Post Office Monthly Income Scheme (POMIS) – How it works and Rules

Are you looking for a safe option to invest your money and earn decent returns? If yes, then I can explore one of the post office schemes. Today, we look at post office monthly income schemes (POMIS) which are not that well-known among urban investors. We often look to fixed deposits and other debt options to park our money or generated monthly income. But the monthly income scheme post office offers myriad possibilities. Let’s explore!

Post Office Monthly Income Account

Post Office Monthly Income Scheme is one of the post office schemes which gives you a guaranteed return on your investment. Anyone who wants to generate a monthly income can open this account and get an assured monthly income. You get an 8% interest per year, which is payable on a per month basis. You will get the interest each month from the date of making the investment, not from the start of the month.

For example Ajay invests Rs 4.5 lacs in the post office monthly income scheme. His interest per year is Rs 36,000 @8%, hence he gets Rs 3,000 per month as income. If you do not withdraw the amount for some month, it would not earn any interest and just lie in the account.

This post office saving scheme does not come under sec 80C so there is no tax-exemption for the amount you invest in this, and interest income is taxable, but there is no TDS cut in this scheme. Read 7 Tax saving Tips

You can deposit the money in the POMIS with cash, demand draft or local cheque. Once you open a monthly income scheme account, you will be issued a scheme certificate and a passbook to record the transactions against the post office MIS scheme. The maturity period of this scheme is 6 years. You will also be eligible for a 5% bonus if you retain your scheme foe 6 years, so eventually, your overall return including this bonus can turn out to be around 8.9 %. There is a limit on the amount you can invest in POMIS. It’s limited to Rs 4.5 lacs for a single account and 9 lacs for a joint account. You can have any number of accounts, but within the overall upper limit. There is no compulsion to take your money out after maturity, you can leave the money in the account, but then it would earn the interest equal to saving bank account for the next 2 years only.

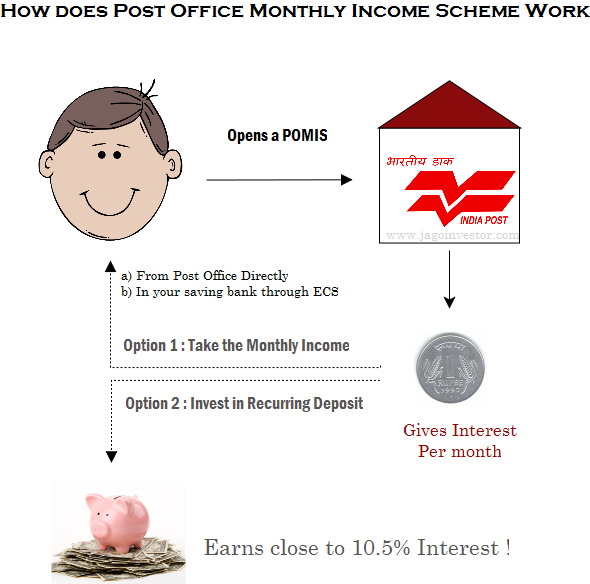

Getting Interest income in your Saving account

You get to withdraw the POMIS income amount by directly going to the Post-office. However, there seems to be a bit of confusion, if you want the income in your savings bank account. According to per some resources, you can get it credited to your savings bank account, provided it’s in the same post-office. But elsewhere, some guys confirm that you can provide ECS information at the time of opening the account and get the interest amount created in your Bank account (see the list of cities covered by Post-office). I found the comment below on this website, where a user claims of using ECS.

YES! you can opt for a ECS facility whereby your monthly interest amount will be credited to any savings account of your choice (here HDFC). After you open the POMIS account, you need to fill up the ECS form, attach a blank cheque of your HDFC savings account and you’re all set. You don’t need to open a Savings account at the Post office just for credit of monthly interest.

The information I’ve given here is authentic, because I’m personally using the ECS facility.

Pre-mature Withdrawal from Post-Office monthly Saving Scheme

Even though the maturity period for POMIS is 6 yrs , there is a facility to break it and take your money out. However you can take your money only after 1 year. You have to pay some penalty which is as follows

- If you break it within 1-3 yrs: 2% penalty on Deposit amount

- If you break it after 3 yrs: 1% penalty on Deposit amount

Example: If you deposit Rs 1 lac in POMIS , and want to take money out in 2nd year, you will have to bear the penalty of 2,000 and you will get back 98,000. If you take money out in 5th year, you get 99,000.

Confusion of returns by mixing POMIS along with RD?

