Why you should stop looking at ‘Past Performance’ in Mutual Funds

One day, a calf needed to cross a forest in order to return to its pasture. No one before this had ever ventured in to the forest. Without any rational, it forged out a long and difficult path full of bends, uneven ground and steep climbs. The next day, a dog took the same path following the calf’s footprints and a flock of sheep followed. As the path started taking some sort of visible shape, men started using the same and gradually, it became a well defined, accepted and the only way to cross the forest.

After many years, the trail became the main road to the village. Everyone complained about the traffic, cursed the long distance and treacherous turns, up and down hills but never thought of a better alternative. The old and wise forest smiled at how men tend to easily accept the way already open, without ever questioning whether it’s really the best choice.

In the same way, if you look at, the mutual funds’ investors. They seem trapped in a similar kind of concept called as – The Past Performance.

Past Performance as selection Criteria

Since quite some time, Past Performance has become a major criterion if not the Holy Grail of the mutual fund selection system. In fact, one of the leading business magazines in association with one of the leading rating agencies went ahead and mentioned “We take into account a much longer period for mutual fund evaluation as that can serve as a serious guide to future performance”… (Their long term means 3 years in this particular case and they used return and risk adjusted numbers for analysis)

Further, rather than challenging the concept, there has been a continuous debate if investors should look at 1-3 year performance or a longer period like 5 years to make mutual fund selections. The treacherous path to the village is already created.

Proponents of the long-history case argue that a long term analysis ensures that the performance is analyzed over various market cycles and if the fund has done well across the long term horizon, it stands a good chance to do so in future.

Sounds logical. Is it really?

I wanted to examine if it really works. For me and for others like me who would like to know the truth and may be many more whose investments have been in red, thanks to these ratings. I gathered historical data of equity mutual fund schemes and worked out the numbers. (3rd chapter of my first book also has same kind of data)

The results were startling !

The core of the finding is “Past performance hardly relates to future returns”… and here we are, pumping our hard earned money into mutual funds, depending on these ratings that rely heavily on the past returns generated.

Analysis Details

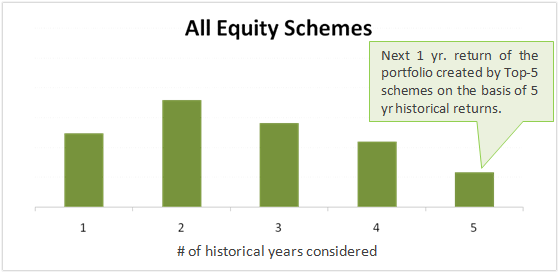

- The top 5 schemes by their 1yr, 2 yr, 3yr, 4 yr and 5 yr returns were selected. Thus 5 portfolios consisting of Top 5 schemes were created.

- The performance of these 5 portfolios was observed over the next 1 year (e.g. say for Dec-09 analysis, the return for 2010 was observed).

- Steps 1 & 2 were repeated every quarter for the past 3 years. The objective was to establish if the relationship with past performance that exists consistently over the period of time.

Findings & Explanation

How to read this Chart ?

The graph shows 5 bars, each bar represents the average next 1 year return generated by the portfolio created on the basis of historical returns. The left most bar shows how much average return was generated by portfolio created on the basis of scheme’s past 1 year return; the second bar is the return of the portfolio created by past 2 year return and so on.

So say the analysis is done on Dec-09, the past 1 year refer to 2009 and the returns are calculated for 2010.The above graph shows aggregate returns of the analysis done every quarter.

The graph ‘suggests’ that the ranking by past 2 years is of greatest significance while the ranking by 5 years is least significant. Please note that this is just an observation and not a conclusion. Statistics is a sensitive subject and any data tortured, throws some outputs. It’s important to delve deeper and see if the outputs can be supported with reason and logic.

