Check your Income tax refund status online & Learn how to use RTI

Do you have any idea about your income tax refund status ? Have you filed your Income tax return long back, but have no idea when will you get your tax fund?

This is one issue faced by millions of tax payers in India. They file an income tax return where they claim back their income tax refund, but have no idea what happens to their cases after that!

For months and years, they keep waiting for the refund status, but they have no idea when they will get their money back. Ideally they should get it back in few months, but in many cases they wait for as long as 3-4 yrs.

In this article, we will see how you can find out your income tax refund status online and how you can use RTI application to find out the status of your tax refund and speed up the process of getting it back.

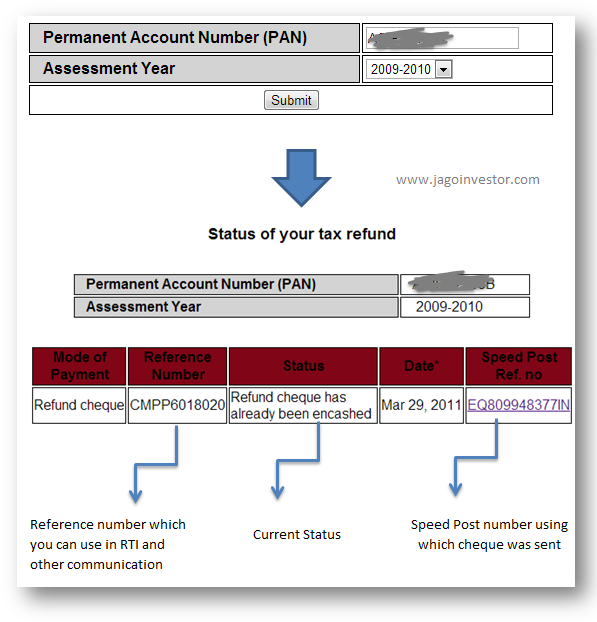

How to find income tax refund status online

If you have filed income tax return asking for your tax refund, and you have no clue about the current status, the first thing you do is track its status online. All you need is your PAN number and assessment year for which you have applied for refund. Here is what you need to do

- Visit https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

- Enter your PAN number

- Select Assessment Year

- Click Submit

You can also track your income tax refund status by contacting the help desk of SBI at 080-26599760 or contacting the Aaykar Sampark Kendra at 0124 2438000

File RTI application for income tax refund status

If you are not able to do much and you feel that just finding out online status is not helping you and you want to now get 100% clarity about your tax refund status, the next step is to file RTI application against income tax department.

We have earlier seen how one can use RTI to find EPF withdrawal or transfer status and how their issues were solved within weeks and months of filing a RTI against EPFO. So your next step is to file RTI in your tax refund case also. But you should wait for at least a year before you file for RTI against the income tax department.

Note that the RTI application has to be addressed to CPIO officer. Now the next question is how to find out the CPIO information. It’s actually not organized in a clean manner, but you need to start by going to this website https://www.

It will take you to the next page where you need to click on “CPIO/CAPIO” and play around to find out the exact place where they have dumped all that information. Below you can find a RTI template which you can use.

Download this RTI template for income tax refund

What should you ask while filing RTI

- You should ask for name and designation of the officer who is supposed to process your income tax refund claim

- Also ask for the officer official address and his contact number

- Also ask for how long the refund is pending with the officer and the reason for the delay

- Ask if some senior authority has instructed for delay and the certified copies if any

- Also ask for the name, telephone number and address of the higher officer with whom you can file the first appeal

These above mentioned 5 things if asked in RTI, will be enough to move the earth below the concerned authorities feet and they might act faster on your case, because in most of the cases there are no valid reasons for delay. The delay is created just because of lethargy and at times in expectation that someone will visit them and bribe them to process the request!

Note that only the concerned person can file the RTI, no one else on his behalf can file it. In case you have tax refund for different years, better file separate RTIs for each. Do not mix them into one.

Tips while filing for Income Tax Refund

There are few well known mistakes people do while filing returns, because of which income tax refund delays happen. Let’s see those points and make sure you don’t do them.

1.Make sure your give permanent Address

A lot of salaried people, who live on rent, give their present temporary addresses while claiming tax refund, and when after 1-2 years their tax refund cheque arrives, in many cases the person has moved out of the current location. This causes the cheque to return back and the person is not there on the given address.

So make sure you always give the permanent address where you or your family lives and there are almost no chances of cheque returning back.

2. Give accurate Account Details, IFSC code

There have been cases where the account number given was inaccurate by 1-2 digits or the IFSC code was wrong, and that created the problem. This small thing can result in lot of frustration later, so double-triple check these details.

3. Try to do E-filing of your tax returns, if possible

As far as possible, try to file your income tax returns online and apply for tax refund, because the tax refund is much faster if e-filing was done. In case you are filing offline manually, make sure you fill form 30, contact your CA if you want to delegate this totally to someone else!

Conclusion

If you have been waiting for your tax refund from years, it’s the time to file a RTI application for it and find out why your income tax refund has been delayed for so long.

January 14, 2013

January 14, 2013

I am not able to track refund cheque courier status courier number is EK850586421IN. Kindly help me

How can i help in this case ?

useful subject concerned to the income tax e-filing and how we go on rti for delayed in tax refund situation. Thank you once again JAGO INVESTOR providing us tax litracy.

Thanks for your comment GOVINDARAJU

Hello Sir,

Thank you for the helpful article.Can you help me understand if I can file a First Appeal if the information I asked to be provided in my RTI application provided is not complete .

