Form 15G and 15H – A Detailed Guide

Many people whose income doesn’t fall under the tax slab have mostly invested in products such as FD through which they can earn interest. But can we do anything to make sure that the bank does not deduct TDS on interest earned if our total income is not taxable?

If you all don’t know then let me highlight to you that it is mandatory for banks to deduct TDS on our interest income. If our income is not taxable and we also earn interest from other financial products etc..then we will have to provide Form 15G and 15H to the bank so that bank doesn’t deduct TDS since our income is not taxable.

In this article, I will be discussing all aspects related to Form 15 and 15H.

What are Forms 15G and 15H?

Forms 15G/15H are forms that an individual can submit to ensure that the Tax Deducted at Source (TDS) is not deducted on the interest income if she/he meets the applicable conditions. Always remember, that if an individual wants to claim tax deduction through Form 15G/15H, then the individual must have a Permanent Account Number (PAN).

Form 15G is to be filled by individuals aged below 60 yrs and Form 15H is to be filled by senior citizens aged 60 yrs and above. You can click on this link if you want to download the form directly from the website. If you want to have a look at the form, click on the link below,

Eligibility Criteria to fill these Forms –

a) For Form 15G –

- An Individual or HUF or trust or any other assessee

- Only Indian Resident can apply

- Age should be less than 60 years old

- Tax calculated on their Total Income should be nil

- The total interest income for the year should be less than the basic exemption limit of that year

b) For Form 15H –

- A Resident Indian Individual

- Age should be 60 yrs or more (senior citizen) during the year for which you are submitting the form

- Tax calculated on their Total Income should be nil

Who all are not eligible to fill these forms?

The following are not eligible for submission of Form 15G/15H –

- Company (Private and Public)

- Partnership Firm

- Non-Resident Indian (NRI)

- An Individual whose estimated total income or the aggregate total income exceeds the basic exemption limit.

Can these forms be filled online or just offline?

a) Form 15G (online and offline) –

An individual can choose to submit Form 15G offline or online, depending on the facilities provided by their bank or financier. Firstly they need to check if their bank allows submission of Form 15G online. If this facility is available in their bank, they can simply log on to their internet banking account and fill up the form online. Once you have filled up the form, recheck the details, and hit submit. For your future reference, you can download the submitted form.

The other option is to fill a physical form and submit it to the bank. The forms are available in the Income Tax Portal. You can download the form and get printouts of the same. You can then submit these duly signed documents to the bank or financier where you have the savings accounts. You can also submit it at the post office or the company you work for depending on your requirement.

Currently, there are 2 banks that provide online filling of the forms. If you have an account in the below 2 banks then you log in through internet banking and fill these forms –

b) Form 15H (online and offline) –

You can submit Form 15H online or offline mode. To submit it offline, you need to download the form from the Income Tax portal as discussed above. Once you have completed filling the form, you can submit these forms at your bank or post office or your employer (in the case of Provident fund).

If your bank or financier allows submission of Form 15H online, you can log on to your internet banking and fill up the form. You can submit the form directly using internet banking. For your future reference, you can download the submitted form.

Currently, there are 2 banks that provide online filling of the forms. If you have an account in the below 2 banks then you log in through internet banking and fill these forms –

A detailed guide on how to fill the form through SBI Internet Banking –

Different other scenarios where these forms can be utilized –

a) TDS on EPF withdrawal –

TDS is deducted on EPF balance if it is withdrawn before 5 years of continuous service. If an individual had less than 5 years of service and plans to withdraw their EPF balance of more than Rs.50,000, then they can submit Form 15G or Form15H. However, to fill this form the tax on an individual’s total income including EPF balance withdrawn should be nil.

b) TDS on income from Corporate Bonds –

If an individual holds corporate bonds, then TDS is deducted on them if their income from these bonds exceeds Rs 5,000. They can submit Form 15G or Form 15H to the issuer requesting the non-deduction of TDS.

c) TDS on post office deposits –

Post offices that are digitized also deduct TDS and accept Form 15G or Form 15H, if an individual meets the conditions applicable for submitting them.

d) TDS on Rent –

TDS is deducted on rent exceeding Rs 2.4 lakh annually. If the tax on an individual’s total income is nil, then they can submit Form 15G or Form 15H to request the tenant to not deduct TDS.

e) TDS on Insurance Commission –

TDS is deducted on insurance commission if it exceeds Rs 15000 per financial year. However, insurance agents can submit Form 15G/Form 15H for non-deduction of TDS if the tax on their total income is nil.

