LIC Bima Account Policy [with Return analysis]

LIC Bima Account is the latest product launched by LIC of India on this festive tax season (generally known as JFM, JAN-FEB-MARCH, Tax saving season). There are mainly two varieties of this insurance plan called LIC Bima Account 1 and LIC Bima account 2, which differ a bit in terms of premiums, tenure, etc. No wonder that it’s the best time to launch the insurance plan as everyone is looking forward to investing in tax-saving, and when something has a tag of “Guaranteed returns” + “LIC” , its an instant favorite :).

LIC Bima account comes under sec 80C, you can save income tax on the amount invested. A lot of risk-averse investors will be investing in these plans. However, It’s important to know what these plans have to offer in terms of returns and see if it’s as transparent as it looks like. The company claims to pay a 6% return, but will it be 6% by the time it reaches your hand? Let’s look at it.

Did you notice the above picture? It’s very much related to our financial services industry. Every other financial product has a face, which is shown to public, but if you analyze it further and look at it from the mirror of IRR, you can see its real face which is too horrifying sometimes .. Be it ULIP’s, Endowment plans and even PMS schemes, every other product has some real face which we need to find out . I have tried it find the real face of LIC Bima Account policy here. It’s up to you to decide is it beautiful or not!

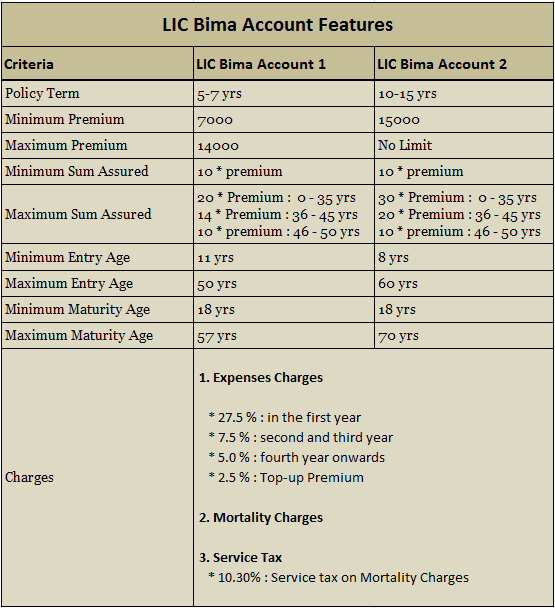

Features of LIC Bima Account 1 and LIC Bima Account 2

The chart below gives you an idea of both the variants of the policy. While LIC Bima Account 1 is for investors who can pay smaller premiums, Bima 2 is for investors who are looking fo paying higher premiums.

The lock-in period for these policies is 3 yrs, You can surrender the policy after paying the premium for 1 yr, but you will be paid back only after completion of 3 yrs lock-in period. The common part of both the plans is that you will get 6% returns from these plans if you continue paying the premiums till maturity, but only 5% return if you make it as paid-up policy. There will be a bonus also paid by LIC in these plans, but it would depend on the company experience with the plan and bonus is not guaranteed. Also the bonus will only be applicable for investors who have completed the whole tenure.

Important: Taxation of LIC Bima once DTC is in Force

Another important point worth nothing is taxation of LIC Bima Account policy after the Direct Tax Code is in effect. As per DTC, the tax exemption will be allowed only if the Sum assured is more than 20 times the yearly Premium, however, both LIC Bima Account 1 and LIC Bima Account 2 offers options where a person can choose Sum Assured which is less than 20 times the yearly premium (see the chart above).

In that case, they will be able to claim the tax deductions in this current year and next year also, however there after they won’t be able to claim any deductions on this policy. I am not sure how many investors are looking at this point. The majority of investors in LIC Bima are going to be from small cities, who will definitely have no idea about this taxation point.

Commission for agents in LIC Bima Account 1 & 2

So what is the commission LIC agents will make from selling these policies? Here are the numbers shared by an LIC agent with me over the phone.

- 16.5% for first year

- 3.5% for the second and third year

- 2% for 4th year onwards

What are the returns from LIC Bima plans?