I dont think so, in your case you should file another RTI application for the rest info , and if you dont yet get it, then you can file first appeal

Hello,

thanks for the article, The site mentioned in your post (http://www.incometaxindia.gov.in/ccit/rtipage.asp) does not work anymore. Any idea where i can get information about the person to address my RTI query in Chennai Tamilnadu ?

Did you google for this ?

Dear sir

i found to be theft of income tex here at below fectroy Name Ratnadeep kapil dhar, at lots of factory at savakundla dist amreli i sware of god i seen that 4 example if any diamond worker abed en factory without any him payment that money put own pocket such as lots of worker gone

most be inquire

Refund Reissue Failure:

1.My refund check was returned by Speedpost, because of address issues.

Now when checking ONLINE, I see the Refund Status as Refund Unpaid, the reason being No such address,

When I try the Refund Reissue Request, it still says that there is no refund failure, and it does not allow me to enter Refund Reissue Request options.

What is the issue here

2. My refund is more than 50000 Rupees. Can I select the ECS option

Hi Ramasubbu

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

hi i not applied for tds hw to apply for refund …of my money…i reved all form to my mail but i dnt knw how to apply..

Hi madhu

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi Manish,

I am in need of help from you. I have filed Ay 2013 – 14 , Ay 2014-15 right on time, however post my evaluation now after comparing with 26AS I found out that certain amount tax is pending from my side. Can I file a revised return with the correction and pay the due refund.

Is there any way to locate from the portal if the validation by IT authorities have completed ?

Hi Subrata

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hello Manish,

I filed my ITR for 2014 – 2015 and 2015 – 2016.

I am on the verge of receiving my refund for 2014 – 2015 but the 2015-2016 status still says ITR-V Received, and then has a blank under it. Is this normal? All my other fellow coworkers have received their refund and since this is my first time filing for it, I am a little concerned.

Hi MissKhan

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I can’t get income tax refund before one month ago I had applied income tax e-filling.

Hi runa pradhan

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Sir I file tds return which they inform me that bank account is wrong.now how can I correct that bank account. Return was filed on line

Ki

Hi R a jesh kumar goyal

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hello,

Please do help with your valuable suggestions,

I had applied for ITR V for 2011-12, and 2012-13, with in the time limit in manual approach, but till now i didnot get my returns . i had acknowledge number with me .

can anyone one give me the details to get my returns back to me

thanks

bhadra

Hi ,

I am not able to track my TDS refund status . I It has been already filed one month ago .

i have tried using my PAN number but it didn’t work .

Please share the web url if possible with proper steps .

Thanks,

Hi sarfaraz

You should take help of RTI now in this case ! .

Manish

2014 – 2015 In my ITR status is showing 139(9) of IT act 1961. after that next status is showing Your ITR is in progress, so kindly wait for next communication mail from CPC, still i did not get any mail from CPC. so i have revised my ITR file. now present status is ITR received when i get the refund amount???

Hi Balaji

You should take help of RTI now in this case ! .

Manish

hlo sir,

I had filed refund reissue bcoz my bank details were wrong. My refund was 11900 rs but i received 7300rs only. my status is that the amount is already transfered to your bank account. what shd i do for this. plz help me out of this

You mean to say that you did not get the actual amount from income tax department . I think its time to file RTI now !

I am having problem in resetting my pswrd which i forgot

.though i have tried it a number of times but the problem still persists.i called up the helpline for help nd they said that reset it after 12 hours…i tried that also but no use…how can i reset my pswrd effectively..i had used otp pin for the same and wish to use that only…seeking guidance

I dont think the customer care at EPFO side will be awesome .. you know how it works in govt organisations . Better ,mail them or file a RTI for this

You can go for efiling login through netbanking

Sir,

i filed my return AY 2014-15 and received msg in my no. that refund processed please check it after 3 days .after checking the refund status i found that the refund cheque has been dispatched .but when i checked the speed post no online it is showing “CONSIGNMENT DETAILS NOT FOUND”.

nOW I HAVE ALREADY SPOKEN TO IT DEPT .CORCERNED PEOPLE AND VISITED MY LOCAL POST OFFICE BUT ALL IN VAIN AS NO SATISFACTORY ANSWER RECEIVED ,I AM IN TROUBLE PLEASE HELP ME WHAT I SHOULD DO????

Sneha

First confirm what address they have at their end. Most of the times its the address with which you had registered your PAN number . File a RTI and check out the status of your queries, thats recommended !

Sir mera year 2012-2013 ka refund cheque wapis return ho gaya.sir mera return cheque wapis dilwane ka kasht Kate.

Thanks.

Better file a RTI and ask your queries!

Hi Manish,

“The Assessing Officer has processed your refund and forwarded to SBI for dispatch.” This is what i have received after I checked my Income Tax return status. How much time does it take after this message for the money to get deposited in my bank account…? Please reply.

Thanks.

Hi,

For AY 2014-15, I received communication as below –

“The Income Tax Department- Centralized Processing Centre (ITD-CPC), Bangalore is not in a position to

proceed with the e-return filed by you, details of which are indicated above. The return is transferred to

Jurisdictional Assessing Officer (in AST) processing of which is to be done by the Jurisdictional Assessing

Officer who may be contacted for further clarifications if any.”

My questions:

1: what could be the reason? Or how can I find the reason?

2: How much time it would take (JAO) to complete the process?

3: any actionable required from my side?

4: It it doesn’t complete before next AY, will it affect returns filed from next year? Will they get delayed too?

Your guidance on these questions and any other details would help a great deal.

By the way. This forum is wonderful place to discuss issues. You guys are doing wonderful job.

Thanks,

Vivek

File an RTI for this