What is Expense ratio in Mutual Funds

Do you know how expense ratio can impact the returns on your mutual funds returns ? We often hear that expense ratio of a fund is 2% or 1.8%, but we never put lot of thought to understand its impact on our mutual funds returns and our own wealth! Lets touch this topic today in detail. For simplicity, I will talk about Mutual funds in this article, but expense ratio as a concept is applicable in almost all the management financial products like Mutual funds, UlIP’s , NPS etc

What is expense ratio in Mutual Funds?

Let me first clear out what is expense ratio? As an investor we just buy and sell mutual funds, but in the background there are many expenses which a mutual fund (and even ULIP’s) has to incur. Some of which are; fund management fees, agent commissions, registrar fees, and selling and promoting expenses. As per SEBI regulations, the maximum expense ratio of an equity fund can be 2.5% and for a debt fund, it should not cross 2.25%.

Now who will pay for this? Obviously you have to pay for it and that’s where expense ratio comes into picture. Expense ratio is cut from your investments on daily basis from mutual funds and only after that NAV is published and that’s how you pay expense ratio. For Example, If you have invested Rs 1,00,000 in a mutual fund whose expense ratio is at 2% and suppose your mutual fund saw a growth of 0.5% in a day, which turns out to be Rs 500. You NAV won’t be 1,00,500. Before that you will have to pay 2%/365 (that’s 365th part of 2% as charges, as it’s for 1 day, remember 365 days in a year) and that would be, Rs 5.48. Hence, final value of your investment would be 1,00,000 + 500 – 5.48 = 1,00,494.50 that’s 0.4945% increase and not 0.5% .

So, the next question which will come in your mind is “So, does this small deduction really make a lot of difference?” The answer is Yes & No. If you are looking at 6 months or 1-2 yrs, it’s not much of a concern, you can probably just avoid it and answer is Yes, if you are looking from long-term point of view like 5-10-20 yrs. In that case it’s mostly something which you can put your eye on once.

Expense Ratio – With & Without

Let me first give you a very clear idea about the distinction between two scenarios where there was expense ratio and there was no expense ratio in a mutual fund. Let’s take this example at least to understand the concept.

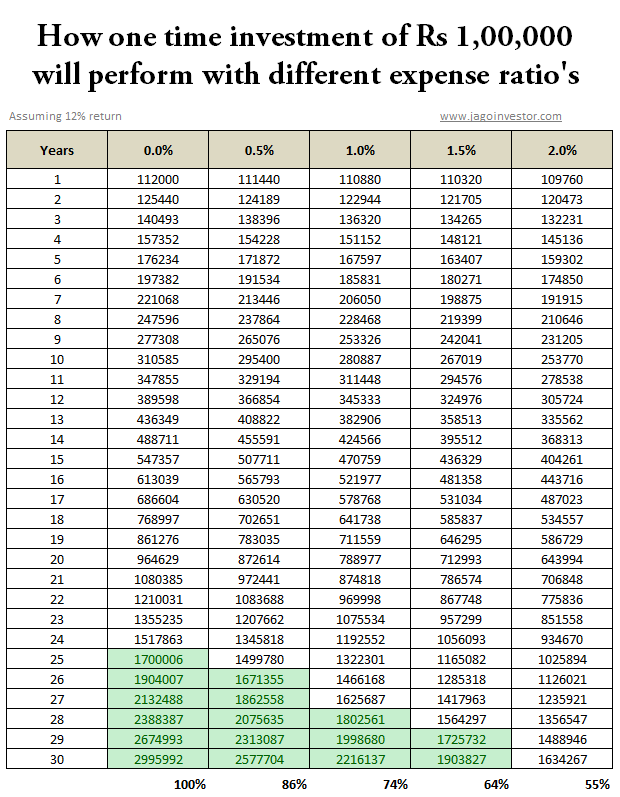

Suppose there was a mutual fund called “Jagoinvestor-Ninja Fund” (attractive name haan!) which generates a 12% return before expense ratio. Now let’s see how this fund final returns will turn out to be in different expense ratio scenarios like 2% , 1.5% , 1% ,0.5% and 0% (imaginary) .

