Don’t buy “Return of Premium Term Plan” – It does not make sense!

Does it makes any sense to buy “Return of Premium Term Plan”?

The one-line answer is “NO – it does not make sense”

A “Return of Premium Term Plan” or TROP as its called – pays back all your premiums at the end of the period, whereas the plain term plan doesn’t return back anything. Before we get into the analysis further, I want you to know why these return of premium term plan came into existence!

Why the Return of Premium Term Plan came into existence?

Term plans have become very popular in the last few years. We are seeing so many advertisements screaming about term plans importance. However, a lot of investors who don’t understand term plans fully, still feel a pinch that their premiums get “wasted” if nothing happens to them.

They equate “paying premiums” as “losing premiums” if they dont die. They compare it with an investment policy (read traditional insurance plans) where they get back there a sum assured towards the end of the policy.

Insurance companies sensed this behaviour and they introduced something called “Term Plan with Return of Premium” which can now proudly tell customers that they have nothing to lose. They get claim money on death, and if they don’t die, they get back all their premiums paid. Many investors who do not understand the time value of money concept fall for a product like this, as to human mind “getting back all your premiums” sounds very attractive offer.

Now, let’s talk about why it does not make sense as a product.

Return of Premium Term plan has an extremely low return

The premium for the TROP (return of premium term plan) is higher than the plain term plan and it can be 2x-3x times the normal premium in some policies.

So basically, you are paying an extra premium for getting your premiums back after 30-40 yrs!

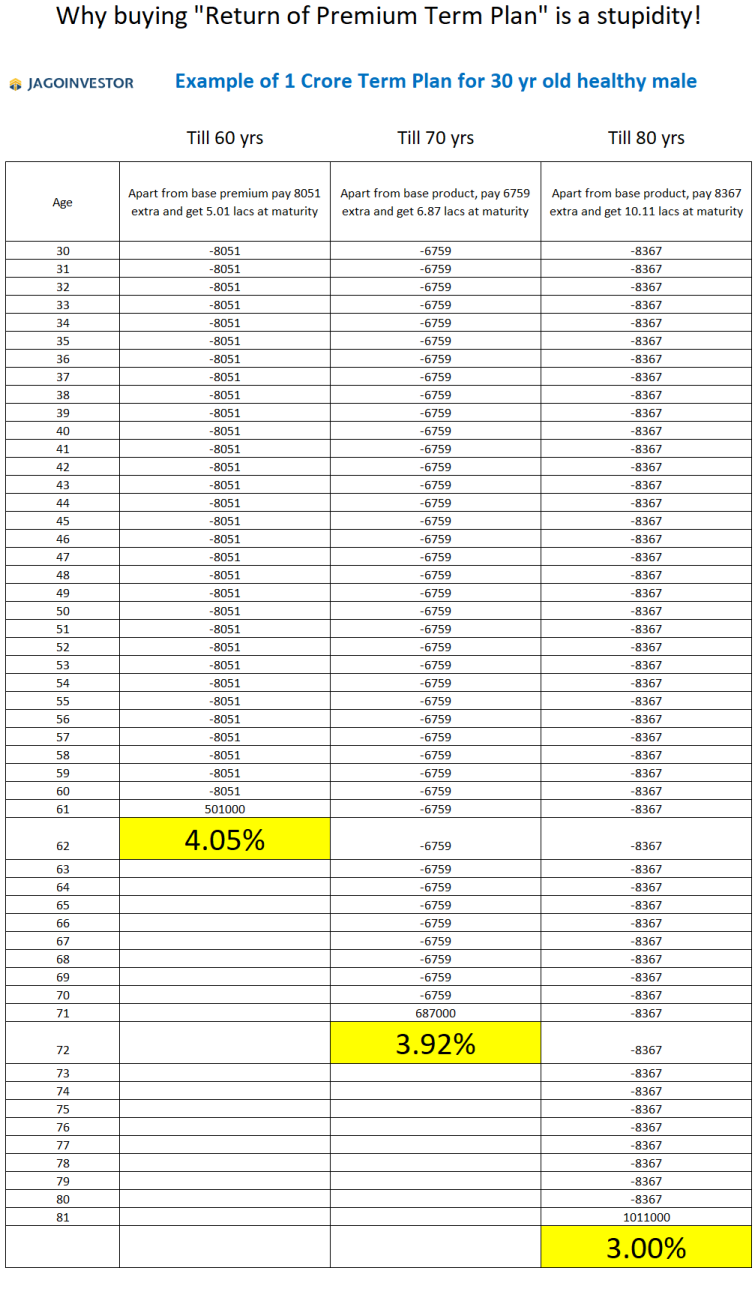

Let’s look at an example of a 30 yr old male, who wants to buy a 1 crore term plan till 60 yrs of age (for 30 yrs tenure). In which case the premiums are as follows (Example is of Max Life Term Plan as on 21st Dec 2020)