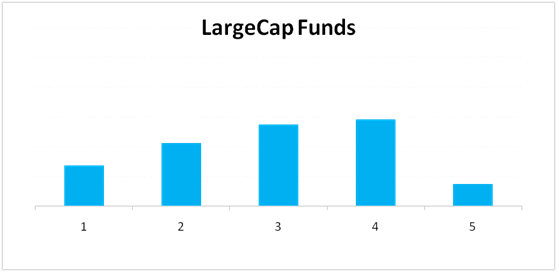

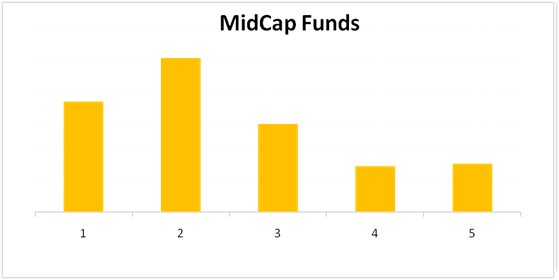

To validate if the inference really holds true and if it can be used for decision making, I dissected the data of all equity schemes into two parts: The Large Cap Schemes and The Mid/Small Cap schemes. The result of analysis conducted over Large and Midcap funds is presented in the charts below.

Take that. While the large cap funds ‘seem-to-be’ driven by their past 4 year returns, the mid caps ‘seem-to-be’ to be driven by their past 2 year returns. I have consciously quoted the word ‘seem-to-be’ as I can’t find a suitable reason to defend even these findings. There aren’t actually. For anything to be considered as a general rule, it should be consistently true. I couldn’t find that when I looked at individual analysis done quarter on quarter.

If I look at each analysis done across quarters, the 2 year return is not the significant driver of future returns always. A considerable number of times the other ones (1, 3, 4, 5 yr returns) gain importance. Just like “past performance” parameter, there are many other mistakes which an investor does in his financial life, and we have decided to talk on some other aspects like those in our upcoming workshop in Mumbai on 10th March. Incase you are in Mumbai, dont miss that event.

Dont use Past Performance to Predict Future

It is quite evident that the past returns cannot be a torch bearer for investment decisions. Following the past returns as a guide or using ratings that rely heavily on past returns is like shooting at a dart board in dark. For any doubts that remain, consider this

Reliance Equity Fund was the top performer in the Large Cap category in 2012, with a return of 41%. Did you know it was the worst performer amongst Large Cap funds by historical return? i.e. if you were in Dec-11 and would have picked up this fund’s historical analysis, it was the worst performer by 1y, 2y, 3y, 4y and 5y return.

Another best performer, SBI Bluechip Fund (2012 return: 38%), never beat more than 33% of its peers ranked by past 1y, 2y, 3y, 4y and 5y return as of Dec-11. Not surprisingly, a leading mutual fund star rating agencies top picks of 2011, underperformed the index in 2012. The agency boasts of using a good mix of longer period historical return and risk adjusted performance.

In my next blog, I shall discuss what can be the reasons of looking at past performance, where did the whole thought possibly evolve and where do things go wrong. The views expressed above are personal and for a change, I own them. All arguments and points welcome. I really value justified facts and accept only my wife’s opinions…!!!

PS: While I finished writing this, there is a news regarding S&P being sued for damages worth USD 5 Billion for misrepresenting the credit worthiness/rating of an issuer due to conflict of interest. (https://on.mktw.net/YRehB0)

Does it sound any bells?

About the Author

Sharad Singh, a serial-entrepreneur, has spent more than 14 years in the analytics domain and has done extensive big data work in finance. He runs Valuefy, an investment portfolio analytics firm that provides portfolio management solutions to BFSI clients. Valuefy has recently launched www.theFundoo.com, a niche portal that aims to make investment decisions easy and effective for individual investors. Sharad is an engineering graduate with PGDM from IIM, Ahmedabad.

Do you use past performance as one of the criteria when you select mutual funds ?

February 21, 2013

February 21, 2013

Dear Manish.

Firstly great admirer of your blogs and jagoinvestor website.

My question basis this article: Am looking to start an investment of 40k per month for a 10 year period and am not at all inclined towards selecting the funds basis past performance but I also have no idea as to how can I then do it? Can you suggest some websites(fundoo for some reason does not work properly) or any advisors that can guide me through this process and I can continue to follow up for my holding period.

My 2nd question is more personal for which how can I reach out to you on 1:1?

Warm Regards

Hi

There are many parameters you can look at , but its out of scope of this comment reply. Our team does regular checks on funds and we discuss it with our clients. If you want, you can first talk to us on this and if you want then start your investments in mutual funds – http://www.jagoinvestor.com/start-sip

You should not pick based on recent performance, you should not pick the one with low NAV, you should not pick the NFO, now you are saying not even to see the past performance to pick a fund….

