6 dumb mistakes which you make while writing Cheque’s – Dont do it !

One of the most common ways to pay money to someone is through cheque’s. Cheque’s give you the flexibility to make payments to someone at some later date (post dated cheque) by writing it now at this moment. Writing a cheque seems to be such a simple task, but do you know that there are many weak links in writing cheques which can create a big problem for you.

If you are not careful while writing a cheque, it can be misused by someone else and potential of monitory loss to you along with unwanted headache. Today’s generation is very causal when it comes to writing the cheques. In this article, I will cover 6 must know points which you should always practice writing the cheque’s . You can see these 6 points as a step by step recipe to write cheques. Lets see them one by one

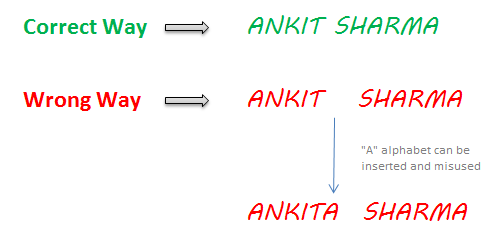

1. Do not leave spaces between words or numbers

Its a no-brainier. When you write numbers and words in the cheque, be it Name or amount, never leave a space or gaps between them, because that gives a chance to add some alphabet or number and change the whole cheque.

Imagine you issue a cheque to “ANKIT SHARMA” , but put sufficient space between “ANKIT” and “SHARMA” and it looks like “ANKIT SHARMA” . One can add an additional “A” after “ANKIT” and the name can become “ANKITA SHARMA” . However if you just leave exact one small space between “ANKIT” and “SHARMA” , its going to be tough to add another alphabet in between.

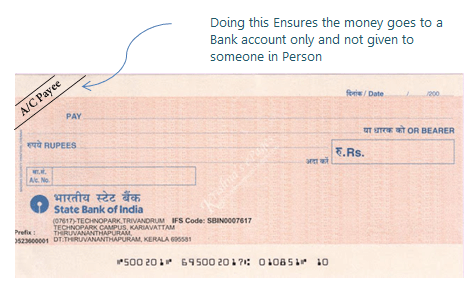

2. Make sure you cross the cheque saying “A/C Payee”

If you are going to pay to some person and want to force that the payment should go to the same person bank account, in that case, you should be putting a double cross line on the left-top corner of cheque and write “A/C Payee” or “Account Payee“, which ensures that the money will get credited only to a bank account and not be handed over to someone as CASH over the counter.

A lot of people forget to do this, and if the cheque is misplaced or lost, someone can pose himself as the target person and take the money from bank, I hope you know how easy it is to steal someone’s identity and misuse the documents.

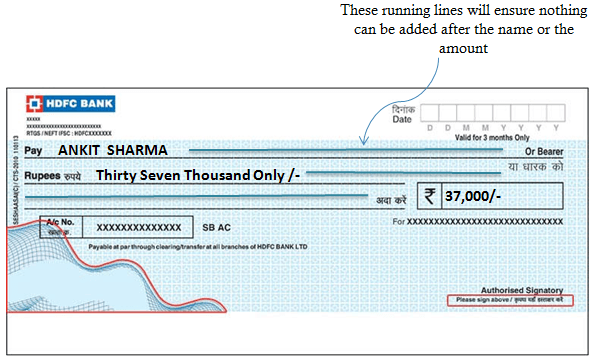

3. Add a line after the name and amount till the end

I recently learned this point, where you add a running line like —————————- after the name and the amount in the cheque, which ensures that one cant add anything after the name and amount and misuse it .

4. Cancel the word “Bearer”

If you look at your cheque closely, in the “Pay” section, there is space for the name and then on the right corner it ends with “Or Bearer” , which means that either the person whose name is written in the cheque or anyone else who is bearing the cheque can encash it , provided the “A/C Payee” is added to cheque as mentioned in 2nd point above. So you should always cancel the word “Bearer” from the cheque, unless you really want it. This ensures additional safety of the cheque.

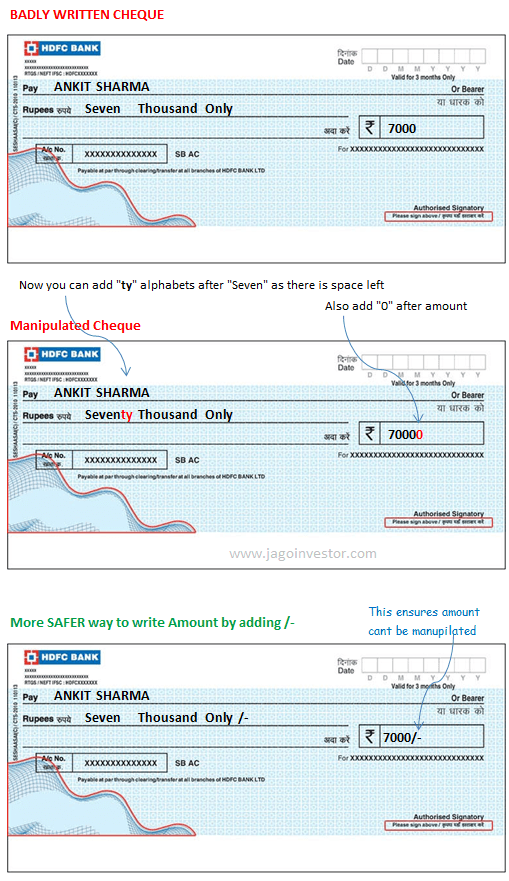

5. Add a sign of “/-” after the amount”

Now this might sound so small, but this has lots of wisdom inside this simple trick . There is huge difference between Rs 37,000 and Rs 37,000/- . In first option of Rs 37,000 , you can add more numbers at the end and can make it Rs 37,00000 if there is enough space ahead of it, but in case of Rs 37,000/- , You cant do anything . Below is a simple example of how it can be misused.