[su_table responsive=”yes”]

| Type of Plan | Yearly Premium | Details |

|---|---|---|

| Simple Term plan | Rs 9912 | One has to pay Rs 9912/yr for 30 yrs for Rs 1 crore cover. You don’t get back anything at the end on survival |

| Return of Premium Term Plan | Rs. 17,969 | One will have to pay an extra amount of 8057 for 30 yrs (apart from 9912) and will get back Rs 5.01 lacs (this is all premiums paid excluding the tax amount) at 60th year |

[/su_table]

If you look at the example above, you can see that in both the plans you are paying Rs 9912 for the Rs 1 crore cover. Only difference is that in second policy, you are paying an extra Rs 8057 to get back Rs 5.01 lacs (excludes the taxes part) at the end. This is the only difference between the two versions.

So internally, the term plan with return of premium is simply a bundled product of a normal term plan and an investment policy. If we ask what is the return of this investment policy where you are paying Rs 8057 per year and getting back Rs 5.01 lacs after 30 yrs.

The answer is 4.05% CAGR.

Yes, its barely above saving account rates and a little below a normal fixed deposit interest.

I did the same analysis for the tenure of 40 yrs and 50 yrs policy (read why you should not take such a long tenure term plan) and the IRR return was 3.92% and 3.00% respectively, which means that if you buy the policy for a longer tenure, the return gets lower and lower and the product becomes even worse.

Below is the IRR return calculated in an excel sheet for your reference

Note : The above calculations are done in Excel for just one company plan, however similar kind of numbers are expected from other companies return of premium term plan. Please do IRR calculations yourself if you looking at other companies plans.

Return of Premium Policy ties you up with the product

What do you do, if you want to stop a “Return of Premium Term plan” in-between? Let’s say after 10 yrs?

It will not be as simple as a normal term plan, because, with the return of premium policy, your mind will tell you that you just have to continue it for another 20 yrs and you will get back all your premiums. Very smartly, the insurance company has converted a pure term plan into an “investment policy cum term plan” with very bad returns.

so the better alternative than a “term plan with return of premium” is to buy a simple term plan (here are 20 checklists before buying term plan) and invest the extra amount in another investment products like PPF, FD’s, Equity mutual fund or debt mutual fund and you will have better flexibility and returns.

Check out this video from Subramoney talking about this product

What happens if you stop paying a premium for Return of Premium Term plan?