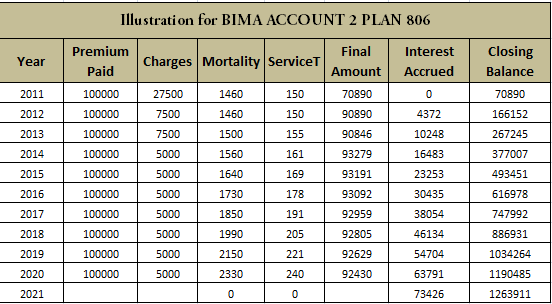

This is where one has to pay attention to. Note that the returns of 6% are offered only in the Net amount invested (Final Amount in the charts below). We will take an example of LIC Bima account 2 Plan 806 below which I got from. Suppose you invest 1,00,000 per year in this plan for tenure of 10 yrs, then at the end of the tenure you will receive 12,36,911, guess how much actual return does it translate to? So we have to do an IRR analysis for this to find out the actually CAGR return an investor will get. As per IRR analysis, the returns turn out to be 4.217 %. So this is the return an investor would earn in 10 yrs, note that is the return without considering any bonus. For investors who will make the policy paid up or surrender it, for them the IRR would be drastically low and might be as low as 0% or negative also depending on how early investor makes it paid up.

Look at the chart below which shows you the IRR analysis for LIC Bima Account 2 policy, The numbers below are provided by an LIC agent over email to me.

So the main point here is that why is an investor not informed about the actual return which he gets in his hand? Why the returns of 6% are shown in a way that common public will not be able to find it out. One can also show the returns like 9% or 10% and then increase the charges to such a level so that the investors in hand returns are just 4-5 %. These plans are going to generate a lot of attention and crores and crores will be generated. Do you feel it can be called misselling or Mis-use of Public trust, as the returns are in a way misleading? This is a question from you as an investor !.

A trusted source Dhawal Sharma had a talk with LIC Development Officer and here is what he found out –

I met with an LIC DO yesterday and he explained to me that BIMA ACCOUNT is for someone looking for other option than Saving Bank Account and thus the name.. Bank Account gives 3.5% and here it is with Minimum Guarantee of 6%, that too with Insurance Cover and tax benefit.

It’s another LIC stunt of JFM (JAN-FEB-MARCH) Tax saving season..Remember, LIC launched WEALTH PLUS last year on 8th FEB…Crores of policies were sold and crores of premium was raised by LIC in 2 months flat..I am eye-witness to last year’s madness when LIC agents were asking people to come along with FILLED FORMs for WEALTH PLUS and public obliging..and there we were, the KOTAK (or PVT PLAYERs) doing everything for the client but still being made to look second-grade in comparison to LIC..That the NAV of WEALTH PLUS now is Rs 9.63 is a different matter altogether 😉 Just wait and look for a new product from LIC every year in FEB..

Actually its not misselling, its MISSUSE of the TRUST that people have in LIC..”Whatever LIC come up with must be good” according to Indian public and thus the result..

Note that the actual returns from LIC Bima after considering the non-guaranteed bonus will be higher, but still it would hardly be attractive enough.

Comments? Are you buying it? What kind of investors should buy LIC Bima Plan?

February 7, 2011

February 7, 2011

He…

This lic plan of bhima account is real worst plan.. .i invested 40000-00k for 5 years and after the maturity date the amount i received is 40672-00 that is an increase of 672 rupees …

if i had done an recurring account also i would have got better interest… few LIC agents are such frauds that they misguide people like us giving false promises…we jus trust these fraud agents words blindly and n we too make the mistake of not reading the plan completely …

i am amazed to see now that the first years agent commission is 27%….jus see who is minting our hard earned money soo easily with fake promises..

LIC people are soo brilliant that they have plans with the same name…like Bima account-1, Bhima account-2, bhima gold….all are bhima plans only…is it not soo confusing…

we people trust LIC as our safe guardians ,so please live up to that…give few greedy agents that value lesson…

Dont hurt the sentiments of our trust,,,

hereafter if any one is planning to buy LIC policy please read the policy documents and then only buy it…

i advice all my fell

Hey shashank

Thanks for sharing your experience with all of us. It was a great learning.

