PPF interest rate reduced from 8.7% to 8.1% effective April

The government has cut the interest rate on Public Provident Fund from 8.7%to 8.1% effective April.

This was part of the interest rate cuts in the small saving schemes and apart from PPF, other very famous instruments like Kisan Vikas Patra, Senior Citizen Scheme & NSC interest rates have also come down by a good margin.

These new rates will be applicable from Apr 1st. Please note that this is one of the biggest rate cuts in the small saving schemes in a long time.

Here is a summary of all the rate cuts

- Kisan Vikas Patra interest rates down from 8.7% to 7.8%

- NSC interest rates down from 8.5% to 8.1%

- Senior Citizen Saving Scheme interest down from 9.3% to 8.6%

- 5 yr NSC (National Saving Scheme) interest down from 8.5% to 8.1%

- Sukanya Samriddhi Yojana interest down from 9.2% to 8.6%

- 1 yr time post office deposits has been cut from 8.4% to 7.1%

- 2 yr time post office deposits has been cut from 8.4% to 7.2%

- 3 yr time post office deposits has been cut from 8.4% to 7.4%

- 5 yr time post office deposits has been cut from 8.5% to 7.9%

- Postal saving deposits remain unchanged at 4%

Interest rates aligned with market rates

On Feb 16, 2016 (before the budget) itself the govt had announced that they are working towards bring the small saving interest rates closed to the market rates, but that time no changes were done in these schemes.

The government had on February 16 announced moving small saving interest rates closer to market rates. On that day, rates on short-term post office deposits was cut by 0.25 per cent but long-term instruments such as MIS, PPF, senior citizen and girl child schemes were left untouched.

Now the interest on these schemes is closer to the interest rates given by the banks.

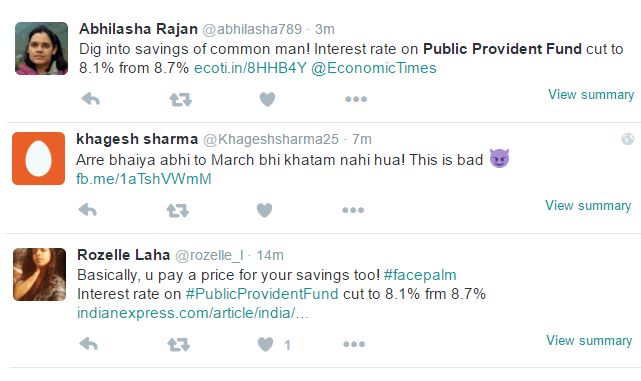

I will leave the decision to conclude if this was a good or bad move by govt on you, however the common man is not very happy with this. Messages against this move are are all over the twitter.

What is your reaction to this?

Majority of investors in India invest in Public Providend Fund (PPF) scheme and it’s very close to their heart. However this move will make many people think if PPF is the best thing they can do with their money or not (learn how PPF interest rate is calculated).

Will they move to equity markets because of this move? Will it make them interested in other kind of financial products?

What do you think? Do you think of this big interest rate cut in PPF and other schemes? Please share your views in comments section.

March 18, 2016

March 18, 2016

I am prospective investor and was looking for some radical investment options. Can you suggest some? Recently heard about P2P lending and was thinking of investing some amount.

P2p is a lending product, not investing product

Hi

Manishji pls write an article about promises made by leaders before election .

As once I saw speech at amrtisar of Mr jaitly who were saying that income tax slab to be raised up to 5 lakh . means no tax up to 5lakh income .where that thought have gone …

Government always forget the promises made before election .but active media should always remind and make question about promises ..

Hope suggestion will be appreciated ….

Thanks for your comment Tarun

The reduction in interest rate is one of the worst decision by any government, showing the inability of the present PM Narendra Modi and Mr. Arun Jaitley the Finance minister, whom the people rejected through vote. If they do not know how to formulate a budget, can approach person like me who can give full support in formulating a good budget, without affecting the below average people. Govt should take immediate steps to bring back the original interest rates for all schemes.

Thanks for your comment KATHIRESANC

It’s very bad and affect every common man in our country as Govt. is unable to get taxes from Reliance, Birla, Jindal etc except Tata.

Govt. failed to get the black money back as well.

Thanks for your comment Jeevan

Firstly Mr Jitley meddles with the EPF and says that all withdrawals will be taxable. Later he had to eat his words in the Parliament and now, he withdraws such a move in the budget. Later, to compensate for loss of revenue, he now has reduced the Small Savings Rate for the Aam Aadmi of the country. The Finance Minister can afford to write off huge loans to Big Industrialists without batting an eyelid and shore up the Share Capital of PSU Banks with Tax Payers money. Wherefrom do you think he can make up his Balancing Act. Tax and Kill the Aam Aadmi. I have known a Hardware shop owner paying Rs .3000 as income tax and he was proud to be a PAN CARD holder. He has around Rs. 20.00 lacs of stocks of hardware in his godown. Whereas a ordinary bank employee in the clerical cadre pays a Income tax of anything around Rs. 50,000

per annum. This is our India. Mera Bharat Mahaan. Finance Minister Jai Ho. Now, for a change, can all the intelligent people from the Aam Aadmi cadre think of ways to avoid paying tax like those hardware dealers? We should really do something. Any ideas please to avoid this TDS business by employers.?

