient. Most of the companies do not cover these pre-existing illness for starting 2-4 yrs (exact time varies from one company to another). So if someone is suffering from some respiratory illness already, then any treatments or hospitalizations which occurs due to respiratory problems will not be covered for first few yrs (the exact tenure depends on company). This is to prevent situations where a person is detected for some disease and he takes the health insurance so that he is covered for the hospitalization, this is simply not allowed and does not make any business logic. So thats the reason its said that one should take health insurance as soon as possible so that those initial few years are passed and then you are covered for wide range of illness.

Pre-existing illness in case of Senior Citizens

In case of senior citizens, pre-existing illness are excluded for rest of the life in most of the policies, because anyways there is higher probability of senior citizens getting hospitalized due to their existing illness. So if someone has undergone bypass surgery and they are senior citizen, any heart related treatments will not be covered for all life. It will be permanently excluded from the policy. Thats one big reason why I keep on saying that you should take your parents health insurance before they turn 60 yrs. There are some companies like Oriental Insurance, which does not even require medical tests for persons upto age of 60 yrs, just the declarations given in the health insurance form is enough.

Exclusion #4 – First 30-90 days waiting period

Almost all the health insurance companies do not give cover for any medical treatment for the first 30-90 days of taking the policy, except the medical expenses which result from injury (like accident). For example Religare Care have a initial 30 days waiting period, however Max Bupa Family First policy has a 90 day waiting period

Conclusion

Health Insurance is a preventive financial product, not a reactive financial product. You take health insurance to make sure that you are covered from future problems, not to deal with current medical issues. So when you are healthy, you should go for medical policy, so that you are covered for any long term medical issues. Most of the people start the procedure of buying health insurance when some illness is detected, and that’s when health insurance policy will not help you much. Instead of having wrong expectations by assuming things, better analyse and research the health insurance policy properly and deeply by reading the policy document.

Let me know if you have any experiences on this or want to share something ?

February 6, 2014

February 6, 2014

I am 31 years old, My wife is 28 years old, expecting baby in next few months. My Mother is 56 years old. I have gone through a kidney transplant 5 years ago and my mother was my donor. Kindly suggest if there is any policy under which this preexisting surgery is covered.

No policy cover preexisting illness

Hi Manish,

I am 30 year old and i want to buy a health insurance policy for me and my wife. I talked to Apollo munich about a cover of 5 lacs. we already have covers from our offices of about 6 lacs. I have a problem of blood pressure for which i take medicines and its completely under control. other than that my health is perfect. Apollo munich is willing to give me the policy without any health check up as they said they do check ups only after 35 and cover of more than 10 lac. Should i disclose my BP to them because they dont seem bothered about that. If i dont tell them now and 5 years later i have a problem related to BP, will there be a problem?

When you say they are not bothered about it, does it mean you told them about it and still they are saying that it does not matter?

Note that insurance is a proposal contract, means the onus is on you to declare all things. SO if you hide it, I seriously think you will never get any claims paid !

I held a Mediclaim policy for myself and my senior citizen parents from Oriental Insurance since 1998. However during the policy renewal process earlier this year, my premium cheque got dishonored because of insufficient funds. I was traveling overseas at that time and the bank balance fell transiently for 2 days. Oriental refused to take cash and canceled the policy. They then accepted the cash and issued a new policy well within the 30 day grace period. However they are refusing to give us continuity benefits.

Does this mean that my elderly parents will not ever get cover for their preexisting illnesses from now on?

Hi Anil

This can only be confirmed by the insurer. You need to check with them on this.

Note that if the policy which is issued is a NEW One , then it might happen !

Sir,

I am 52 years old and my wife (House wife) is 46 years old. I would like to take a Health insurance for a SI of Rs.10 lakh. Kindly advise whether I should go for a floater policy for both of us or individual policy for each of us separately.

I read somewhere that family floater policy may be cheaper but risky. Since I am the proposer after the proposer’s death say after 20 years, at that point the policy cannot be renewed further. Since most floater policies make no specific provision for continuing cover of the surviving members in case of the unfortunate death of the senior-most member/proposer. Then my wife will have to take a fresh cover which is going to cost a fortune regardless of the fact she was covered for 20 years and even if she has had no major ailment in that duration. At that stage my wife will need to take a fresh policy without having the benefit of her claim history and preexisting disease cover that comes from continuous renewal of the policy that she had got under the family floater policy.