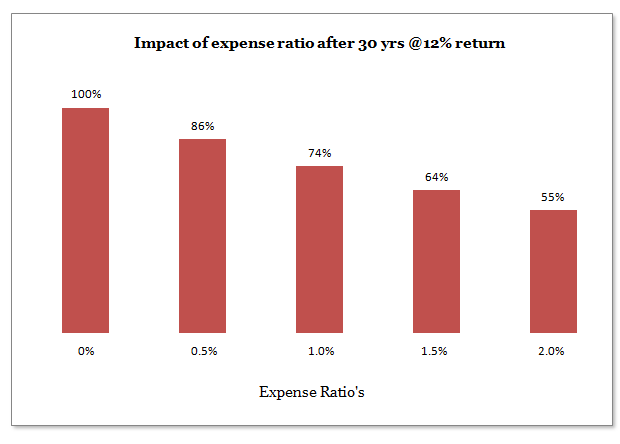

Did you see that? How same funds performance can lead to huge a huge difference depending on expense ratio. In a longer term, you can see how the corpus value reached 29.9 lacs without any expense ratio, but if the expense ratio was 2%, then despite the same performance, the corpus would be reduced to only 16.3 lacs. That’s huge deficit of 45% compared to original corpus. While it’s a little unrealistic to consider 0% expense ratio, because it’s not possible in real life. Let’s see the different between 1% and 2% expense ratio. You can see that with 1% expense ratio the corpus was 22 lacs and with 2%, it was 16 lacs, that’s again huge 20% difference.

Also if you see the chart above, you can see a greed part showcasing how low expense ratio cases achieved the same corpus few years early than the high expense ratio scenario. You can see that with 0.5% expense ratio, 16 lacs was the corpus in 26th year itself which took 30 yrs in case of 2% expense ratio. In the chart below you can see how much the difference in different scenario’s final corpus percentage wise was.

Remember that when you compare returns of mutual funds in long run (video), the calculations are shown after-expenses; hence it might happen that a better fund today is better in returns because its expense ratio was lower than the other one. It might happen that two funds differ in returns to some extent, but don’t vary too much when it comes to their ability to generate returns before the expenses. Naturally the mutual funds which have lower expenses would have better return at the end.

Case Study – HDFC Tax Saver vs Canara Robeco Equity Tax Saver

If you look at Valueresearch website, it has given Canara Robeco Equity Taxsaver fund a 5 star rating, but HDFC Tax saver gets just a 4 star. If you look at both these funds history, both the funds are 15 yrs old funds and if you look at short-term performance of both the funds, you will see how Canara Robeco is doing equally good or better than HDFC Tax Saver. But if you look at long-term performance of both the funds, you will notice a big difference.

While HDFC Taxsaver stands with tall chest giving 31% annual return, Canara Robeco seems to stare the earth with just 20% annual return. Now there can be a lot of reasons for this, but if you look at expense ratio, Canara Robeco has as high as 2.49% expense ratio, where as HDFC tax saver has just 1.91% expense ratio. So it might happen that Canara Robeco these days has to perform better than HDFC Tax saver before expense ratio and only then it’s able to sustain the performance.

As per a small study by moneylife, this phenomenon is true across the category , here are the excerpts : –

Consider the performance of 43 equity diversified funds which have been in existence before 2000. We chose 2000 because we wanted to gauge decadal performance of the funds. Of these 43, we selected the 15 most expensive funds and 15 cheapest. Among the expensive lot, we have only seven outperformers and eight underperformers. Whilst among the cheap funds, we have 12 outperformers and only three underperformers. It is not that the expensive funds have not earned good returns, but a part of their returns has been washed away by their high expense ratio.

For instance, Birla Sun Life Advantage Fund, which is one of the costliest and was launched in February 1995, has given a return of 19% beating its benchmark, BSE Sensex, by a margin of 8%. Reliance Growth, launched in October 1995 (seven months later), has given a return of 28% beating its benchmark, BSE 100, by a huge 16%. Was it the pure stock-picking skill of Reliance? Maybe. But the fact is the Birla Fund has an expense ratio of 2.31% and Reliance Growth Fund has an expense ratio of just 1.79%.