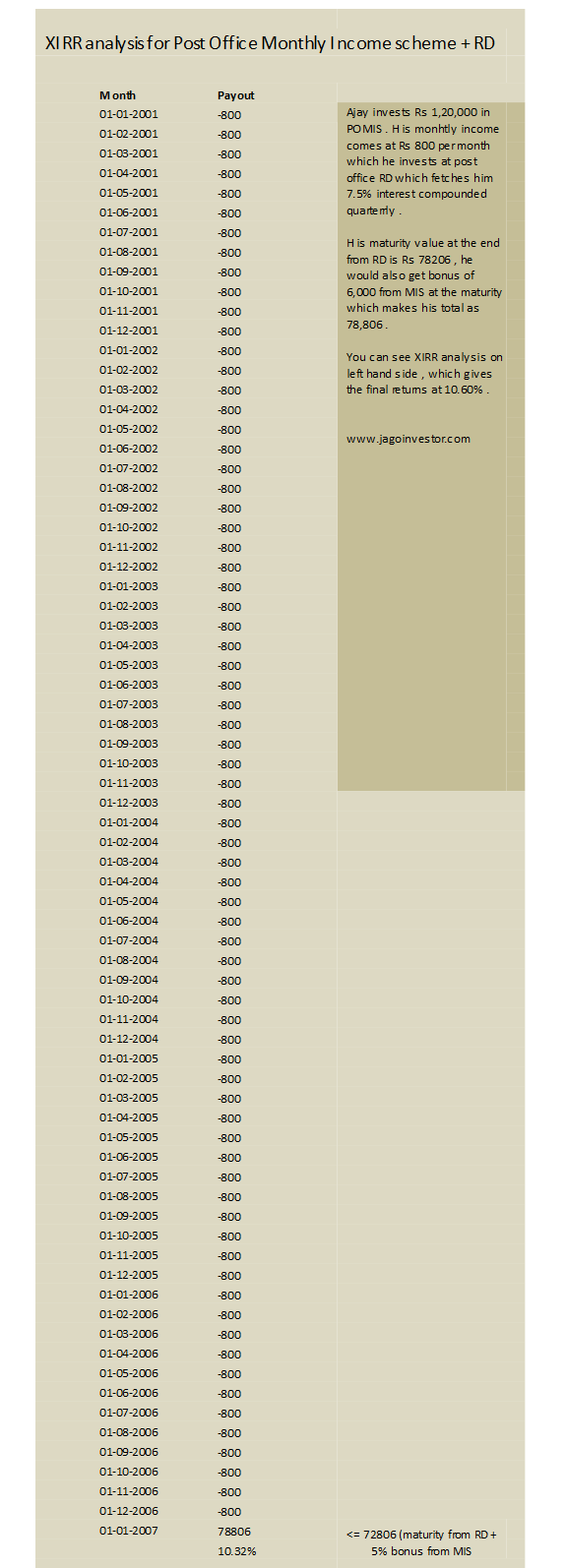

There are some claims which say one can invest the monthly income coming from Post office monthly income scheme into the Post office RD and earn a return of 10.5 %. This at first looks amazing, but its kind of untrue and marketing gimmick. I did a XIRR analysis of the whole cash flows and found out that considering everything , your final and actual return is just 8.77% , which means that when you invest your money in POMIS , direct all the monthly income to an RD and at the end when you get the maturity amount along with the bonus of 5 %, in total you have made an annual return of just 8.77%, which is quite ok considering the safety and conservativeness of the product. But considering the tax to be paid at the end of the tenure, again you might not get great Real Returns! , Remember that the RD comes for the 5 yrs, but it can be extended for 1 more year and it can be made for 6 yrs.

However, the Post office website claims that you earn 10.5% when you put your monthly income into an RD, which is just to attract investors and not give a complete picture. This 10.5% figure is actually only after considering the bonus amount you get at the end, If you remove the Bonus of 5% from the scene , then the return drops to 7.92% . In the below example, you can see that a person who has invested Rs 1,20,000 will get Rs 800 as monthly income , and he gets 72808 as maturity amount from RD, 1,20,000 back as the initial investment and 6,000 as bonus amount .

Scene 1 : If you consider the 800 payment per month in RD for 6 yrs and the maturity amount of 72,806 at the end of 6 yrs , then the returns are just 7.92% (XIRR)

Scene 2 : If you consider scene 1 along with the Bonus amount also , which means you get 72,806 + 6,000 Bonus also = Rs 78,806 , in that case your returns are 10.32% , but its misleading as this bonus is the cost of your 1,20,000 getting stuck at one place for 6 yrs and not an RD feature . So this is not the right way of looking at it . (See chart above)

In case of scene 2 into consideration , then the return from “Only POMIS” is just 8% , but if you consider POMIS + Bonus only then its 8.91% .