Thanks for your comment GOWRISHANKAR

Manish, I have on PPF account (opened in 2012 and interest rate was 8.7%). now as per new notification interest rate will be 8.1% (effective from April 1, 2016 ).

so here is my doubt.. what would be applicable interest on my old deposits after 1st april ? and if i am doing any new deposit (account opened in FY 12) after 1st april what would be applicable interest rate on this new deposit ?

I read your replies for one of the similar question , but still I didn’t understand bcz your reply was too short.

please help me to understand it, please explain in detail.

Regards,

Shyam

Interest is calculated on monthly basis, so all the interest calculation each month is done and amount is added to your account. You cant lock in a interest rate !

Good for economy in the long run but bad for investors!!!

are you kidding me good for economy these politicians want money so they can fill up their own pockets or can run election campaigns if u trust and think its good for country then donate everything u have including ur house to this govt. they will take it gladly and after that will ask u who r u i and lot others now think we wasted our vote voting for this party who sucks middle class really bad garib to garib hi rahega uski to maar nahi sakte middle class ki maar lo unko bhi poverty line ke nichar lekar aao BJP is all abt anti middle class & pro taxes rich jo hein unko aur loan do defaulter banao aur bhagao is desh se what a joke

Yes

sir this is not good declaration to reduce PPF rate of interest and also other tupe of savings…….if it happen than middle class person can not invest as because they did not get return from their….please do something for middle class people

You tell me what should I do ?

Dear Sir, if I open new postal RD before 31mar2016 i.e 24march16. current interest rate is 8.40% for RD. from apr16 reduced to 7.40% what interest will apply 8.40 for entire 5 year? if we extent 5 year block what interest rate same % are future rate on next 5 year? also I am aware quarterly compounded in RD after three months which interest rate is calculated? 8.40 or 7.40 kindly explain.

after april 16 when ever u contribute money to RD it will be accroding to revised rate i.e 7.40% but all contributions made towards RD will be according to 8.40% it will be new reduced rate until its revised again sucks middle class ki maarne lage hein BJP = ANTI MIDDLE CLASS i and india wasted our votes dont u think so

Thank you. god only saves middle class.

You cant lock in a fixed interest rate for entire tenure . Its calculated on monthly basis

Thank you sir.

reducing interest rate on small saving scheme is disappointing for middle class n retired persons. govt is pro corporates n business class( VERY RICH) N very poor people.neglecting middle class people.bad luck

Thanks for your comment dkyamdagni

Earlier discussion of EPF withdrawal was rolled back not because middle class protested it happened because journalist working for print media & MSM too where impacted they too keep switching there job and probably earning are in several lakh & renowned journalist CTC may run in crors. So they shouted now see no protest by media on interest cut on small savings so far not came across any article on this cut by so called journalist in finance expert as they are least bothered and concerned about small savings.

Thanks for your comment Jaykumar

Not a good move

You should forward all. these comments of comman man/middle class / senior citizen and. serving people to Modiji and Arun jaitly to know the pains of these people.

Thanks for your comment Tej

I am shocked at so many people here whom I assume as literate commenting that this govt is against middle class for this rate cuts.

What do these people want? 12% inflation overall with 10% interest paid on their deposits? And a congress govt to loot the country while dividing and ruling the people?

Its fair to say most of the people here doesn’t understand economics.

This country badly needs growth and it can happen only if investments start and it can only start if banks lend at lower rates. Growth and investment creates jobs which will put many youngsters on work and money on their hands.

Obviously they could spend some and save some of it. Only if people spend money, does other people can go to work.

If you keep money in the bank, it will lose value and who knows you may not be around to spend whatever is left.

Having said that, I think Modi govt is wrong in not reducing fuel prices which is real looting and EPF tax which they rolled back

Congress govt killed growth and made the people beggars. They are now not allowing BJP to pass any reforms.

Our people will get another 10 years of that Rahul govt from 2019 and we will be sure to see unemployment of 20% and riots for food. IT WILL HAPPEN if people continue to be illiterates

I second Pradeep !

Why this development always has to happen by killing the middle class? Even the senior citizens are not spared. Doesn’t matter which party is in power. Why no positive attempt is being made towards bringing the black money thrashed in foreign lands. Why the super rich always escape the barrel. Why India is becoming a safe heaven for scam-stars?

Anyway this is not the right forum for all these. Literacy shouldn’t make you blindfolded my friend.

Dear Friends,

new to JI….Stones will be thrown at the trees with full of fruits which is the earning class.

When was the last time in the history of our country’s freedom did a tax payer got any freebies.