Conclusion

High expense ratio will hurt you in long run, so incase you are choosing two similar looking and similar performing financial products, you should look at their cost structure.

Can you share what you took from this article and how you will apply in your financial life?

July 4, 2011

July 4, 2011

So if I were to take on a SIP of 10 yrs and the SIP were to complete in 2018. Would the expense ratio be taken away at the end of the 10 year period, or is it taken annually?

The expense ratio is adjusted on daily basis from NAV

Oh so this adjustment is felt on my end everytime i purchase a stock/MF, etc? Makes sense…does that also show why there is a difference between regular and direct MFs. The difference in the expense ratios (example : 2% vs 1.2%)?

Yes that correct. Thats the reason for difference between regular and direct plans.

Thanks

Hi Manish,

I m new to MF and invested on ICICI Focused Bluechip Fund (Direct Growth) I had invested 3000 per month By SIP for 39 months and amount was 117000 and money value was 142,539.16. when I redeemed it I got only 1.30,050.32 Rs. why this much Deduction? they deducted 12,488.84 from my current value. I redeemed it on 2nd Feb 2016. can u guide me on dudection or they deducted wrongly on my investment.

YOu must have got the NAV of almost the same date when you redeemed. Check with MF on that !

Hi Manish…

Big fan of this website. Really thanks for some eye-opening insights on personal finance.

I have a doubt about “Expense Ratio”.

Suppose a Fund “X” declares that its CAGR for last 3 years is 15% and expense ratio is 3%. Then, is the actual CAGR for the investor 12% (After adjusting for expenses incurred)? or the 15% CAGR advertized is after accounting for expenses?? (3% annually in this case)

If returns published by the funds are after accounting for expenses, then why should expense ratio matter at all?? Even a fund with high expense ratio will be a logical choice if its relative returns are even higher….

Please throw some light on this.

The CAGR mentioned are after taking into account expense ratio !

I am new to the mutual fund and have question regarding Mutual fund.

1. Mutual funds is interest based investment?

2. If am investing in the mutual funds, is any mutual fund company or any stocks in that funds providing / adding any interest to that fund to raise the investment value. Please let me know with details?

Thank you !

Mohamed Rafi

1. NO , its not interest based

2. No idea what you mean by that

Thanks for your prompt reply. That means for both regular and direct fund will be managing by fund manager, for which every investors in MF required to pay expense for fund management. Now, doubt arise is why should we pay agent/intermediator charges in case of regular plan in addition to expenses amount as fund manger for both plans manged by same person? Is this right? please correct it if my understanding is wrong.

Yes your understanding is correct, if you can still pay to agent, if he is helping you with the overall decision making and if you feel that his inputs adds value to your financial life.

Hi

Really a informative article on expense ratio. I have following question

1. If investor choose low expense ratio then performance of portfolio will be lower as compered with high expense ratio’s funds? is I am correct? can you you please give your opinion/suggestion?

regards

chary

Its not neccessary, each fund is different and their performance will depend on their fund managers ability , not expense ratio !

it is sbi pharma fund and sbi pharma fund – direct. even reliance and uti have 2 funds each with same criteria i.e. all things being identical only inception date is different.

i had checked on morningstar.in

sbi pharma fund – growth was a typo. 🙂

Thanks for the article.

I’m new to investing. And I concluded from your article and all comments that I should invest in large and old funds (cos they have lower expense ratios) and for not more than 5-6 years (ofcourse after looking at the returns). Am I on the rite track? 😀

btw this also cleared a doubt about why AMC’s create identical funds with a different name eg. SBI pharma and SBI pharma growth have same portfolio allocation, same benchmark, same fund manager etc only inception date is different !!

They are not different funds, they are same .. in general there are GROWTH and DIVIDEND option !

