How to file your income tax returns online in 6 easy steps

What is the best way to File your income tax returns online ? Tax filing season is on and most of us will still wake up after few days.

I will talk about efiling your tax returns with govt website and also private websites like taxspanner, taxsmile and investmentyogi which are autorised by income tax department. You can also win some free coupons for income tax filing through some online p0rtals .

Income Tax efiling using govt website

I just want to tell you that incase you are just salaried and have no income from other sources, then the whole process of e-filing is just as simple as filling up details in tax return form at govt website, creating a .xml file and preparing an acknowledgement form using the tools provided by income tax website and then you need to speed post it to Bangalore Income Tax Office.

Read do & dont;s of tax filing

Steps for Online Income tax filing

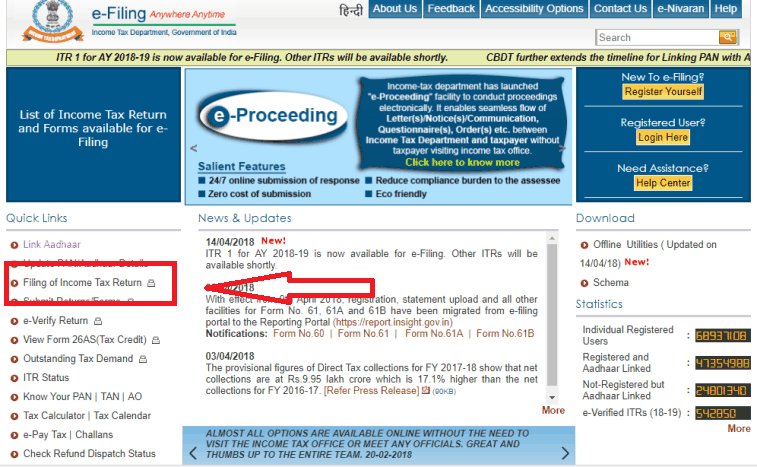

Step 1: Login to https://incometaxindiaefiling.gov.in/ and download the appropriate software from the website as per your case. This software is nothing but a nice detailed excel sheet (enable the macro’s)

Step 2: Once you have the excel sheet on your computer, fill up all the details (if you don’t have form 16, you can still fill all the details manually). After that verify it once again and then export it to XML (the export button is there in the software itself)

Step 3: Once you have the xml file with you, you need to login to the website (you will have to register for it once). You will see the option called “Upload Return” on left side after login. Click on it.

Step 4: There will be two options called “Digital Signature” and “No Digital Signature”. As most of the people would not have digital signature, just choose the option. Upload your XML file and just create your acknowledgement form called ITR-V , You need to download it . Once you have the acknowledge form, just verify it once again.

Step 5: Just send this acknowledgement form using a regular or speed post (no courier allowed) to “Income Tax Department – CPC, Post Box No.1, Electronic City Post Office, Bangalore – 560100, Karnataka”

Step 6: You will get the receipt of your ITR-V receipt by email in some weeks (takes time) , you can track its status of your ITR.

A lot of people who work in big companies might already have filed their taxes as they get lot of tax filing agents coming in their offices, but for people who still want to do it by themselves, they can take this pain. I personally prefer to to through an agent 🙂

E-filing your tax returns through private websites with Taxspanner or TaxSmile

There are various online websites authorized by income tax department who can file your tax returns . The major reason why you might want to explore these online options are because they are really convenient . One more reason for you to start e-filing your taxes is because in coming years e-filing is set to become mandatory (just like for corporate’s) .

Watch the video given below to now how to file ITR online:

So may be you want to be comfortable with that before it becomes mandatory . There are multiple benefits of filing e-return especially through private websites authorized by income tax department. The additional benefits over govt website include convenience, accuracy, tax planning cum saving, professional support after filing ITR and

1. Processing on real time:

E-filing ensures income taxes are uploaded in the tax system instantly which helps in tax computations processing on a real-time. If PAN details are matching the income tax department and income tax return filed, the taxpayers gets an acknowledgement on e-mail called ITR V.

In case PAN card information is incorrect, the electronic returns get rejected and the taxpayer is intimated for failure i.e. the ITR V copy is not delivered. This ensures the return has been submitted in time.

2. Jurisdiction free:

In case the return is being filed manually and an employee gets transferred to other city than he/she need to transfer his income tax return to the city where he is working presently. Whereas, e-filing is jurisdiction free.

This means your PAN address will be the jurisdiction and same can be continued even if you move out of city or country.

3. Faster refund:

As per the Controller and General Auditor of India, there are 40 lakh pending cases of refund with the income tax department as on 31.12.2010. Refunds are generally received in 10 months in the case of physical tax returns ran.

Whereas, the refunds are getting cleared within 1-2 months in the case of return filed electronically. “We want tax-payers to file electronically as that helps in faster processing of refunds,” Sudhir Chandra, chairman, Central Board of Direct Taxes.

4. Revise return online:

In case the return is filed online before the due date, and taxpayer has missed out on declaring any income or investment. He/she can revise the return online without visiting ITO. If the original returns have been filed physically then, the revised returns cannot be filed online.

If there is refund in the revised return then, you will get the benefit of faster processing and refund.

5. Rectify the mistake online:

In case of physical returns, if there is an error at the time of filing, the mistake cannot be rectified online which means it will be more time consuming and costly too. The process of online rectification is faster and simplified.

However, online rectification is allowed only for the returns filed electronically

300 readers win free tax filing discount coupons

Whats the use of this blog if I cant get some freebies 🙂 . TaxSpanner & TaxYogi has agreed to give 100 & 200 promotional codes (taxspanner – 100 and taxyogi – 200) to jagoinvestor readers which can be used for free tax filing from their website.

I will pick 300 best comments on this article & other articles and all of them get to file free tax return using the promotional code. Note that it will be totally free and there are no charges for you . Apart from taxspanner.com & taxyogi.com, even taxmunshi.com has offered 5 promotional codes to jagoinvestor readers .

Note that these can be used to file only ITR1 & ITR2. Some other websites which can be used to file tax returns are taxsmile.com & taxshax.

E-Filing means faster tax refund

Did you know that if you have some refund to get back, then e-filing would ensure that you get it back faster than manual process.

With online filing it saves a lot of time which is taken in other process like generating acknowledgement form, feeding your details from the form and various other things, that itself takes few months. So e-filing ensures that you get your refunds faster. On of the very active members of our forum , Ashal Jauhari confirms this

Dear Rakesh, I’m already e-filing ITRs from the last year i.e. FY 2009-2010. Till date I have not face any problem for me & my friends (mainly office friends). Last year I e-filed some 40+ ITRs & this year the figure is already over 125.

Error has been reduced tp a great extent after e-filing on our parts.

Me or my friends who were calculated refund refunds, got the same last year within 40-50 days of ITR-V reaching Banglore & that too through ECS. Cool isn’t it?

Thanks

Ashal

No need to file return if, you have only salary income and earnings are less than 5 lakhs per annum

If your only income is from salary and its less than 5 lacs in 2010-2011, then you are not required to file the tax returns. Note that this is true only if you don’t have any other source of income. If you have some income from mutual funds, shares or bank interest etc, then you need to file tax return.

So which website is the best one to file your income tax returns online ? Which one did you use ?

July 10, 2011

July 10, 2011