Are you getting fooled and paying extra money on your restaurant Bills ?

Do you know that you might have lost thousands of rupees in paying extra money on restaurants bills over last few years, just because you do not understand what does service charge, service tax and VAT actually means and how are they calculated. Most of the times customers take it for granted assuming that hotel must charged it in right manner and as per rules laid down. Lets learn about these 3 concepts today so that next time you pay a hotel or restaurant bill, you exactly know what you are paying for and raise your voice if something is wrong.

When the Bill Arrives

Just before the bill arrives, I have this habit of running “guessing competition”. Whoever is with me, I ask him/her – “Guess, what would be the bill amount be around ? Give the range , whoever is close wins !” .

Almost all the time I am very close to the actual amount, but then I am not close to the final amount to pay, because I always forget to consider various tax and charges applicable, which always inflates the bill by 20-30% . Imagine you eat worth Rs 1,000 and pay Rs 1,260 finally ! . You know that feeling :).

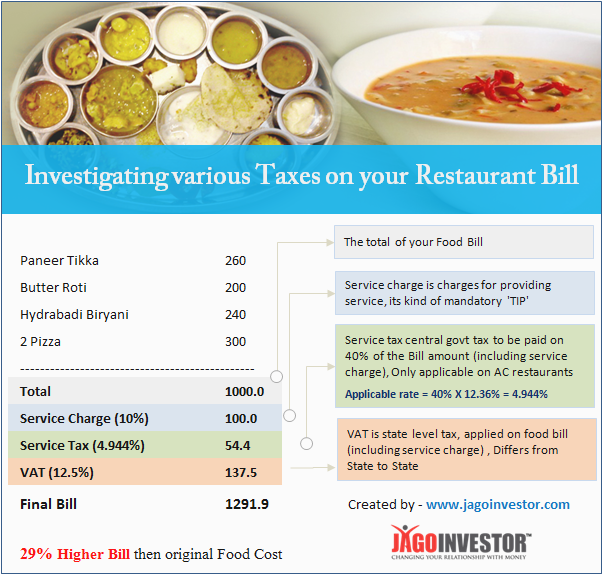

So if you look at your bills when you eat at hotels and restaurants, you will see 3 kind of charges namely “service charge” , “service tax” and “VAT” . Lets decode them one by one and see what exactly they are

1. Service Charge

Service Charge is a charge levied by restaurant for the service provided to customers. This is generally 5%-10% of the bill and restaurant owner is free to charge whatever amount he/she wants as service charge. Its up-to you to decide if you want to eat there or not. The service charge has to be displayed in Menu, only then it can appear in the final bill. If you do not see it on Menu, it means it was not communicated to you and you cant not be charged service charge.

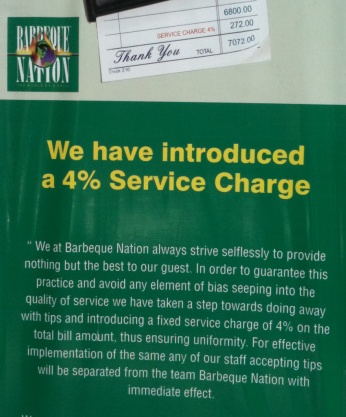

Actually service charges are to be distributed among waiters and staff and its kind of compulsory “tip” to be paid. So if there is service charge on the bill, you are not suppose to tip officially to any one. So don’t feel awkward not paying the tip, because you have already paid it in form of service charge, however most of the hotels and restaurants never tell you this explicitly. However one of the exceptions I know is restaurant called “Barbeque Nation”, I could clearly see it was written in their menu that “We will levy 4% service charge on the final bill, and you are not suppose to tip any one (strictly prohibited), because service charge will be shared among the staff” . The ethics quality was as high as their food quality 🙂

Actually service charges are to be distributed among waiters and staff and its kind of compulsory “tip” to be paid. So if there is service charge on the bill, you are not suppose to tip officially to any one. So don’t feel awkward not paying the tip, because you have already paid it in form of service charge, however most of the hotels and restaurants never tell you this explicitly. However one of the exceptions I know is restaurant called “Barbeque Nation”, I could clearly see it was written in their menu that “We will levy 4% service charge on the final bill, and you are not suppose to tip any one (strictly prohibited), because service charge will be shared among the staff” . The ethics quality was as high as their food quality 🙂

So if your food bill is Rs 1,000 and service charge is 10% , then your final bill will be Rs 1,100 .