Manish

I have taken Bima Account II policy with yearly premium of Rs.15000 ans S.A. of Rs. 150000 for 10 years. I have already made payment for the two instalment premia i.e. Rs. 15000*2=30000. But I somehow dont find this product attractive enough.For the current Fin year i.e. 2012-13 ,under section 80 C I am left with another Rs. 28000 to invest with the ceiling being just Rs. 100000. Will it be wise to stop any further payment of premia w.e.f. Feb 2013 as the DOC is 28.02.2011 and look to invest that in some other instruments or should I continue to carry on with this. The plan specifies that the policy can be surrendered after paying one year premium though the Surrender value will be payable only after the expiry of 3 years from the DOC. Also if I surrender the policy now, How much surrender value will I get. Kindly suggest me .

Sumeet

You need to go through the policy document first .. also read – http://jagoinvestor.dev.diginnovators.site/2011/08/lic-policies.html

I take back my comment … it ‘s a pure insurance policy my bad 🙁

I think this policy is to be taken for covering the cost of medical examinations that are not covered by health insurance companies. Thus a guranteed income of 6% sacrificing a 2.5 % compared to PF for covering your medical bill expenses.

This is not too bad considering you invest just 10K per year. You make a loss of 300 Rs each year but you are covered against medical examination bills.. Not very bad

A LIC agent of Najafgarh branch, Delhi sells LIC policy giving 50% of his commission. One of my close relative got benefit, when I introduced the agent to him. When, I tried he gave me wrong policy and also not giving commission discount. Can I withdraw or change policy?

Can you please inform/ comment about the advantages/disadvantages of Jeevan Sneha policy for women to which am paying a premium of Rs.8260/- annually.

Actually have also invested Rs. 1 lac in 2007 for which am getting a yearly credit of Rs. 11000/- + which I think is ok to this day.

Your advise on the above please

Most of the endowment plans do not give high returns in long term .. which is the real issue , do you know how much will be final return from your Jeevan Sneha ?

I AGREE THIS POINT

An LIC Agent has offered the following Jeevan Saral Plan:

Invest 6000PM for 10 years, then earn 120000 PA for next 10 years, then earn 6000 PA for Life time. After 10 years of Policy paying term risk cover of 15 Lakhs ceases and now a Family Fund of 9Lakhs is given to Nominee after death.

This plan may be modified by paying 12k,15k,18k,20k etc per month….hence returns too will be high.

Kindly Guide regarding the above.

Krantivir

Amazing 🙂 . Let me tell you this .. This plan looks so attractive .. but do you know much is the return at the end from this policy ? I did a IRR Analysis for this whole deal and guess what .. the returns are 5.9% . yes.. you can also do an IRR analaysis and see yourself .. check this post : http://jagoinvestor.dev.diginnovators.site/2011/02/calculate-insurance-policies-returns-video.html

Also see : http://jagoinvestor.dev.diginnovators.site/2009/08/what-is-irr-and-xirr-and-how-to.html

Dear Ujjwal,,

Rather just using such words,,why don’t you provide your own analysis and calculation of LIC products and prove yourself.

ok…..sorry about my words….

i will do it after some time…..

i will give my argument why you should go for LIC, PSU banks….rather than to pvt companies with some economical data…..

sorry chauhan ji….

i am so frustated about the mis-match between the advertizements and marketing with the actual services provided by them…..i am himself a sufferer….but i think as population of india so huge…if everyone get trapped for once in their life-time, this will ensure enough business for them….as they will constantly change their strategy and make innovative way to cheat….

Ujjwal

What you are saying is not just for pvt companies but almost every company wheater its LIC or non-LIC. almost all the companies have sold (mis-sold) policies based on wrong information and giving rosy pictures . So I am still not clear why you feel LIC is not in that game of misselling , Take Wealth Plus , it was sold saying that one will get 12% return “guaranteed” , after 3 yrs , its NAV is less than 10 .

And its not just LIC . ICICI , Kotak , Birla , HDFC everyone is same . So i want you to understand that i am not against LIC, its every company which missells .