So only option is to become a fund manager myself for my fund then…

Hi Karthik

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

what if person is chosing MF acordingly his 10Y perfomance??

for me i think it is best to predicat from the behaviur of funds and it’s manager?

Not 100% , but yes , you will get some good idea about it !

Hi,

After looking at the last three year return for DSPBR Top 100 equity and ICICI Prudential Bluechip , is it advisable to switch from DSP to ICICI ?

Or till now whatever invested in DSPBR leave it as it is and then start new SIP with ICICI bluechip.

I have Franklin India Bluechip & HDFC top 200 as well, I invest 4k per month in each.

Pls advice.

Thanks

If its not performing for a long time, then better take a call to SWITCH !

Hi,

Could you please shed some light on “Direct investing in mutual fund”- I always used to invest in MF through KARVY/CAMS. I was in teh assumption that this is direct investing. Is it so?

NO , its not direct investing . Here you are going through an AGENT , which is Karvy … they must be getting the commissions . If you want to do it in direct way, you need to convert it to DIRECT ,talk to your mutual fund company on that.

oh. I always thought that its direct investing. The guys at Karvy has told me that they are not charging anything from me, theres no entry & exit load.

Anyways, I have closed all SIPs and MFs since we are buying a flat. Need to start everything afresh…

My Two SIPS- UTI master share & Sundaram Select midcap performed really poor- i invested in them for two years, and the growth was NIL. I got what I invested.I was ready to wait, but since i was in need of money, closed them.

So Can I expect an article on direct investment in MF?

Hi Deepthy

I think there was some mistake from my side. Seems like Karvy is just the backoffice partner (same with CAMS) , and you can invest in DIRECT options through them . But if you had old funds, then you will have to convert them to DIRECT by placing a written request.

[…] I short list funds that I think will perform over the period 3 years. This shortlisting is based on kind of stocks and business they have majority of their investment. Here is the List of Tax Saving Funds by ValueResearchOnline. Sort them based on 1 Years performance and select few funds that have performed averagely for last 1 year or so. We choose average performing funds because they have invested in some under performing midcap stocks which have not performed in the current market rally and so have higher chances of performing later. You can also check similar fund selection criteria by Manish Chauhan – Why you should no go with ‘Past Performance’ in Mutual Funds. […]

@ sharad, Thank you for this very well written/researched article.

However, I am wondering if it would have produced different results if we had looked into “long term” future returns (not just 1 year).

Quote “Proponents of the long-history case argue that a long term analysis ensures that the performance is analyzed over various market cycles and if the fund has done well across the long term horizon, it stands a good chance to do so in future.”

When someone looks at a long term past performance, ideally, he should also be willing to wait for a long-term future returns. For instance, if I decide to invest in Quantam LT fund after analysing its past 5 years’ performance, I would be more interested in the fund’s returns for the next 5 years (and not just 1 year as you have analysed). A single year anaylsis can not really represent anything.

Just my 2 cents!

Very good point Harsh.

I checked it for future periods greater than 1 year and the results still highlight the same issue with past performance.

The long-history point is valid as it aims to get an idea of fund management style by looking at various cycles. However, in my opinion we should decipher the fund management style using different techniques which are available and used for this very purpose viz. Performance Attribution, Style Analysis.

Just to put an analogy, we select stocks for investment on the basis of fundamental information, management profile, sector fundamentals and so on, not by looking at just the series of past returns.

We should look at funds similarly. Yes, we should go back as much in history as possible to establish those fundamentals.

Regards,

Sharad

[…] READ MORE of this guest column by Sharad Singh – CEO, Valuefy, published in February at the Jago […]

Dear Manish and Sharad,

a good article, a new outlook.

But is this approach practicable?

A person invest in MF for Long Term to achieve his long term goals. Generally it is seen that some funds like FT Bluechip, HDFC -Equity, Top200, Prudence, ICICI Pru-Dynamic, Discovery, IDFC Premiere equity has consistancy in their performance, has good Fund Managers , then why not to look their past performance. Such funds never disappoint the investors.

Sir, I also want to clarify one doubt- If I invested in for eg. SBI Magnum Contra from 2001(SIP). Suppose this fund is doing very bad. I redeem from this fund and all above amount (in lumsum) invested in FT Bluechip. In such case can I get the benefit of Compounding?