Note that this setup operates automatically, you have to set up this once and then no more overseeing. It will happen automatically each month (official link)

Other Features of Post Office Monthly Income Scheme

- A minor above age 10 years can open an account on his/her own name directly. There is a limit of 3 lacs for guardian and it would not be clubbed with guardian limit (More on Clubbing rules)

- Non-Resident Indian / HUF cannot open the Account.

- Interest not withdrawn does not carry any interest.

- Your POMIS account can be transferred from one post office to any Post office in India free of cost.

- The amount deposited in POMIS is exempt from Wealth Tax

Nomination

You have to make the nomination for your Post office monthly Income scheme at the time of applying, however, if you don’t do it at the time of opening, you can also do the nomination later. Incase of the death of the account holder the money will be paid to the nominee. Read more on nomination here.

January 31, 2011

January 31, 2011

I have invested some amount in POMIS and it is matured on 01/01/2016. But as I am currently not in India, I did not claim it yet. What happens now? Does PO auto renewels or PO pays with interest whenever I actuallly withdraw or there is no extra interest post maturity date? Could you clarify.

I am not sure on that, but I dont think its on auto renewal. It will be kept in an account which will not grow

There are two dates written on my India post MIS pass book. One is Registration Date : 27/11/2010 and another one is Issue Date : 02/12/2010. It is a 6 year plan, hence it is going to be matured in this year that is 2016. I am confused about the maturity date, is it 27/11/2016 or 02/12/2016 ? Will be extremely helpful if you can help.

Hi Abhishek S.

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

I have 1.5 lakh , can i deposit in MIS and what is the monthly income

You need to check it with them only

Sir, If I open MIS A/C , Can I withdraw the interest amount per month

Yes

Above 9 lac can be invested by a jointly senior citizen ?

I am planning to invest In MIS scheme …as we are 3 members and each holding a pan card …and I want to invest 4.5 lacs each !so do I need to pay income tax ?

Income tax is paid on INCOME ! .. Not on investment.

Agar mein 4.5 lac ka mis karta hoon to tax dena parega keya?

Yes

Sir

I have 3nos. of MIS of 14 lakhs. But the Post master does not issue RD. Now I want to transfer the interest amount from MIS to RD. Is it possible. if, how ?

Hi MihirSarkar

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Agar me 4.5L MIS ka scheme karna chahta hu to kya mujhe imcometax varna padega?

Hi sir,

I invest 100000 in mis in 2013

I want this money

Can i get my money in 2016 ????

Yes, you can withdraw it. Please talk to them

I m planning for MIS. Some one already having MIS told me that bonus facility no more available now.

Is it so ?

Rgds

Thats correct

Sinior citezen ke liye MIS limit kya hai ?

9 lacs

Mene mis a/C open kiya hai jisme pese 9 date ko kat gaye the par koi wazah se a/c opning me deri ho gai hai to post master mis ki date ajki laga raha hai to mere ko janna hai ki mere ko per month intrest konsi date ko molega ???

we are 3 in the family all are holding pan i want to invest in mis scheme of post office with all the thee as a joint holders invest will be like this 450000/-*3 ac which will be 1350000/- where there would not be exceed in limit and if one person diesthe other 2 can close one ac and continue the other 2 ac which comes to 9 lakhs 450000*2 whether that is possible.please explan

No , the maximum one can have is joint account with 2 people . Thats all

Hi

Is it advisable to do POMIS of 9 Lakhs (joint) and put monthly income into ongoing exisitng SIP portfolio of diversified equity MFs.

Thanks

Yes you can do that, This way your principle will be intact. But then how is it helping you ? I mean return wise !

Thanks much for the useful article!

A query: My PPF investment already covers the max limit of 150000 in Section 80C. Now, if I invest in MIS and arrange for the MIS interest to be invested in a PO RD a/c, isn’t it true that both the MIS interest and the RD interest are taxable? ?

Yes, both of them will be taxable !

can i deposit in mis scheme with my huf pan number

then it will be in HUF name !

I HAVE A MIP DONE AT MEERUT POST OFFICE AND NOW AS IT IS MATURED I HAVE TO REDEEM IT,BUT PRESENTLY I AM IN LUCKNOW,CAN I REDEEM IT IN LKO ITSELF

PLS ADVICE

You need to visit the branch I guess!

Hi Manish G,

can you explain what is the rule of Interest, after death of a join account holder,in MIS.

is it true ? no interest will be paid after such period by PO after the death of any one in both account holder ?

Regards,

Kailash

I am not sure on this, but it looks like that rule cant be there. I suggest using RTI to get the right answer !

Hi Manish ,

What is the rule? in case of death (,Monthly interest scheme )

Please check it with the post office itself !