Manish

Dear Manish

As you are greatest financial consultant, please tell me the defination of Insurance and its impact in Balance Sheet and Profit and Loss Account? Further Why you compared all and give your nonsense answer without having a indept financial instrument? I think you are working for Pvt. Insurance Company they all are cheater at the time of settlement of Claim? Dear All reader ask to Manish to Provide Claim Settlement details or other wise you all are request that kindly visit http://www.irda.org for details which company is better performed? And not compare Insurance with Mutual Fund and SIP. Both are worked on differant Basic my dear Manish. If you want to compare Mutual Fund Return compare it with Other Instrument like Share Market, Real Estate, Gold and Silver Market… I think Mr. Ujjwal you are right, Mr. Manish i think work for Pvt. Insurance Company or With Mutual Fund AMC Co.

Hi

So are you saying if a person has to invest his money for next 10-20 yrs , he should not compare term+MF with Insurance policies ?

Do you know why claim settlement of pvt insurers is low than LIC ?

Manish

Doesn’t matter Nav goes down. don’t you have an idea of LIC wealth Plus. LIC’s Wealth Plus (Table No.801) is a ULIP insurance plan that protects your investment from market fluctuations, so that your investments are protected in financially volatile times. Wealth Plus offers Guarantee of the highest NAV in the first 7 years of the policy.

Ulips Long term will give better return.

Don’t you think its too early to comment on a performance in a year.

wait atleast for 6 year.

Sudhakar

What is the point you are making ? Can you elaborate ?

Manish

i think, manish himself have term plan with LIC, as he knows very well about pvt companies ( as he is a paid up agent of them)….and then mis-guiding netigens…..

the fact of the matter is its not only LIC but all insurance companies do like this.

I do not understand why we have only LIC products reviewed here lolz looks like some one here is promoting some thing ha ha ha

anyways problem in our country is ‘Corruption’ and ‘Scams’ a large no of people only go for LIC for fear of a scam in pvt insurance cos in LIC they still seem to have a bit of hope …….. but honestly i don know how true is that 🙂

To give you an example :

My friend bought the a ULIP from a Pvt Insurance co (Which always suck) just because some one of his relatives was an agent and had to complete his target.

He filled the form for 5 years and received the policy document for 15 years.

when he tried to approached the DO he made all kind of excuses and even offered some money for not complaining in Insurance ombudsman……..

My friend did not made any further payment to the company ……. after 3 years he received the letter from the company about policy forfeiture with form which needed to be completed and deposited in nearest branch.

As per normal process the company has to return the amount after deducting the charges etc.

However when we went to the company the clerk said unfortunately he cannot enter the ‘forfeiture ‘ in the system as there is no provision!!! he told us to come back later as he will consult his IT dept

My Friend called and the response was SIR UNFORTUNATELY YOU DO NOT HAVE NAY REFUND AS THE ENTIRE AMOUNT OF YOUR FIRST AND LAST PREMIUM HAS BEEN EATAN AWAY IN CHARGES AND BESIDES THERE IS NO PROVISION OF forfeiture IN OUR SYSTEM …….

To this I ask people here even if one has to go for TERM INSURANCE which co should be trusted !!!! what is the guarantee of the maturity or claim processes of these new pvt cos again the entire thing comes down to CORRUPTION had the laws in our country been strictly imposed then we would have had to face the above mentioned situation.

By da way am a trader and have BSE membership if this can happen to people like us what will happen to retail investor ………….

Hence my advice for retail investors do your research carefully before choosing any company REMEMBER CHEAPEST MAY NOT BE THE BEST.

SITES LIKE THIS WILL OFFER FREE ADVISE BUT IN THE END IT IS THE INVESTOR WHO HAS TO TAKE HIS OWN DECISION ……. DO NOT GET 100% INFLUENCED WITH WHAT OTHERS SAY USE YOUR MIND WHAT WORKED FOR SOMEONE MAY NOT WORK FOR YOU

Just to add to your line that CHEAP may not be THE BEST always – the other side of the coin is that GOVERNMENT is also not TRUSTWORTHY or RELIABLE always 😉

Dhawal Sharma

URJA WEALTH CREATORS

yes, every word is true,this cases happens all overy india irespective of education, social status etc.. because we either simply trust or hates someone.it takes one hour to fill policy proposal form so to save our valuable TIME or let him/her do all this paper work attitude is also one of the reason for mis selling !