FAQs –

i) What will happen if I forget to submit the form on time to the bank?

If you forget to submit these forms on time then the bank will deduct the TDS. However, one can claim the deducted TDS by filing an ITR.

ii) What is the difference between Form 15G and Form 15H?

Both are self-declaration forms that an individual will have to submit to the bank once they open a fixed deposit. While Form 15G is for those who are below 60 years and come under Hindu Undivided Families (HUF), Form 15H is for everyone who is 60 years and above.

iii) Is the form provided by banks one and the same? Or is it different?

The forms which banks provide are a little different from the actual form which is available on the income tax website. However, both type of forms serves the same purpose. You can have a look at the form in the above section.

iv) Can HUF, NRIs submit Form 15G/Form15H?

HUF can submit Form 15G if it meets the conditions but Form 15H is only for individuals. NRIs cannot submit Form 15G or Form 15H. These can only be submitted by resident Indians.

v) Do I need to submit Form 15G/ Form 15H at all the branches of the bank?

Yes, you must submit one at each branch of the bank from which you receive interest income though TDS is deducted only when total interest earned from all branches exceeds Rs 10,000.

vi) Does filing Form 15G/Form15H mean my interest income is not taxable?

Form 15G/Form 15H is only a declaration that no TDS should be deducted on your interest income since the tax on your total income is nil. Interest income from fixed deposits, recurring deposits, and corporate bonds is always taxable.

vii) Will my interest income become tax-free if I submit Form 15G/Form15H?

Interest income from fixed deposits and recurring deposits is taxable. For senior citizens deduction of Rs.50,000 is available under section 80TTB for the interest income from fixed deposits/post office deposits/deposits held in a co-operative society. You should submit this form only if the tax on your total income is zero along with other conditions.

viii) I have submitted Form 15G and Form 15H but I also have taxable income, What should I do?

You must inform your bank that the tax on your total income is not zero. The bank will make changes and deduct TDS accordingly. You should report the entire interest income in your tax return and pay tax on it as applicable.

ix) Do I have to submit this form to the income tax department?

You don’t need to submit these forms directly to the income tax department. Just submit them to the deductor, and they will prepare and submit these forms to the income tax department. At times these forms can also be filled and submitted in the bank.

x) Is there any time limit for submitting these forms?

There is no time limit or due date for submitting Form 15G/15H to the bank. However, it is advisable to submit it at the beginning of the financial year (i.e. Apr 01) or as and when the new deposit is created.

xi) What is the time limit during which these forms are valid?

Forms 15G/15H are valid for one financial year ending on Mar 31 of every year. So, you will have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure that no deduction is done on any interest income earned.

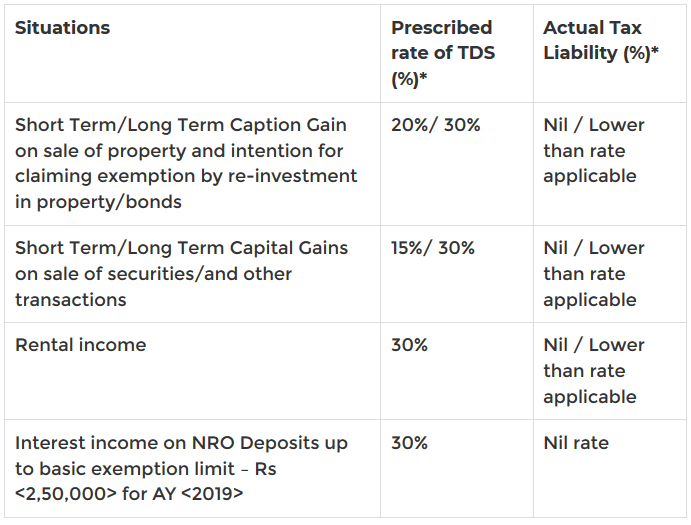

xii) Is there any other way NRIs can refrain from TDS deduction as they are not eligible for Form 15G and 15H?