I meant SBI pharma fund (Growth) and SBI pharma fund – direct plan (Growth). Like that even Reliance and UTi has 2 each of their pharma funds. The only difference was the inception date rest everything being identical.

I checked on

http://www.morningstar.in/tools/mutual-fund-performance-comparison.aspx

thanks for the article.

I’m new to investing. And I concluded from your article and all comments that I should invest in large and old funds (cod they have lower expense ratios) and for not more than 5-6 years (ofcourse also looking at the returns). Am I on the rite track? 😀

btw this also cleared a doubt about why AMC’s create identical funds with a different name eg. SBI pharma and SBI pharma growth have same portfolio allocation, same benchmark, same fund manager only inception date is different !!

Hi Manish,

It was an excellent article and a real eye-opener for people who often get misled about which fund has given more returns, regardless of the charges that will reduce the final returns of the funds. I believe people should be given knowledge on the fund charges and how it would impact their final return, rather than trying to sell the product to people who are less literate about such minor details.

One question from me: I am looking forward to invest in Gold (Pure Investment). And I plan to invest in Quantum Gold Saving Fund (0.25% — Expense Ratio). My time horizon is 12 to 18 months. What is your advice/take on it ?

Thanks,

Joel Vaz

Go ahead .. Gold ETF is also an option if you have a demat !

Hi ..I want to clarify about a scheme. Is there any scheme named ” canara bank robecco equity saver” ?

Does that scheme contains the following features ?

One of my friend invested in this scheme on 2009 for 3 years with one time investment 25000 Rs . Then he was getting dividend 4000 Rs every 4 months once ..for 3 consecutive years. Recently he finished that scheme and got 39000 Rs lump amount as market value of 25000 Rs .

So he totally got 4000*3=12000 Rs (each year)

For 3 years 36000 Rs .(DIVIDEND FOR EVERY 4 MONTHS )

On finishing the scheme 39000 Rs .(MARKET VALUE OF 25000)

Totally he got 75000 Rs by simply investing 25000 Rs 3 years before .

With this credentials any schemes available in robecco.. please inform me ..

http://jagoinvestor.dev.diginnovators.site/forum/canara-robecco-clarification/3464/

hello manish,

I was checking two mid/small cap finds….icici prud.discovery and tata div. yield and they have exp.ratio pf 1.00 and 2.36!

Why so much of a difference when the former perform slightly better?

Aseef

Thats totally dependent on them and it depends a lot on the assets managed !

Hi manish

I am a regular reader of your blogs. for the past six months. Whenever i am free i will come to your website and read the old articles written by you.

At that time i came to see this article.

I have one doubt.

In case market is down . will they deduct expense ratio?

Regards

Vignesh

Vignesh

Yes , expense ratio is the charge for managing the mutual funds, markets position does not matter .

Manish

It’s simple If Loss making company told their employee this year not pay you salary, Next year pay you salary If company get good profit.

It’s a possible, No

Same thing to calculate expense ratio

If expense ratio reduce or cut then no way to do business for Fund house.

No expense ratio = No Fund House

means No Mutual Fund Industry

hello manish.

Its a great article and the discussions are even better.

Well, i have a basic question.how is this exp.ratio levied from the investor.should he actually pay it or is it deducted from the asset worth?

Aseef

Its deducted from the fund each day . So you pay 1/365th of expense ratio each day and then NAV is published.

Hi,

Reading the article above and comments prompted me to go to the HDFC website and download the financial report for HDFC AMC for last year.

Just to add some perspective. HDFC AMC made a PAT of Rs. 242.2 crs in FY 11 and Rs. 208.4 crs in FY 10. This on Income (proxy for sales) of Rs. 681 crs and Rs. 625 crs respectively. Thats a handsome margin of 35.6% in FY 11 and 33.3% in FY 10. The ROE for this business for HDFC is almost a mind boggling 47% in FY 11 and 48% in FY 10. Can i buy this business pls?

Ofcourse for an HDFC, Reliance and Pru we also have so many others like Fidelity which are struggling.