This is the first time I visited jago investor website and I am pleased with the quality information for the mass. Thanks all of you

Shyam

thanks . welcome and keep reading 🙂

Nope. Again LIC did it. I have stopped looking at LIC policies in general.

SS .. I only look at their term plan , nothing else

Dear Manish,

I think that you are a writter who is appointed by the Pvt. Insurance Co. and give you to right to write against LIC. As you mentioned for LIC’s wealth Plus, my dear tell me about the same plan was launched by Pvt. Insurance Co. also and where the NAV stand. Further if you are a news paper reader and particulary reader for Finance Section then read the case of Widow at where Kotak Mahindra refuse to pay Claim Amount. Why? Dear read paper and donot apply your own mind because in your mind you are agsinst LIC, why? Just you tell me why pvt. insurance co. launch various scheme for agent? and for this from where money come? You are just misguiding a reader of Jago Investor. If you are not capable to write aginst Pvt. Insurance Co. then i think that you have also not have right to write against LIC. You idiot.

Smart Person.

smart person

i will tell u the reason behind writing aginst this plan . Its because these plans reaches masses , lic has biggest player and all pvt companies combined cant match lic reach , so it makes sense to review lic plans , but its about the kind of policy and not company as such .

All plans in market which are like these are bad .

manish

Wish the reader used better wording in the end. He has no business calling you an idiot. Every one has say. So Mr.Smart Person please use good language. Jagoinvestor.com is giving a platform to express ones views freely. It is upto an individiual believe it or leave it.

Sanjay

Thats fine .. we just have to focus on our work . I assume Mr Smart is agitated may be because he is biased for LIC , which is ok .

Manish

dear Manish, you can have some more masala to irritate this MR SMART by writing review of the latest offering from LIC by the name SMRIDHI PLUS..

yes,many rural innocent persons trust lic as a govt. backed institution.only simple trust can not a buying factor.

We may all recall what happened to uti mutualfund pla

ns like childrens rajyalakshmi scheme and us 64.

A loss of money and mental agony.

yes, never use bad language in public form,

even today can any one guess the bonus declared by huge trusted LIC ?

thanks and all best wishes for JI and its readers.

@srinivasu go to LIC website and you will see the bonus declared by year.

if you do a little maths you will be able to forecast this for coming years as well

Bonus declared are between 3 to 5% and this is true for all insurance companies LIC or others so never treat insurance as an investment thx i hope this helps

M

Thanks Srinivasu

Manish,

This is my first comment/writing on these pages. JI caught my attention when I was trying to get some gyan about Life Insurance for myself. I much appreciate the contributions several people make in these blogs.

Couple of points I would like to make here are:

About returns…

1. The ULIP product offered by Insurers are not governed by SEBI and therefore the holdings/investments are not disclosed in the manner MF are obligated to do. This brings a lot of concerns.. (A). ULIP fund managers are monitored only by their well meaning? employers.

B. Private insurers who bank heavily on the ULIPs or Equity linked products are yet to declare any profits. So which insurer has got richer?

2. The illustrations that private companies make/provide while selling products and the actual performance of these products should be available with all informed people. We have heard about how some companies have failed miserably in US and EU and millions of people have lost their life’s savings. Remember many of these companies have opened shops in India with limited liability. A country where financial prudence and aware is very very low.

3. Contrary to the above, the promises LIC offers in its plans are conservative (probably the reason for public contempt??) but I hear that it has a proven record of delivering on most (except the market plus and money plus types which are so highly equity linked) of its promises.

