How can you add an “extra” Godrej lock in your bank locker and make it 10 times more secure?

Today you are going to learn how you can add an “extra” 3rd lock in your bank locker and make it really more secure compared to what it is now at this moment. This information is really hidden one and almost no one is aware about this really interesting and useful thing.

I would like to thank Jay Sheth, a reader of this blog to share this information with me in one of his comments. Let’s acknowledge him fully for his openness for sharing this amazing information with all of us and appreciate him to take out time to send me all the pictures and information which you are going to read below. The author of this article is Jay Sheth, so from now on the article language will be as if he is sharing his experience.

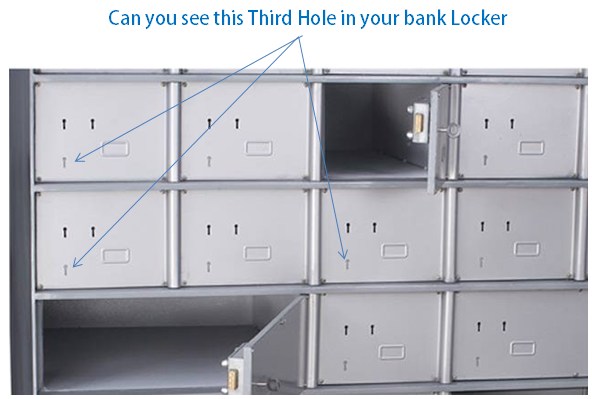

Why there is 3rd Key Hole in the bank locker ?

One day when I was operating my Bank locker I realized that there is a third hole in the bank locker apart from the two key holes where I and the bank person put our respective keys to open the locker. This made me wonder as to why it has a third key hole when it’s not being used?

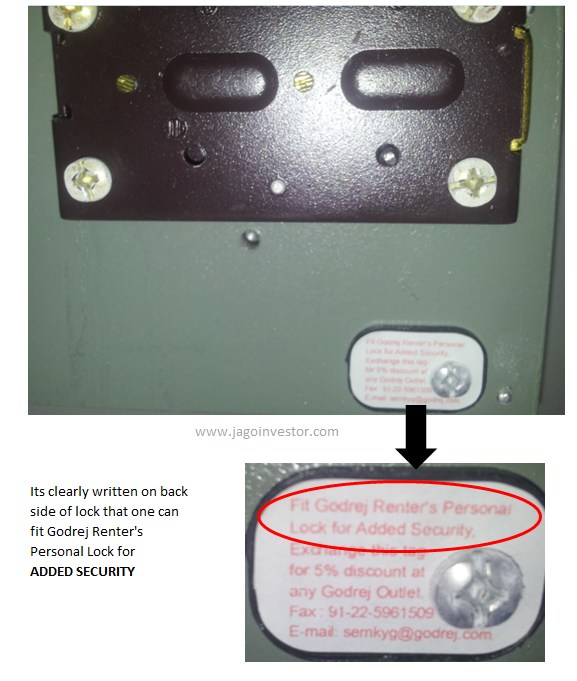

With these thoughts, I further researched on this. There is hardly any information on the internet. I met several authorities, contacted Godrej (who are manufacturing locker cabinets) and found something very useful. There is something called as “Renter’s Personal Lock” which is available directly from Godrej, and we could fit it ourselves easily with just a screw driver.

So if you open your bank locker, and see the exact back side of this 3rd keyhole, you will see that there is a specific fixed place along with already drilled screw holes , where this “Renters Personal lock” from Godrej can be installed. Let me show you how the back side looks like

How to Install this lock in Bank Locker ?

There two ways you can install this extra lock in your bank locker.

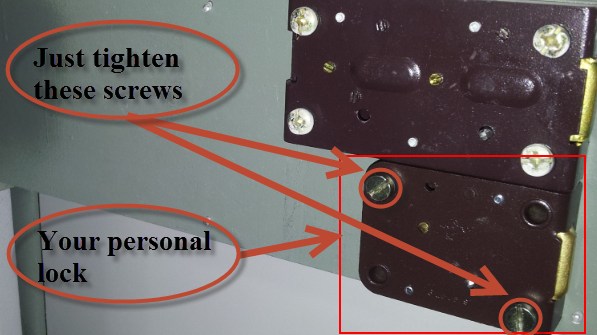

Method #1 – Install it yourself – This method is recommended, to install the lock yourself. It is very straight forward. When you buy this Lock from Godrej, It comes into a sealed pack, with the lock, one single key, and 2 screws. All you need is a screw driver at your end to install this. Visit your bank locker, once the bank person opens the locker for you, and leaves from there, you can then close the door first (so that no one disturbs you). And then you can put the lock in the bank of the locker and install it with screws there.