6. Keep the details of Cheque’s issued, even if it sounds boring !

And finally, when you give a cheque to someone, write down the cheque number, account name, amount and the date when it was issued or dated, because you might need this information incase you want to cancel the cheque. A lot of times, it happens that you need to cancel the payment, but do not remember the details. Having recorded this information would be handy at times and will help you to act faster.

ICICI Bank also has a small tutorial on correct way of writing cheque’s, which I have added below, just have a look at it and you should understand most of the things.

Some more tips (From Readers Inputs in Comments section)

- Rishi Bhatia says – “Generally, while giving a cheque, i also make a point to use a cello tape on the name and amount, so that no one can change these”

- Jitendra says – “In the present era of mobile phones, when most of us have camera enabled cell phone, it is better idea to get a snapshot of Cheque before handing over. This way all your details will be maintained.”

Use these 6 things everytime you issue a cheque

Next time you write a cheque, just make sure you have done all these 6 things, and the chances of misuse of your cheque will be close to ZERO because each and every step add a security layer. Let me know if you have any tips on writing cheque in correct manner or any real life experience on this issue.

October 7, 2013

October 7, 2013

sir i wrote in cheque 17,181 as seventeen thousand one eighty one only is it ok. or the bank will return the cheque

Its ok

I m Rohit, m I issue sbi a payee cheque,

(1)on the front side of cheque

crossed a/c payee, valid date, valid signature, valid amount written in figure a

nd words,

(2)on the back side of cheque

written account number, my mobile number, valid signature, name, from my sbi account to my ib account

Even then how my cheque got boounce

fyi amount under 50000

so not needed pan number

The balance may not be there in the target account!

for larger amount of cheque it is good practice to mention payee account no after the name at front sode just after pay section .

Thanks for sharing that Pravin

Sir, i have a small doubt. My brother want to give me a check of 20000 and that check has crossed line. So he has to write my A. C number, name and mobile no to the back side of check or he has to write his detail to the back side of the check?

Front side ..

He can mention his details in backside, but its optional!

Can I write 1000 rupi as 1000/00?

I don’t think you should do that.. cheque will get bounced !

i write a self cheque and i crorred it it will clear or hav to sign where i crossed

hello sir,i did a mistake and worrying for tat for a month,i had a cheque for about 3 years written as in rs 70,0_____.. . two months back i used it for ECS purpose for advertising ,representative ask me for a cancelled cheque and i gave tat cheque by simply scribling in middle like 2 to 3 lines continuously (dont know how to cancel a cheque at tat time) after tat he ask me to sign for sample and i did and gave to him. until now no problem came up…later i browse through net an came to know about canceling cheque…. and i saw that cheque was UNUSED until last week through NET BANKING .i stopped the cheque through on line is that ok or any thing to worry….reply me sir…

What is your question ?

If i issue a chueqe to any firm then “M/S” is mandatory before the firm’s name or not.

No , its not mandatory

One small silly mistake…i got one cheque from another person but

A/C Payee was written by that person in his handwriting

and i wrote accout number using my handwriting

will the cheque be cleared or it will get bounced?

It will get cleared . Nothing to worry !

hi sir i gave a cheque to front party put a wrong date in that cheque

So whats your query ?

Can I write my name & phone number on the back of the cheque? Will the banker dishonor my cheque if I do so?

No they wont

7,736/- but i wrote ‘seven thousand seven hundrend thirty six’ will the cheque be dishonored?

I think you wrote the right thing only . .Why will it get dishounered !

Manish

i wrote ‘hundrend’ instead of hundred

Not that wouldn’t Cause any problem as far but still if you really want to make sure ” just circle that unnecessary or excess letter you written mistakenly nd Signature near to it . That’s it .

Sir, i want to write a cheque amounting Rs 1,000/- then can i write the amount in words as “one zero zero zero only”. Please reply.

I am not sure on that . If you can do it ! ..

No,that would have your cheque dishonoured.

It is an amount in money and not a UPSC Roll No.,isn’t it?

Bank will dishonour the cheque written as one Zero zero Zero for Rs 1000/-

Yes, you need to write one thousand !

The article is very good, thank you very much!

Welcome !

I always put up an extra signature on the back side of the cheque drawn. Is it ok to pust such a signature on backside of the cheque ?

This article is indeed very good and informative.

Thanks.

Yea its perfectly fine and a good practice !

Dear manish awesome post…one more thing I want to clarify. …like if I have crossed the cheque and written “AC Payee” on the corner and leave the “or bearer” side on the other side…will there be any issue like can the bearer also deposit the money in his account

There wont be any issue if you have put “ac payee”

I always write my cell no below my signatures but above the white strip. In case you lose the cheque, some samaritan can contact you and also the bank can contact you on your present number in case there is any problem in passing the cheque,say difference in signatures or any other mistake.

Nice tip I would say ~

This was an amazing tips for all the new check users , i was also one of the victim who lost 5o thousand when i have written as 5 thousand but finally i got my money back after lot of follow up and lot of time was . so pleas follow it .

What happened in your case ? Any details ?

very useful information

thanks

Good Information. As an accountant I have caught one of my staff misusing a cheque by inserting additional alphabet because of more space

in between the name …………lakshman

Thanks for sharing this ! . Its like a real life confirmation on this topic