“We lost 96% of our Wealth .. from RICH to Middle Class”

Today we are sharing a very different money story, where one of our readers is going to share his life journey of becoming a middle class from being RICH years back. Yes – you heard it right.

As per his request, we are not revealing his name and identity. I thank him to share his story with a bigger audience.

Here it goes…

My story starts with an assumption that most of the jagoinvestor readers belong to a middle-class background or from a humble background. Most of the readers have either already moved to a level higher or are trying to move to a level of lifestyle better than what was available to them in their childhood.

My story is a complete reversal

Yes, I moved from affluent background to a mid-income kind of family (from a big city perspective and not on pan India basis)

My story is a lesson on why financial planning and diversification are important. I was born in a rich business family of a small town (population of 1 lac), my father was a well known and socially connected/respected person in society.

I still remember we used to have a car (when there were only two or three cards in the whole town), BSNL landline with a two-digit number (i.e. less than 100 connections in the whole town!). Money was the last thing to worry about in our family. Things were very smooth in my childhood, and we used to discuss how to take the next leap towards the ultra-rich families.

There was more than sufficient money, my family used to give donations to temples, hospitals, etc. I had an elder brother (1 year) and I never wore his used clothes, never used his books (same school), and never used his toys.

How we lost money

Unfortunately such was the turn of time that the business suffered three-four very bad years, which eroded the entire family wealth.

This coupled with the lavish wedding of my sister left almost nothing for us two brothers. My brother decided to join the business and I was banished to a poor software job 7 yrs back. I initially faced a lot of troubles, but gradually managed to come out of the situation and did an MBA and now I am doing well. Even the family business is doing great under my brother’s leadership.

It still gives me a nightmare, that we had a substantial loss in the family business. Probably I would have never discovered blogs like jagoinvestor and subramoney had that loss not occurred. The virtues of financial planning were learned at a great cost.

Did it impact our social life?

Not much…

One very good (some may consider it wrong) thing which my father did even when business was downhill, he never cribbed in front of society. He never let the lifestyle go down.

So society never knew that the problem is so deep. When my brother joined the business, the total net worth of our business excluding the house and gold was just ~20 lacs (We lost 96% of business value, down from 5-6 crores in real terms. note that this was many many years back) with two marriage and my MBA still pending. But still he was able to conduct business by borrowing (unsecured) and credit, only because our credit rating in the society was still AAA.

Had the society knew about this, we would be ostracized. Luckily my brother turned around the business and things became much better going ahead.

My childhood and money

My first good experience with money was when I got pocket money from my grandfather. I used to get 1 rupee a day and my brother 2 rupee, and we used to get candies from the shop. The pocket money gradually increased to Rs 30 rupee a week on Sunday, and we used to feel like Tata/Ambani on that day.

Not even a single incident I remember, when my parents refusing to give me money. Even during the bad days they maintained the lifestyle, paid for my college, held lavish wedding for my sister. I as an individual was not a spendthrift and that helped a lot.

I was educated in the best school in the nearby city, but education was just a formality since the ultimate goal was to join business. But very early in life, being from a business family, we were introduced to the importance of money very early.

My lifestyle NOW vs. THEN

Although financially I am comfortable now, there is no more that kind of luxury in my life. I am very frugal now. Here are some points which can give you all an insight into how my life has changed.

- I live in a rented 1-bed room flat in Mumbai.

- Consciously own no car and live a frugal lifestyle.

- Earlier the minimum we traveled was 2AC, now the maximum I travel is 3AC

- I avoid overseas holidays which my colleagues frequent

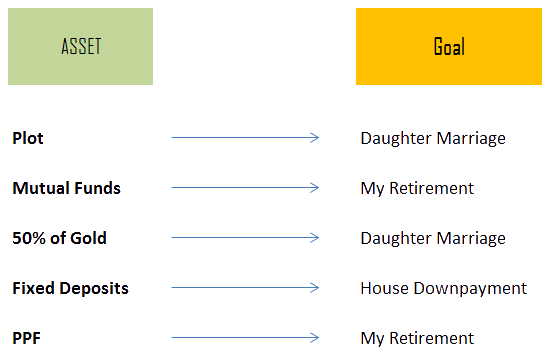

Although I do not complain, I wish I should have more wealth. I have done full financial planning (and also my family’s) with the help of blogs like Jagoinvestor.