Regards-

amol

Amol

How do you know that looking at the past performance is helping you , May be these funds are all great and have potential , but that cant be determined by past performance alone . Just because their past performance is good, does not mean its a sole reason for the future performance of these funds.

What do you mean by – “Can I get benefit of compounding” ?

Dear Manish ,

thanks for reply.

Regarding my second point, I want to say that-1. when I invest in a good scheme, say ABC fund for 15 years, I get benifit of compounding.

2. If I changes schemes often ( switch between 3-4 good funds) for same 15 years, can I get same amount as in case (1) above?

What is the effect on final amount when 1. I continue in same fund and

2. I changes schemes after 2-3 years

regards

amol

Amol

It will not matter. What really matters is that you are in same asset class for long . Even if you switch funds in similar funds .. that should not be an issue given there is not a big gap in between !

Hi Manish, How could you say that ” It will not matter” ?

My opinion is you must consider the exit loads, expense ratio of existing scheme and future scheme.

If you consider both it is going to matter… isn’t it?

Rgds

Hari

Hari

What I mean is “Its not going to matter a lot” .. It will matter, but then for a common investor it will get very complicated .

Thanks Manhish.

Hi Amol,

You would benefit from the power of compounding if you are a regular investor for long term.

There isn’t any harm in realigning portfolio to the healthier schemes. That way the power of compounding meets the power of better selection 🙂

Regards,

Sharad

Thank you Manish and Sharad.

Hi Manish and Sharad,

In an earlier article on your website, I commented that the performance of the MF can be solely attributed to the Fund Managers like Kenneth Andrade for IDFC Premier, Sandeep Sabharwal for SBI MF etc. however there are fund houses like HDFC which has its own stock picking strategy and the change in Fund manager doesnt affect the fund performance.

For solution on how to pick the MF can be divided into two groups –

1. One who have knowledge in finance and stock market and have access to reports from various magazines like Dalal Street – They can study the sector watch reports post budget and check which sector has the potential to outperform the market in the current macro economic environment, such as FMCG in 2012, Power in 2003, Real Estate in 2007 etc…..

2. The people who are new to the market and doesn’t have time to study the markets – They should seek professional experts such as Financial Advisors. One of whom Jagoinvestor is among the most famous and puts the customers at ease from the mammoth financial planning.

Regards

Mayank

Hi Mayank,

I appreciate the point you have made but those under category 1 have to tread a very fine line. Its full of judgment from various agencies in the market and has its own serious risks.

Regards,

Sharad

Its quite true that one can not guarantee same fortune for any mutual fund scheme in future.

But at the same time its not possible for any individual,any application,robot to predict future performance of any mutual fund scheme.

I don’t think “running behind the best” is a solution,it will only result in the disappointment…We are on the highway & its not possible for any bus to be front-runner always.

One should also remember that fund manager is not that much important factor to be considered as he has to abide by strategies,research reports of his AMC….he is fund manager..it doesn’t mean that he is free to take any decision.

Yes Paresh.

The idea is not to capture the front runner always, the objective is to capture the funds that can generate healthy returns.

True that fund manager are supported by teams, have mandates etc. However, the style and skills analysis of a fund encapsulates the influence of all these contributors.

If a fund house has very good processes and analysts then even if the fund manager leaves the decision making and skills won’t get impacted severely which can be gauged from analysis.

Regards,

Sharad

Then what basis we should follow for selecting funds?

Hi,

The mutual fund selection should focus on the skills and style of the fund managers. It should consider how consistent the skills have been and how well the fund manager has been complying to the index. Such an analysis is called Performance Attribution and is widely used by Asset Managers across the globe for their internal analysis and fund management.

Shall detail the same in the forthcoming write-up.

Regards,

Sharad

Dear sir, Thank you for some clarification.

Hi Sharad,

what you are saying can’t be practiced by ordinary investor !!!

Fund manager is bound to perform as per the mandate called ” investment style”

It is the philosophy of fund house and investment style are solely responsible for getting healthy returns.

The only reason why we should look at past performance is that, we will come to know the ability of scheme to sail through the troubled times. For new fund/schemes such data will not be available. If you look at best schemes you will find that they have beaten benchmarks during tough times as well.

Rgds

Hari

Its a widely known fact, but people do it due to lack of better alternative. Disclaimer that goes something like” past performance is not a guarentee of future returns” has been beaten to death by now.