Here are the easy steps to put up the lock yourself:

- Insert the key in the “extra” (bottom left) keyhole.

- From the back side of the door, place the new lock in such a way that the key inserted above gets in its keyhole. This will give you the correct positioning quickly.

- Tighten the two given screws with a screw driver (top left and bottom right side respectively).

Let me show you a sample picture of how it has to be installed, it will give you a fair idea.

–

Here is an important point if you are installing it on your own. Just get your locker opened and wait for the officer to walk out. Then install it at your pace and leisure. Next time when you want to open it, you will have to put both keys (the key cannot be taken out while the lock is open, which is for our safety only. But the officers will know). But that’s perfectly fine, as it is absolutely legal and allowed – just that many officers do not know the rules, so to avoid arguments with them just put it up silently for the first time. Read this incident where one guy struggled to get back his locker content back after it was closed by bank.

Method #2 – Installation by Godrej – Contact the Godrej Dealer in your city and they will send a person who will take around Rs. 250-300 as installation charges and will do it for you. This is a simple way, but cost a bit to you. There could be the following issues in this approach:

a) You might not be able to find the right person in your city, as this whole thing is not well known and even some Godrej guys are not aware about it. Manish called a guy in Pune who said that you can get this done in Pune. You might want to search a bit in your own city.

b) For confidentiality reasons, you might not want them to know the bank, location and locker number of the locker in which you intend to put this lock. Naturally, all of this is compromised if they install it for you.

c) You might have a hard time convincing the bank officials that this is indeed a person from Godrej, as many banks are pretty strict about only allowing the actual renters to enter the locker room.

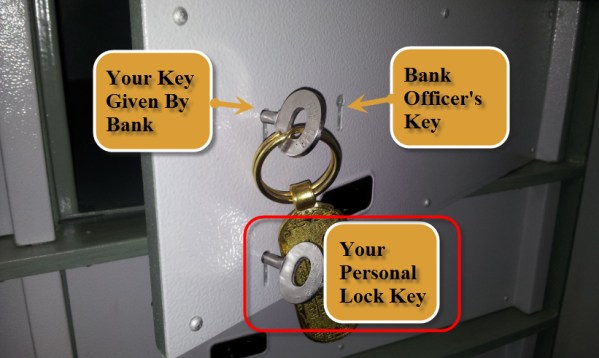

Once you are done installing the extra lock, from there on, your locker will open only when all the 3 keys are applied, where those 3 keys are

- Your Main Locker Key

- Bank Locker Key

- Your EXTRA Godrej Locker Key

Here is how it looks from the front when you have installed the extra lock.

Should I really add this “extra lock” to my locker ?

Bank lockers are very safe compared to your home locks. But then it is only comparatively safe. You must have read about a lot of incidents where there were robberies in bank and lockers were looted, you might also have read about stories of how someone’s locker belongings were missing when they checked it after many years. There is always this thought which crosses one’s mind that what if there is some security loophole, or if someone misuses your bank locker main key, what if it’s lost and goes into a wrong hand? In that case, if you are too concerned about your bank locker and want to add a 3rd layer of security (which is just one time work and costs a bit) , then you can install this 3rd lock.

There have been incidents where bank lockers have been compromised and looted . So now its your choice, if you want to add this extra lock in your bank lockers or not.

How to Buy the Personal Renter’s Lock ?

Now let’s come to the main topic of from where you can buy this extra lock called “Renters Personal Lock”. You will get this only and only from Godrej company. You can contact a Godrej dealer in your city and ask him about this lock. It costs approximately Rs. 800-1000. If you are interested in getting it installed by the Godrej person, then you should ask about this from the same dealer itself.

You can buy the lock and get it via Courier

You might face some issue finding it, but don’t worry. Keep trying to find it from many vendors, try to search Godrej dealers from justdial or internet and will surely be successful.