Since I cannot afford the mistake which my family had done, I am completely opposite to them.

And I am seeing the good result to my net worth, with 5-7 years of job and though my salary is not high, my net worth is high. The only reason is being frugal and financial planning, avoiding toxic products like LIC policies etc. I have never touched ULIPS, endowments, FD ever in my life (totally my views)

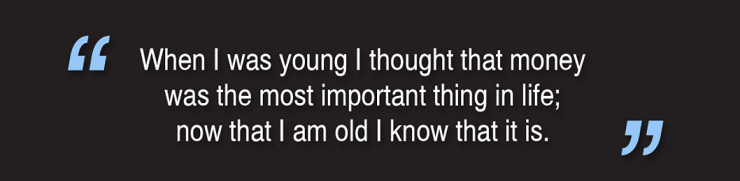

How important is Money in life – My views!

Money is very important, as important as health. The emotional trauma of not having enough money is unbearable. When I was young money was always there and I thought it would always be there in abundance. I just have to graduate and join the business, but life had other plans for me.

After the tragic losses in business, we decided as a family that one of the brothers should find a stable job; while others will try to revive the business (which is now revived by God’s grace). All the while, I never felt the urge to study since the ultimate destination of father’s business required no qualification; I suddenly was required to study and find a decent job.

So I pulled up my socks and did engineering and MBA and landed a good job in the financial sector now.

I fantasize regaining old glory days and become a wealthy person, and I believe courtesy the financial education I may or may not live rich but I am sure I will die rich. I think if I can accumulate 5 crores (in today’s terms), it will make me feel that my future is secured.

Stupid mistakes people do in area of money

Everyone has their own way of looking at things, but having seen a lot of money in life, I think a few mistakes people do are

Mistake #1 – No financial planning, just random investing

Most of the people just randomly invest in some policies or open few FD’s without any concrete planning for future. They think life will continue in the same way like last 5-10 yrs. But life can have lots of surprises at times. One should always be 2 steps ahead and plan for their bad times. Start doing your financial planning. If you are not smart enough to do it yourself, accept it and hire a professional.

Mistake #2 – Invest/consume gold/jewellery

Do not see gold and jewelry as investments. Some of it should be just used for personal consumption, but nothing more than that. Try to invest your money in robust financial products which create wealth for you over long term.

Mistake #3 – Invest in fixed deposit

Fixed Deposits are not for investments, It’s to just park your money for 1-2 yrs and nothing more than that. If you want to create wealth, fixed deposits are not the best thing in today’s world. By the way, I am yet to meet someone who has become a millionaire by putting money in FD’s , unless you put millions in FD!.

Mistake #4 – Invest in property without proper due diligence

I can’t understand, how people invest their hard earned money in real estate without proper due diligence. There are enough cases where lakhs and crores are stuck in bad deals and people have just lost money. If its real estate, catch a lawyer, pay his professional fees and check things in detail before committing your money.

Mistake #5 – Same with stocks

It is just beyond my understanding that people think they can do stock investing and trading successfully for years and generate consistent profits. If it was so easy, everyone would be doing that by now. Leave things to professional and don’t do stock trading (unless you are really a pro and into it full time)

My father suffered from Mistake # 1. There was no financial planning done at that point in time. Most of the money was either plowed back in business or invested in PPF.

There was a belief that business would always be very good, so no land was bought and no equity investments were made. Some PPF investments were done for tax planning. Even my mother didn’t buy gold.