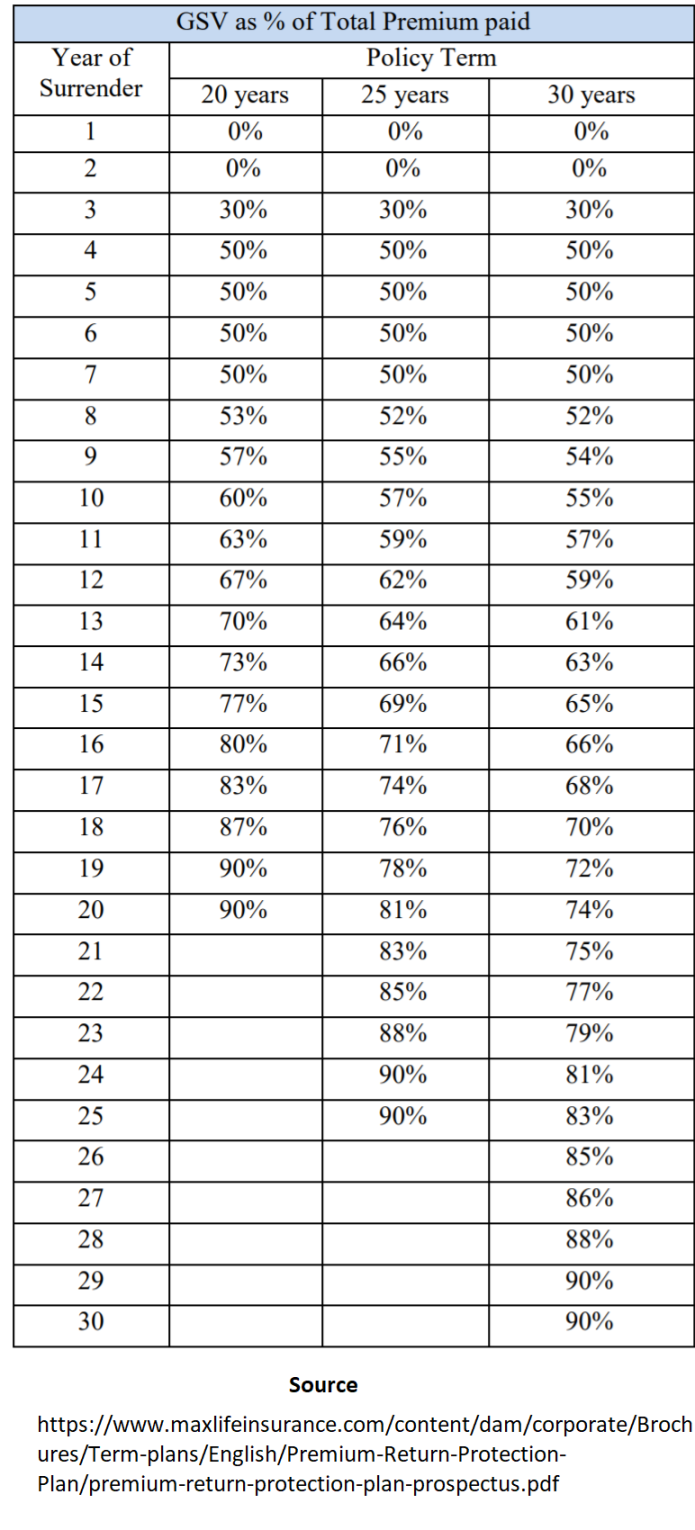

There is an option to get a surrender value if you stop paying the premiums in between. Just like traditional plans, there is the concept of “Guaranteed Surrender value” in these kinds of policies which comes into picture once you have paid 3 yrs premium. However, the amount you get back is a fraction of what you have paid. There is a percentage assigned for every year which tells what part of the premium paid will you get back if you surrender the policy in a year. Below is a snapshot of the chart taken from Max Life Brochure

So, as per this chart – if one wants to surrender the policy in 10th year, they will get back only 55% of the premiums paid (excluding premiums).

Some other Info

- The TROP gives you income tax benefits as per sec 80C

- There is an option to pay premiums on a monthly, quarterly or yearly basis

- There is also an option for limited pay (pay in 10 yrs) or in one single premium

Conclusion

So TROP is a very carefully designed product which favours the insurance company but makes the product look very good and works on the psychology of the investor. Better stay away from it. The best idea is to buy the simple term plan with the lowest premium.

If you have already invested in this kind of plan, then you need to evaluate what will make sense for you!

Do let us know if you liked the article and does it make sense to you? Share in the comments section!

December 22, 2020

December 22, 2020

pleas review “IndiaFirst Life Long Guaranteed Income Plan” in some post

Avoid!

Thanks for sharing some of the great and informative insight into the term plan. Keep up the great work.

Thanks

HI Manish,

Thanks for the article..I already have SBI E -Shield term plan of 50 L for 30 years and paying since 2014 onwards & it is wiser to have another term plan probably for another 50 lakhs… please suggest

Yes..

But its better to take a single 1 crore term plan now if costing is fine .. and close the old one!

Manish

Sir, I m confused I m invest in term plan or mutual fund plz suggest me .

You dont INVEST in term plan, its for your life insurance purpose. You can invest in mutual funds for long term

Do one thing , just leave your details here and our team will call and guide you http://www.jagoinvestor.com/pro#schedule-call

aergon ireturn plan.. for 20 years if i invest 11459 rs for a cover of 50 lakh.. i get my premium returns 11459 -112 rider – 15% service tax multiply by 20 = 223540.)

now term plan comes to around 4405, but for others its 6-7k.. so i invest remainder in tax saver FD every 5 yearly for 4 times.(20 years) i get 240000, around 15k more than investing in this plan while 220000 if i invest in other term insurances..

so ultimately its almost the same thing.

