How to find your Income Tax Refund Status Online

Do you know how to find your income tax refund status online? Yes, there is a simple way of finding out the status of your income tax return online. A lot of people are clueless about the refund status!

Now, one can just enter their PAN number and the Assessment year for which the refund status is to be known and get the status update on a click of a button.

How to check Income tax refund Status Online

All you need to do is go to this website and enter your PAN number and choose the Assessment year and click on submit. This will give you the current status of your income tax refund. You can also track the status of the income tax refund by contacting the help desk of SBI’s at toll free number: 18004259760 or email them at [email protected]or refunds@

Note that the income tax refund is valid only if you file your income tax return on time. If you delay the income tax return filing, in that case you will lose the interest on your refund money. I hope you know that filing your tax return online helps one to get tax refund faster than offline return filing.

What can be different types of Income tax refund Status?

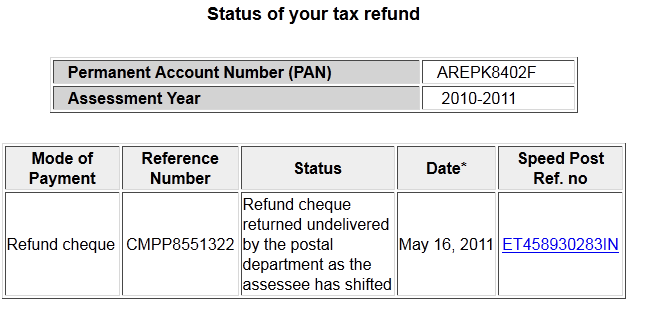

1. Change in address

A lot of income tax refunds get dispatched at right time, but they go back because of the change in address. A lot of people keep moving from one place to another and because of this the income tax refund status shows “Refund Cheque returned because of change in address” reason in the status.

Look that the snapshot below

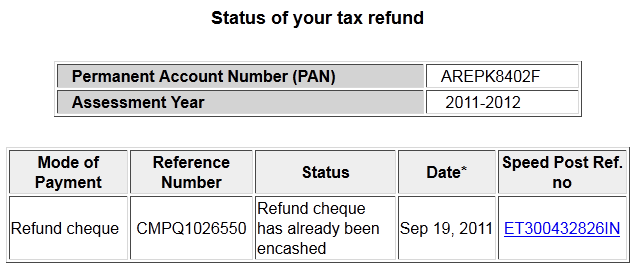

2. Cheque Encashed Status

In case one has already en-cashed the cheque which has come for income tax refund, and then he will see the following message in the status box. If you see this and haven’t already got the cheque – you are in problem!

There can be other status also depending on the situation. The above two status’s were just for demo purpose.

Some Important Points about Income Tax Refund

- The State Bank of India (SBI) is the refund banker to the Income Tax Department (ITD). So State bank of India sends the income tax refunds

- Refunds are generated in two modes i.e., ECS and paper. If the taxpayer has selected mode of refund as ECS (direct credit in the bank account of the taxpayer) at the time of submission of income return the taxpayer’s bank A/c (at least 10 digits ) and MICR code of bank branch and communication address are mandatory. For taxpayers who have not opted for ECS refund will be disbursed by cheque or demand draft. For generation of refund through paper cheque bank account no, correct address is mandatory.

- The status of the refund would be available for tax payers, only 10 days after the refund has been sent by the Assessing Officer to the refund banker.

- Refund status can be viewed only if you have received an acknowledgement from the IT department of having received the ITR form.

Did you check your Income tax refund status? If No, then check it soon and let us know what is the status?

January 19, 2012

January 19, 2012