Such was the belief in business that no investment was made for a kid’s future education and marriage. Two-three big losses and there were no backup assets. So diversification is very important, never put all your eggs in one basket.

I also lost Rs 10 lacs recently!

I would also like to share one incident from my life where I lost money personally and learned an important lesson.

As I come from a business background, I wanted to get into some kind of business. But, I recently lost around 10 lacs in a business I started in partnership with my friend. A business plan was good but somehow it did not work out as per the plans. I learned an important lesson that “Slow and steady wins the race” .

Had I kept the money in my equity Mutual funds, they would have yielded good returns, but that’s fine. You learn from your mistakes. I took a calculated risk, hence the impact on me was less.

Don’t be afraid of making mistakes especially when you are young and have lots of time in your hand in the future.

One suggestion for your future

Manish asked me if I can share one insight I want to share with every one of you out of my years of experience and from my life.

So here it goes…

One should always have a plan B in life, like what will I do if tomorrow my company kicks me out, I have plans like starting a business, someone in IT may be looking at re-skilling or someone can survive on rent/dividend, etc.

There should be a little basket for every goal, as a plot of land for my daughter’s marriage which I will not touch, in my case, we thought that the running money in the business would be sufficient enough to meet all kinds of expenses or emergencies.

All this is a part of financial planning, so even if you are very talented today and earning much more than you require for your expense, you may feel that financial planning is for the poor or middle class, but that thought is not right. In fact when the going is good; that’s the best time to amass assets.

A real-life example of my friend family

One of my father’s friends with a similar profile, good business which subsequently went bust had a lot of good shares like HUL, SBI at IPO pricing (imagine HUL @10 INR) and he never sold. Can you believe he gifted AUDI to his daughter only from the wealth created by equities (he showed us the Demat slip the day he sold shares)?

If you are low in wealth right now, then I have just 2 things to say

- Be Frugal, don’t copy your friends and cousins and overspend

- Try to increase your income, learn some extra skills, work overtime, etc…

Is your happiness linked with money?

Yes, For me it is linked; in the sense that I should be able to provide. There should always be enough money to support the family, health, education, retirement.

One should not ignore the value of good health, relationships, and friends. Even if one has all the money and there is no health or family to enjoy, then what is the use of all the wealth in this world? Given a choice, I will choose the later over money.

I feel very good after writing my story. Jagoinvester is providing a very good platform to share your life story. Even if few of the readers can take away a few lessons I will feel that the effort is worth.

What is your money story?

If you want to write your money story, Leave your details here and Jagoinvestor team will get in touch with you with the next actions.

What do you think about my money story? Did you enjoy it? Can you share your views about money and how it changed over the years?

March 9, 2018

March 9, 2018

Thanks ,

i religiously follow your articles

Thanks for your comment paritosh sharma .. Please keep sharing your views like this..

Manish

Save money for daughter’ education rather for wedding. Save money for your /our retirement.

Save money for future, lifestyle upgrade

Hey Sreeni

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Thanks for sharing this insightful post.

You are doing a really great job. Keep going.

I really love to read your posts

Thanks for your comment Manisha .. Please keep sharing your views like this..

Manish

Thank you for the great article, Manish! but I think the investment is a must.

People’s income varies, but I think that trying to spend money on needs will help us go a long way in terms of savings. Proper investment in stocks, mutual fund, FD, or in gold always help in your retirement.

Yes, TRUE !

Hi Manish,

Thanks for the fabulous articles with real time experiences you post. Kudos…

I am from a humble background and i have bought a plot and have invested 13 lakhs in FDs with a goal to build a house in the next 5 to 6 years. The interest money i get from this 13 lakhs is again reinvested into shares/ Mutual funds.However I am worried what will happen to the money kept in the bank as the decisions taken by the government are really troublesome to me (FRDI Bill). So I have broken the FDs and have invested this money in senior citizens savings scheme on my mothers name. Is this a safe investment?? does senior citizens savings scheme come under the ambit of FRDI. Now I still want to build a house and pay for the EMIs with the money I get from the interest of this SCSS.