The other point I am trying to make is that is there a place for something like a Vanguard kind of structure in India where the AMC is owned by the mutual funds themselves. The extra-money that is left over after meeting expenses, incentives et al goes back to the MF holders. So the MFs holders themselves benefit. These are Non-profit entities , different from Not-for-profit. Ofcourse what happens if there is a loss. Just a different idea.

Regards

Anish

Anish

Should you not see the profits (net) in relation to what funds they are managing , that would be more real and better indicator . MF in india are for profit entities

Manish,

Thats also a view but then that would be like measuring profits of a co on the assets (Fixed plus Current) in this case the AUM (Assets Under Management). A metric which doesnt really tell us anything. Usually fund houses are valued at a% of their AUM. Measuring profits on AUM is not an indicator of profits as they are not assets in the traditional sense i.e. the fund house doesn’t own the AUM.

We have to look at what the promoter has invested and what they are making out of it i.e. Profits/ (Equity cap plus various reserves) or profit margin.

I know MFs are a for profit entity. But Vanguard is a pioneer and one of the largest fund managers in the world ($1.6 trillion as of last year) and they have non-profit model. The founder John Bogle has a diff take on the for-profit entities.

Anyways anyone who is interested can check this link

http://en.wikipedia.org/wiki/The_Vanguard_Group

Regards

Anish

Agree 100%,

concrete changes are required in the way Mutul Funds are managed in India,

SEBI’s stipulated charges are only maximum charges funds can charge but funds should lower the actual charges by reducing costs and taking only sensible returns, I heard SEBI was going to tighten the rules slowly by expanding the slab in expense ratio structure and there should be strict auditing of the expenses being deducted on base of expense ratios

Its a very insensitive on fund managers side that very large funds like HDFC TOP 200, HDFC Equity are also charging highest possible expense ratio stipulated by SEBI, I know only one fund house which even being very small is delivering good funds at low expense ratios, that is Quantum mutual fund

Yea quantum is really doing well on that side

Valuable Article.Thanks. In your first example you are calculating 365th part of 2 % on 100,000- that comes to 5.48. however in table, at any given expense percentage you are calculating value on 112000 (in first row)- that comes to 110880.

if i am correct then plzz let me the know the reason ? or plz rectify if i am making any mistake?

Sidd

The table shows the yearly calculation as per 12% return, so after calculating the interest , you then calculate expense ratio

thanks. Would it be possible for you to tell me how are you getting this value 122944 in second year with 1% expense ?? i am unable to get this value. why there is a difference of 2496 if 1% has to be deducted on 125440. if possible plz explain.

Sidd

Its =100000*((1+0.12) * (1- 0.01))^2

Because you are getting 12% return and paying 1% back in charges , so 1.12 to the power 2 multiplied by .99 (1% deduction) to power of 2 (for 2 yr)

Think like this , you earn 12% and then on final value you pay 1% , then again you earn 12% and then pay 1% ..

Now this is not exactly how its calculated because the expense ratio is deducted on daily basis , but for ease point of view , we have taken this calculation .

Manish

Manish, thanks for clarifying the formula used for the table

Welcome !

Sir,

I have read in this website some where, NAV declared by Fund is after deduction of charges. So, there is no need to think of expense ratio, I think.

We consider returns based on NAV.

Please confirm

R Siva Prasad

R Siva Prasad

Yes .. but you never know about the future performance .. if Fund A has 2% expense and Fund B has 1% expense .. then what about bad performance of A , becasuse even with bad performance you will be cut 2%

Manish

Hi Siva,

I don’t think that becouse of the fact that NAVs are declared after deducting expense ratio daily , makes no difference, Its ultimately being spend from investors money principal money or returns, see the article in economics time how Funds are partying with investors money even during not so good or bad times in market

http://articles.economictimes.indiatimes.com/2011-09-12/news/30145350_1_expense-ratio-equity-funds-reliance-equity

Don’t you think ethically atleast large funds should lower their expenses instead of charging whatever SEBI permits them to charge?

Is it better to bu e-preferred term or offline preferred term plan from kotak