4. More importantly, what ever the returns are, the insured can avail the returns only if the policies run their full term ( long live everyone!) The percentage of policies lapsing in this country is significantly very high. This is a worry as public lose a lot of money this way ( hard cash loss)

LICs reach and public awareness:

5. It is true that LIC has the bigger brand value. They setup shops even before roads were laid in some villages!! They funded several infra projects, rural development projects and been here for several decades since nationalisation of insurance and so enjoys great brand equity. Private companies vying for level playing field will look for distributors in these areas. If agents in metros are so helpful, what do you expect in rural areas?

6.Lets be reminded that the writings on this blog still reaches a very small population of educated, computer literate and net savvy people in this country. So what’s your argument about creating awareness among the masses through this blog. We should find a better medium.

Lastly, without trying to judge your bias, subscribers to JI would be immensely benefited if informed people like you can provide comparisons or alternative products to show which is better..

I am looking forward to a great insights from these blogs and hope to be benefitted as many have vouched for themselves.

Prashanth

Some good points from you . My replies to each are as follows

1. Yes, ULIP’s are definately not that much transparent as Mutual funds , and no independent research or comparisions are available as in mutualfunds . I would hope that it will happen soon by someone , for now I would like to believe the Regulator and assume thats things are fine .

2. You are correct ,take an example of LIC Wealth Plus , which has given negative returns to investors who were mis-sold those policies stating 15%-20% returns .

3. If you promise 6-7% , how difficult it is to deliver , Its like promise-less , give little more , make everyone happy

5. True , LIC has a dense reach and I dont see any one competing for next 20-30 yrs

6. Agree .. A little better can be done if each reader understands his reponsibility of educating others and make other 10 people aware about it .

Dear Manish,,

I do not know whether you have mentioned or not ,,,the effect of compounding…..

First yr charges are 27%

So over a period of time 0f 10 yrs,,what the policy holders are actually loosing??????

Paresh.

Disclaimer:I am mutual fund distributor and my comment may be biased..

Paresh

I am not clear what is your question . That first year charges has no significance in these kind of product which are not ULIP . There are other debt option like FD or Debt funds which have no charges .

Manish

Suppose we consider only for first installment:Ignore remaining installments for calculation

100000 (1 lac) in Bima Account.

100000(1Lac) in fixed deposit.

For Bima account:after deducting charges of 27% balance amount remains to invest is 73000

so if we consider returns of 8.75% compounded quarterly( rate offered by IDBI) for 10 yrs then after 10 yrs maturity value comes to be :1,73,473.

Now for fixed deposits

Rs 1lac will get fully invested

After 10 yrs consideing rate of 8.75%,, maturity value comes to 2,37,635.

So consideing only for first installment:difference after ten yrs comes to

2,37,635 – 1,73,473 =64162….i.e indirectly first yr charges of 23000 resulting into loss of 64162 after 10 yrs.Thats what i mean.

Thats good point Paresh

Dear Manish,

Thank you for your reply.

If we calculate for compelete term,then the returns are no where.

Adding inflation returns are below0%.

Paresh

Yea , thats what small investors do not understand , they concentrate on numbers , not worth

Manish,

The illustration given is totally differ from lic circular / authentic information / and way of calculation. If someone not knowing about the fact is giving his own perception with pretending that he is doing write then what others can do? Before publishing why not check authenticity? If someone is pretending some fact with his available knowledge (may be differing from reality) and inducing others to be away from fact then what is our duty? Do you accept whatever calculation done in the illustration is giving 6% effective return in monthly cumulating? If not why to give publicity for wrong based calculation and comment on it?

Prahlad

Which part is wrong ? Can you clarify , Is the IRR not around 4.5% considering 10 yrs period and without bonus numbers ?

Manish

people like you are real unsung heros of india who open eyes of finanacially uneducated masses of india falling as preys of eagles like lic and others.

please continue to provide financial eye openers like this

dr rjaeev

Rajeev

thanks 🙂 . Keep reading and spreading the word

I hope the regulator will take action on this product from LIC that is taking the poor innocent public for a ride every year in the JFM period. Just like the EGYPT crisis wish one could use FB to take on IRDA and ask them come down heavily on mis-selling by all Life Insurance companies.

BR Sanjay

How can IRDA take action on LIC product when the same IRDA approved the product , note that all the products gets passed from the IRDA only .