Hi sid

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hi Manish,

Thanks for the well written article. The example you have given above is just for 12 Lakhs. What happens if the minimum sum assured is 1 crore? Will we still be able to compare the PPF+life term option.

the example is still applicable ..

Hai Sir, I have Jeevan Taran Policy. i have started by 2012 Feb up to now i have paid regularly.Now after gone through your articla i am scaring to continue my policy. I have a doubt if i complete my tentur i.e 20yar at the end how much money i will get . i thought full sum assured (600000) + Additional Benifits i will get after the completion of 20yrs .But you have mentioned in that artical only special assured only i will get afte my accumulation period.Sum assured after my death only it will come or after the tenture it comes to me….please guide me sir……

Yes, as I mentioned only what is written in policy documents will be done

hi Manish,

I have simple question for you on this, I think you have posted in some other post about the tenure of the term plan. if you know(high probability) that you are going to survive more than 70 years of age then take cover only for years when your family is dependent on you(for income purpose) i.e. till 60 years. so if I already investing in ppf & mutual funds already then would it be better that I go for term plan with return of premium? I understand I would be paying more but as you mentioned anyway I am going to survive full term of the policy so I would atleast get my money which I gave to insurance company. Is it correct way of think?

Please advise as I am planning to buy term insurance with rop in next couple of days.

Thanks

Sameer

No Sameer

Its not correct way to think. You are not taking into account VALUE OF MONEY concept. The money you will get after the full tenure, just think how much it will be after 25-30 yrs , it would be peanuts at the end and at that time, it will not help you at all .. So right now just go for normal term plan and any extra money use for investments.

Manish

Hi Sameer,

Simple explanation to your query would be value of money decreases as the time passes because of inflation, this concept is called time value of money.

For example, just compare the purchasing power of a 100 rupee note in your childhood to its current purchasing power.

In the current context, the purchasing power of what you get after 20 or 30 years (premiums paid) will be very when compared to the extra premiums what you pay now to get it back at the end of the term.

Hi Manish,

My name is Ravi and I am staying in Bangalore.

I am planning to get a term policy worth of 50lkh coverage and also I would like get return on my investment if incase nothing bad happens to me. So I contacted SBI and they said they have a plan where I need to pay 28600 for 30 years and as I said if nothing happens to payee he will get 28600*30=858000.

After reading your comments I am in doubt whether I need to go for term policy with return on investment or just go with simple term policy and invest in mutual funds.

My age is 32

My investments:

LIC:32400 Per year

MF(ING):48000 Per year

MF(RIL):35000 Per Year

Br

Ravikiran

Better not to go for it ! ..

Dear Manish,

Thanks for the Mathematical explaination however scenario changes if we go for higher coverage value e.g 1.2 Cr instead of 1200000 as Term insurance is meant to pay all your debts plus provide enough income to your family for all those rest of the years one whould have been earning. In such case, the premium difference is coming out to be 10000 ( regular term plan (max life) 14700, premium return plan (aegon religair 24000 with coverage 1.2 Cr & return of premium) Do you still suggest to go for regular term plan in this case say for 20 Yr policy term?

Hi Sandeep Chandrashekhar Pawar

Even then term plan is a good choice . Let us know if you need our help in choosing and buying a right term plan . You can leave your details here – http://jagoinvestor.dev.diginnovators.site/services/life-insurance

How is the insurer Edelweiss Tokio ?? I am looking for a term insurance.

Hi Vikas

Every insurance company is fine as far as you are honest in filling up the form . HDFC Click2Protect is a great option too , and you can look at it . If you want a call back from them , you can participate in our Action month we are running this month and you would get our support in choosing the plan .

Check out – http://jagoinvestor.dev.diginnovators.site/2014/12/december-action-week-for-life-and-health-insurance.html

Its a new company . I cant comment on how good or bad it is, but you can take it if you can connect yourself with it. Why not go for other companies like LIC, HDFC , Aviva etc !

Dear Manish,

First I want to say Thank God, that I visit this site today.

Today I am [35 yrs old] goining to pay today my Aviva i Life insurance policy 5th premium Rs 5099/ [30yrs term plan – 50 lacks]. Now days I am seeing term plans with return premium so I am confused. Please help me that I have yo continue with these policy or I have to exit and take new one. I have more to ask you regarding my financial planning but first i want guidence from you for above mentioned issue.

I have gone through all your bloks and impressed very much with your advice.