If you are in Pune – then you can buy it from this place mentioned below.

Godrej & Boyce Manufacturing Co Ltd

4, Shop 517,Dyananda Society,

Dyananda Society Sadashiv Peth,

Pune, Maharashtra ( West ) – 411030

Phone – 020-24471453

Price mentioned by them over phone to us – Rs 880

If you are outside Pune, you can still buy it and get it delivered via courier

Manish called them and confirmed that they will be able to deliver the lock via courier to all over India, however the courier charges will apply apart from the lock price of Rs 880.

Just call 020-24471453 and the contact person is Mr. Gafur Shaikh . Hope you get it 🙂

(Please understand that we are just connecting you to them, and nothing else. If you face any issues with them, it will be between you and them, dont blame us for that)

Let us know if you are going to install this extra lock in your locker or not. Also tell us what you feel about this information.

Finally thanks Jay for sharing this useful information with all of us.

May 26, 2014

May 26, 2014

Update: 03rd May 2016:

I could obtain the lock by calling the number: 020-24471453. They will courier the same to you. The price was Rs.890 + Courier Charges – Rs.160 = Total – Rs.1050.

Hi All,

I called on this number but it’s not working now..

Also I called on toll free,send emails but till now I am unable to get this lock…

Can someone provide a lead to procure it online..

Regards

You need to check online on new numbers . as this was written long back

Hi !

I represent Kailash Hill Vaults Ltd, in New Delhi.

We provide the Renter’s own lock to ALL our customers as an added feature and even install the same in the presence of the customer and provide them with a sealed key which comes with the Lock.

It is an additional feature which some clients prefer

Kailash Hill Vaults is a Private Safe Deposit Locker facility providing Lockers since 1993 and is owned and operated by Senior Ex-bankers from the State Bank.

Went though the article, and then through the whole blog. Very Informative. Very Interesting. Thanks a lot to Manish, Jay Sheth, Nikhil, and all those who have contributed to build up this source of highly useful information. My PNB branch on their own suggested to me that I should install a Renters Personal Lock myself and even gave me specifications by providing me an empty carton (same as shown in this article). The carton mentions four contents – (a) One Lock, (b) One Key, (c) Two Screws, (d) Two Spring Washers. MY QUERY: Exactly how to use the Spring Washers while installing?

By the way, the Godrej Product code of the Renter’s Personal Lock is written on one side of the carton, and it is: “LKXL 1D109”

With reference to Jay Sheth’s (January 30, 2015 at 5:26 pm) suggestion, I bought matching nuts, since the lock was fitting very loosely. I had purchased some extra washers too for just in case I needed them, but it turned out that only the nuts sufficed. MY EXPERIENCE: First put the Godrej supplied spring-washer into the bolt, then put the nut into it, then insert that bolt through the lock. Now you will find that very little thread visible for screwing into the door. But don’t worry. On tightening the bolt into the door, the spring-washers get compressed and yield more thread making the whole assembly quite robustly fixed. Once again thanks to Jay Shethe for his very valuable information.

FOR MUMBAI RESIDENTS: Renter’s Personal Lock is a highly specialized item and so not readily available off the shelf at retailers. Best option is to go to Godrej’s Vkhroli plant office. ADDRESS: Godrej Gate No. 1, Plant No. 4, Mumbai Branch Office, Vkhroli, Mumbai. CONTACT: Tel: 022-67961700, ask for Securities Section, Extn. 1360. MANAGER: Burzin Davar: 9820109889, Others: 9702386494, 9619115880. Better take prior appointment and ascertain availability of item at the site. Once inside, the formalities take around half an hour. But it is worth the trouble. Once again thanks to all.

Hi BJay

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

BJay,

Very happy to know this information helped, and thanks for sharing the purchase option for Mumbai based folks.

Regards,

Jay

For this lock PAN India you can contact Godrej call center at 18002099955 or email at [email protected]. the person will come directly from the company or its Asp.

Around two years back when I took a bank locker in Hyderabad I was given my key and this was just an open key . It was not even sealed in a pack. Since then I am always having a nagging fear about the jewelry stored there for my daughter’s marriage. I think I have to now take some proactive step.

