6 smart ways to PAY OFF your credit card debt trap in India

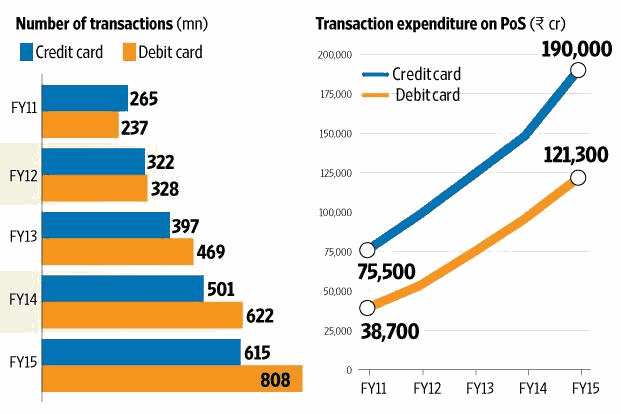

1,90,000 crore was spent using credit cards in India in the year 2015. Over the last decade, the usage of cards has increased many folds and while that’s great for the economy, it also means more and more people getting into credit card debt as many people are now dealing with credit cards.

In the graph below which was published by Livemint, it shows the growth in the card usage in our country

How investors get into Credit Card Debt Trap?

Credit cards if not used properly can get you into debt trap very easily. We get several emails and comments regarding how to handle credit card debt. Below is one of the comments

“I have a SBI card in which I have an outstanding balance of Rs 100000 so I went for settlement and they offered me a settlement amount of Rs.78000. Can it get it still reduced? Because I am not in a position to pay this amount”.

A lot of investors who do not use credit card in a wise manner end with a large outstanding on their cards and finally have to go for credit card debt settlement which lowers their credit score and puts a black mark on their credit report and this inturns hampers their chances of getting loans in future.

In this article, I am going to share some of the options which one can explore. If you want to quickly look over those 6 points, you can just watch the video below

Note that these points to be looked in order. I mean first, you see if option 1 is applicable to you or not. If not, then you move to option 2, if it still does not help you then you move to another option.

[su_table responsive=”yes” alternate=”no”]

| Option #1

Break your investments and pay the bill |

Option #2

Pay off the credit card debt in 5-6 payments |

| Option #3

Take a loan from friends/family and pay off the credit card outstanding amount |

Option #4

Take a personal loan to pay off credit card debt |

| Option #5

Convert your credit card loan to EMI |

Option #6

Use a Credit Card Balance transfer facility |

[/su_table]

So here you go

Option #1 – Break your investments and pay the bill

There are many people who keep rolling their credit card debt, and at the same time have money in their bank account or a fixed deposit. It does not just strike them that they can just pay off the full outstanding by breaking their FD or cash into the account.

This happens out of ignorance most of the time.

So if you can restructure your money here and there and can pay off the credit card debt, it’s the best option.

Option #2 – Pay off the credit card debt in 5-6 payments

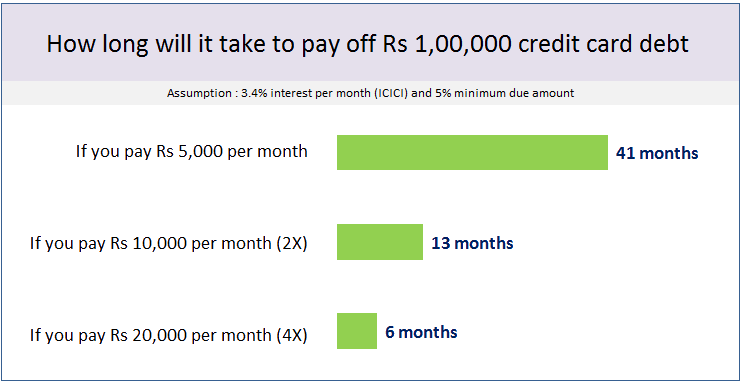

If option #1 is not feasible for you, then the next best option is to pay off the debt in 5-6 parts. Most of the people get too attached to the minimum balance amount and then they just stick to it because that’s the minimum required to be paid to save the penalty.

But then the interest is anyways to be paid, which makes sure you never get out of the debt.

So go beyond the minimum balance amount and pay 3-4X of the minimum balance each month. For example, if your credit card debt is Rs 2 lacs and the minimum due amount which can be paid is Rs 10,000.