I want to know how safe is money in SCSS.

I am looking forward to your reply

FRDI is just a proposal as of now and I dont think it will be easy to get implementated !

I think you are over thinking on this for now .. dont worry !

Thanks Manish

A story which relate to me but the difference is i have JAGOINVESTOR team with me now

Thanks for your comment Lokeshwar .. Please keep sharing your views like this..

Manish

excellent story! inspiring to the core.. such stories of courage re-navigate one and all back to their own personal finance journey..

I’d like to share my father’s personal finance success story, true rags-to-riches style, (although it has very little of equity investments per se; it is inspiring nevertheless), if Jagoinvestor allows me too.

Yes, definately ! ..

Yes u are right…it is time taken

You are right LICs are not for investment but in 80s or90s LICs were the only option for tax saving and were considered good investment also I am retired now and all the LICs are already matured being for 20 or 25 years and money spent in daily needs I booked a house in Gurugram in 2012 with some loan and gave all my savings as margin when i had 6 years to retire.I have got possession of the house but rent is not much only rs 10000 or so per month loan outstanding is still 30 lacs dont know from where to pay will have to sell the house but rates are not much in real estate not enough to cover the cost and interest paid by me over last 6 years

Hey Poonam Batra

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

A lesson perhaps for business families is to diversify their financial portfolio..

Saving for wedding is something I believe ruining your own retirement .( It’s a setup by society,a few hours of celebration but amount good enough to live for few years with out work )

Thanks for your comment Abhishek .. Please keep sharing your views like this..

Manish

Simply brilliant

Thanks

I would like to convey my feelings to both the brothers. I came from a middle class family (working in BLR since 2007) still trying to reach upper middle class status by investing in Plots, PPF and creating some rental income for retirement. I have not concentrated much on PPF, I will start doing it from the April 2018. I read blogs on this site very regularly and changed my financial investments (stopped paying LIC plans, used to have 40L term plan cancelled it and bought a new Term policy with HDFC for 1Cr, started investing in PPF, invested in Plots)

Hey Nag

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

But want to ask you one question that “Why Jago Investor is not associated with SEBI to accept investments ” I read the blogs and they all are eye opener for me..But lot of thought go in mind when you are investing hard eraned money on someone’s recommendation..I am 29 now and doing random investments without any goal and want somebody to guide me but it should be long term association..

Pls revert ..

We are AMFI registered and distribute mutual funds as per SEBI regulations . You can leave your number here or leave your details at jagoinvestor.com/mutual-funds

Our team will contact you

Manish

Good to hear of a person’s real story,

As per Mr.Dr Rajnikant, what he said is true…

🙂

I read the story and I felt many Indians are live like this.

What happened to the money amount invested in PPF ? Is not redeemed yet ?

Lack of financial literacy is major problem here. People invest in PPF without knowing the lock in period involved.

Thanks for your comment Suresh .. Please keep sharing your views like this..

Manish

Good one and many should read this…

Thanks

Happy to note that it feels like real story.

Stories do not give knowledge,only experience .

Not ready to learn from other’s experiences,very good ,pay the price yourself

Glad to hear that 🙂

The story made me to cry….how life changes in a day or a week. I personally experience same business loss and seen many instances within my extended family also.

It’s good to grow from middle class to rich but it’s very very difficult to survive from rich to middle class or poor only one in lakhs survive others drink and destroy their life thinking of past.

Convey my wishes to your brother who brought your family business back to Live.

Good financial planning is need of hour is my learning.

Thanks Manish for sharing valuable thoughts.

Thanks for acknowledge that Prasanth!

Although I understand the crux of this story, I am very much surprised that in today’s world people have to set aside so much money for a daughters wedding than her education. Everyone wants to save money for son’s education and daughters wedding.

Yea .. these things will take time to change 🙂