For any NRI, whose TDS is more than his/her tax liability, such excess tax can be claimed as a refund from the Indian Tax Department (ITD) by filing the Return of Income in the particular Financial Year. Such excess TDS results in loss to NRI due to the time interval between the tax deducted and refund of such excess tax, which may take generally 1 to 2 years.

In order to address the above situation, a procedure has been prescribed under the Act, whereby NRI recipient of income can apply online to ITD (in a prescribed format) along with the relevant supporting documents to issue a Tax Exemption Certificate (TEC) authorizing the payer of income (who deducts tax) to deduct tax at a lower rate or Nil rate, as the case may be.

In the case of NRIs, whose actual tax liability is lower than the rate of tax prescribed under the Act, it is beneficial to obtain a TEC. An NRI should apply for TEC under few situations listed below –

Procedure – The Jurisdictional Assessing Officer (from the International taxation ward of the ITD) of an NRI generally issues a TEC between 2 to 4 weeks from the date of application.

Validity – TEC is normally valid for the period for which such TEC is obtained (i.e. a Financial Year) and for the specific income as stated in the TEC.

Filing Return of Income – NRI who has obtained the TEC has to compulsorily file his Return of Income in India for that Financial Year.

xiii) How can an individual make use of these forms?

These forms can be used only if the tax calculated on the individual’s total income is nil for the financial year. Both forms – Form 15G and Form 15H – have a validity of one financial year. That is why either of them is required to be submitted at least once every financial year. Forms 15G and 15H are basically submitted to save TDS on interest income.

For example, Banks deduct TDS on FDs when interest income is more than Rs 10,000 in a financial year. But if the total income is below the taxable limit, then Form 15G and Form 15H have to be submitted to the bank requesting them not to deduct any TDS on the interest.

Points to Remember –

- An individual can only submit Form 15G/15H to a bank with a valid PAN, if an individual doesn’t have a valid PAN then, the tax will be deducted at 20%.

- It is advisable to submit a copy of the PAN card with the cover letter.

- The individual should make sure he/she receives an acknowledgement while submitting Form 15G/15H. This acknowledgement can be kept for future reference.

- Acknowledgement of submission of PAN details is useful if a dispute with the bank arises.

- The individual will need to submit the details of the Form 15G/15H submitted by him/her to other banks as well as the interest income amount mentioned in these forms.

- As the individual has submitted his/her PAN, the respective assessing officer will have access to all the information submitted by the individual to other banks and will cross check if there is any incorrect information submitted by the individual or not.

- There is a provision for imprisonment for a minimum of three months if an individual is found to have provided incorrect information in the declaration forms.

A short video on How to Fill these Forms –

a) Form 15G –

b) Form 15H –

Conclusion –

So this was all that I wanted to share in this article. If you have any queries then you can post them in the comments section.

May 1, 2021

May 1, 2021

If form 15G is given to the deductor then what’s the point of TDS statement 26AS?

It will show NIL in that case.. form 26AS is just a place where one can see all their TDS deducted entry. It can be NIL

Thanks for sharing this detailed guide on form 15g and 15h it cleared out all my queries regards with the topic.

Most people are not aware of 15G and 15H but here you shared all information is very informative.

Thanks for all…

Some points.

Form 15G/H is a declaration to the bank by individual HUF stating that a person’s income is less than taxable limit.

Some banks(ICICI) print these forms with deposit details and the customer has to sign on that. Can check with your bank.

In many places, it was mentioned that the customer needs to meet the criterion of tax. One should remember that the responsibility of verification will be with customer and not a banker. If one submits an incorrect form and subsequently query comes, the customer is answerable and not the bank or firm.

One need not worry whether he/she has to submit 15G/H. Bank will provide the correct format as per the conditions.

It is advisable to submit at the beginning as TDS once deducted, the bank cannot give back. One has to go through the tax return filing route to recover the same.

Thanks for sharing Srinivas

sir recently I had sold my property and I had cleared all my loans and obligations and I had balance amount of 10 lakhs I am giving this amount to my wife which she has no income sources she want to keep this amount for fd to avoid tax what to do.

Hi shrinivas

Please read http://jagoinvestor.dev.diginnovators.site/2015/02/gift-tax-rules-in-india.html

I submitted Form 15G for some of my FDs last year as I did not know what my earnings in my 1st year of retirement would be. TDS was deducted in other FDs. Around Oct, I suspected income would exceed 5 lacs (taxable income more than 2.5 lacs after standard & 80c deduction) and paid Advance tax of 10000, just in case. Will I have to pay penalty & interest for not paying tax in 1st 2 quarters? Also, will I be in 10% or 20% tax slab for income above 4 lacs?