In the next article, hoping you would explain what http://www.thefundoo.com/Fundoscope_app.aspx is all about, its success rate i.e., does it accurately forecast what the next year’s top 5-10 ranking funds would be? If not, how different is the end-result for an investor than relying on past performance PRIMARILY?

Hi Chaitanya,

Yeah I would attempt to explain the application and also talk about how we can use the inferences to select MFs.

However, I don’t expect retail investors to go through this app (it’s complex), collate data and do analysis. It would be too much to expect.

We have already created a MF grading mechanism for various categories using all these mechanisms and we would be launching the tool Fundpicker within the next 2 months. This tool would be extremely easy to use and pick the right funds for investment even though having all the complexity backstage.

To provide you an idea of impact: If I had invested in a Fund-of-Funds from the Top Large Cap picks that a prominent star rating agency had recommended in Dec-2011, that FoF would have under performed Nifty in CY 2012. The ones that we had, have outperformed Nifty and the rating agency’s picks on comprehensive return and risk-adjusted return basis.

Though, I am not advocating that a methodology can predict the No. 1 performer, but a logical method with sound analysis can consistently help being invested in the most healthy funds.

Best Regards,

Sharad

Dear Manish,

I come to jago investor because I am a financial illeterate person and I only understand your simple language and thought process. The way a idea is formed , presented , explained and a conclusion is reached. Man your style is unique. I am not complaining but am begining to notice you are using other peoples articles , its your blog and its run your way but then i ask why take the trouble of publishing the whole article over . Just give the link and we can read it from its original source just like in subramoney. If Mr. Subra does not have anything original to say he just gives the link.

Idea could be anybody , in the above case Sharad singh . But Manish your style and lucid language and simple explanations help a lot. You could have done the explanation. This article bounced , yours never did.

Regards

Joel

Dear Joel,

Inconvenience regretted.

Can I help with some more explaination? Would love to interact and discuss and I hope you would enjoy some of the nice findings that we have.

Please feel free to write to me at [email protected]

Regards,

Sharad

Joel

Thanks for sharing what you feel . I can understand you might love my way of writing . But each topic has a KING for it , and this is not my topic . Sharad is a great person to write in this area and a well experienced one . A lot of others have liked the article . Guest articles are a good way to attract amazing writers and at the same time give a new life to blog 🙂 .

I would say if you do not understand some point , just ask the author and they will help you with explainations . I hope you will take the reply in right spirit . Anything which is good for the blog has to be done 🙂 and quality guest articles are always one of them ! .

May be Sharad can take this as a critical feedback to make things very very simple next time 🙂 . Looks like I have ruined my readers

Sure Manish. I do appreciate the feedback and shall keep improving 🙂

Going by the logic of the article, one should dump all history books in the sea and just not read about how mankind progressed. The selection committee of the cricket or any other sport for that matter, should select the players by a toss of a coin and not going by the averages. No it is never done this way…..It is said that one should learn from other’s experiences and you are preaching just the reverse…. sounds unusual.

However, the tone of the article should have been …’Do not look at the past preformance ALONE. Look at other factors as well. Does it sound rational now??

You are correct Buddy.

To err is human…:)… to correct Divine…!!!

Thanks,

Sharad

You are correct Buddy.

At any point in time we only have historical info to make decisions for future.

So history is important, however more critical is to understand which part should be more stressed on for decision making.

The article only talks about past returns and risk adjusted returns and conveys that they shouldn’t be looked at, in entirety. There are better parameters and methods to look at… I shall discuss the same in further articles.

I appreciate the fact that there might be a scope in bettering the tone and message.

To err is human…. to correct Divine…:)

Thanks,

Sharad

wow that is a big article, but I personally feel all the analysts & the experts miss a very simple point while analyzing companies, companies are separate entities only on paper, they are still run by Humans, & the performance depends on the value traits or performance traits of the HUMAN IN CHARGE OF THE COMPANY, I see analysts giving remarks as if the company runs itself which is not true, THE Experts are putting very very little time in analysing the HUMANS running the show. THE CEO,MARKETING HEAD & FINANCE HEAD these are the people who decide the course the company takes period, & yes you can depend on the past performance of these people.

I rest my case.

Good point Siddhant. The case is strong.

So essentially, good managers make great companies that give great returns.

Similarly, the mutual fund selection should focus on the skills of the fund managers. Such an analysis is called Performance Attribution and is widely used by Asset Managers across the globe for their internal analysis and fund management.