Since a continuous cover and claim history is critical in this category is it wise to buy a individual policy?

This is my doubt. Could you please throw more light on this.

Thanks

Hi,

Does tests like MRI scan, CT scan covered under health insurance?

Thanks

No I think thats too advanced one !

Hi Manish,

Thanks for this helpful article, I am going to buy medi-claim policy for me and my family, but I have following few doubts in it. Could you please help me to decide.

I am 29 years old, My wife is 27 years old, expecting baby in next few months. My Mother is 58 years old. Me and My wife are healthy, My mother is having diabetes and hypertension since 2 years.

Q1. Should I buy Family floater policy or Individual? Or, individual policy for my mother and family floater for my rest of the family? Please suggest.

Q2. Is it true, that in family floater, If senior most person expires then whole policy lapse and rest of the member need to take policy again?

Q3. Is it possible to add new member in policy? as I am expecting baby in next few months. If yes, then will it affect pre-existing deseases waiting period and how?

Q4. I am thinking to buy policy without maternity cost cover because people says that that will increase premium considerably. I am planning to cover this cost from the mediclaim policy offered by my company. Am I doing right thing, Is it correct decision? Please suggest.

Q5. In my specific case which insurance company you would suggest, which best suite to my requirements? I have few in my list: Oriental ,Star Health, Apollo Munich , Max Bupa.

Thank you,

Rohit

I’m Rajendra, 37 yrs, salaried from Punjab; I want to buy a term insurance plan, but am confused ?? While I got on line quote for 50 Lacs cover for 28 years, the premiums of Aviva & Aegon Religare was same around 7000/- inclusive taxes but it was 8450+taxes at HDFC & 12500/-+ taxes at ICICI pru; for death benefit only; please suggest which plan to purchase. Is Aviva good or not?

You can go with HDFC !

Hi Manish, I am having high cholesterol detected in previous test.But not shown in latest test after taking medicines.Can I mention this in my Health insurance proposal form? Is it taken as pre existing illness? Can it increase my premium??Please guide

Hi kiran,

In my view, you need to know “High cholestrol” detection was a one off case or this has happened earlier also with you.

Before going for the test (in which high cholestrol was detected), did you have too much oily foods ?

In the 2nd test, high cholestrol was not detected because of the medicine you had taken.

As of now, don’t be in a hurry to go for mediclaim,I would suggest you to again go for a test after having a normal food and without medicine. If in this scenario also, if high cholestrol is detected then yes, you should reveal the same

in the proposal form.

Once it is revealed in proposal form, it is quite likely that it will be considered as a pre existing disease and even company might might load your premium also

The main question is “Did you ever have problems of High Cholesterol for a long time and were suggested medication for that? ”

If thats the case then you need to inform company about it. But if it was just a fluke and mistake, then its fine to not report it .

Yes, this if detected in the test done by company, can raise the premiums

THANKS for information about Health Insurance

Welcome

I want to buy a mediclaim for my father who is senior citizen and diabetic. I recently heard that it is difficult to buy a mediclaim for a senior citizen with diabetes how relevant is it? If no which product should I go for? Is there any advantage of buying the policy from an agent or should i buy it online?

Hi bhushan,

Below are the answers with regards to your query:

Q.1 – Is it difficult to buy a mediclaim for a senior citizen with diabetes how relevant is it ?

Ans: In your query, two major things are involved:

One is senior citizen: Many mediclaim companies don’t issue policy post the age of 65. However RELIGARE and MAXBUPA have no entry age limit so one can approach these two companies irrespective of the age.

Second is diabetes: If a diabetes patient (whether young or senior citizen) apply for a policy, mediclaim companies become more cautious.

If the diabetic person is depandant on insulin through injection, then chances of getting the policy is very very rare but if that person is dependant on insulin through tablets, then there is a slight probability that some company might accept the case with some loading.

As per my experience (being into mediclaim by advising people on suitable policy), companies like Apollo outrightly reject the diabetic case. But companies like Religare/MaxBupa, might accept it if the person clears the pre policy medical check up.

So I would suggest you to first apply to RELIGARE. Make sure that you reveal all the details related to diabetes. On the basis of your proposal form, they will conduct a pre policy medical check up out of which one will be Hb1AC. This test actually reveals the level of sugar in the last 6 months.

If the reports are ok, policy will be accepted with diabetes related treatment having a waiting period of 4 years.