Manish

Manish, gr8 article as usual

what is the best option( plan, policy) available for 80 C.

i wanna invest 1 lakh for pure 80 C.

Please throw some light on it

If possible write a topic as many people want to save tax through 80c

Pankaj

Are you salaried or not ? If yes ,then your EPF is also under 80C which employer cuts from salary , so 1 lac minus EPF is what you have to invest .

You should not look out for “Best” option ,as there is no best option , it all depends on the time frame and risk you can take, for risk takers ELSS (tax saving mutual funds would be a good option) . For non-risk takers , Bank FD for 5 yrs might be ok

Manish

Hi Pankaj,

The best plan to invest is PPF if you can live with the 15 yr lock in or ELSS (if an agressive investor)

Thanks,

Manish

Hi Manish,

Nice work.

Even my neighbour is an LIC agent and the way he is selling these plans, god help the general public.I asked him why did he became LIC Agent and teh answer was-” i m retired now and was getting bored.So i took up the easiest job i can do.Now i feel energized”.

Guess whom he is selling.Not to the educated class but to workers and people with less education.

Jitendra

@JITENDER SOLANKI – Being an AGENT myself, i take great offence to this being labelled as the EASIEST JOB..No sir, it certainly not is..Talking to 8-10 people everyday, visiting all of them at least once, then going to office to submit the case, follow up, providing receipts for tax saving purposes etc. will not allow any agent to sit and relax, let alone mr RETIRED UNCLE JI…

Do you yourself believe that to convince someone not to use a 2 rupee pen of TODAYs and switch to REYNOLDs pen of 5 rupees is easy?? then how can it be EASY to ask someone to part with a sum of Rs 5000 to Rs 10000, and that too for some intangible product like insurance??

..and let me tell you with my experience of last 4 years, its not the question of EDUCATED or UNEDUCATED, it takes the same kind of effort and conviction to convince somebody about the product..EDUCATED, UNEDUCATED, WORKERs – they all ask lot of questions (Sometimes outright stupid questions) before signing a cheque..

UNCLE JI must be ENERGIZED because he is seeing MONEY now which is kind of a bonus in his retired and avilable-time life..

Might look easy to outsider but its not..Try convincing somebody who is buying LIC BIMA ACCOUNT that your returns will be negative, that IRR is less etc and you will know 🙂

Dhawal

Your “Akrosh” is genuine and correct . But I think you missed the point here :0

That retired uncle ji said its the easiest job for him considering he wont get any other job at the moment, this is only thing which he can do and its “easy” to enter in this .

Also remember that he is doing it for LIC, being an agent yourself , you know how easy it is to work as an LIC agent compared to other pvt companies ?

right ?

manish

Manish,

I agree Manish that it is easy to be agent with LIC compare to other private insurers as their is huge advantage of publicity about it. But what Dhawal told is also correct, because it is restless profession if someone taken it as fulltime.

I agree

Fully agree with Basavraj…Half of the job of LIC agents is done by LIC itself, as they promote their products aggresivly and on a nation-wide ad campaign..Initially hype is already created by LIC for its agents to cash it on..

Its really a sad comment about LIC Agents. Sir, I would like to pint out that i had been in USA for 5 years with one of the large financial firm, i have taken up LIC agent role with so much pride. I am proud that LIC investments in INDIA’s Assets such as power plants, Ports, state electricity boards and Infrastructure helping GDP growth of our nation. People should change their perception of LIC. LIC invests only in India. Share 90% of their profits with its policy holders. Please tell me – which company / corporate in the World share their profits / returns with their real customers. Loyalty addition bonus only exist in LIC and of course its available for the policy holders who stay with their policy for the entire term.

Not every one missell their services to their clients? we need to walk with them for long years. I know people who are LIC Agents who have two generations of the same family as clients and some of them treated as GOD in that family.

May be LIC Agents may not be writing in your blog – do not underestimate their services in rural India. Today every private firm wants to make quick profit? do u agree?

Thanks for your reading and allowing my opinion to post in your blog.

with all respects and humility

M Rajaguru