2. Service Tax

The important thing, you should be aware about is how service tax is calculated! . Do you know that, Service tax is only applicable on 40% of the bill amount, not the total amount. As the service tax is around 12.36% at the moment, the final tax you need to pay is only 4.944% (12.5% X 40%) on the bill (inclusive of service charge).

The next important thing you should know is that, only AC restaurant can charge service tax. If there is no AC in restaurant (fully or partially) , they cant charge service tax at all. This service tax goes to Govt of India. The service tax is payable on the bill amount + service charge. So if Bill amount is Rs 1,000 , and service charge was Rs 100 (10%), then your sub total would be Rs 1,100 . And your service tax will be computed on Rs 1,100 (not Rs 1,000). 4.944% of Rs 1,100 will be Rs 54.38 and your total bill after service tax would be Rs 1154.38 . A lot of unprofessional and small restaurants are found to charge service tax on the full bill and most of the customer pay because they have no idea what is wrong and what is right. Here is official Note on service tax

Note – On 3rd Nov 2012 , Bar Council by mistake interpreted that service tax is to be paid only on service charge, and it starting circulating over facebook and emails. But note that it was a mistake and later clarified that service tax is to be charged on 40% of the bill amount also. So dont fall for wrong information . Even some one posted it on our jagoinvestor forum and I myself believed it to be true !, but later decided to investigate it.

3. VAT – Value Added Tax

VAT is Value added Tax collected by State Govt. VAT is only applicable to the food items which are prepared inside the restaurant, because they “added some value” and then hand it over to you. So make sure you do not pay it on packaged items which are not prepared by Restaurant like Packaged food items, water bottles etc. A lot of times you eat at restaurant and also take a lot of packaged items, in which case VAT should be applicable not on final bill, but only sub total of the food items you consumed.

VAT Charges vary from state to state, but generally lie in the range of 10% – 15% . Like in Maharashtra its 12.5% , and in Karnataka its 14.5% . VAT is to be charged only on the main bill + service charges. It CANT be charged on the amount after service tax. So in the same example we looked about, the final bill after service charge was Rs 1,100 , so VAT at 12.5% will be Rs 137.5. Now total bill amount would be

- Food Bill – Rs 1,000

- Service Charge – Rs 100

- Service tax (4.944% of 1,100) – Rs 54.38

- VAT (12.5% of 1,100) – Rs 137.5

- Total – Rs 1,291

29% higher Bills compared to Cost

You can see how various charges and tax can increase your final bills by 25-30% . So next time you pay your bills, just make sure your check, if all the taxes and charges are computed properly and as per rules.

Any personal experiences ?

August 5, 2013

August 5, 2013

thanks for the valuable information but I think the service charge should not be charged in case of taking away. Clarify with the restaurant on this

Yes it should not be .. but then if they still do , the only option for you is to not go ahead with the order !

if we take a food for service to hotel that is food vendor is third party we just take prepare food form him than is it so that food vendor charge is 15% vat and 6% service tax? i m in vat food component shcem please guide

I am not very clear on this

hai sir , service tax applicable in parcel

Yes

When we order something on home delivery basis and on pick up basis, for the same order we get a different bill why is it so??

What do you mean ?

What type of Taxes attract in Mineral Water Bottles in A/c Restaurant.

* “value added tax”

Can they charge VAT twice?

Stating one as “VAT” and another one as “value added atx 58” ??

No , both are exactly same

Sir, Iam working in Restaurant

Can we collect tax on water bottles cost@20/- + taxes

No

Wonderful!! this is really one of the most beneficial blogs I’ve ever browsed on this subject.After read this i get some idea about vat charges thank you for sharing this good info with us.