For all the questions asked before about the trust etc.. in my case the keys were handed to me by the dak boy who may or may not be a permanent employee of the bank. One can never keep the valuables at home so no rocket science logic is involved in making the bank locker a bit more secure.

Regards.

Thanks for your comment Najmuddin

That’s a quite detailed and positive update, Nikhil. Thanks.

Nice to hear the product is continued.

I totally agree with your view on “why pay 500 extra”, and besides that, why take a chance for a remote possibility of the technician duplicating the key before the lock reaches us!

About the screw size, it totally depends on the thickness of the door. For me, in one bank the door was thick enough to accomodate screw. In another bank, it the door was thinner and the lock was dangling. Instead of cutting the screw, however, I went to a hardware shop to buy a matching nut. They said these screws have unique threads only by Godrej and I wouldn’t get this in hardware shops, but instead re-directed me to any bike/auto spare part store. So I went there, got few nuts for Re.1/- each, and filled the “extra space” near the screw head with those nuts. Rest of the installation was a breeze.

Thinking further, in general, placing an extra nut to fill the extra space around the screw length might do better than cutting the screws, should we decide to remove the lock and install it elsewhere with a thicker door requiring full length screw.

Yes Jay you are right. I talked to sales person of Godrej’s security solutions department and he said production is continued. Go through bank and they will arrange with Godrej and technician will fit at a given appointment and that will cost Rs.1400=00. Sales person also said if banker doesn’t permit you can not fit bcos lockers are property of bank. But I fit it myself, bought the lock from authorized dealer and he gave me 2.5% discount when I gave him the Godrej tag which is inside the locker door. For just fixing two screws, why to pay Rs.500=00. I had some technical difficulty; the screws were three threads long so lock was not flush to the door though it will not cause any problem as hole inside the locker door has threads(tapping) so there is no chance of slipping of screw or lock. But being a technical man myself, I cut three threads from both screws and fix the lock and it was perfect to my satisfaction, washer and head of the screws flush to the body of lock and absolutely full tight. I operated the locker and it was perfect, banker did not asked me anything, though I was prepared to tell him that it’s our right and I can complain it to bank obdusman in writing.!!

Thanks Jay and Manish,

Yes you are right, I fitted renters personal lock myself and lock costs Rs.899=00. It’s simple to fit, insert key from third key hole so you get correct alignment and than hold lock and tight two screws thro’ holes provided on inside locker door. When we want to operate locker, all three keys has to be inserted at a time than only door will open. Thanks.

@Nikhil, that’s great to hear. What a firm security for just Rs.900/-, isn’t it?

As you could get hold of renter personal lock, does that mean that the product is not discontinued as you wrote above?

Cost looks fine. I had landed up in ordering 6-8 locks for myself and gifting to my close friends and family 🙂

Hi Nikhil,

Totally agree with your view on your locker cabinet standing out apart from the rest. I had the same situation (when I was not aware of renter personal lock myself) and we decided to not put any “patti” or outside lock ourselves.

Renter personal lock is a standalone item and has nothing to do whatsoever with bank master key. When we get a bank lockers, as we all know, it is a single lock with 2 keys – 1 with the bank, 1 with us. That is how that (default lock) works. Renter personal lock, on the other hand, is half the dimension, and operates with only 1 key. Trying to go through the bank, to install a renter personal lock, in my view, will only increase our hassles as customers, as that would be like being on mercy of those unaware and/or non-obliging bank officials, whereas it is our birth right 😉 to put “our own” personal lock as the name of the product itself suggests.

If Godrej has indeed discontinued the product as you write above, it is surprising and annoying. It is like snatching away someone’s personal right to install additional safety measures for his/her own belongings. Multiply this by the community at large and this becomes a severe injustice to the public.

Manish, it might be good for us to re-check with our Godrej contacts at Pune. Your thoughts please?

Yea , I think it would be good idea to check with them and update the article . Will try to do that !

There are locker tamper evidence labels also available at one Bangalore company. I inquired thro’ email and MoQ for bank locker labels is 25 label in roll format. Rate 500 INR + shipping charges by Bluedart. Company is Linksmart Technologies and email ID is : [email protected]

Thanks for sharing that !