If the report is on the boundary line or little bit above it, then policy will be accepted with some loading. But do not worry on loading front, because if the company loads the premium then you will get a cross proposal from the company. If you accept it, then you need to pay the additional premium and the policy continues.

But if the report is severe, then policy wil be rejected

Also if you are applying to RELIGARE, do not apply for sum insured equal to or more than 5 lacs because co-payment clause (20:80)will come into play . So apply for may be 2 lacs, 3 lacs or 4 lacs depending on your requirement as there is no copayment clause below Rs. 5 lacs ka sum insured

Post RELIGARE, my second preference will be HEART BEAT – silver policy of MAXBUPA where you have two options of sum insured which are 2 lacs and 3 lacs. My second preference is MAXBUPA because they have co-payment clause post the age of 65.

Q.2: Is there any advantage of buying the policy from an agent or should i buy it online?

Ans: Unlike online term plan where premium are quite cheaper as compare to offline term plan (plan taken through agent), in case of mediclaim there is no difference in the premium of online buying or buying through an agent. So I would rather suggest you to take it through an agent (after doing due diligence and surety that that agent will help you at the time of claim settlement because that’s what an agen’ts job is primarily).

Do let me know , in case of any further query…

Thank you sir… really appreciate your advice…

Thanks for sharing the detailed answer on this topic 🙂

Let’s say one has 2 health insurances for Rs. 3lac each with 1% room rent capping. Hospitalization incurred with total cost of Rs.2lac in the category of room rent Rs.5000 per day. One claim is settled cashless and claim paid proportionately (i mean according to Rs. 3000 per day). Can one claim the balance from second policy as the second policy also entails the claim proportionate to Rs.3000 per day rent?

hi Mr. harishj

If both company have room rent capping then both company will pay only 1500 per day for room rent as per ur details given above (as per the IRDA contribution rule) but if one insurer have room rent limit and another one doesn’t then one ll pay 1500 and other will pay 2500 (without room rent capping).

One more thing i want to clarify as per IRDA Health insurance guideline 2012 customer have right to take claim from both Insurer proportionately or take full claim from any one insurer which one he like.

Hope you got your answer.

Regards

Imran khan

Dear Harishj,

The balance cannot be claimed from the 2nd policy. Claiming from the 2nd policy would have been possible if your actual claim amount would have been more than Rs. 3 lacs

Dear Dineshji,

I fail to understand why he can’t use second policy to claim the remaining room rent? Can you please elaborate?

-Mahesh

I just wanted to ask, what should one do if his insurance claim is rejected because of past history of alcohol consumption which was not mentioned while taking the policy.

Should one mention history of alcohol and smoking at the time of next year’s renewal even if he has quit both?

You cant do much for the current claim, and yes, you should mention about it next time, but I am not sure if it will be accepted , Why was it not mentioned at the time of taking the policy ?

Manish

Hi,

Can you please inform if the online health insurance policies don’t need be issued in hard copy? I am told so by a big health insurance company.Is there any fine print on that?

Thats not true , any health insurance you take, you will get the policy document at your address

Could you please throw some light (or one article 🙂 ) on bank-insurance tie up for saving bank account holders. Those health insurance policies are very cheap. e.g. oriental bank of commerce mediclaim policy with oriental insurance.

Should we go with them?

Already written about it 🙂 http://jagoinvestor.dev.diginnovators.site/2013/07/health-insurance-policies-from-banks-with-low-premiums.html

Hi Manish,

My parents were covered under my company provided insurance till recently. Now that facility is withdrawn and i’m looking for a separate cover for them now.

My dad is 58 yrs old and mom 55 yrs old. Can you please suggest me some good plans or atleast rank various Health Insurance providers on basis of service provided?

YOu can go with Oriental , its a good one

Can you pleases suggest me for healh insurance covering my mother aged 74 ,

I think its a little tough to get health insurance at this stage, but you can apply in various companies like Max Bupa or Religare, Oriental

Thanks Manish , I will look into this

very good article.

Thanks Manish 🙂

Regards/Jay

Thanks Jay

The agents are insisting the clients to buy their products. But, they never inform the risks behind the screen. The above article revealed one of such risks. Today I come to know one of the key area to focus while purchasing Health insurance. Thanks so much Manish for this article.

Thanks Dhinesh

Hi Manish

Great Eye opener…

Thanks for sharing .

Cheers

Welcome 🙂

Good info Manish….Thanks for sharing….

Welcome 🙂