I read that form 15g should not be submitted if gross income (without exemptions) is above taxable limit. For FD with cumulative interest, bank deducts tds on quarterly /half-yearly interest paid. The reduced amount added to principal, reduces further interest due, hence reducing maturity value. With exemptions, final taxable income may be less than minimum taxable limit. When one claims back the tds amount from IT dept, the interest on the tds is not gained, hence there is loss to taxpayer. Isn’t that unfair to a low income person?

Hi Rao

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Hi sir my mother is pension person the bank say submit form G or H how to going on this process plz help me

Just take the form from bank, and submit it back after filling it up !

DEAR MANISHJI,

I AM SANATAN PRAMANIK, WORKING UNDER THE WEST BENGAL POWER DEVELOPMENT CORPORATION LIMITED. I maintained tax returns. I am salary holder. I had ppf and 2 fd (90,000.00) pl. tell how i maintain tax deduction. I had land property (HUF) so what sujest to tax saving matter.

Hi SANATAN PRAMANIK

I am not clear on what is your question. Please repeat it with more clarity

Manish

An FD worth 300000 in the name of a minor under guardianship of mother is eligible to submit 15G with mothers pan???

I am not sure on that. Talk to bank on this

Sir,

There is a speculation that if the interest income will exceed 90000/- per year then the 15g form will not be valid.Is there any truth of this word?

Hi Dibyendu

I have not heard anything like that. Where did you read it? I dont think there is any rule like that!

Hi Manish,

My father’s age is 65 years, he has FD of 1.5 lakhs with 9.75% interest. His maturity value will be 3,11,406 in 2019.

What amount value should I mention in filling 15H:

1) Estimated income for which this declaration is made.?

2) Estimated total income of the P.Y in which income mentioned in column 15 to be included.?

Please reply ASAP

It has to be the interest income for that year !

i am a salaried person with an income of 4 lac annually I have fixed deposits of 30 lac for five years. But submitted 15g form in previous years. .Should I submit this form this year?

I am not sure how it will help you?

When a FD is 1 year long say from Nov 2015 – Nov 2016. How do we get to know the exact interest earned on such FD for the Financial year 2015-16?

Check your bank account. The money must be credited as interest

Sir,

My senior citizen mother submitted Form 15H in April 2015 at banks where she holds FDs. As there was unanticipated income and also inability to invest in tax saving instruments, both the total aggregate income and taxable income for the financial year have exceeded the exemption limit for current financial year. Would there be a problem on account of prior submission of 15H?

No , just pay the tax properly !

Hi Manish,

Can you please suggest some good CA in Bangalore

Hi Sir,

My Father is a retiree from Govt services (aged 66). He is drawing pension around 3.5 Lac per year. Holding FD in Banks of 25 Lacs. Now is his FD interest income taxable in this case keeping the Indian Income Tax slabs in view

Thanks

YEs, what matters is the total income in hand in a year .. so it will be taxbale for him !

Hi,

My father is 81 years old, he get a pension around 7 lakhs pa, he and my mum have some savings as fixed deposits amounting nearly 40 lakhs, rate of interest on average of 10%. . they do file 15H every year. My question is -Does tax will be deducted from their interest or not? and if yes than are there any procedure to avoid it?

Thank you.

No Tax will be deducted as form 15 is given by them

hello sir

If my father give me 5 lac Rs for fixed deposit and my income is nil then may I submit form 15 g to the bank?and then should I payment liability in income tax

No , in that case there wont be any tax liability on you

Sir , Interest earned amount won’t be included in ” Income from Other sources “

Yes it will be

Dear Sir,

I made e-STDR in SBI for the period of six months for Rs.25000/- . In system generated advice it shows me to avoid tax deduction submit 15H/G to the branch after opening e-STDR. 15H/G is necessary for me to submit to avoid tax deduction.

Regards,

Gautham K

Yes. thats correct

sir, I have opened a new e-RD account in sbi through internet banking, i have doubt whether i have to submit 15G or 15 H to sbi branch. kindly give your valuable information. thank you.

YOu need to submit 15G