Hi Manish,

in continuation… Godrej new lockers has company fitted aluminium patti type lock on which we can fix our traditional “taala chabi” type pad lock and also provision of renters lock. For putting extra renters personnel lock I think you have to go thro’ bank only bcos every lock has different key and how every key of personnel lock is going to match bank’s master key?Every bank also must have their different master keys. Bank has to provide information of locker no. and also of the number on key which is different from locker number to Godrej company. I think thats why 2015 Godrej catalogue has no mention of renters lock and I inquired at Godrej and they said they have discontinued the product. So in new Godrej locker you got original lock and you can put renters personnel lock and also you can put pad lock (taala) from outside aluminium patti. Someone who had idea of putting aluminium patti must be stupid as they would have easily put solid steel patti and that would be much stronger than aluminium.

Ok , I want not aware that its discontinued now 🙂 . thanks for informing !

Manish and Jay…very good article.

The bank in which I have locker has installed steelage lockers and they have only two key holes so I can not put extra lock. Inside the locker door, there is third key hole but from outside only two, I wonder for what third key hole is inside at the bottom of door. i inquired at company’s Thane office and they said apply to your bank for renters personal lock and they will provide flat patti type and it can be seen from outside and put your conventional lock which we use on our main door…I mean what we call ‘tala chabi” type. How ridiculous…I have not seen a single locker with “tala” from outside.

But Nikhil

Thats not such a bad idea either 🙂 . I mean the lock from inside is best, but if its not there, then even the 3rd lock from outside gives some good protection provided some looting happens suddenly (not a planned one)

Thanks Manish…

yeah, not bad idea but of the whole cabinet my locker will stand out…! Bcos nobody has put that patti type lock….someone may think this locker must have some Alibaba ‘treasure’ inside….!!!:D 😀

Ahh .. very valid point 🙂 .. good one !

Continuation…..And the bottom key is with Manager…so I am little bit worried in this case

Adarsh, I would also worry if I were you. It is unusual for the manager to keep the bottom key. You can tell the manager the bottom lock is officially termed as “Renter’s personal lock”, and it is supposed to be completely operated by the customer. Your manager is not following RBI norms if he continues to disagree.

Take him in confidence, and change the lock thereafter (put your own personal lock). It will cost around 900/- to buy your own lock, but that’s totally worth it considering the peace of mind.

Never ever then share the bottom right lock key with any bank officials.

Recently I opened a account in SBM. There was a locker with 3 key facility…brand new from Godrej. Top left key is for customer and Top right for Bank…

But as per manager the bottom left key will be given to joint accont holders.

My worry is is any ways bottom key is with bank and it possible for bank ppl to open locker with bottom left and top right keys>?????? In our absence ??

It is not possible for the locker to be opened with bottom left and top right keys (you always need all 3 keys), but it is not right for the bank to control the bottom left key. The bottom left and top left key should only lie and be used by the customer.

If customers who require the above lock in Tamil Nadu can contact us by writing in [email protected]. We can arrange by your nearest dealer.

We are discussing adding a ‘3rd lock’. But all bank lockers have a provision for the customer to put his personal (conventional) lock externally on his locker. So isn’t that the ‘3rd lock’?

Vindi, these are 2 separate things. Yes, we can call it 3rd lock and 4th lock respectively (or in any order). The main point is, the lock to be put up externally is nowhere near to being as safe as the “sturdy” lock to be put up from inside.

External lock rests on simple alluminium strip and it is easy to compromise (look at my comment no. 35 above for details).

thats an extra thing . .I am talking about a more secure option than a secured lock !

Thanks to all who appreciated our work. Keep sharing this useful information among your circles. Special thanks to Manish for giving publicity.

indeed new information and the meaningful comments over the subject matter. thank you all.

Welcome !

Thank you for your information.

Regards,

Sathish

I think permission of bank authority is necessary

ho thanks for sharing the view. But I feel it is better to have a lock of

your own in the face of cabinert

Thanks for sharing your views !

The issue with the lock on the cabinet face is that it is put up on a thin aluminium strip, which is very easy to cut. The idea of putting this lock there is still good, from “sanity” point of view (you will easily know the next time you visit the locker room that someone messed around with it, thereby trying to break open the locker). But when it comes to real “security” layer, nothing can beat a thick and firm Godrej lock installed from inside. Hence this article.