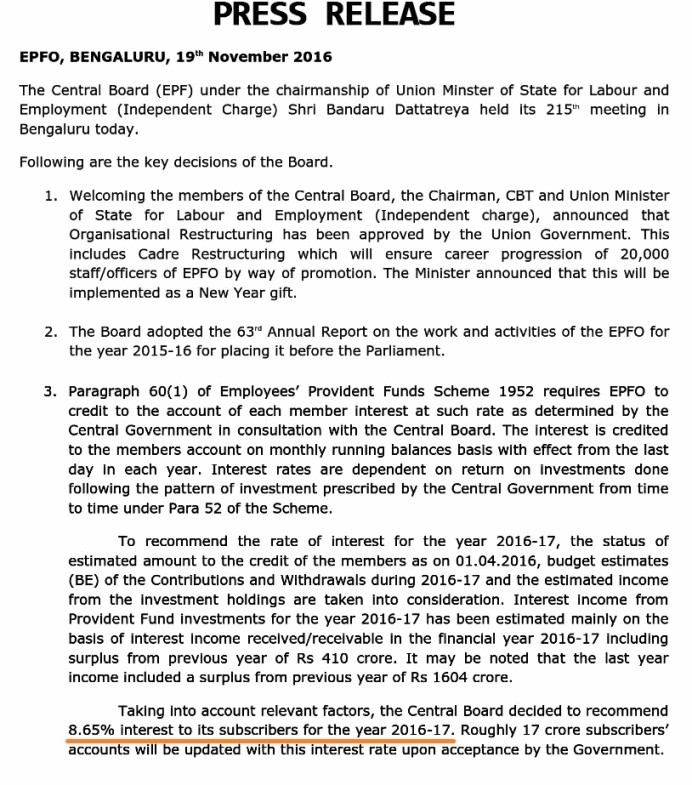

EPF interest rate reduced to 8.65% from old 8.8%

The EPFO department (Employees Provident Fund Organisation) reduced the EPF interest rate to 8.65% today. The old interest rate was 8.8%.

This interest will be applicable for the deposits made for financial year 2016-2017. Which means that all the deposits which were made after 1st Apr, 2016 by the employers will be earning the interest of 8.65% only, and not 8.8%.

Why was the EPF Interest rate was reduced?

As per a Hindu report

While an interest rate of 8.62 per cent would allow the EPFO to keep a surplus of around Rs 22 crore, fixing the interest rate at the present rate of 8.8 per cent would have left it with a deficit of Rs 700 crore, EPFO’s income projections showed.

According to sources in EPFO, the lower interest rate is on account of poor rate of return on investments made by the EPFO on all fronts.

You will notice that the bank deposits interest rates were also reduced recently and this move might be in tune to that decision, as it’s tough to provide high interest as the money availability is high.

What do you think of this EPF rate cute?

December 19, 2016

December 19, 2016

I have EPF account currently. My employer contributes in it. Can I also start to invest in nps separately without employer contribution. I mean can I have both epf and nps account s.

Yes, you can invest in both EPF and NPS !

I Think Further Reducing in Interest Rate are expected because of Demonetization bank have high cash inflow and bank have to pay interest on such deposit. The expectation in reduction interest rate not only EPF but other section like Fixed Deposit etc,

Thanks for your comment Ashoksinh Gohil

Many comments i read in the internet says, “still this PF is an attractive instrument @ 8.65%” and i think as the interest rate will be reduced in the future for sure, does it make sense to continue investing a huge sum in PF account?

Yes, it still makes sense due to the fact that its tax free and also secured

Hi Manish

Thanks for sharing the quick update as usual. 🙂

As we all know EPFO has started investing in equities, I have been wondering how and when it will affect EPFO’s overall returns going forward.

Regards

Satheesh

But they have started it with a very small percentage only. I dont think it will boost major part of returns !

Dear ALL,

I’ve a query regarding EPS. While we shift/change employer we change our EPF a/c and all its accumulation under unique UAN.

But what about EPS amount like ( say 541 earlier now Rs 1250/month contribution from employer part)?

Pls suggest how EPS also can be transfer to the UAN.

Once you link the EPF account to a UAN, you dont have to separetely link the EPS part again !

Thanks Manish Ji, For reply.

But as per an ET artcle i got this line.”When the employee switches jobs, the EPF gets transferred to the new employer, but not the EPS.”

http://economictimes.indiatimes.com/wealth/invest/heres-how-an-employee-can-keep-track-of-his-eps-amount/articleshow/55220491.cms

Pls check the above article.

I will have to check more on this .

Good question from Brundaban.

@Jagoinvestor : but EPS does not reflect in UAN..

I am not sure. Please take help of RTI

Hi Manish,

With regular reduction in EPFo and PPF rates is it wise to start investing through NPS for retirement? your views?

Thanks,

Viswanath

NPS is always better than EPF or PPF as it has equity component of 50% ..

Rate cut always hurts.

Confusion Article says

This interest will be applicable for the deposits made for financial year 2016-2017. Which means that all the deposits which were made after 1st Apr, 2017 by the employers will be earning the interest of 8.65% only, and not 8.8%.

Shouldn’t it be after 1 Apr 2016

Err.. it was a type 🙂 . Corrected it 🙂 Thanks

Your mailers still show it as 1st April 2017. Got the mail today at 14:26

I didnt not get what is the issue Saurav?

YOu got an email with a different date ?

Newsletter email:

“EPF Interest rate reduced

EPF interest rate reduced to 8.65% from old 8.8%

The EPFO department (Employees Provident Fund Organisation) reduced the EPF interest rate to 8.65% today. The old interest rate was 8.8%. This interest will be applicable for the deposits made for financial year 2016-2017. Which means that all the deposits which were made after 1st Apr, 2017 by the employers will be earning the interest of 8.65% only, and not …”

Even after you corrected the date here. Just wanted to let you know. No issues

Yea that was mistake at my end, It was corrected in the article 2 days back itself, But it still went in emails like that as it was planned earliar!

The government should let the employees decide on what they want. Mandating the EPF was fine until the employees had that higher returns. IMO Interest will be in keep reducing trend only as the finance minister is trying to equal all the investment and it’s returns in part with the FDI on insurance and investment sector.

Yea I think govt should think over this point

JUST read, pf deposits to attract lower interest.