Anonymous

Thanks for your comment Abcs

I am sure all of us got so much frustration, I can add some more. Why politicians get away with all scams, why economically well off Backward classes and ST/SC enjoy reservation benefits generation after generation rendering it meaningless, why our autorickshaws still charge plenty despite drop in fuel prices, etc.

Do you know the Superrich pay 35% taxes on their income? Do you want to milk more from them? This isnt a communist state to snatch money from rich and give it to poor. I would say middle class only pay 10% tax overall after deductions and lesser tax rates on lower slabs. So please dont blame superrich, they pay back so much. They run business too creating jobs. If you drive them out by plundering from them many of our children might be jobless tomorrow.

Tomorrow if you become superrich, you would not want to pay that much tax even though today you might say you would,

Then literacy is so important you know my friend. Let me explain interest rates.

Interest rates will be high only when inflation is high. So it is an abnormal situation if interest rates are high in a country because inflation is high and what you earn you spend most of it due to high cost even for basic services and items.

But if the inflation is low, you will be able to save more and when you save more you may put more money in the bank account. So even if interest rates are low, you will still have more money in the bank. Go search for “Real Returns” in the internet and you will learn more.

Mind you low inflation means prices are rising slowly and not that it is coming down.

Developed countries have 1-2% inflation and thats somewhere ideal.

Finally, a lot of us disapprove rate cuts by govt, but we don’t even do proper tax planning which would leave more money on our hands. So we must be smart with our money and these instruments are not forced upon us by anybody. I know plenty of people have invested in LIC policies for 5% returns and hardly any complaints.

PPF still gives you 8.1%, not bad when inflation is 5% today. When inflation was 8% 2 years back we were only getting 8.7% at that time.

When inflation goes up, interest rates will go up and PPF will give you more. But let me tell you no one wants high inflation

I agree to Pradeep’s comments.

Thanks for your comment Pradeep

Some of the schemes of the government are appreciable. Like the Jan Dhan, the accident and the pension. I think some good work is happening. When Modi govt had asked people to voluntarily give up LPG subsidy, many raised eyebrows. However today around 75 lakhs have surrendered their subsidies. It is a welcome move.

Please understand that PPF is still tax free. If you compare any MF debt product with PPF, taking into consideration the tax component, PPF still scores higher on many accounts.

Thanks for your comment Atanu

I assure u after BJP done looting middle class for next few years economy wont be anywhere indian youth still not going to have jobs u r day dreamer or bjp supporter anyways i voted for BJP biggest mistake of my life but u know we learn from our mistakes i guess BJP is Anti Indian middle class

Thanks for your comment Pradeep

Are these rates applicable for older deposits also? Suppose, I open a SCSS (currently at 9.3%) on or before 31st March, 2016. Will reduced rate of 8.6% (effective from April 1, 2016 and to be reviewed quarterly) be applicable on my savings as well. Regards

No , there interest are calculated as per the current rates !

Thank you very much !

Sir does it mean if I open a new account before 31st march 2016, I will get at rate of interest of 9.3% for next five years i.e maturity of the deposit

No

Dear Modi ji/ arun jailty ji if you are thinking…you have come in the power for life time… you are wrong if you are thinking no one can beat you in elections you are wrong…this has proved in Delhi elections….how long time u can encash modi’s face and his false promises and only verbal commitment….. day will come u will regret on your decisions. you are messing with middle class family….Don’t mess with middle class…. you will loose your reputation permanently…..yahi ache din hai to nahi chahiye please………Don’t expect vote from middle class in next election…whenever it will held……Please take your decision back or be ready to loose your next election for sure……

Thanks for your comment Tarsem

Lowering interest rates on PPF and SCSS is a cruel attack on senior citizens and common people.will never vote for BJP in future.Waiting when BJP govt term will end.God save us from this govt for the corporates.

Thanks for your comment Balbirsinghnanda

now at 8.1 is Somewhat ok..but every 3 months once Interest rates get changed.. so within next year Its Possible to go below 8 also definitely possible. Its highly Disappointing especially for Middle Class..Rajkum

You never know !

If the govt is running out of cash, they should try to close all the loop holes people use to avoid paying tax, this will be a large scale exercise but they need to start doing it, not all the companies in the country is paying PF for all their employees, not all business paying correct tax – there should be raid carried out in all such companies, Govt’s one of the promise was to bring all the black money into the country which they are not concentrating on… but they are keen an find each and every way to tax the common man….. This is a shameful situation.. I have read in some of the blogs the writer has supported govt on this interest reduction, but the thing is most of the people who don’t want to invest in Equities through direct share of through MF due to lack of trust or lack of risk taking abilities, instruments like PPF, SCSS are their only hope for retirement corpus hence may not be good to reduce these interest rates..

Thanks for your comment Renga

Please note the other side too …. View by a expert in session I recently attended.

With rising population & inflation it is also necessary for a economy to maintain flow of money. Money needs to be in rotation and not locked in fixed guaranteed instruments. Economies of developed counties have already gone through such bad patches. Governments executes such interest reduction steps gradually to avoid resistance. But they have to do for sustenance & job creation for next generations.

Thanks for your comment Santosh