Thanks for your comment varshinidevi

Please provide bill format for 3 star hotel bill to note tax % of Luxury tax, Vat, Service tax etc., including food items, banqut hall rent and Bar with Aircondition hall in Hyderabad, India

You need to check this with a CA

Can VAT be charged on total amount(ie. FOOD AMOUNT+SERVICE TAX OF 5.8%+SB CESS)? KFC SOUTH CITY KOLKATA have charged vat on all these amount. It will be helpful if you can provide a solution.

It should not be charged on the full amount !

Is service tax no. is necessary to be mentioned in bill or only tin no. is sufficient to collect service tax?????

Service tax number should be mentioned to collect the service tax !

Service Charge is not a Govt levied Charge, so can restaurants impose Service Tax and Vat on Service Charge as well? I dont think so Manishji. Could you please clarify ?

No they cant !

Hi Manish

Greetings for writing this article. I highly appreciate your efforts.

Though one point surely gained my attention, as you have mentioned that VAT is applicable on service charge, my query is that VAT is only applicable on value of goods, and as service charge is not a good, hence VAT should not apply on the service charge portion of the bill.

Kindly enlighten with your comments on the same.

Cheers!

Arnav

Yes, i think you are correct !

Please help me about vat limit on restorent business

Hi deepaj

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

As per tax rules service tax and vat is not charge on the same amount.The bill amount has to be break up for each tax. But if hotels charge both tax where to complain for same

Can you share the source of this information ?

Can a home delivery restaurant ask for service charge , service tax and Vat ?

I am ordering food online and they use to collect two tax.

Where should i Complain ?

well yes u will be required to pay service charges and vat as vat is mandatory and serivce charge is discretionary.

Yes for service tax, and Tax, but not service charge !

Dear Manish,

From what I know, if food is being delivered from a commercial kitchen (not a restaurant) to a consumer at home,

1. Service tax is not applicable. (even if food is from a restaurant, Service Tax is not applicable)

2. VAT would be 5% if revenue is is between 5 lakhs and 1.5 crores and 14.5% if revenue is more than 1.5 crores.

Please correct me if I am wrong. (Telangana Commercial Taxes)

Hi Ram

We are still researching on this and at this moment we are not 100% sure of the answer.

We will write an article on this and let you know

Manish

Hi..I would like to know Service tax and luxury tax is applicable in guest house in kolkata where in the room tariff is below Rs.1000 but the total sales is more than 30 lac per annum ? Rooms have Tv and Conditioner.

* total sale is more than 10 lakh

Yes, service tax is applicable !

Do we have to pay tax on the home delivery food or take away service? If yes, which tax and what percent shall be paid?

Ideally no for the restaurants which dont have AC . check this for detail https://www.quora.com/In-India-is-it-legal-to-levy-service-tax-on-takeaway-parcel-food-items-from-any-air-conditioned-restaurants

Thanks Manish for Clarification..!!

Why would VAT and Serve Tax apply ?

I am selling lunch dabba prepared at my home. The food is very normally packaged just to make sure it won’t spill over and not much branding. The subscribed customers come to a point and collect their dabbas.

In this case, I don’t think I am giving any service so do I have to pay service tax ?

I am selling the home prepared lunch dabba at a very normal room temperature Zero Rated category. Do I have to pay VAT here ?

Please clarify my doubts. This must be helpful to many people here.

There is no VAT here, but service tax still applies. You are giving SERVICE . This is service as per govt 🙂

However if you are not making more than 10 lacs a year, you dont need to worry !

Hey Manish, That was a very quick reply. Thank you…. but I see you mentioned in some posts below that service tax is not charged on home deliveries and take aways? Now I am confused why I need to pay service tax to home deliveries of homemade food ?

Hi! In many restaurants like mc donalds I am being charged with service tax, vat @14.5 and AGAIN vat @20% and I cannot seem to figure out where the VAT @20% came from. I live in New Delhi. Please reply back asap

Please give a snapshot by uploading it somewhere

I also faced similar issue… 20%vat on vat of 14.5 %…. Ur fb I’d plz