I like to join this forum too so please help.

Thank you.

Best regards,

Dipak Katekar

You can go with it .. no issues ..

Thank you very much for you guidence

Hi Manish,

I have subsribed to term insurance from aviva ilife term is 35 years SA is 60lac age is 29 years, all this is along with health insurance for 30 years SA 10 lac from aviva, now could you please suggest me shall i continue with my LIC tarang or go with balanced and growth oriented MF or PPF, thank in advance

You can be with LIC tarang for investment reasons, from insurance point of view I think its anyways not a big amount and does not serve you !

Sorry to bother you again

I have term insurance of 60 lac from AVIVA plus health insurnance of 10 lacs all this for term of 30 Years, would like to know shall i invest in PPF or MF or in both if i want to generate maximum out of my investment

Thanks,

Yashwant

Yes, you can invest in PPF or MF , but how is it related to your insurance part , they are totally seperate part !

Great review…

thanks a lot first of all for posting such a easily understandable article.

i want to take your valuable advice for my future planning and will be highly thankful to you always.

(i am 24 year now and will take term plan for 54 year term.[because taking 30 year term will be probably make no sense. as in general average indian will not die till 70 year]

my current income is 4 Lakh per annum. and wish to take cover of 1 crore).

my budget is around 24,000 per year for term insurance + investment options.

i also wish to have corpus after 20 years around 10,00,000(in current value of rupee-please calculate inflation as i dont know how to calculate it :sorry for inconvinience).

what should i plan for the best possible return and that too considering life insurance in mind ???

i think i should buy term plan from AEGON for 1 crore (as it is the cheapest and longest cover provider )

so should i go for AEGON or change the company ? or split into two companies ?

but i have a doubt regarding their existence after 54 years ???

and second doubt is claim settlement ratio as i found that it is only 67% now a days for 2012-2013 ???

what do you suggest to me for above situation ???

pls. guide me and suggest the best looking into current trend …..

p.s :-can you meet me personally (or do you have any assistant) in surat,gujarat ???

THANKS A LOT N LOT N LOT IN ADVANCE…..WAITING FOR YOU BEST REPLY SOON…

Hi Mayank

You should read this article – http://jagoinvestor.dev.diginnovators.site/2013/04/why-you-should-not-take-term-insurance-till-75-yrs.html

thanx a lot first of all.

i have read the article you mentioned above. my question is that difference in premium is only 516 rupees per year for coverage till 75 year & 60 year. then why to take chance ? if i dont want to continue after 60 years of age then just stop paying premium and thats all. but in case i wish to go for new cover on that age it will be highly costly.

and another question is that why should WASTE money with insurance company by taking insurance till 60 years only ?as per general circumstances average age of indian is 75 currently. (instead take till 75 and pay around 150000 more to insurance company and take 1 crore is a better deal what i think) WHAT IS YOUR OPINION ?

AND sir , perhaps you missed my another question regarding 10,00,000 corpus after 20 years from today .. pls. reply on the same sir,

Thanks a lot once again.

Mayank , you can go ahead if you are ok with the extra payment !

Dear Manishji

As i have checked on policybazar.com while showing that i am a mariner, there are few company like Aviva, Maxlife they have the option in their “profession” column, Marine. So should i take from there?

Please advise me that what are the things need to be checked before taking the term policy.

Regards

Prabhash

Yes please choose it from dropdown and move ahead . They might put some loading factor or deny it , but you cant do much from your side, go ahead !

Dear Manishji

Good day

I am a mariner & want to take a policy of 50 lacs for 20/25 years. Please advise me which term policy should i take, as i dont have any idea.

Thanks a lot

Regards

Prabhash

Hi Prabhash

I can see you also opened a thread on our forum for this . Lets wait for answers there . From my side I can tell you that very few companies will be ready to give you term plan , You should look at some offline term plans . Contact each company in market and tell them you want it, see what they say ! .. There is no one company which is known to give it to mariners !

Hai manish, me and my brother have taken ULIP policies from lic namely lic money plus and market plus1 each with premium of Rs10000 per annum, 5 years ago.. Their performance is not good.. Do U suggest us to surrender them..

Excellent article Manish !!

Thanks

Hi Manish,

Nice contribution to leyman investment knowledge..

Keep posting such posts.. I’m loving it!! 🙂

Thanks & rgds,

Rakesh

thanks Rakesh