Performance attribution of all Indian mutual fund schemes is available at http://www.thefundoo.com/Fundoscope_app.aspx

Regards,

Sharad

Hi Sharad singh,

I dont know why you have to take this much big article to tell a simple point, which many investaors know already.

Can you tell me what other factors, people has to consider it before investing, which will never change during course of investment time. Beta value of fund, allocation towards diff sectors, equity allocation.. all this will change time to time as per the views of fund manager, even himself will be replaced some times.

Now, i will tell why we have to take past performance as one criteria, while u choose funds, Because the fund mgr/mgmt team is syudying the market dynamics well compared to other funds, and changed the allocations, scrips , liquid position.. of the fund in tune to gain maximum returns (some funds may be lucky also to be well performed). So there is little probability they do it again.

At the end of the day, all market investments (i mean equity related) are based on future expectations with an analysis of present and past day parameters. And nobody is perfectly correct in predicting the future trend. Also luck factor plays a big role some times.

Hi Raghavendra,

One can analyze the past performance and rely on it solely assuming that everything is encapsulated and repetitive there.

However, reality is different. That’s not even how the fund managers select stocks. They have mechanisms/models that value a company by their fundamentals and not just past stock price movement. Though even in this case, the stock price movement encapsulates the company financials and management’s performance.

The future effect is dependent on management’s performance and skills, which is the cause.

Same is the case with mutual funds. If we can find the skills and style of a fund manager and then relate to how good is he/she in generating the returns with his skills, we can establish a cause-effect relationship which can add value in fund selection.

Regards,

Sharad

Good article. However the central idea boils down to plain commonsense. Agree with Sunil above that there too much focus on the problem rather the solution in the article.

“In my next blog, I shall discuss what can be the reasons of looking at past performance, where did the whole thought possibly evolve and where do things go wrong.”

Bit of an overkill!

If you want to look at numbers, any number associated with a fund/stock then it IS looking at the past. You take a call with the full expectation that it can go wrong. Looking at the past is all that anyone can do. The problems lies is expectations. A deeper problem is the lack of a clear goal. If the fund performs better than your goal planning parameters then you stick with it irrespective of star ratings. Simple as that.

A lot of people want to invest in SBI Emerging business mainly because it had a great 2012.

Greed, for want of a better word is stupid.

Looking at the rear-view mirror is not wrong. Clouding the windshield with that image is.

Hi Pattu,

Appreciate your reply.

yes it’s commonsense, but let alone the majority of people, even the star ratings lay up to 75% emphasis on past returns.

Ditto your point on SBI Emerging Business. Uncommon commonsense practiced…!!!

Next one shall feature on the solution and better methods.

Appropriate usage of historical info is a must, an insensitive data torture can yield random results. Like you said “Looking at the rear-view mirror is not wrong. Clouding the windshield with that image is.”

Regards,

Sharad

A good article, but is there any other way for a normal investor? If i could judge the future performance of a Mutual Fund, i would have been the next Warren Buffet.

My view – To judge the performance, we can compare the past performance against the market returns. Eg, for a MF that invests in Mid Cap, can we compare the past MF returns with the Mid Cap index, and see, which one has delivered in line with the index. In my opinion, that is the only way to select the mutual funds.

I think the only reason that people depend on the past performance is, that there are no other “defined” and measurable means to select a MF.

Dear Rishi,

You have made a very valid point.

Funds should be compared against relevant indices. It must be analyzed if the performance is from within the index or from stocks outside. Such measures are a good test of fund management skills, compliance, style etc. and a fund that does good on such parameters stands a good change to perform consistently.

You can find a tool for such analysis at http://www.thefundoo.com/Fundoscope_app.aspx.

Appreciate your sensitivity towards “Defined” and “Measurable” means. Objectivity is the key.

Cheers,

Sharad

Thanks Sharad, and sorry for replying late. The FundOScope tool looks to be great. I have spent some time to understand the ratings and trying to use them to buy some MF. It would be great if you include a FAQ/ How To guide, so that the readers can better understand the numbers.

The Interperations are OK, but in reality an Investor has no other option than to chose a fund with past performance. One remedy available is regular monitoring of the performance of funds.

Hi Nagmohan,

My replies above might help. In the next blog, I shall focus and expand on the same.

Feel free to contact.

Regards,

Sharad