Then try to pay 2-3X of that amount, which is Rs 30,000 or Rs 40,000 per month. If not that much, then at least 20,000. That way at least you will pay off the entire debt in next 1 yr if you are disciplined enough.

Option #3 – Take a loan from friends/family and pay off the credit card outstanding amount

The 3rd option is to try to get some loan from friends or family members and pay off the credit card debt in one go and then pay back the person later as per what you agreed with him/her. One can often get free loans without any interest from a close friend or a sibling if you communicate your problem well.

Make sure you pay them back exactly within the time frame mentioned.

Most of the people have burned their fingers by giving money to their friends and relatives because it gets very tough to ask back the money and it can bring sourness in the relations due to money matters.

So you can also choose to pay some interest because the person can anyways earn some money from FD, so better offer to pay 10% interest per year. It’s a win-win situation if it works out!

Option #4 – Take personal loan to pay off credit card debt

If you don’t get loan from someone close in family/friends, then you can go for a personal loan and use that money to pay off the card outstanding. Interest will be in the range of 14-18%, but still, it’s better than paying 40% on a yearly basis.

This does not clear your debt, but just shifts your debt from credit card to a personal loan. Much better option. For those who already have a home loan going on, they can also look at the top-up loan facility which will be much cheaper to a personal loan.

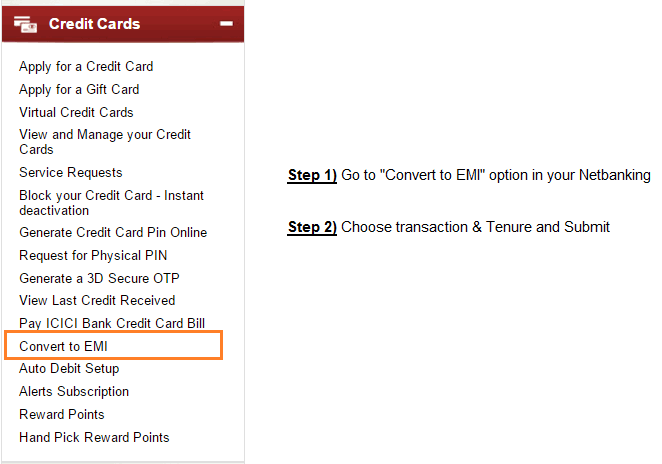

Option #5 – Convert your credit card loan to EMI

If you are not getting a personal loan, then you can convert your debt to an EMI option from the same lender. Almost all the big banks give an option to convert the credit card debt to EMI for tenures like 3/6/9/12/24 months. The interest can range between 13-18% depending on the lender.

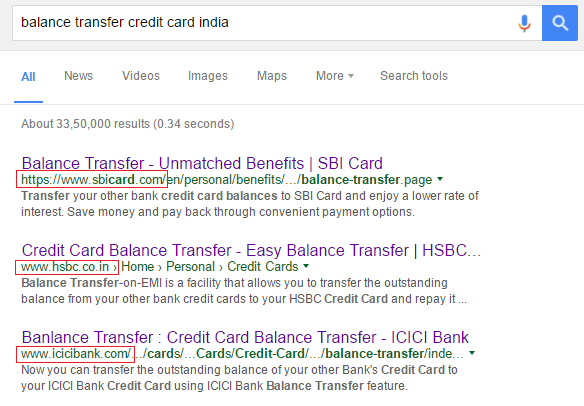

Option #6 – Use a Credit Card Balance transfer facility

There is a facility called Balance Transfer provided by many credit card companies, where you can switch your current credit card outstanding to a totally new credit card. In this case, the new credit card will pay off your old credit card and will also offer you some benefits like an interest-free period of 3 months or low interest for the first few months.

Almost all the major credit card companies like SBI credit card, ICICI credit card, and HSBC have this credit card balance transfer facility service with them. SBI credit cards even provide 0% interest for the next 60 days.

However, before opting for this option, please check if there is any processing charge or not? It might happen that the lender is providing free interest period, but then high processing fees will nullify the advantage 🙂

However, note that this is a temporary solution for the next 2-3 months and by that time you should look for further solutions.

Use your credit card wisely

Below are some high-level points which will save you from getting to credit card debt

- Pay your Credit Card 3 days before the due date, keep a reminder on the phone if it helps

- Don’t spend much more than you can afford.

- Carry debit card instead of credit card, You will pay only what you have

- Don’t keep very high credit limit, if you can’t control yourself when it comes to spending

Please share if you have any more solutions?

May 11, 2016

May 11, 2016